ASX Small Caps Lunch Wrap: Who found out there really are monsters in the walls this week?

News

News

Local markets are down again this morning, and I’ve gotta say it’s starting to feel personal. I’ve been in and out from work over the past few weeks, taking much-needed holidays, and every time I get back from a few days off, this happens. So… if it’s me, I’m dreadfully sorry.

The thing is, I know it’s not – the market spent the first 10 minutes in freefall this morning after Wall Street delivered a red hot mess overnight, after investors in New York noped out of everything they could put on the chopping block.

I’ll get into the details of that in a minute, but first there’s a news story out of Charlotte, North Carolina that caught my eye this morning, after a little girl’s complaint that there were “monsters in her bedroom” turned out to be nightmarishly true.

The youngster in question, already burdened with being named “Saylor” by well-meaning but clearly daft parents, had been pestering her parents about monsters living in the walls of her bedroom at the family’s farmhouse for quite some time.

But, parents being parents, her mother Ashley figured it was just the overactive imagination of a toddler at work, and tried the usual tricks to convince her child that she was imagining the scratching and loud buzzing sounds coming from the walls and ceiling of her bedroom.

“We even gave her a bottle of water and said it was monster spray so that she could spray away any of the monsters at night,” the mother told local media.

When that apparent Parent of the Year subterfuge didn’t work, young Saylor’s continued complaining for months about the noises in her room, finally spurring her folks into action to look into what might be the cause of it.

After spotting a few more bees than usual around the house, the family called in a pest control company, which found an estimated 60,000 bees living in a colossal 45kg hive in the walls and ceiling surrounding the young girl’s bedroom.

It took the pest controllers three attempts to remove all the bees, which are a protected species in North Carolina, moving them all to a honeybee sanctuary where they can live out their lives without fear of driving a 3-year-old child batshit crazy.

The family, meanwhile, is on the hook for about $20,000 in home repairs as their insurance policy doesn’t cover “many thousands of bees”, and probably many hundreds of thousands of dollars in therapy bills for the child they’ve been inadvertently gaslighting for months on end.

Things are very much on the nose on the ASX today, with pretty much every market sector sinking into the red mist of losses. The only holdout throughout the session so far has been Consumer Staples, and even that has weaving in and out of the gains lane like a drunk driver all morning.

The short version of the answer to “yes, but why?” is “Wall Street crapped the bed last night”. I’ll put the long version on paper in a minute, because there’s more local news worth noting.

The headlines today are filled with more woes for Qantas, as the company deals with a cock up on its Frequent Flyer app that has apparently treated users to the exhilarating experience of being able to log into anyone’s account but their own.

I gave it a go this morning, discovered that a woman called Adriana has enough points to fly nine times around the planet, and then was unceremoniously logged out when the company pulled the app to fix the bug.

Also on the radar was federal Treasurer Jim “Supernintendo” Chalmers, who’s been on a media blitz to sell his shake-up of Australia’s foreign investment rules, under which Chalmers wants to “streamline the process for investments which are less risky”, with the risk portion of that statement pertaining to foreign control of supply chains, possibly.

I’m really not sure – the more I listen to him talk, the less what he’s saying is making sense, leading me to believe that this media blitz really could (and should) have been handled with an email.

Anyway, it’s approaching midday, and the market’s showing no sign of getting any better, so here’s a snapshot of how things are going… spoiler alert, it’s “not great”.

The sectors look like this:

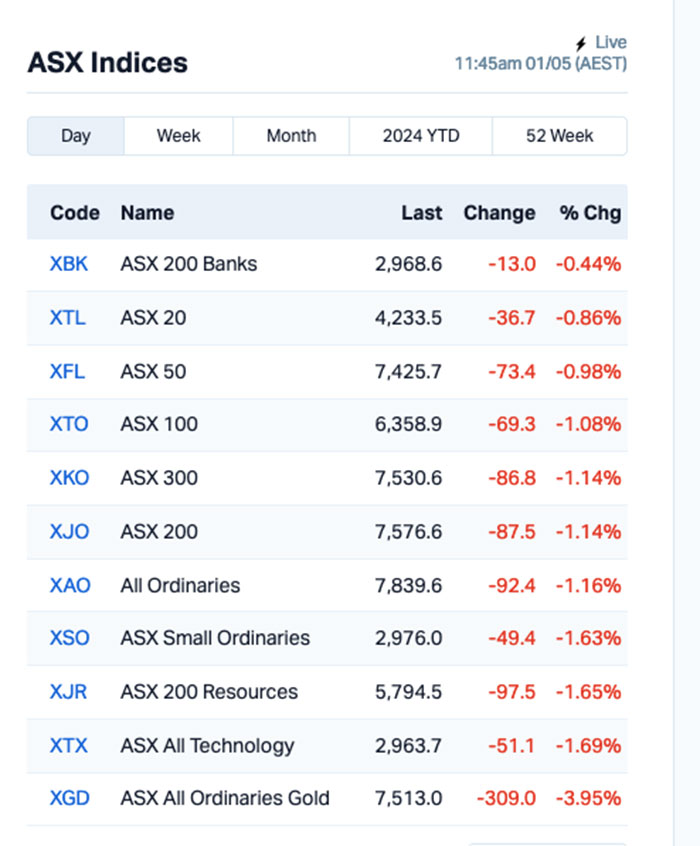

The ASX Indices look like this:

Despite that horror show, there are a number of large caps pulling hard to gain value this morning, including a swag of uranium diggers that are making big moves, as yellowcake prices topped USD$87.70/lb this morning, up more than 64% year on year.

That includes Paladin Energy (ASX:PDN), up 4.6%, Boss Energy (ASX:BOE), up 4.8% and Deep Yellow (ASX:DYL), up 3.7%.

Food and Beverage packaging company Amcor (ASX:AMC) is up 3.84% on news of a gangbuster quarterly, and a handy $0.125 divvy for shareholders.

Mesoblast (ASX:MSB) is also up this morning, on yesterday’s quarterly that included news that the company is working with FDA guidance to resubmit its Biologics License Application (BLA) for approval of remestemcel-L in children with SR-aGVHD.

And, just because more iffy news is better than no news at all, it appears that all four of Australia’s Big Banks are on the same page in terms of possible interest rate relief, with analysts all in a row with expectations of one rate cut by the RBA this year, but it’s not gonna happen until November.

So… what happened in New York that shook local markets so badly today?

For that, we turn to Earlybird Eddy Sunarto, who reported this morning that US investors rushed for the exit after data showed that US labour costs accelerated in Q1, led by the government sector.

The employment cost index was 1.2% higher vs 0.9% in the last quarter, well above the 1% expected and above every single forecast in the Bloomberg survey.

“Not a good look as this is the Federal Reserve’s favoured measure of labour costs, and given labour costs are the biggest cost input in a service sector-led economy, such as the US, it can help to keep price pressures elevated,” said a note out of ING Bank.

“This reinforces the prospect of hawkish messaging from the Fed tomorrow,” ING added, referring to the FOMC meeting that began last night and will culminate in a rates decision later today (US time).

In US stock news, Amazon popped +2.3% post-market after Q1 results showed a beat on both the top and bottom lines, buoyed by a strong showing from its cloud computing segment.

Starbucks shares sank -12% after the bell as revenue fell -13% in the quarter vs the same period last year.

Eli Lilly, the maker of top-selling weight loss drugs Mounjaro and Zepbound, rose +6% after the company raised its annual sales forecast by US$2 billion, citing demand for those two drugs.

Meanwhile, cannabis stocks surged after a report from the Associated Press said the US Drug Enforcement Administration (DEA) will move to reclassify marijuana to a Schedule III drug, or a less dangerous drug.

In Asia, Chinese markets – along with just about every other market in the world – are closed for Labor Day.

But the good news is that Japan’s Nikkei is open. The bad news is that it’s down -0.81% in early trade.

Here are the best performing ASX small cap stocks for 01 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap YPB YPB Group Ltd 0.003 50% 1,000,082 $1,580,923 SRK Strike Resources 0.064 45% 4,750,774 $12,485,000 KPO Kalina Power Limited 0.004 33% 590,000 $6,778,360 RIE Riedel Resources Ltd 0.004 33% 3,600,000 $6,671,507 EMUDA EMU NL 0.023 28% 147,966 $1,214,863 OXT Orexploretechnologie 0.023 28% 522,297 $3,517,482 SNS Sensen Networks Ltd 0.028 27% 471,891 $17,041,278 WAK Wakaolin 0.052 24% 784,315 $17,798,933 KNO Knosys Limited 0.052 21% 818,662 $9,293,964 EEL Enrg Elements Ltd 0.006 20% 225,580 $5,049,825 EXL Elixinol Wellness 0.006 20% 903,574 $6,505,370 MKL Mighty Kingdom Ltd 0.006 20% 2,191,357 $12,487,999 VRC Volt Resources Ltd 0.006 20% 2,149,864 $20,793,391 NOU Noumi Limited 0.135 17% 264,125 $31,867,572 TTI Traffic Technologies 0.007 17% 155,938 $5,227,924 MYE Metarock Group Ltd 0.29 16% 438,750 $76,631,493 MTC Metalstech Ltd 0.2375 16% 465,351 $38,735,691 RCR Rincon 0.089 16% 27,256,279 $17,028,655 LYN Lycaonresources 0.38 15% 1,948,214 $14,538,563 EOF Ecofibre Limited 0.069 15% 85,011 $22,732,434 CVR Cavalierresources 0.195 15% 2,505 $5,410,916 1CG One Click Group Ltd 0.008 14% 456,567 $4,817,252 BCT Bluechiip Limited 0.008 14% 62,625 $7,705,368 KOR Korab Resources 0.008 14% 287,400 $2,569,350 MQR Marquee Resource Ltd 0.016 14% 85,105 $5,787,381

YPB Group (ASX:YPB) was top of the small caps charts this morning, on news that the company has raised $33,075 after costs at a small 5.6% discount to the 15-day VWAP via an At-The-Market (ATM) subscription facility with Dolphin Corporate Investments.

That deal was signed in November of last year, giving YPB access to up to $2 million – and today’s dip into the kitty comes on the heels of the company’s recent quarterly, showing that it has managed to reduce cash burn by 24% on Q4 2023 thanks to a revenue bounce.

Strike Resources (ASX:SRK) is in the winner’s circle this morning, as a 27% shareholder in Lithium Energy (ASX:LEL), which in turn announced yesterday that it had sold its 90% share of the Solaroz lithium brine project in Argentina to CNGR – one of the world’s largest producers of precursor materials for leading companies in the battery materials supply chain – for about $97 million in cash.

Kalina Power (ASX:KPO) inched up $0.001 (+33.0%), ostensibly on news that it has appointed former Macquarie Capital Markets Canada CEO Matthew Jenkins to its board as non-exec director, as well as the board of its wholly owned Canadian project development company, Kalina Distributed Power.

And Orexplore Technologies (ASX:OXT) has been boosted this morning on news that it has developed a nuggety gold detection system that is being validated through commercial testing with multiple tier-1 gold mining companies.

The company says its tech “identifies gold nuggets larger than ~100 micrometres throughout the entire core, providing data to support improved operational grade control and to assist in producing more useful estimates of gold mineralisation”.

Here are the most-worst performing ASX small cap stocks for 01 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -0.5 94,336 $11,649,361 LSR Lodestar Minerals 0.001 -0.333333 770,000 $3,035,096 SHO Sportshero Ltd 0.004 -0.333333 5,517,260 $3,706,997 HCD Hydrocarbon Dynamic 0.003 -0.25 2,000,024 $3,234,329 HLX Helix Resources 0.003 -0.25 3,528,884 $9,292,583 ME1 Melodiol Glb Health 0.003 -0.25 2,072,407 $2,693,949 NRZ Neurizer Ltd 0.003 -0.25 56,789,176 $6,305,643 MCL Mighty Craft Ltd 0.01 -0.230769 2,112,141 $4,746,718 TSL Titanium Sands Ltd 0.007 -0.222222 5,279,137 $17,943,572 LU7 Lithium Universe Ltd 0.026 -0.212121 1,324,030 $13,585,998 AMD Arrow Minerals 0.004 -0.2 4,580,280 $47,398,532 CAV Carnavale Resources 0.004 -0.2 266,788 $17,117,759 SIT Site Group Int Ltd 0.002 -0.2 550,000 $6,506,226 GLN Galan Lithium Ltd 0.27 -0.181818 5,454,145 $136,304,518 BUR Burleyminerals 0.054 -0.169231 935,180 $8,474,111 INP Incentiapay Ltd 0.005 -0.166667 139,554 $7,463,580 NMR Native Mineral Res 0.02 -0.166667 25,250 $5,036,412 PRX Prodigy Gold NL 0.0025 -0.166667 605,115 $6,041,322 RML Resolution Minerals 0.0025 -0.166667 50,000 $4,830,065 TMR Tempus Resources Ltd 0.005 -0.166667 4,083,298 $4,385,992 DY6 Dy6Metalsltd 0.037 -0.159091 15,000 $1,778,077 FGH Foresta Group 0.011 -0.153846 683,851 $29,237,703 PAT Patriot Lithium 0.084 -0.151515 212,205 $6,892,096 FML Focus Minerals Ltd 0.1575 -0.148649 532,919 $53,013,349 ADY Admiralty Resources. 0.006 -0.142857 25,000 $11,406,318

Azure Minerals (ASX:AZS) has secured Foreign Investment Review Board approval for its proposed acquisition by SH Mining – the bid vehicle jointly owned by Chilea’s Sociedad Química y Minera de Chile and Hancock Prospecting.

SH Mining is acquiring the company for $3.70 in cash for every AZS share with a fall-back conditional off-market takeover offer for a cash consideration of $3.65 per AZS share should the scheme not be successful.

The acquisition is now only subject to customary conditions precedent and approval by the Supreme Court of Western Australia at the Second Court hearing scheduled later today.

Lithium Universe (ASX:LU7) is raising up to $3.46m to further develop its Queensland Lithium Processing Hub strategy that is aimed at closing the lithium conversion gap in North America.

The hub will serve as an independent 1Mtpa concentrator and 16,000tpa battery-grade lithium carbonate refinery.

It will raise the funds through a two tranche placement of shares priced at 2c each with the first raising $1.9m and the second the remaining $1.74m.

OD6 Metals (ASX:OD6) is a successful applicant for Round 29 of Western Australia’s Exploration Incentive Scheme that will co-fund the cost of exploration drilling to a cap of $180,000.

Funds from this award will be used to drill the prospective Tighthead and Loosehead targets at its flagship Splinter Rock clay-hosted rare earths project northeast of Esperance.

These two areas are northeast of the main Splinter Rock discoveries and were identified through industry collaboration and partnership with the CSIRO.

At Stockhead, we tell it like it is. While Azure Minerals, Lithium Universe and OD6 Metals are Stockhead advertisers, they did not sponsor this article.