ASX Small Caps Lunch Wrap: Who else thinks Taylor Swift superfans are a bit ‘on the nose’?

Shake it Off. Actually, best not. (Getty Images)

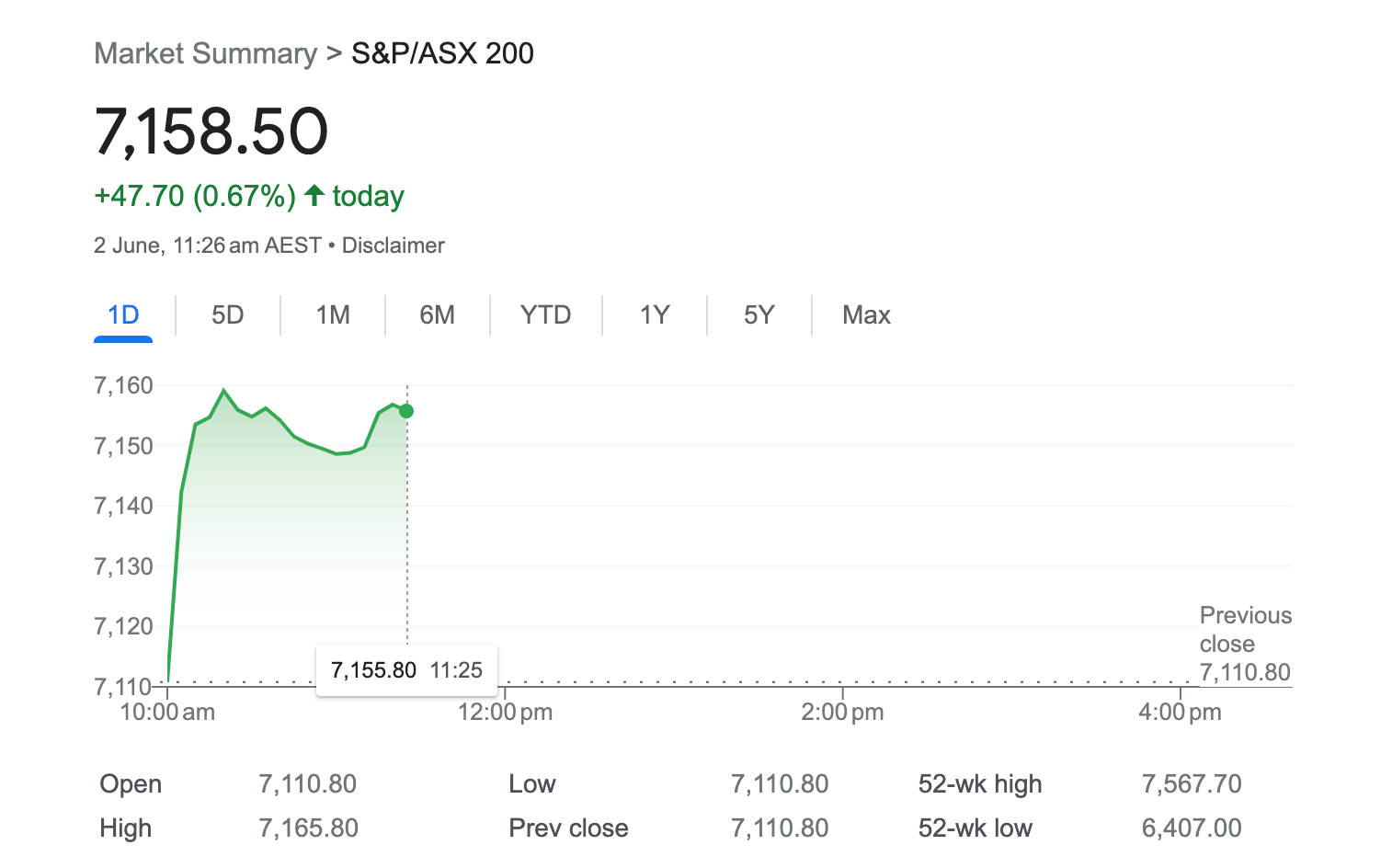

The local bourse cracked one through the covers this morning. What was the story morning glory, ASX 200?

(And here’s an image that supports said innuendo…)

Courtesy of Eddy “Market Highlights” Sunarto, we can tell you that this frisson out of the gates very much had something to do with some positive action on Wall Street overnight. That’s not exactly a huge revelation in itself but we’ll get a bit more granular on it further down.

And speaking of getting a bit granular further down… that’s apparently what some Taylor Swift fans are planning to do when they attend her ongoing “Eras” tour.

Despite that headline, we’re not here to comment on whether we guiltily maybe sort of like one Taylor Swift song amid dislike or mainly ignorance of the rest of her canon. The fans in question certainly love her energetic style of pop-country-poppage, and fair enough, each to their own.

What we will question, however, is Swift fans’ reported need to wear adult nappies to her shows, in case they’re busting or touching cloth during one of the star’s best, or even worst, numbers.

Some Taylor Swift Fans Are Wearing Adult Diapers To Her Concerts So They Don't Miss A Song Because They Had To Go To The Bathroom https://t.co/wODG8G2UUw pic.twitter.com/ESNEQNycsr

— Barstool Sports (@barstoolsports) June 1, 2023

Can’t they just quickly run to, or even behind, a porta-loo and “shake it off” – like any decent concert-going continent adult?

(You knew something like that had to make it in here somewhere, right?)

According to a New York Post report, many of the singer’s superfans, known as “Swifties”, would rather soil themselves than miss a single nano-second of her performances.

“The diaper rash and trench foot was worth this moment of Taylor Swift looking right at us,” wrote Caylee, 23, in a TikTok caption under a video of herself and a friend going nuts at a Swift show in Massachusetts recently.

In any case, we heavily digress, as is customary here. In the meantime, let’s hope the ASX hasn’t crapped its pants for one reason or another…

TO MARKETS

Actually, the bourse has indeed drooped significantly in the time we took to make it to this sub-heading and section. Don’t worry, fans of +s, because it’s still in the green overall, for the moment: +0.27%.

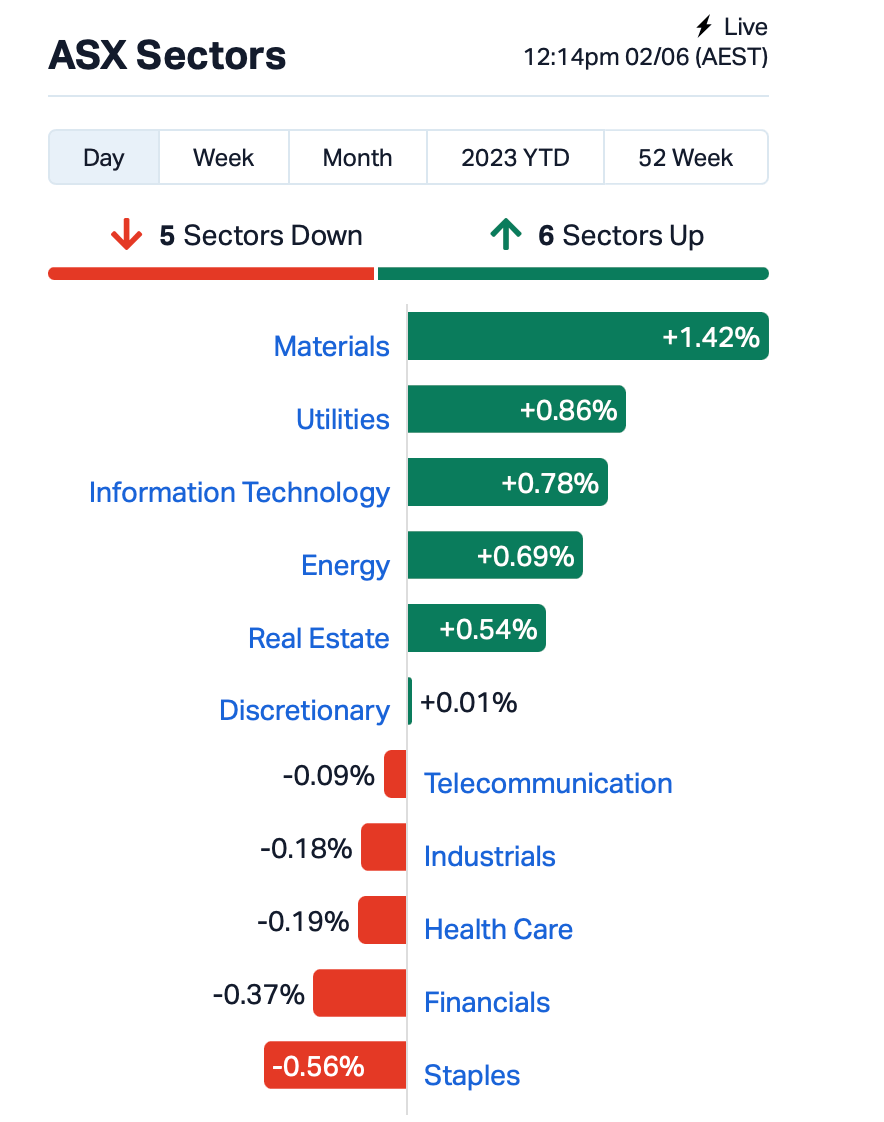

Let’s take a closer, but still fairly zoomed-out look at what’s doing in the various sectors. And for that, we turn to the good folks at Market Index, and this here handy chart…

Materials, Utilities and IT are the big winners. Sorry Financials, but you’re a loser today. Although not as much as Staples. We could go on, but we suggest you just look at the chart.

What we will do, however, is find a few standouts with decent volume in the larger end of town for you…

• Paladin Energy (ASX:PDN): +8.68%. There’s still some positive trading here for the uranium-mining outfit, on alleviated fears surrounding a Namibian government move against Paladin’s flagship mine, the Langer Heinrich project based in the Namib Desert.

• Silex Systems (ASX:SLX): +6.1% on no fresh news for the high-tech laser-enrichment, uranium-mining focused company.

• Appen (ASX:APX): +11.93 on no fresh news for the globally focused language technology data services company.

And just for some balance, here’s a couple of stocks doing their best impression of a Taylor Swift superfan today…

• Mindax (ASX:MDX): -32.6%. Something about a suspension of trading of MDX not being lifted until Mindax announces what’s happening regarding its Mt Forrest Iron Project joint venture shareholders’ agreement.

• Adairs (ASX:ADH): -14.3% on a less-than-impressive trading update pointing to a “subdued trading environment since April with lower traffic observed both in stores and online”.

NOT THE ASX

As is customary whenever I fill in here, let’s ape off Eddy’s excellent Market Highlights work from earlier in the day.

As our macro guru noted, “Aussie shares are set to extend gains on Friday as US stocks advanced in New York.” He wasn’t wrong, although the early surge has cooled.

But this is called “Not the ASX”, so why were Wall Street types high fiving themselves before heading to Dorsey’s for a bite, a spot of racquetball with Gordon, or Blockbusters to return some tapes?

Well, it could well be the ongoing feels that the US economy has dodged a bullet by pushing its bipartisan debt-ceiling bill through the House and onto the Senate, where it’s likely to be approved – before this bloke falls down again and breaks his signing-into-law wrist.

https://twitter.com/disclosetv/status/1664346003808329738

So there’s that, and it’s further validated by this, reckons Eddy:

“The VIX index, which measures stock market volatility and sometimes called ‘Wall Street’s fear index’, tumbled 12% as the debt ceiling bill passed the House on a 314-117 vote. An approval by the Senate is expected soon despite a revolt amongst a handful of Republicans.”

Here’s some of the cold, hard market-movement stats for you. Overnight these indices in the US closed like this:

S&P 500: +0.99%

Nasdaq: +1.28%

Dow Jones: +0.47%

Meanwhile in a few of the biggest Asian markets, at the time of writing, things are also looking up…

Hang Seng: +3.36%

Shanghai: +0.75%

Nikkei: +0.67%

“Crude prices recovered and gained almost 3%, with WTI now trading at US$70.09,” said you guessed it, Eddy, who also informed us that “Gold rose +0.75% to US$1,977.10 an ounce”.

For Bitcoin and crypto info, meanwhile, Eddy is also across that, too. But we’ll give him a break. Head over to this morning’s Mooners and Shakers, where, earlier at least: Litecoin was up, Bitcoin was down and Binance Australia was licking its AUD debanking wounds.

News just in, though, BTC has surged a little since then and is threatening to reclaim US$27k again as we type. By the time we finish this sentence, however, it will’ve dipped… nope, it actually hasn’t and it’s made a liar of me. Again.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 2 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Today Volume Market Cap CLE Cyclone Metals 0.0015 50% 40,000,000 $9,089,248 PRM Prominence Energy 0.0015 50% 600,000 $2,424,609 GMN Gold Mountain Ltd 0.004 33% 1,325,808 $5,909,798 A3D Aurora Labs Limited 0.028 33% 18,603,635 $5,161,969 GGE Grand Gulf Energy 0.012 33% 8,802,624 $14,942,223 INP Incentiapay Ltd 0.017 31% 1,680,819 $16,445,827 DOU Douugh Limited 0.009 29% 6,333,745 $6,887,289 WCG Webcentral Ltd 0.125 25% 891,834 $32,912,623 EMU EMU NL 0.0025 25% 120,507 $2,900,043 PVS Pivotal Systems 0.01 25% 1,568,470 $4,276,950 ZEU Zeus Resources Ltd 0.041 24% 4,625,436 $14,465,385 TNY Tinybeans Group Ltd 0.28 22% 136,792 $14,118,655 MNB Minbos Resources Ltd 0.12 21% 1,615,366 $78,332,439 VSR Voltaic Strategic 0.088 21% 37,350,262 $26,970,415 DCX Discovex Res Ltd 0.003 20% 1,795,363 $8,256,420 GTG Genetic Technologies 0.003 20% 400,788 $28,854,145 THR Thor Energy PLC 0.006 20% 100,000 $7,368,064 ZMI Zinc of Ireland NL 0.024 20% 54,924 $4,262,886 IG6 International Graphite 0.235 18% 78,089 $17,597,622 MAT Matsa Resources 0.042 17% 5,346,564 $14,832,265 CTN Catalina Resources 0.0035 17% 886,658 $3,715,461 DLT Delta Drone Intl Ltd 0.014 17% 2,955,323 $6,206,445 VIT Vitura Health Ltd 0.4 16% 566,750 $192,003,564 DC2 Dctwo 0.022 16% 50,000 $2,483,606 BMG BMG Resources Ltd 0.015 15% 2,199,216 $6,077,364

Some standouts:

• Cyclone Metals (ASX:CLE): +50% on an announcement of proposed issue of securities (totalling more than 1.17m securities to be issued).

• Grand Gulf Energy (ASX:GGE): +33% on an independent review (from Blade Energy Partners) that confirms “significant helium flow potential” within Grand Gulf’s “Jesse 1A” and “Jesse 2” drilling operations in Utah in the US.

• Aurora Labs (ASX:A3D): +33% on the announcement of an MOU signed with Aramco, one of the world’s leading integrated energy and chemicals companies.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for June 2 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 100,000 $11,649,361 MDX Mindax Limited 0.068 -28% 165,851 $194,328,084 AMD Arrow Minerals 0.003 -25% 130,357 $12,095,060 MCT Metalicity Limited 0.0015 -25% 3,475,287 $7,472,172 STM Sunstone Metals Ltd 0.02 -23% 18,984,202 $80,131,607 MOB Mobilicom Ltd 0.007 -22% 300,000 $11,940,090 H2G Greenhy2 Limited 0.019 -21% 1,112,264 $10,050,140 AYT Austin Metals Ltd 0.004 -20% 67,881 $5,079,373 CTO Citigold Corp Ltd 0.004 -20% 398,333 $14,368,295 MTB Mount Burgess Mining 0.002 -20% 20,771,784 $2,207,928 NZS New Zealand Coastal 0.0025 -17% 7,750,000 $4,962,030 RBR RBR Group Ltd 0.0025 -17% 1,013 $4,855,214 EQN Equinox Resources 0.11 -15% 55,892 $5,850,000 ZLD Zelira Therapeutics 1.95 -15% 90,751 $26,098,457 ADH Adairs Limited 1.6125 -14% 4,033,511 $326,201,101 CI1 Credit Intelligence 0.15 -14% 25,000 $14,612,353 OLL Open Learning 0.026 -13% 28,586 $8,036,072 AGR Aguia Res Ltd 0.033 -13% 517,368 $16,486,462 VEN Vintage Energy 0.054 -13% 1,953,705 $46,191,715 AOA Ausmon Resorces 0.0035 -13% 4,004,164 $3,877,157 AVM Advance Metals Ltd 0.007 -13% 21,428 $4,708,470 OAR OAR Resources Ltd 0.0035 -13% 378,000 $9,644,152 TIG Tigers Realm Coal 0.007 -13% 130,434 $104,533,619 XTC Xantippe Res Ltd 0.0035 -13% 117,404,066 $45,920,399 CAY Canyon Resources Ltd 0.056 -11% 3,069,862 $63,993,290

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.