ASX Small Caps Lunch Wrap: Who learned there’s honour among thieves this week?

Rodney was arrested after spending four hours trying to figure out why he couldn't just scare the van into unlocking its doors. Pic via Getty Images.

Anyone hoping for a recovery on the ASX this morning after yesterday’s blood-letting was in for a disappointment, as the benchmark managed to bounce even less than the proverbial dead cat in early trade today.

Wall Street turned in a mixed bag, but the local effort has beaten the dour prediction of the ASX Futures index, and at lunch time the benchmark is up a surprising +0.55%. There’s almost definitely a reason why, but it’s escaping me at the moment, because – if I’m being honest – my heart and head are still in the wilds of Tasmania, where I learnt last week that the Tassie highlands and I have a few things in common.

We’re both ruggedly handsome to look at, cold to the touch and responsible for the deaths of at least three bushwalkers every year.

But I digress…

I’ll get into the nitty gritty of why the market’s doing what it’s doing shortly, but first, we’re off to… Florida, because of course we are. That’s where all the best news stories come from.

This morning, the story hails from a town called Winter Haven, where a local ne’er-do-well has shown that there might be some honour among thieves after all.

Larry Carter Jr has told local media that when thieves stole his custom car, they made off with more than just a set of wheels – they literally took his mother’s ashes with them when they went.

The car – a 2023 limited edition Dodge Charger SRT Hellcat Redeye Jailbreak, which currently holds the world record for the stupidest model name in motoring history – was a rolling tribute to Carter’s dead mother, Lorena Leonard.

“It was special, you know, it’s last call. Got my mother’s name. Got Jesus on both sides,” said Carter. “It was meant for her. That’s the main reason I got that car because of her, to represent her.”

But thieves apparently removed a window, rolled the car down the street and started it up a long way from the house, as Carter reportedly didn’t hear a thing when the vehicle went missing from his driveway.

However, the following morning, Carter woke to find the car gone – and a day later, he woke to discover the thieves had apparently returned at some point during the night, to deposit his dead mother’s ashes in Carter’s letterbox.

“They got some good heart. They still got a good heart, but just their mind messed up,” Carter said about the thieves. “Whoever it was, still got a good heart.”

Carter’s Hellcat, worth round $130,000 without any modifications, is still missing.

TO MARKETS

To be fair, the ASX 200 Futures index was pointing to a sharp drop this morning, but we’ve managed to avoid the worst of it as investors took in the news that the US is holding firm on interest rates, and reporting season continued to deliver the usual ups and downs we’ve come to know and love.

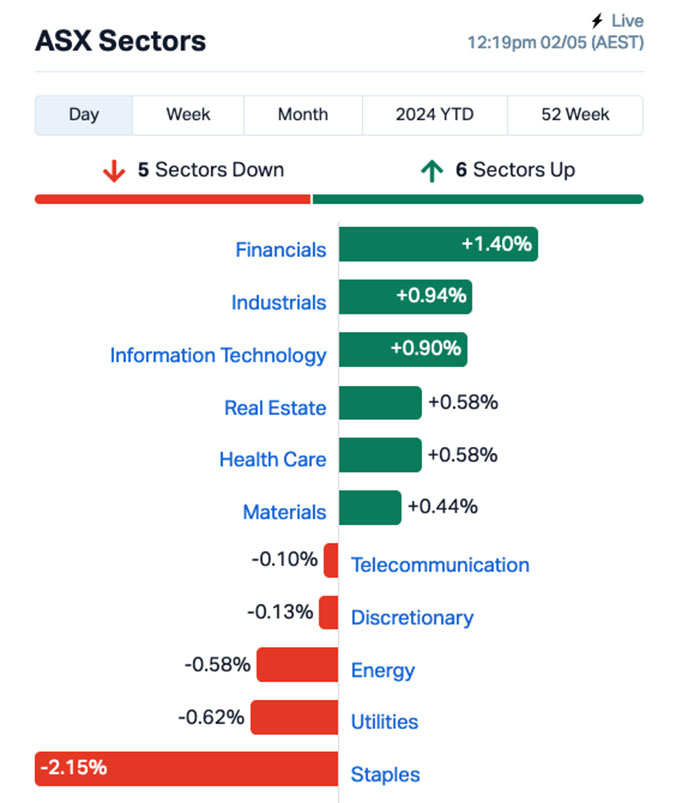

After close to an hour, local markets were ahead by a respectable 0.10%, with the market sectors all looking reasonably normal, except for the one sector from yesterday that appeared to be weathering the storm – Consumer Staples.

This morning, that sector was taking its turn in the barrel, down about -2.8% and in way worse shape than its nearest stablemates.

The good news, though, is that there was a smattering of sectors actually making headway this morning… and here’s a picture!

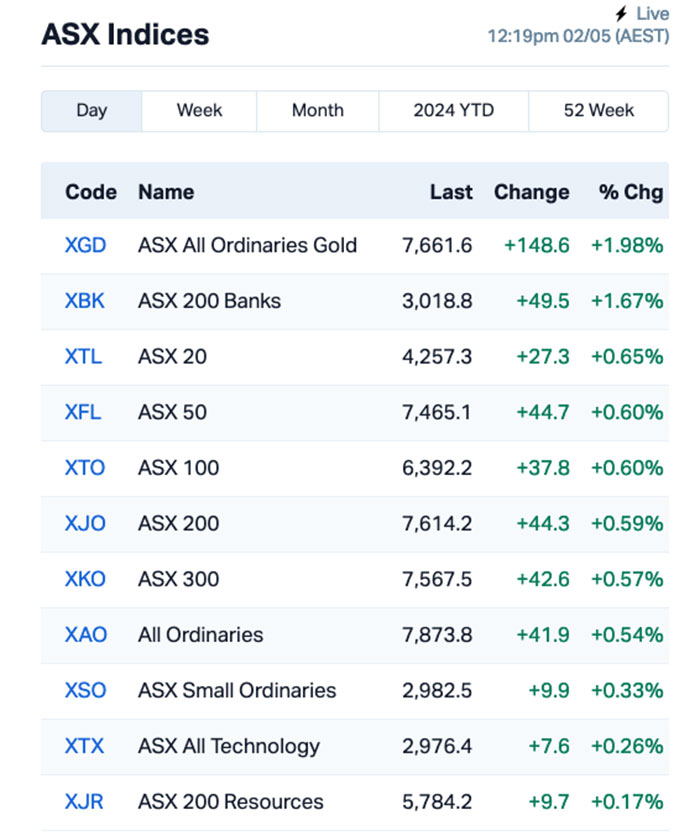

And you’ll never have guessed this in a million years, but the goldies are once again smashing it out of the park, well out in front of the rest of the market because we certainly know what the script says when Wall Street’s all a-muddled.

That’s despite gold prices easing over the previous sessions, and staying relatively flat today.

The headline news from reporting season comes from National Australia Bank, which has revealed that its half-year profit has dropped 11.9% to “only” $3.5 billion, largely a result of the bank’s net interest margin falling from 1.77% to 1.72%.

The decidedly iffy news for Australians came via David Taylor at the ABC, who filed a frankly terrifying story this morning warning that there’s a shockingly high number of small businesses on the brink of collapse in Australia.

Taylor wrote that credit reporting firm illion reckons there’s been a 20% surge in the number of small businesses rapidly approaching the point where they can’t pay their bills – and that’s largely due to big businesses firming up their fortunes and are showing a 20% drop in insolvency risk.

In other words, the business landscape is starting to look like the housing landscape and if you’re not already on the boat with the big kids, it’s probably high time you started to learn how to swim.

NOT THE ASX

The news out of the US overnight wasn’t nearly as bad as it was yesterday, and that’s partly because US Fed Chair Jerome “The Assassin” Powell has broken with tradition by appearing in public and not tanking the market.

After the FOMC meeting wrapped with the gang deciding not to solve The Mystery of Interest Rates, through the simplest means possible of leaving things as they currently are, Powell took to the microphones and had investors around the nation poised at their laptops, cursors over the sell button and index fingers twitching above mouse buttons, ready to dump the lot.

But for once, Powell managed to keep things relatively sane, dropping the bad news (no interest rate cuts for the foreseeable future) with a thin veneer of good news – no interest rate rises on the horizon, either.

That left US markets in a mixed state, with the S&P 500 down by -0.34%, the blue chips Dow Jones index up by +0.23%, but the tech-heavy Nasdaq tumbled by -0.70%.

“I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely,” Powell said.

“I think we’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2% over time. That’s not what we think we’re seeing.”

However, he warned about sticky price pressures in the US economy.

“Inflation is still too high. Further progress in bringing it down is not assured and the path forward is uncertain,” Powell said.

US treasuries rallied (bond yields fell) across the curve on the back of Powell’s comments, sending the US dollar to tumble against major currencies. The Aussie dollar gained 0.8% to trade at US65.32c.

In US stock news, healthcare giant CVS plunged -17% after cutting its 2024 profit forecast, and Amazon rose +2% after profit more than tripled in Q1, topping analysts’ expectations, while Microchip maker AMD fell -9% after its forecast of AI chip sales for 2024 fell far short.

Fellow chips stock Super Micro also fell -14% after Q3 revenue missed estimates. Both of these stocks led a selloff in other chip stocks.

And for you crypto nerds, the banner headline this morning is Binance chief CZ has been handed a four-month prison sentence for failing to install money laundering safeguards at the exchange.

That takes the list of high-flying crypto kings doing prison time to something completely uncountable this morning. I mean, I could figure it out, but I honestly can’t be bothered, because it’s far easier to point out that it’s a preposterously large percentage of them that have been skewered for being a little lax with the law.

In Asian market news, Shanghai markets are closed again for yet another market holiday, which I found out this morning is one of 20 they enjoy every year.

Twenty days off… and Shanghai’s only open for about four hours a day even when they are trading, and there’s no pre-market or after-hours trading allowed.

If I wasn’t already on about a thousand government lists, I’d consider moving there and covering those markets for a living… talk about a cruisy gig.

Hong Kong markets were open this morning, but only just – and at lunchtime here, the Hang Seng was up +1.31%

In Japan, the Tokyo exchange was open today, but is closed tomorrow for one of that market’s 17 holidays… and I’m really starting to feel like the paltry eight days off we get here in Oz is a bit of a slap in the face.

The Nikkei, for anyone interested, was down -0.30% in early trade, probably because everyone there knew that they get to sleep in tomorrow and simply stopped trying.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 01 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap KTA Krakatoa Resources 0.019 73% 31,752,670 $5,193,179 VPR Volt Power Group 0.0015 50% 591,119 $10,716,208 TRI Trivarx Ltd 0.037 42% 12,732,549 $8,800,446 HLX Helix Resources 0.004 33% 2,889,755 $6,969,438 NAE New Age Exploration 0.004 33% 5,288,000 $5,381,697 GBE Globe Metals & Mining 0.052 30% 536,414 $27,034,704 CUF Cufe Ltd 0.015 25% 384,493 $13,753,348 VNL Vinyl Group Ltd 0.15 25% 981,388 $91,403,206 BLZ Blaze Minerals Ltd 0.005 25% 888,835 $2,514,233 SHO Sportshero Ltd 0.005 25% 100,000 $2,471,331 IRX Inhalerx Limited 0.039 22% 29,629 $6,072,543 RRR Revolver Resources 0.097 21% 242,998 $20,769,941 AHK Ark Mines Limited 0.165 18% 16,181 $7,762,498 CR9 Corellares 0.02 18% 30,001 $7,906,571 PVT Pivotal Metals Ltd 0.02 18% 6,159,145 $11,970,011 ENV Enova Mining Limited 0.021 17% 8,429,822 $17,242,728 88E 88 Energy Ltd 0.0035 17% 6,199,469 $86,678,016 AML Aeon Metals Ltd 0.007 17% 19,438 $6,578,404 IS3 I Synergy Group Ltd 0.007 17% 1,144,073 $1,824,482 ME1 Melodiol Global Health 0.0035 17% 81,413 $2,020,462 SEN Senetas Corporation 0.014 17% 449,509 $18,855,400 SFG Seafarms Group Ltd 0.0035 17% 6,500 $14,509,798 HPC The Hydration Company 0.015 15% 114,241 $3,446,843 LEL Lithenergy 0.575 15% 2,229,989 $56,000,785 G6M Group 6 Metals Ltd 0.046 15% 514,024 $40,160,914

Cracking the top of the small caps market on Thursday was critical minerals-hunting junior Krakatoa Resources (ASX:KTA), smashing through +73% on news that the company has identified a promising new niobium-REE gravity target at the Mt Clere tenement, located in the northwestern margins of the Yilgarn Craton in Western Australia.

It’s an extensive, 40km long target catchment area with potential for alkaline intrusive systems including carbonatites, and the company says that infill soil sampling is underway, so we can expect further updates soon-ish.

Meanwhile, Pivotal Metals (ASX:PVT) is concentrating its efforts in Quebec, Canada, eschewing the usual trendy lithium search in that region in favour of copper, nickel, and PGMs.

First assay results from the first two of 34 diamond drill holes are back from its 100% owned Horden Lake project. It’s hit some thick copper zones, with Cu-Ni-Au-PGM-Co mineralisation, including 37.5m at 1.31% Cu equivalent.

And Vinyl Group (ASX:VNL) is up on yesterday’s news that that Songtradr has issued a conversion notice for a portion of its Tranche #2 convertible note, increasing its beneficial ownership in VNL to 19.95%.

The company says that Songtradr will convert a principal balance of $1,629,351 into 77,588,162 ordinary shares in VNL at the conversion price of $0.021 per share, with Songtradr CEO Paul Wiltshire saying his company is “very impressed with the strategic progress and discipline Josh and the team at Vinyl Group have shown over the last year.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 01 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAV Javelin Minerals Ltd 0.001 -50% 37,550 $4,352,462 MRD Mount Ridley Mines 0.001 -33% 875,024 $11,677,324 YPB YPB Group Ltd 0.002 -33% 1,366,667 $2,371,384 LPD Lepidico Ltd 0.003 -25% 796,219 $30,553,232 SGC Sacgasco Ltd 0.006 -25% 5,650,000 $6,237,497 BAP Bapcor Limited 4.4 -24% 7,240,472 $1,961,804,250 VRX VRX Silica Ltd 0.054 -23% 2,196,388 $40,836,498 H2G Greenhy2 Limited 0.008 -20% 174,009 $4,187,558 MTB Mount Burgess Mining 0.002 -20% 7,143 $2,612,034 RML Resolution Minerals 0.002 -20% 336,076 $4,025,055 ROG Red Sky Energy 0.004 -20% 1,104,608 $27,111,136 BCT Bluechiip Limited 0.0065 -19% 200,000 $8,806,134 MCL Mighty Craft Ltd 0.009 -18% 2,187,805 $4,016,454 ATH Alterity Therapeutics 0.005 -17% 119,000 $31,470,692 BFC Beston Global Ltd 0.005 -17% 30,000 $11,982,281 EXL Elixinol Wellness 0.005 -17% 5,025 $7,806,444 NRZ Neurizer Ltd 0.0025 -17% 824,555 $4,959,538 YOJ Yojee Limited 0.047 -16% 3,022 $14,602,101 EWC Energy World Corporation 0.011 -15% 20,000 $40,025,976 TG1 Techgen Metals Ltd 0.028 -15% 282,721 $4,228,375 TMK TMK Energy Limited 0.003 -14% 28,460 $23,645,002 TTI Traffic Technologies 0.006 -14% 50,000 $6,099,245 AZY Antipa Minerals Ltd 0.01 -13% 563,497 $47,550,291 SRK Strike Resources 0.061 -13% 1,615,883 $19,862,500 CLZ Classic Min Ltd 0.007 -13% 35,285 $2,480,276

ICYMI – AM EDITION

ADX Energy (ASX:ADX) has received firm commitments from institutional and sophisticated investors for the subscription of shares worth a total of $13.5m under a two tranche placement.

The strong demand from offshore and domestic institutional investors and family offices endorses the company’s growth opportunities in the heart of energy starved Europe.

Proceeds from the placement will be used to evaluate, analyse and production test the Welchau-1 gas condensate discovery as well as assessing its exploration prospectivity and potential deepening.

Funds will also be used for the drilling of a gas exploration well in the ADX-AT-I licence, drill and tie-in the Anshof-2A sidetrack well, and for gas processing upgrades including a CO2 reduction plant at its Vienna Basin oil and gas fields.

Alvo Minerals (ASX:ALV) has appointed Ore Investments chief executive officer and founder Mauro Barros as a non-executive director.

Ore Investments – a prominent Brazilian natural resources private equity group – had made a $4.2m investment into the company in April at a 25% premium, giving it a 19.9% stake in ALV and the right to nominate a non-executive director.

Barros is a qualified lawyer with broad experience in mining and the capital markets in Brazil, which he will use to aid the company’s exploration and development efforts at the Palma copper-zinc project as well as Bluebush and Ipora ionic clay-hosted rare earths projects in Brazil.

Hot Chili (ASX:HCH) is raising up to $29.9m through a private placement of shares priced at $1 each, or a ~18.6% discount to the 10-day VWAP, to institutional, professional, and other investors. Proceeds from the placement will provide up to 18 months of funding for the ompletion of the Costa Fuego pre-feasibility study, completion of the water supply business case study, completion of the Costa Fuego environmental impact assessment, ongoing exploration, drilling and consolidation activities.

The placement will also improve HCH’s trading liquidity on the TSX Venture Exchange.

At Stockhead, we tell it like it is. While ADX Energy, Alvo Minerals and Hot Chili are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.