ASX Small Caps Lunch Wrap: Who gets to write less for Lunch Wrap this week?

Pic via Getty Images.

Local markets have fallen this morning, with the ASX 200 down around 0.7% straight off the bat because Friday was not a fantastic day in New York… or elsewhere, for that matter.

But first – a quick explanation. After two years of finding something ridiculous from the news headlines to make us all laugh a little at lunchtime, we’re changing things up a bit, just to streamline a few processes and so that we get to the important stuff a little quicker.

So… here’s what’s happening on the markets today.

TO MARKETS

The ASX 200 benchmark fell fairly sharply this morning, thanks to a far-from-excellent session on Wall Street on Friday, and some worrisome falls among a few key commodities.

And, by “a few key commodities”, I mean “pretty much all of them”, starting with copper, which saw its fifth straight fall, down 1.1% on Friday on the way to banking a 7.9% loss for the week.

That’s copper’s worst performance since August 2022, and hopefully I don’t need to remind you what happened back then… largely because I don’t remember either.

Oil prices also took a beat, with Brent crude falling 2.9% to US$82.63 a barrel, largely on talks of a ceasefire in the Middle East, alongside a strengthening US dollar, which put downward pressure on prices as well.

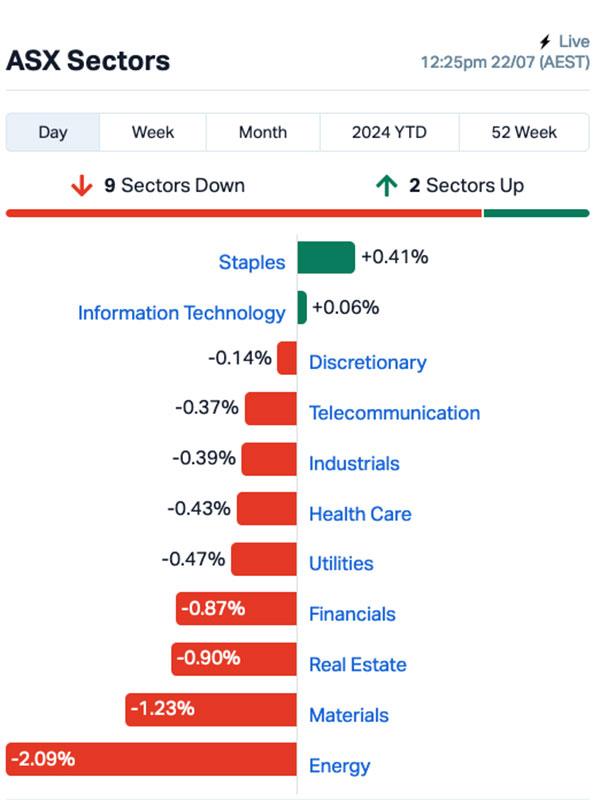

All that set the market up for a sour start to the week, and so Monday morning has felt about as Monday as mornings get – by lunchtime, the benchmark was down around 0.75%, and Consumer Staples was the only sector showing any signs of positivity, up 0.38%, with InfoTech trending higher as well.

A more granular look at the market shows a sea of red, with the goldies doing best while still losing ground to the tune of -0.38% at midday.

A strengthening US dollar and some fairly robust profit taking at the end of last week pushed the price of gold down below US$2,400/oz for a while, but last time I checked it was back above that mark, climbing 0.57% and chugging along quietly.

It’s left the goldies as a group in a bit of a state, with most of the big billion-dollar-plus players down for the morning, including Bellevue Gold (ASX:BGL) and Evolution Mining (ASX:EVN), which have dropped 1.1% and 0.7% respectively.

That’s not to say there aren’t goldies making headway… it’s just mostly down the smaller end of the market. Last week’s high flyer DGR is still trading well on its happy news from last week, up 30.4% and leading the pack.

Up the fancy end of town, South32 (ASX:S32) delivered its quarterly this morning to a chorus of jeers among investors, as the company revealed a double-whammy of soft production numbers and some grisly-looking impairment charges.

The company reported – among other things – a 34% fall in Manganese production, but that was Cyclone Megan’s fault. However, a downgrade for future production of copper, silver and lead for next year also added weight to the investor mood.

The impairment charges, however, are very much not great – $554 million for Worsley Alumina operations, and a pre-tax $264 million for Cerro Matoso in Colombia = more than $800 million in write-downs that South32 could definitely have done without.

The tale of the tape says it all, and South32 was down 12.7% at lunchtime.

Not quite as dramatic a fall, but still worth mentioning is Woodside’s (ASX:WDS) 2.8% slide on news that the company is dropping $US1.2 billion on a Louisiana LNG project – which isn’t a lot, until you consider the roughy US$15 billion that Phase 1 and 2 of the project is reportedly going to cost.

NOT THE ASX

It was a grumpy end to a moody week on Wall Street on Friday, which saw the S&P 500 tumble by 0.71%, the blue chips Dow Jones index slip by 0.93%, and the tech-heavy Nasdaq decline by 0.81%.

The headline loser in the US on Friday was, of course, CrowdStrike, after the company caused “the biggest IT outage in history”, when the company rolled out an update to its mainstay Falcon product that gave Windows computers everywhere a severe case of the BSOD.

The resulting chaos meant widespread outages around the world, severe dispepsia among IT helpdesk workers and – worst of all – meant that I had to work back on Friday night to put out a newsletter.

Oh, the horror.

CrowdStrike has been punished, though, losing 11% while Wall Street was still open and then another 1% after hours.

In other US stock news, Nvidia was down 2% on Friday and 9% for the week, while Amazon fell by 6% for the week.

Chip equipment maker ASML also saw a drop on Friday, bringing its total drop over the past five sessions to 17%.

And Tesla fell 4% on Friday as as electric vehicle stocks came under pressure following Donald Trump’s criticism of the Biden administration’s clean energy initiatives, which he labeled the “green new scam” during the Republican Convention.

“I will end the electric vehicle mandate on day one, thereby saving the US auto industry from complete obliteration, which is happening right now, and saving US customers thousands and thousands of dollars per car,” Trump said.

That comment came a couple of days after Tesla CEO Elon Musk publicly pledged US$45 million per month to the Trump campaign.

The massive, breaking news out of the US today was Joe Biden withdrawing from the presidential race, which I think everyone saw coming. Except Joe, that is.

How that will affect US markets remains to be seen, as the Democrats settle in for a serious few days of infighting and backstabbing before figuring out that Kamala Harris is likely to emerge as the winner of the post-Biden punch-up.

Meanwhile, in Asian markets this morning, things are a little mixed. The Hang Seng is up 0.51%, but the Nikkei is down 1.17 and Shanghai markets are off by 0.71%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 22 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AUK Aumake Limited 0.006 75.0 65,604,127 $7,657,627 AD1 AD1 Holdings Limited 50.0 965,836 $3,594,594 FFF Forbidden Foods 0.012 33.3 14,370 $2,045,011 HIQ Hitiq Limited 0.022 29.4 1,531,012 $5,981,364 JAY Jayride Group 0.009 28.6 198,149 $1,654,164 KOR Korab Resources 0.009 28.6 165,128 $2,569,350 WTM Waratah Minerals Ltd 0.35 27.3 1,084,605 $49,325,237 DGR DGR Global Ltd 0.029 26.1 12,422,842 $24,004,950 AEV Avenira Limited 0.005 25.0 124,342 $9,396,136 MSG Mcs Services Limited 0.005 25.0 1,100,010 $792,399 ASE Astute Metals NL 0.046 24.3 2,363,492 $15,689,115 GLH Global Health Ltd 0.145 20.8 13,765 $6,965,944 EVR Ev Resources Ltd 0.006 20.0 8,627,194 $6,856,357 OVT Ovanti Limited 0.006 20.0 5,559,218 $6,200,527 SWP Swoop Holdings Ltd 0.22 18.9 199,337 $38,518,653 PCK Painchek Ltd 0.042 16.7 2,590,766 $58,889,850 BMO Bastion Minerals 0.007 16.7 1,773,952 $2,610,503 ECT Env Clean Tech Ltd. 0.0035 16.7 2,339 $9,515,431 EXL Elixinol Wellness 0.0035 16.7 20 $3,963,547 FHS Freehill Mining Ltd. 0.007 16.7 1,654,292 $17,999,067 GGE Grand Gulf Energy 0.007 16.7 100,000 $12,571,482 VML Vital Metals Limited 0.0035 16.7 113,298 $17,685,201 TTT Titomic Limited 0.215 16.2 5,155,300 $187,030,952 ENL Enlitic Inc. 0.18 16.1 28,585 $12,200,767 FXG Felix Gold Limited 0.0545 16.0 260,053 $11,770,162

Astute Metals (ASX:ASE) was up early on Monday morning, reporting assay results from a further four drillholes at its Red Mountain lithium project in Nevada, USA – and the news is good. Astute says drilling has found thick intersections of lithium above 1,000ppm, with the standout result being 13.7m @ 1,070ppm Li / 0.57% Lithium Carbonate Equivalent1 (LCE) from surface, including 83.8m @ 1,230ppm Li / 0.65% LCE from 16.8m.

AuMake International (ASX:AUK) was up on Monday morning on news that the company has entered a non-binding three (3) year strategic co-operation framework with Chinese State-Owned Enterprise Yangtze River New Silk Road International Logistics, to “establish a comprehensive end-to-end supply chain network for Australian goods and services”.

EV Resources (ASX:EVR) made headway on news that surface rock chip samples of up to 71% Cu and 874g/t Ag demonstrated previously unknown copper and precious metals potential at the Khartoum project in northern Queensland, with the company reporting that the high-grade copper values include 10.9% Cu, 9.11% Cu, 8.6% Cu and 4.16% Cu.

And Swoop Telecommunications (ASX:SWP) was on the move thanks to news that it has signed a key customer contract and committed to construct, own and operate a significant new fibre infrastructure network in Melbourne, with initial committed revenues of a minimum of $24 million and up to $36m over the next 22 years.

The laggards table this morning is topped by a large cap, which doesn’t happen very often, so it’s worth a mention here. DroneShield (ASX:DRO) was taking a kicking this morning after the company’s quarterly revealed a sizeable drop in revenue quarter on quarter, which fell from $16.7 million in the first quarter to $7.4 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 22 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DRO Droneshield Limited 1.49 -24.0 37,444,132 $1,494,598,764 NRZ Neurizer Ltd 0.007 -22.2 3,402,512 $17,121,876 CAV Carnavale Resources 0.004 -20.0 73,002 $17,117,759 CTN Catalina Resources 0.0025 -16.7 400,000 $3,715,461 DTR Dateline Resources 0.005 -16.7 1,150,000 $8,745,282 TX3 Trinex Minerals Ltd 0.0025 -16.7 113,331 $5,485,957 OD6 Od6Metalsltd 0.042 -16.0 109,944 $6,434,509 DBO Diabloresources 0.017 -15.0 24,652 $2,061,429 LIO Lion Energy Limited 0.018 -14.3 221,870 $9,176,533 AMD Arrow Minerals 0.003 -14.3 1,154,075 $36,887,778 PAB Patrys Limited 0.006 -14.3 22,103 $14,402,131 ALY Alchemy Resource Ltd 0.007 -12.5 615,365 $9,424,610 CUL Cullen Resources 0.007 -12.5 1,850,220 $4,561,386 GTR Gti Energy Ltd 0.0035 -12.5 680,000 $10,154,988 PLC Premier1 Lithium Ltd 0.014 -12.5 2,162,000 $2,793,186 S32 South32 Limited 3.005 -12.1 30,335,973 $15,490,064,303 NXS Next Science Limited 0.255 -12.1 156,827 $84,591,580 AI1 Adisyn Ltd 0.038 -11.6 102,741 $7,960,676 HFR Highfield Res Ltd 0.28 -11.1 1,110,569 $123,537,876 JBY James Bay Minerals 0.12 -11.1 88,195 $4,514,738 LCL LCL Resources Ltd 0.008 -11.1 100,000 $8,683,902 VKA Viking Mines Ltd 0.008 -11.1 400,000 $9,227,326 AKM Aspire Mining Ltd 0.29 -10.8 331,773 $164,982,020 FBM Future Battery 0.025 -10.7 250,000 $18,543,726 FCT Firstwave Cloud Tech 0.017 -10.5 1,529 $32,490,368

ICYMI – AM EDITION

Anson Resources (ASX:ASN) has received approvals from the WA Department of Mines, Industry Regulation and Safety for three Plan of Works it had submitted for drilling at the Mary Springs prospects in WA’s Mid-West region.

This drilling is intended to identify extensions to the current 390,000t lead resource and will focus on shallow high-grade mineralisation striking through the tenement at the Mary Springs deposits as well as the Gallaghers and Mary Springs South prospects.

Besides testing for high-grade zinc, lead and silver, drilling will also test for critical minerals such as gallium, indium, germanium and barium that were discovered by previous drilling.

Godolphin Resources (ASX:GRL) has successfully secured $600,000 in Federal government Junior Minerals Exploration Incentive (JMEI) scheme credits in relation to its greenfield mineral exploration.

The Australian Taxation Office confirmed that the JMEI tax credits have been allocated to the company for potential distribution to eligible shareholders.

The JMEI scheme encourages investment in exploration companies that carry out greenfield mineral exploration in Australia, by allowing these companies to give up a portion of their tax losses for potential distribution to eligible investor.

Drilling is now underway at Riversgold (ASX:RGL) Northern Zone gold project just 25km east of Kalgoorlie.

This targets the shallower, up dip portion of the mineralised system that yielded a previous significant intersection of 18m at 4.14g/t gold from 36m.

The Northern Zone project has an exploration target of 200-250Mt at a grade range of 0.4-0.6g/t gold, or 2.5-4.8Moz of gold.

At Stockhead, we tell it like it is. While Anson Resources, Godolphin Resources and Riversgold are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.