ASX Small Caps Lunch Wrap: Who might be losing their trading privileges this week?

Pic via Getty Images.

Local markets were up this morning, following a cheerful session on Wall Street overnight that saw all three indices there rising more than +1.0%, on yet another day that saw yet another swathe of record highs in the US.

I’ll get into the details of that shortly, but first to news that will no doubt strike fear into the hearts of many US political representatives, after a bipartisan group of US senators kicked off another attempt to stop elected officials from playing the stock market.

It’s been a bone of contention for years, with many arguing that the level of access, and the sort of information that members of Congress have at their fingertips puts them at a severe advantage to pretty much everyone else who wants to invest.

This latest bill, which the cynic in me is pretty sure will almost certainly get defeated, will “immediately forbid members of Congress, the president and the vice president from purchasing stocks and other covered investment”, according to CNBC.

“If passed, the bill would also prohibit lawmakers’ spouses and dependent children from trading stocks, beginning March 2027,” the report continues, which would be bad news for the likes of former House Speaker Nancy Pelosi, whose husband Paul is a highly-regarded – and very successful – investor in the United States.

It could well be a moot point, though – Mrs Pelosi is, like a lot of her colleagues, already super-old. She’s 84 years old, and has been hinting at retirement for quite some time, so – if this bill was successful (which it almost certainly won’t be), she’d be more likely to retire from public office than, say, force her husband to liquidate all of his investments… or move out.

“Also starting [in 2027], the US president, vice president and all members of Congress would have to divest from any covered investments,” CNBC says, which would mean a complete end to the sorts of things that led the FBI to investigate at least three sitting senators over some very profitable trades during the early days of the Covid-19 pandemic.

But, like I said, there’s almost zero chance that this bill will amount to anything serious – but that means that there’s still a non-zero chance that the members of Congress could surprise everyone and vote against their own ability to make huge stacks of money from the privileged information that comes across their desk.

It will be worth keeping an eye on that one as it progresses – and if there’s a significant news, we’ll do our best to keep you updated.

TO MARKETS

Local markets are enjoying a surge this morning, off the back of a record-breaking session on Wall Street overnight.

The ASX 200 benchmark raced out of the gate this morning, piling on +0.9% in very short order, before settling around that mark for most of the session before lunch.

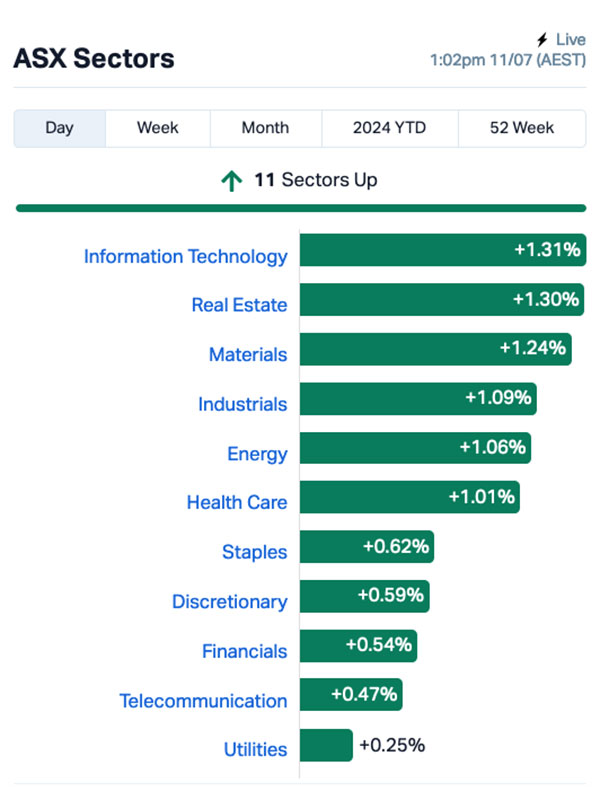

A quick look at the market sectors shows that it’s InfoTech out in front for today, with investors piling into the sector’s big guns this morning, pushing the likes of Xero (ASX:XRO) up +2.77%, Life360 (ASX:360) up +2.16% and Macquarie Tech Group (ASX:MAQ) higher by +2.84%.

Over on the ASX Indices side of the charts, once again it’s our local goldies pushing things along from the front, up by +2.73% before lunch – more than double its nearest colleague, the XSO Small Ordinaries index, which is chugging along at +1.32%.

Here’s what the rest of the indices are doing so far today.

Mid morning, energy giant Woodside announced that it’s signed a deal that will see it provide Taiwanese state-owned natural gas firm CPC Corporation with LNG for a decade, starting later this month.

The deal will see Woodside deliver 6 million tonnes of LNG over the next 10 years, with a further 8.4 million tonnes of LNG to CPC from 2034 to 2043 – but the details of that part of the deal are yet to be negotiated and finalised. Woodside was up +1.05% by lunchtime.

And while there’s not a lot of super-exciting economic news in Australia this morning, there are rumblings from across the Tasman that all is not well again in New Zealand, with the ANZ’s boffins using one of their special crystal balls to predict that our cuzzies over the ditch may be in for a bad time again, and soon.

NZ has been through not one, but two, recessions over the space of a year, and the ANZ data people have been tracking how things are looking using a pretty nifty indicator they call their “Truckometer”.

It’s “a set of two economic indicators derived using traffic volume data from around the country”, which ANZ chief economist for New Zealand, Sharon Zollner says has been a good proxy for consumer demand in NZ, and is weirdly accurate – and ahead of actual economic data – by about six months.

Anyway, the Truckometer has apparently driven off a cliff again, with sharp drop-offs in heavy vehicle traffic (-5.2%) and light traffic (-2.2%) throughout June – which doesn’t bode well for efforts to keep the NZ economy growing.

NOT THE ASX

In New York overnight, the records kept on tumbling, with a buoyant session that left the Dow Jones index up 1.1%, the S&P 500 higher by 1.0% and the Nasdaq Composite advancing by 1.2%.

It was the first time ever that the S&P 500 finished above the 5,600 point mark – and another record high for the Nasdaq as well, which was driven by US tech stocks making new records of their own.

Apple climbed 1.9% to a fresh record high, lifting its market cap to an impressive $3.6 trillion, while other major tech stocks put on significant gains as well.

Nvidia climbed 2.7%, Advanced Micro Devices was up 3.9% and Micron Technology jumped 4.0% as investors got a bit excited about the latest round of comments from US Fed Chair Jerome Powell.

J-Pow was in front of Congress for Day 2 of his trip to the Capitol, and under questioning from lawmakers, he budged from his usual mood-dampening stance a tiny bit.

He’s been at pains to avoid saying that everything’s cool, and that US inflation is on its way down to the US Fed’s 2.0% target, but he did say that he has “some confidence” that it is.

That was enough to get rate-sensitive investors in the US up off the couch and back into the Wall Street money fight – hence the buoyant mood there last night.

In Asian markets today, things are looking pretty peachy around the region. Japan’s Nikkei is up +0.88%, the Hang Seng is higher by +1.75% and even Shanghai is moving in the same direction as its neighbours today, up +0.93%.

Meanwhile, markets in Mongolia remain closed today – and for the rest of this week – as the nation takes time off to celebrate the Naadam Festival, which is one of the most amazing festivals in the world, and heaps better than Splendour in the Grass.

The Naadam Festival is three days of traditional Mongolian sporting action, with the bulk of it the kind of sports that only generations of warriors on horseback, chronically bored in between battles, would engage in for fun.

That includes (obviously) horse races, some Very Serious wrestling and archery – so if you’re a fan of watching very burly men wrestling in the dirt, literally in the middle of nowhere, then hooo boy, are you in for a treat.

Because there’s a guy called Vinny who’s been trying to break into the Mongolian wrestling scene for a while now, and he’s over there at the moment, taking part in some warm-up meets with the locals.

It is very much down the “no one is watching this stuff” end of YouTube, but here’s one of his videos, which I reckon you should watch and get yourself a bit of culture.

Good on ya, Vinny – I’m rooting for ya, bud.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 01 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AUG Augustus Minerals 0.096 152.6 19,970,029 $3,244,060 C7A Clara Resources 0.025 127.3 6,750,653 $2,201,529 SM1 Synlait Milk Ltd 0.35 52.2 617,471 $50,273,782 AVE Avecho Biotech Ltd 0.003 50.0 510,162 $6,338,594 RNE Renu Energy Ltd 0.006 50.0 66,688 $2,904,536 TD1 Tali Digital Limited 0.0015 50.0 109,537 $3,295,156 SVG Savannah Goldfields 0.033 43.5 669,048 $6,464,953 IBG Ironbark Zinc Ltd 0.004 33.3 7,567,312 $5,077,718 JAV Javelin Minerals Ltd 0.002 33.3 8,814,782 $4,688,164 SFG Seafarms Group Ltd 0.004 33.3 259,193 $14,509,798 SHO Sportshero Ltd 0.004 33.3 1,828,095 $1,853,499 LIT Lithium Australia 0.024 33.3 9,641,303 $22,001,250 LSA Lachlan Star Ltd 0.065 32.7 516,650 $10,171,087 XPN Xpon Technologies 0.015 25.0 1,667,747 $4,349,298 ADD Adavale Resource Ltd 0.005 25.0 3,158,088 $4,261,061 HLX Helix Resources 0.0025 25.0 520,002 $6,528,387 ME1 Melodiol Glb Health 0.0025 25.0 33,077,106 $612,527 PRX Prodigy Gold NL 0.0025 25.0 72,333 $4,235,549 TAS Tasman Resources Ltd 0.005 25.0 79,000 $2,850,677 ZLD Zelira Therapeutics 0.595 24.0 23,888 $5,446,634 RNX Renegade Exploration 0.011 22.2 13,704,899 $11,520,481 ASN Anson Resources Ltd 0.1525 22.0 6,612,437 $161,316,026 SLM Solismineralsltd 0.14 21.7 792,045 $8,849,718 AOA Ausmon Resorces 0.003 20.0 505,257 $2,647,498 CZN Corazon Ltd 0.006 20.0 901,695 $3,339,528

Augustus Minerals (ASX:AUG) was well out in front early on news of substantial fresh rock chips from its Ti-Tree project in the Gascoyne region, with chips coming in as high as 35% copper and 236g/t silver from rock chip assays at the company’s Tiberius prospect.

Savannah Resources (ASX:SVG) was up on news of the completion of the Share Purchase Agreement for the sale of Savannah’s remaining shareholding in Renison Coal, the entity that owns the Ashford Coking Coal Project, to Clara Resources.

Meanwhile, Clara Resources Australia (ASX:C7A) was up on news that it has sold its holding in LSE-listed First Tin via an Institutional Bookbuild conducted by UK-based Arlington Group at GBP£0.04, to raise net proceeds of about A$4.3 million, settling on 12 July 2024.

Synlait Milk (ASX:SM1) was up on news that A2 Milk (ASX:A2M) is set to vote in favour of Synlait receiving a $130 million shareholder loan from Bright Dairy International Investment, a related company of Bright Dairy Holding, Synlait’s 39.01% shareholder.

Lithium Australia (ASX:LIT) moved higher on Thursday on news that its recycling operations have achieved maiden Operating Cash Profit1 in Q4 FY24, with the company now focused on growing that operating profit on a sustainable basis.

Adavale Resources (ASX:ADD) climbed on news that it’s all aet to go drilling for uranium in South Australia, following the acquisition of 100% interests in tenement EL6553 from Kilonova Metals. The company is set to undertake 3,000m of drilling to test priority Marree Embayment targets at the site.

And Zelira Therapeutics (ASX:ZLD) was up on news that it has had a positive meeting with US FDA officials to discuss its HOPE autism drug program. Zelira says the meeting request was met with a prompt reply from the FDA, and that it is looking forward to receiving the official minutes of the meeting soon.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 08 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap OLH Oldfields Holdings 0.05 -43.8 56,179 $17,778,279 1TT Thrive Tribe Tech 0.002 -33.3 1,350 $1,411,865 88E 88 Energy Ltd 0.002 -33.3 6,916,642 $86,678,016 AXP AXP Energy Ltd 0.001 -33.3 165,122 $8,737,021 GMN Gold Mountain Ltd 0.002 -33.3 914,830 $9,533,230 LSR Lodestar Minerals 0.001 -33.3 980,002 $3,035,096 APC Aust Potash Ltd 0.0015 -25.0 2,034,441 $8,040,379 EXL Elixinol Wellness 0.003 -25.0 935,448 $5,284,729 TSL Titanium Sands Ltd 0.003 -25.0 260,414 $8,846,989 MAY Melbana Energy Ltd 0.025 -21.9 40,331,534 $107,846,531 LNR Lanthanein Resources 0.004 -20.0 2,047,118 $12,218,181 IAM Income Asset 0.067 -19.3 7,850 $27,462,278 BMO Bastion Minerals 0.005 -16.7 5,477,693 $2,610,503 TTI Traffic Technologies 0.005 -16.7 120,000 $5,837,311 BIT Biotron Limited 0.033 -15.4 2,663,170 $35,188,745 KGD Kula Gold Limited 0.011 -15.4 1,036,508 $8,036,755 CMP Compumedics Limited 0.29 -14.7 14,152 $60,235,402 LML Lincoln Minerals 0.006 -14.3 954,046 $14,393,317 TMK TMK Energy Limited 0.003 -14.3 650,000 $24,225,642 NIS Nickelsearch 0.019 -13.6 473,232 $4,697,934 MAP Microbalifesciences 0.16 -13.5 3,500 $82,852,616 JPR Jupiter Energy 0.026 -13.3 6,293 $38,209,566 AL3 Aml3D 0.165 -13.2 7,127,765 $71,648,816 QHL Quickstep Holdings 0.235 -13.0 239,716 $19,366,078 M2R Miramar 0.007 -12.5 7,092,674 $1,579,118

IN CASE YOU MISSED IT – AM EDITION

GreenTech Metals’ (ASX:GRE) soil samples with assays of up to 467ppm Li2O from the Ruth Well and Osborne JV projects have extended the Kobe South pegmatite trend up to a strike length of 5.5km.

New Age Exploration (ASX:NAE) has executed the sale of its Lochinvar metallurgical coal project in the UK to Paladar Trading.

Other than the nominal cash consideration of a single dollar, the company will also receive a $1/t royalty that is payable on the first 15 million tonnes of any minerals, ores or concentrates extracted from the licences that comprise the Lochinvar project.

The sale allows the company to focus on its highly prospective gold and lithium assets in WA’s Central Pilbara region and New Zealand.

Queensland Pacific Metals (ASX:QPM) has been awarded a $8m grant from the Australian Federal Government under the International Partnerships in Critical Minerals program to help advance its planned TECH refinery that seeks to produce battery grade nickel and cobalt from laterite ore.

Receipt of the grant is subject to matched funding and an agreed project scope.

The company is progressing discussions with commercial partners and the Queensland Government to secure the funding required to support the grant and complete commercial validation of the project.

Strickland Resources (ASX:STK) is poised to accelerate drilling at its Horse Well project in Western Australia with the arrival of a second diamond rig.

This rig will speed up work to map out and expand the key primary mineralised structures across the Palomino, Warmblood and Bronco targets.

Drilling will also focus on testing the Great Western target as part of the successful WA Exploration Incentive Scheme co-funded drilling application.

At Stockhead, we tell it like it is. While GreenTech Metals, New Age Exploration, Queensland Pacific Metals and Strickland Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.