ASX Small Caps Lunch Wrap: Who was nearly murdered by a dead bear this week?

I said I'M SORRY I GAVE YOU WORMS, you dumb dirty bastard. You need to go see a doctor." Pic via Getty Images.

Local markets are up this morning, which shouldn’t be surprising considering last week’s down-swing and how dejected everyone looked as they wandered off the field at full-time on Friday, limping with both legs and trying hard to mentally prepare for the spray they were about to receive from the coach.

But, it appeared that fortunes have take a turn for the better on Monday morning, thanks to a mildly-great session on Wall Street on Friday, and a rockin’ start right across the board from local stocks.

I’ll get into the details of that shortly, but first we’re off to Canada, where a black bear has attempted to exact a brutal revenge on its killer, reaching out from beyond the grave in an attempt to bring a slow, gruesome death to those who wronged it in life. Kind of.

The story has its origins in Canada, a country as famous for its maple syrup as it is for its ability to be a melting pot of cultures, and still manage to function modestly well – or about as well you’d expect if you took one of the tiny patches of America that is genuinely full of nice people, but forced them to live cheek-by-jowl with group of fiercely parochial Parisians, trapped in a walk-in freezer, where the only entertainment allowed is a 45-second super-cut of only the sharp inhalations of Celine Dion just before she goes for one of her patented, gut-busting high notes in an effort to deafen every dog in the universe, all at once.

On one fateful summer’s day, an American was across the border in Canadia, doing what Americans do best: shooting stuff. And one of the things that hunter shot was a black bear. There are literally hundreds of jokes that could follow that statement, but – in a rare moment of self-censorship – I have decided to keep my job.

A few months later, the hunter’s family gathered in South Dakota, and feasted upon the meat of that bear, before returning to their homes in several other US states. But before long, one man took ill, plagued by fever, severe muscle pains and gross swelling around his eyes.

The bear, from beyond the grave, was striking back… as it had been, before its untimely death, riddled with parasitic round worms that are iron-clad proof that Mother Nature has moved beyond shouting out her “safe word” and instead, is trying to rid herself of all humans.

The worms are horrible, entering the body when undercooked or raw meat containing their larvae is consumed. They meet up for a horrifying worm orgy in the victim’s small intestine, where they mate like their existence depends upon it, and then die – leaving their children to carry out the rest of the attack.

The worm offspring then start to burrow, finding their way into the muscles, blood stream and even the lymphatic system, with the strongest of them eventually making their way to the ultimate in luxury living – the soft, squishy oxygen-rich environment we know as “the brain”.

All up, six people from that one family reunion were treated in hospital for roundworm infection, prompting authorities to issue yet another warning about eating meat that hasn’t been cooked properly.

So… if you’re reading this while you’re waiting for your lunchtime steak to be brought to the table, do yourself a favour and flag down your waiter, and get the kitchen the make sure your lunch has been cooked to at least 74ºC all the way through – or you’ll end up with worms in your brain, and suddenly find yourself running for US President.

TO MARKETS

Sentiment was looking pretty spritely – even, dare I say it, spry – on the ASX on Monday morning, after a semi-decent run on Wall Street on Friday nudged local investors into action and get our local week off to a decent start.

It’s a pretty good attempt, too – only one sector has failed to heed the rallying cry (Utiities, I’m looking at you…) – but the rest of the sectors are doing just fine, largely because there’s somer proper Monday morning bargain hunting to be had, and the rest of this week is going to be dictated by a series of data releases that could prove hard to digest.

Overall, Monday morning sectors looked like this:

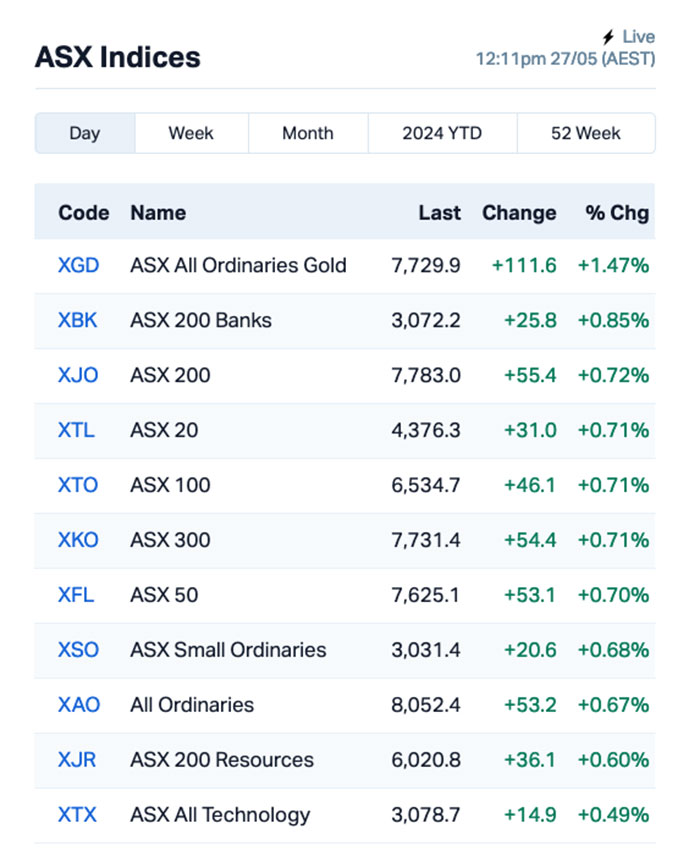

… and the more granular ASX indices look like this:

The goldies are back into their usual swing of making people rich, and the Big Four banks are doing their part in the heavy lifting as well, ranging from National Australia Bank (ASX:NAB) on +0.80% through to Commonwealth Bank’s (ASX:CBA) +1.02% rise.

The week ahead will be a busy one for the data lovers among us, because the Australian Bureau of Counting Stuff has a string of reports due out between now and Friday.

As something of an amuse douche tomorrow – (leave it… I know what I said) – the ABS has Retail Sales figures for April, and we’re expecting only a modest rise there, because everyone apparently went mental on the credit cards in March because Taylor Swift (remember her?) was in town.

The big one that everybody is just gagging to see arrives on Wednesday, when the monthly CPI indicator is unleashed, and we all get to find out that nothing has changed, there’s no surprise rate cut coming next month – but it’s important that we all look as disappointed as possible, because that’s what makes it harder for the RBA Board to keep saying “no” to rate cuts.

Wednesday will also see first quarter data on construction work, and I am already yawning just thinking about it.

Building approval forecast data is due out on Thursday, most likely to show that 3/8ths of 5/8ths of sweet bugger all is happening to relieve the Great Australian Housing Crisis, alongside data on private enterprise capex spending and I will be inches away from descending into a persistent vegetative state.

But Friday, we’re expecting something that will really brighten up everyone’s day, and that’s the Provisional Mortality Statistics report, which – unless I am sorely mistaken – we can use to find out how many Australians died on the toilet in the preceding 12 months.

You know where I’ll be on Friday… trying to die like The King.

NOT THE ASX

On Friday, the S&P 500 rose by +0.7%, the blue chips Dow Jones index was flat, and the tech-heavy Nasdaq surged by +1.1% – not exactly a “stunning” result, but it was enough of a cattle prod to get local markets moving in the right direction this morning.

Earlybird Eddy, who knows a lot more about this stuff that I do, reported that the results were due to US traders pivoting after the closely-watched Survey of Consumers from the University of Michigan showed that about 38% of Americans expect the unemployment rate to jump in the year ahead.

I’m assuming that’s a report done by the University of Michigan, and not just a survey of consumers who attend that particular learning facility.

Anyway – that survey also found that Americans are a bit less worried about inflation than they were earlier this month, raising hopes that interest rates might be cut later this year.

“This is a bounce where people are like, ‘maybe things aren’t as bad as we thought, maybe there’s room for the Fed to cut rates and the economy’s going to be OK, and we’re not completely falling apart’,” said Rob Haworth of U.S. Bank Wealth Management.

Personally, I reckon Rob’s off the mark by a large margin, as I suspect he’s not taken into account the level of apathy that has settled on the average Joe Lunchbox and Mary Gettingherhairdone across the US, because this interest rate soap opera has gone full pantomime.

The “will they or won’t they” trope has already been played out in every rotten Rom-Com out of Hollywood since the cocaine-fuelled 1980s, and we all know that the answer is “Yes, they will… but you have to sit all the way through the rest of the performative bullshit, so that the pay-off, when it comes, actually feels meaningful”.

Prime example: When Harry Met Sally could – and probably should – be cut down from a runtime of 1 hour and 35 minutes, to a far more parable 90 seconds… 77 seconds of which are just Meg Ryan causing our collective blood pressure to spike in that restaurant scene.

In US stock news, Meg Ryan was amazing in that film. No, really… it is hands down one of her best performances as an actress, and I’m not just saying that because those 77 seconds are probably the most watched seconds of her entire career.

Sorry. Got distracted…

In US stock news, Alphabet (Google) rose almost 1% after saying it will not be rolling back its AI Overview feature, launched earlier this month, which gave some strange and incorrect answers that were widely shared on social media.

Google instead said it was going to work on improving this new AI search tool.

And Workday, the corporate software company, plunged -15% after lowering its full-year subscription forecast in its Q1 results.

Asian markets are, I’m told, alive and well. Japan’s Nikkei was up +0.39% this morning, China’s Shanghai markets have gained +0.24%, and someone emailed me from an anonymous secure address this morning, with a picture of Hong Kong’s Hang Seng holding up a copy of China Daily with this today’s date on it, alongside a scrap of paper with -0.25% scrawled on it… but I’m sure everything’s fine.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 27 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap DY6 Dy6Metalsltd 0.160 321% 9,634,167 $1,535,612 CAQ CAQ Holdings Ltd 0.028 87% 1,338,540 $10,766,794 AMM Armada Metals 0.020 54% 2,270,824 $2,704,000 NRZ Neurizer Ltd 0.003 50% 1,897,997 $3,804,841 HYD Hydrix Limited 0.016 45% 1,884,676 $2,796,407 NAG Nagambie Resources 0.014 40% 901,038 $7,966,357 ECT Env Clean Tech Ltd. 0.004 33% 2,257,012 $9,515,431 A8G Australasian Metals 0.100 32% 784,604 $3,961,158 BNL Blue Star Helium Ltd 0.010 25% 14,152,223 $15,538,122 POL Polymetals Resources 0.335 22% 94,372 $43,344,897 MTL Mantle Minerals Ltd 0.003 20% 855,078 $15,493,615 WMG Western Mines 0.400 19% 94,470 $25,365,591 OPL Opyl Limited 0.021 17% 850,202 $3,048,168 BFC Beston Global Ltd 0.004 17% 425,892 $5,991,141 HCD Hydrocarbon Dynamic 0.004 17% 300,000 $2,425,747 WYX Western Yilgarn NL 0.036 16% 100,203 $2,849,133 VGL Vista Group Int Ltd 1.940 16% 112,392 $398,107,638 AAJ Aruma Resources Ltd 0.022 16% 3,130,727 $3,740,939 DXB Dimerix Ltd 0.390 15% 10,832,621 $186,889,375 RIL Redivium Limited 0.004 14% 7,730,704 $9,557,992 HMG Hamelingoldlimited 0.085 13% 355,817 $11,812,500 WEC White Energy 0.035 13% 118,130 $3,510,295 SIO Simonds Grp Ltd 0.180 13% 30,281 $57,585,032 EEL Enrg Elements Ltd 0.005 13% 3,040,641 $4,039,860

Explorer DY6 Metals (ASX:DY6) was soaring on Monday morning, after revealing that the company has taken a closer look at historic drill samples from the Tundulu project in southern Malawi, and found that the project is – apparently – absolutely riddled with Rare Earths.

This is worth explaining because it’s kind of an awesome story… like buying a second-hand wallet in an op-shop, and finding a winning lottery ticket tucked away inside when you brought it home.

The project was initially explored in 1988 by Japanese International Cooperation Agency (JCIA), with the drill cores examined, catalogued and stuffed a in drawer somewhere – presumably because back in 1988, JCIA went to Malawi looking for something other than REEs.

There was some follow-up exploration work done at the site, which continued sporadically until 2014 – leaving a juicy tranche of samples to go over with a fresh set of eyes, which were focussed on finding the kind of Rare Earths that are super-fashionable at the moment.

In steps DY6, and they’ve taken that historical data and some far more recent boots-on-the-ground exploration work – and the news there is good.

Drilling intercepts including 101m @ 1.02% TREO from surface, 109m @ 1.06% TREO from 53m and 97m @ 1.35% TREO from surface tell the story – there’s probably a lot of valuable stuff there, close to the surface – which DY6 says compares favourably to Lynas’ (ASX:LYC) Mt Weld deposit.

Anyway – DY6 was up more than 320% on Monday morning, and that’s the reason why.

Also doing well was Armada Metals (ASX:AMM), on news that a binding agreement has been signed to acquire 100% of the issued capital of Midwest Lithium, an Australian company that currently holds, or has the right to acquire, a 100% interest in 1,098 unpatented lode mining claims covering approximately 93km2, located in the Black Hills of South Dakota, USA.

Hydrix (ASX:HYD) was also moving well on Monday morning, on news that its wholly-owned subsidiary Hydrix Services has entered into a $2.3m contract with leading European medical company Paul Hartmann, to provide a second round of services to assist with product development.

And Australasian Metals (ASX:A8G) was on the rise, after it announced it has entered into an Option Agreement with Verdant Minerals regarding the Dingo Hole high pure quartz project in the Northern Territory.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 27 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AUH Austchina Holdings 0.002 -33% 100,000 $6,301,151 AUK Aumake Limited 0.002 -33% 2,380 $5,743,220 NGS NGS Ltd 0.002 -33% 100,000 $753,682 FTC Fintech Chain Ltd 0.011 -31% 20,171 $10,412,313 ODE Odessa Minerals Ltd 0.003 -25% 16,895 $4,173,130 S66 Star Combo 0.115 -23% 20,039 $20,262,447 ICU Investor Centre Ltd 0.010 -23% 1,097,387 $3,958,647 AAU Antilles Gold Ltd 0.007 -22% 7,668,493 $8,968,815 SER Strategic Energy 0.027 -21% 22,190,859 $16,517,715 SBM St Barbara Limited 0.223 -21% 21,383,699 $229,031,706 LNR Lanthanein Resources 0.004 -20% 1,621,747 $12,218,181 MKL Mighty Kingdom Ltd 0.004 -20% 73,624 $12,487,999 PRX Prodigy Gold NL 0.002 -20% 29,704 $5,034,435 TAS Tasman Resources Ltd 0.004 -20% 84,375 $3,563,346 EMS Eastern Metals 0.041 -18% 412,937 $4,941,312 AMO Ambertech Limited 0.263 -18% 157,160 $30,529,531 GHY Gold Hydrogen 1.635 -18% 1,396,716 $152,176,101 ADR Adherium Ltd 0.019 -17% 2,509,673 $8,970,920 1MC Morella Corporation 0.003 -17% 2,438,802 $18,536,398 REM Remsensetechnologies 0.020 -17% 20,784 $3,956,632 NPM Newpeak Metals 0.027 -16% 221,890 $3,955,789 CVR Cavalierresources 0.170 -15% 28,500 $6,365,783 AGC AGC Ltd 0.435 -15% 3,042,081 $113,333,333 CYC Cyclopharm Limited 1.410 -15% 86,348 $155,413,119

ICYMI – AM EDITION

Blue Star Helium (ASX:BNL) State 16 SWSE 3054 development well at its Galactica helium project in Las Animas County, Colorado, has successfully intersected 96ft of high-quality gas filled sandstone in the targeted upper Lyons production section.

The well, which was successfully drilled to a total depth of 1211ft at the base of the upper sand of the Lyons formation, flowed gas naturally with no water from the target formation during drilling and has been “cleaning-up” since drilling operations were completed.

During drilling operations and while flowing at TD the onsite mass spectrometer recorded elevated helium as expected.

The company is now moving to start pressure and flow testing with gas samples taken during testing sent for laboratory analysis of the reservoir gas composition.

Equinox Resources (ASX:EQN) has appointed its chief executive officer Zac Komur as its managing director with effect from 1 June 2024.

Since joining the company in late 2023, he has been forming a development pathway for the Hamersley iron ore project and reshaping its asset portfolio with the addition of highly prospective Brazilian rare earth projects.

Komur has extensive experience in executing large-scale mining development and capital projects, commercialisation of assets, raising capital and running operations in the mining industry.

He has also operated in Brazil and ran world-class iron ore operations.

Great Southern Mining (ASX:GSN) has carried out a process of target generation and refinement at the Duketon gold project that will leverage the knowledge of consultant geologists with long-term experience in the Duketon Belt and its own geological team.

This work has verified the Golden Boulder, Amy Clarke and Southern Star areas as key prospects while generating several new target areas such as Boundary where recently uncovered historical drill intercepts coincide with an interpreted favourable structural setting.

The structural setting at Boundary is analogous to that which hosts the Garden Well deposit to the north.

Step-out reverse circulation drilling is underway at Riversgold’s (ASX:RGL) Northern Zone gold project to enable estimation of a maiden JORC resource.

Gold at the Northern Zone project is hosted in a porphyry intrusion with drilled widths exceeding 100m in true width.

An aircore drill program to test the project for supergene gold is also progressing well with 11 holes totalling 783m completed to date.

Toubani Resources (ASX:TRE) has appointed Matt Wilcox as a non-executive director as it progresses the definitive feasibility study for its Kobada gold project in southern Mali.

Wilcox is highly experienced across the gold mining industry, particularly in West Africa, and was previously the chief executive officer at Tietto Minerals where he oversaw the design, construction, commissioning and operation of the Abujar Gold Mine before being acquired by Zhaojin Capital for A$750 million in May 2024.

The company has also appointed current non-executive director Scott Perry as its non-executive chairman while strengthening its DFS owner’s team.

At Stockhead, we tell it like it is. While Blue Star Helium, Equinox Resources, Great Southern Mining, Riversgold and Toubani Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.