ASX Small Caps Lunch Wrap: Who spent $150k on a piece of violent hip-hop history today?

US entertainer Cardi B waves to everyone she's planning to assault at the annual Met Gala in New York. Pic via Getty Images.

- ASX down 0.2% at lunch

- Allkem’s (ASX:AKE) massive lithium resource increase at James Bay rubs off on nearby junior explorers Rubix Resources, Cosmos Exploration

Local markets have cheerfully ignored Wall Street’s small success overnight, falling 0.3% at open before slumping to -0.2% at lunchtime.

But first, if you need any further proof that the End of Days are fast approaching, look no further – because someone has dropped US$99,900 (about 150,000 of our puny Australian dollary-doos) for a microphone.

It’s not just any old microphone, though – it’s the very same microphone used by US entertainer Cardi B to viciously assault a drunken fan during a recent appearance in Las Vegas.

You can tell, because the eBay auction clearly states the item is a “Shure Axient digital Mic Cardi B threw at a person”, which obviously means that it’s a very special Shure Axient digital Mic indeed.

In case you missed it, here’s the footage in all of its ragey glory, highlighting that not only does she possess a solid throwing arm, but that rumours of her being distantly related to 80s German-French pop duo Milli Vanilli may hold some merit.

Either that, or the microphone is a magic microphone, capable of blasting out the performer’s voice, clear as day, while hurtling through the air and colliding at pace with the head of the hapless fan, who probably could have done with taking some lessons from former US President George W. Bush.

On the positive side of the ledger, though, is the fact that the astronomical sum the microphone’s auction drummed up is set to go to a local Las Vegas charity, presumably to be spent on a spirited campaign to wipe out Being Assaulted with a Microphone in our lifetime.

TO MARKETS

Local markets are proving as temperamental as a recently-moistened rap star today, swinging wildly between flatline and -0.3% as the morning unfolded at the ASX, before hitting the cafeteria queue down 0.2% for the morning.

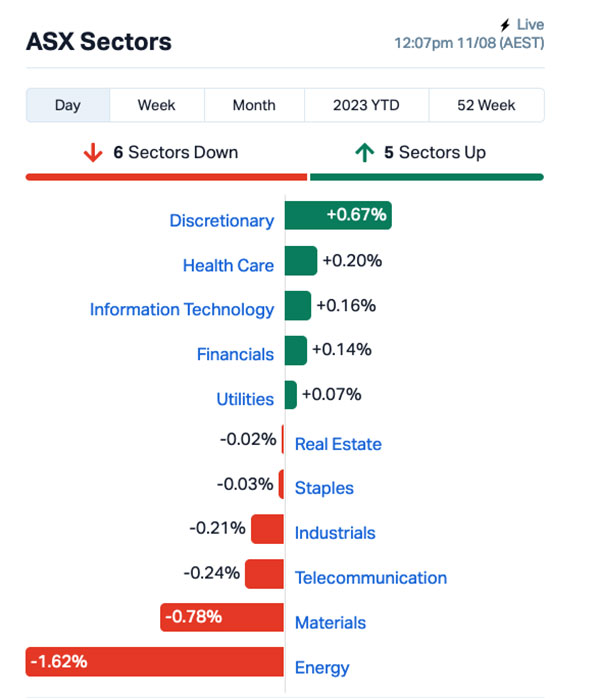

Across the sectors, today’s result is nearly a mirror image of yesterday, with Energy giving back a stack of yesterday’s gains, and InfoTech had been enjoying some time back in the sun again., but by lunchtime that moment had dulled considerably, leaving the sector close to flat.

The best performing sector, however, is Consumer Discretionary, thanks to news for The Star casino (which I’ll explain in a moment), and a win for the purveyors of Australia’s most-favourite squeaky leather recliner chairs, Nick Scali (ASX:NCK), after it posted an NPAT increase to $101.1 (+26.1%) for the year, on the back of a 15.1% revenue bump to $507.7 million.

There’s nothing terribly exciting happening, other than a rare win for Star Entertainment Group (ASX:SGR), which has climbed more than 24% after the NSW State Government delivered a bunch of changes to the tax regime used to squeeze money from the company’s flagship Sydney casino.

The Star casino will reportedly end up “paying half a billion dollars more tax between now and 2030”, NSW Treasurer Daniel Mookhey said, but there are some strict provisions in place in the new deal that’s been struck.

The ABC reports the NSW government “will legally require Star to protect 3,000 jobs for the next six years as it transitions to a sustainable business model”, in return for not having the tax rate on poker machine revenue to the top rate of 60.7%.

So, it’s happy days for Sydneysiders fond of schlubbing around in a barn with 3,000 other tracksuit-clad smokers – and even happier days for investors who’re feeling a love of the punt today.

But the banner headline today is the fact that Phillip “Keepin’ it on the Down” Lowe has made his last-ever public appearance in his capacity as Big Cheese at the Reserve Bank.

Lowe fronted the media to once-again defend the rate hike disaster he’s overseen for the past 16 months, point out (again) that there’s probably more pain on the horizon, make the case (again) that he’d like to see more Australians on the unemployment queue, and patiently explain that if anyone’s unhappy that the Big Banks have made a fortune from the rate hikes, they should “shop around”.

I was secretly hoping the Lowe would take the opportunity to go Full Cardi B and hurl his mic into the assembled media scrum, but alas the even-tempered RBA chief has instead quietly shuffled off stage.

I’m gonna miss him.

NOT THE ASX

Wall Street staged something of a turnaround overnight, leaving the Blue chips Dow Jones index +0.15% higher, tech heavy Nasdaq up by +0.12%, while the broad S&P 500 rose by +0.03%.

Earlybird Eddy Sunarto reported this morning that US inflation rose by a tamed 0.2% in July, and 3.2% from a year earlier. This was the first time inflation has risen in the US after 12 straight months of declines, but housing and used car prices have cooled down.

“It doesn’t seem likely that we will see a re-acceleration with prices, given the weakening labour market and as lending takes a hit,” said Oanda analyst, Edward Moya.

“Wall Street remains optimistic that the Fed won’t need to raise rates in September.”

To stock news, Alibaba rose 4% after the Chinese e-commerce giant posted revenue of $234 billion which beat estimates.

Disney rose more 5% as Q3 earnings beat expectations, and after announcing a reduction in capital expense of US$1 billion.

And how do you tell when everyone thinks your company’s a joke? Well… it’s often not a fantastic sign when Reddit swings in behind it, and spends a few hours shouting “to the moon!” and “short squeeze” and “I have to go, it’s past my bedtime” at each other.

The rush of interest in WeWork – on the heels of the CEO openly admitting that there are Grave Concerns about the company’s ability to stay afloat – has bounced 43% overnight.

That result is largely being attributed to WeWork becoming the Morbius of Wall Street – so terrible that it’s almost good.

Meanwhile in Asia, Japan’s Nikkei is up 0.84%, Shanghai markets are down 0.2% and Hong Kong’s Hang Seng is abnormally flat.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ETR | Entyr Limited | 0.009 | 29% | 3,211,679 | $13,837,977 |

| RB6 | Rubix Resources | 0.205 | 28% | 271,464 | $6,728,000 |

| BP8 | BPH Global Ltd | 0.0025 | 25% | 562,468 | $2,669,460 |

| MDX | Mindax Limited | 0.064 | 23% | 32,126 | $106,369,057 |

| IBX | Imagion Biosys Ltd | 0.017 | 21% | 11,279,353 | $18,280,732 |

| TRT | Todd River Res Ltd | 0.012 | 20% | 2,861,020 | $6,515,475 |

| TTT | Titomic Limited | 0.024 | 20% | 5,275,071 | $17,310,571 |

| SGR | The Star Ent Grp | 1.1525 | 18% | 27,991,271 | $1,578,213,855 |

| LDX | Lumos Diagnostics | 0.07 | 17% | 10,523,276 | $26,223,595 |

| ADY | Admiralty Resources | 0.007 | 17% | 500,000 | $7,821,475 |

| AUK | Aumake Limited | 0.007 | 17% | 8,211,382 | $8,923,557 |

| TIG | Tigers Realm Coal | 0.007 | 17% | 1,500,000 | $78,400,214 |

| C1X | Cosmos Exploration | 0.43 | 16% | 730,910 | $16,455,750 |

| ZMM | Zimi Ltd | 0.029 | 16% | 50,000 | $2,787,372 |

| M2R | Miramar | 0.055 | 15% | 141,713 | $5,324,487 |

| NCK | Nick Scali Limited | 12.26 | 15% | 1,369,409 | $866,700,000 |

| CCZ | Castillo Copper Ltd | 0.008 | 14% | 479,628 | $9,096,537 |

| FGH | Foresta Group | 0.016 | 14% | 393,801 | $28,868,544 |

| MTB | Mount Burgess Mining | 0.004 | 14% | 2,000,000 | $3,554,764 |

| GPR | Geopacific Resources | 0.017 | 13% | 1,247,433 | $12,317,867 |

| MPG | Many Peaks Gold | 0.265 | 13% | 85,837 | $8,548,004 |

| AYA | Artrya Limited | 0.36 | 13% | 65,399 | $20,137,127 |

| BSX | Blackstone Ltd | 0.135 | 13% | 137,207 | $56,842,669 |

| LNR | Lanthanein Resources | 0.018 | 13% | 2,373,019 | $17,945,209 |

| RMX | Red Mount Min Ltd | 0.0045 | 13% | 1,209,300 | $10,097,404 |

Allkem’s (ASX:AKE) massive lithium resource increase at James Bay has rubbed off on nearby junior explorer Rubix Resources (ASX:RB6) which last week said there were possible pegmatite outcrops at its Ceiling lithium project.

Here some good timing –– Cosmos Exploration (ASX:C1X) said it was about to kick off its maiden helicopter-assisted rock sampling exploration program at the Corvette Far East and Lasalle lithium projects, also in James Bay.

The company’s exploration plans were delayed slightly by bushfire restrictions in the area, but they’ve now been lifted and the Cosmos choppers are set to take to the air later today.

Imagion Biosystems (ASX:IBX) signed a Memorandum of Understanding with California’s Prestige Biopharma, which will see the companies combine their efforts to develop “the world’s first non-invasive early detection diagnosis and staging plaƞorm for pancreatic cancer”.

“We are very pleased to form a strategic partnership with Imagion Biosystems,” stated Lisa Park, CEO of Prestige Biopharma.

“Prestige Biopharma Group has made significant progress in building the pancreatic cancer therapeutics system, encompassing diagnosis, treatment, and even prevention. It is an honour for us to take a step closer to achieving our goal in pancreatic cancer diagnosis through the partnership with Imagion Biosystems.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 11 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -33% | 1 | $8,737,021 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 306,373 | $14,368,295 |

| RSH | Respiri Limited | 0.034 | -19% | 3,139,207 | $39,236,560 |

| ELE | Elmore Ltd | 0.005 | -17% | 4,829,182 | $8,396,303 |

| WYX | Western Yilgarn NL | 0.145 | -15% | 90,519 | $8,441,776 |

| BEX | Bikeexchange Ltd | 0.006 | -14% | 4,170 | $8,324,051 |

| GCM | Green Critical Minerals | 0.012 | -14% | 5,091,651 | $13,810,701 |

| MPR | Mpower Group Limited | 0.019 | -14% | 858,415 | $7,561,472 |

| FAU | First Au Ltd | 0.0035 | -13% | 650,000 | $5,807,973 |

| SIX | Sprintex Ltd | 0.028 | -13% | 236,561 | $9,323,723 |

| TEM | Tempest Minerals | 0.014 | -13% | 1,023,465 | $8,109,146 |

| VAL | Valor Resources Ltd | 0.0035 | -13% | 1,170,337 | $15,212,139 |

| TGH | Terragen | 0.021 | -13% | 4,000 | $5,820,930 |

| PGD | Peregrine Gold | 0.275 | -11% | 98,077 | $17,391,809 |

| AX8 | Accelerate Resources | 0.024 | -11% | 413,796 | $10,249,247 |

| ESR | Estrella Res Ltd | 0.008 | -11% | 2,812,432 | $13,352,147 |

| LSA | Lachlan Star Ltd | 0.008 | -11% | 226,440 | $11,871,114 |

| ODE | Odessa Minerals Ltd | 0.008 | -11% | 838,421 | $8,524,006 |

| ROG | Red Sky Energy | 0.004 | -11% | 212,857 | $23,860,022 |

| THR | Thor Energy PLC | 0.004 | -11% | 3,970,015 | $6,566,812 |

| FNX | Finexia Financialgrp | 0.255 | -11% | 10,005 | $13,670,190 |

| CCR | Credit Clear | 0.175 | -10% | 42,153 | $80,445,741 |

| EMC | Everest Metals Corp | 0.135 | -10% | 196,738 | $19,414,966 |

| 1ST | 1St Group Ltd | 0.009 | -10% | 111,111 | $14,169,912 |

| ADX | ADX Energy Ltd | 0.009 | -10% | 3,343,876 | $36,102,138 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.