ASX Small Caps Lunch Wrap: Who was running really, really late to work today?

It wasn't my fault that I'm late. Honest... Pic via Getty Images.

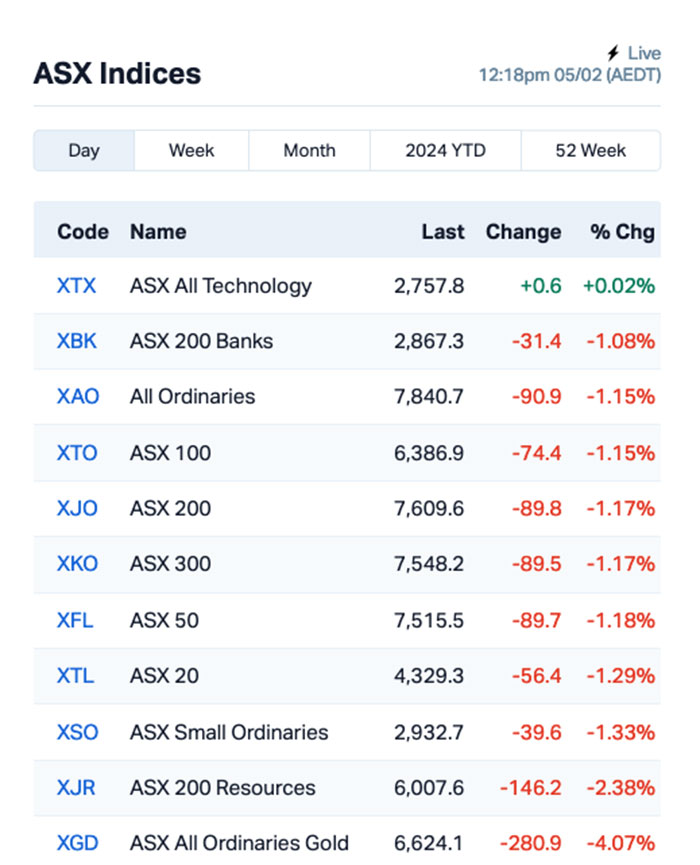

Local markets are really depressed this morning, which isn’t unusual for a Monday – but today, it’s particularly bad. As we trundle into the lunch hour, the ASX 200 benchmark is moping at -1.2%, and – again, quite typically – it’s not having a bad day because of anything in particular we’ve done.

It’s someone else’s fault, surely.

Normally at this stage, I’d offer up a bit of lighthearted news, but I’ve had an unexpectedly lengthy 4-hour commute to work this morning, so let’s all pretend I wrote something amazingly witty, you all had a good laugh, and we’ll get down to business.

TO MARKETS

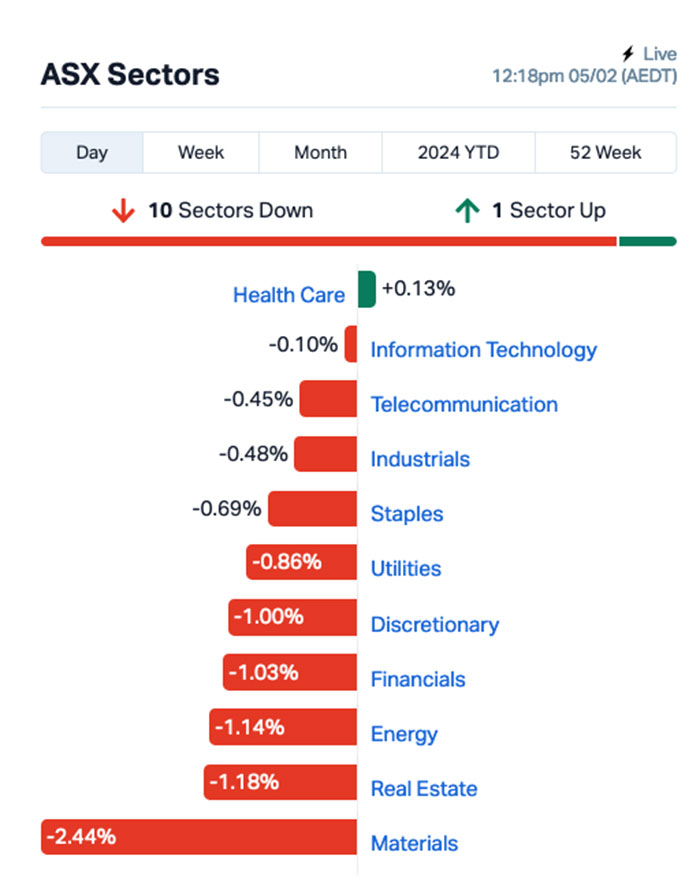

So… the benchmark is well below anything that could possibly be described as happy, with the Materials sector taking a caning.

The reasons being posited for that include, but are not limited to, a sudden surge in the US dollar against our local bantamweight currency, after the US market spent Friday – and I guess most of the weekend – internalising the notion that the Fed’s really not interested in pursuing an easing strategy at the moment, and probably won’t be until at least May.

The other gut-punch has come via China, after markets there tanked heavily on Friday, which in turn took a baseball bat to the kneecaps of several crucial commodities, upon which some of the big names in Aussie mining are currently precariously perched.

That led to a very rapid sell-off among the big players in early trade on Monday, leaving the likes of BHP (ASX:BHP) down 2.27%, Fortescue (ASX:FMG) down 2.52% and Rio Tinto (ASX:RIO) short by 2.02% the last time I looked at the tickers.

And that’s why the sectors look like this:

A more granular look at the ASX has the XTX All Tech index with one nostril above the high water mark, and everything else well below the surface today – and it’s reasonable, I reckon, to argue that we’d be in much worse shape if it weren’t for tech heavyweight WiseTech Global (ASX:WTC) posting a well-timed +2.25% this morning to keep things vaguely afloat.

Because it’s never our fault when things go bad, let’s go check on what’s happened overseas, so we can point fingers and swear loudly with an unwarranted degree of confidence.

NOT THE ASX

So, here’s the thing… Friday’s effort on Wall Street was, undeniably, strong.

The S&P 500 rose by +1.07%. The blue chips Dow Jones index was up by +0.35%, and the tech-heavy Nasdaq surged by +1.74%.

Any way you slice that, it’s a good result – achieved through the magic of massive companies seeing massive spikes in trading price, as the market rewarded several of them for winning what are, essentially, a series of one-horse corporate races.

Meta went bananas, up 15% to a record high after smashing earnings expectations – just days after CEO Mark Zuckerberg spent four hours being soundly thrashed by US Senators during an appearance to talk about child safety online.

Similarly, Amazon cranked out an +8% jump after delivering news to the market that its Q4 sales had come in well ahead of forecasts, at US$170bn.

But it was the delivery of US jobs data that really grabbed the headlines – because the US non-farm payroll data arrived with a barn-storming result that blew the doors off market expectations.

According to people whose job it is to count these things, the US added more than 353,000 jobs in January, which was twice the forecast number – an astonishing leap by any reasonable measure, which led US President Joe Biden to declare that the US economy is “the strongest in the world”.

That’s the good news. The bad news is – at least from where we’re sitting – that pushed a whole lotta strength into the US dollar, and our Aussie dollarydoo crumbled.

And then came news about China – specifically, from Barclays which delivered a pretty dire warning that China could face “a prolonged deflationary environment”, which is never good for business here.

As Christian put it this morning, that – coupled with weakened domestic demand exacerbating overcapacity issues – is “not a stellar combo, and not when confidence continues to flag”.

And if commodities weren’t already under enough pressure from China’s economy turning into soft, delicious tofu, the ongoing threat of peace in the Middle East has once again reared its ugly head.

Oil prices skidded for the bulk of last week, losing about 6% – and not even a fresh round of air strikes by the US could do much to drive prices up over the weekend.

Currently in Japan, the Nikkei is only just treading water on +0.17%, while Chinese markets are reeling from some soft economy body blows. Shanghai markets are down 0.52%, and Hong Kong’s Hang Seng has fallen 1.27% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 05 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP CDT Castle Minerals 0.009 50% 14,347,737 $7,346,958 TD1 Tali Digital Limited 0.0015 50% 500,137 $3,295,156 BP8 Bph Global Ltd 0.002 33% 3,115,961 $2,753,345 BXN Bioxyne Ltd 0.016 33% 4,067,123 $22,819,745 MRD Mount Ridley Mines 0.002 33% 290,065 $11,677,324 4DS 4Ds Memory Limited 0.093 27% 39,111,421 $128,394,949 VML Vital Metals Limited 0.005 25% 429,198 $23,580,268 EGR Ecograf Limited 0.155 24% 953,975 $56,753,977 AHN Athena Resources 0.003 20% 4,175,491 $2,676,169 ASR Asra Minerals Ltd 0.006 20% 400,000 $8,182,479 IEC Intra Energy Corp 0.003 20% 700,000 $4,151,954 LNR Lanthanein Resources 0.006 20% 5,436,674 $6,449,060 MTL Mantle Minerals Ltd 0.003 20% 7,702,000 $15,493,615 CMX Chemxmaterials 0.078 18% 18,439 $6,160,649 MKG Mako Gold 0.021 17% 20,617,897 $11,923,369 GMN Gold Mountain Ltd 0.0035 17% 600,000 $6,807,236 GSR Greenstone Resources 0.007 17% 146,466 $8,208,681 1TT Thrive Tribe Tech 0.015 15% 49,375 $3,856,080 REM Remsensetechnologies 0.023 15% 434,132 $2,573,694 ARV Artemis Resources 0.017 13% 3,854,232 $25,367,942 BPM BPM Minerals 0.13 13% 216,762 $7,719,055 TSO Tesoro Gold Ltd 0.027 13% 283,007 $29,509,937 ASO Aston Minerals Ltd 0.018 13% 377,891 $20,721,028 TAR Taruga Minerals 0.009 13% 710,000 $5,648,214 VMS Venture Minerals 0.009 13% 1,291,561 $17,680,104

Now for some good news, and the party is most definitely on at Bioxyne (ASX:BXN) this morning, on news that the company’s wholly-owned subsidiary, Breathe Life Sciences has been awarded a Good Manufacturing Practice (GMP) licence to manufacture medical cannabis. And psilocybin. And MDMA.

That’s huge news for Bioxyne, as the licence also allows Breathe Life Sciences to produce “final dose form capsules for supply to authorised prescribers and clinical trials”.

No doubt the company is now in the process of heavily fortifying its headquarters, ahead of the arrival of hordes of zombie-like hippies, armed with bongo drums and terrible BO, to surround the building and demanding to speak to “the man” about “some stuff”.

Battery anode business Ecograf (ASX:EGR) has surged 36% this morning, despite not having anything of interest to tell the market – and I’m not entirely sure why. I’ll try and find out, but don’t hold your breath waiting for an answer just yet.

Last week’s high-flyer Mako Gold (ASX:MKG) is at it again, rising another 16.6% after delivering a presentation to the 121/Mining Indaba Conference in Cape Town, South Africa.

The prezzo doesn’t contain any salient information that the market didn’t already know about, by the looks of things – but it does tie up all of Mako’s recent great news in a pretty format, so there’s that.

Worth mentioning, though, is Friday’s last-minute gut-buster effort from Bougainville Copper (ASX:BOC), which saw the company go utterly ballistic in the dying hours of trade at the end of last week – a +128% jump in 90 minutes that, by rights, should have seen some momentum carried over to today.

However, that hasn’t panned out at all – BOC is down 12.8% today after profit-taking knocked all the wind out of its sails.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 05 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP BCT Bluechiip Limited 0.008 -38% 5,440,952 $10,339,859 MSG Mcs Services Limited 0.01 -38% 2,261,450 $3,169,594 MCT Metalicity Limited 0.002 -33% 54,800 $13,455,161 RR1 Reach Resources Ltd 0.002 -33% 1,870,384 $9,630,891 AL8 Alderan Resource Ltd 0.003 -25% 1,374,303 $4,427,445 DCX Discovex Res Ltd 0.0015 -25% 44,366 $6,605,136 BOC Bougainville Copper 0.6 -25% 761,742 $320,850,000 TTI Traffic Technologies 0.007 -22% 505,862 $6,819,032 UNT Unith Ltd 0.016 -20% 4,271,443 $18,014,283 SVL Silver Mines Limited 0.1375 -19% 7,989,158 $238,736,464 RIL Redivium Limited 0.005 -17% 43,407 $16,385,129 RMX Red Mount Min Ltd 0.0025 -17% 100,000 $8,020,728 L1M Lightning Minerals 0.071 -16% 110,000 $3,589,130 ZGL Zicom Group Limited 0.042 -16% 104,000 $10,728,000 WZR Wisr Ltd 0.032 -16% 1,765,849 $51,855,354 FRS Forrestaniaresources 0.022 -15% 494,717 $4,206,429 PLN Pioneer Lithium 0.14 -15% 31,611 $4,690,125 CNJ Conico Ltd 0.003 -14% 369,999 $5,495,332 LBT LBT Innovations 0.012 -14% 9,530 $17,640,996 RGS Regeneus Ltd 0.006 -14% 1 $2,145,058 SHO Sportshero Ltd 0.012 -14% 342,000 $8,649,660 DXNDA DXN Limited 0.013 -13% 21 $2,773,340 ORN Orion Minerals Ltd 0.013 -13% 20,000 $87,675,520 BKG Booktopia Group 0.054 -13% 38,760 $14,148,716 SLR Silver Lake Resource 1.1025 -13% 7,405,100 $1,182,451,581

ICYMI – AM Edition

Arafura Rare Earths (ASX:ARU) has appointed Darryl Cuzzubbo as Managing Director and Chief Executive Officer, following the departure of Gavin Lockyer. Cuzzubbo’s tenure is “effective immediately”, however the outgoing chief will be staying on for a short period of time to deliver handover to make the transition as smooth as possible.

BPM Minerals (ASX:BPM) has informed the market that it has identified several gold in soil anomalies with multi-element geochemical support following exploration at its 100% owned Claw Gold Project is located in the Murchison region of Western Australia, immediately along strike of Capricorn Metals’ (ASX:CMM) 3.24Moz1 Mt. Gibson Gold Project.

Redivium (ASX:RIL) and Classic Minerals (ASX:CLZ) have announced that the two companies have agreed to extend the deadline date for satisfaction of the conditions of sale of the Forrestania Project, with the new deadline set for 30 April, 2024 – or such other date as agreed.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.