Mooners and Shakers: Litecoin gains while Bitcoin slips; Binance Australia updates banking situation

Getty Images

The price of Bitcoin is currently banging on the door of US$27k, but there’s no one answering just at the moment. Meanwhile, Litecoin’s on track for gains and Binance Australia has updated where it stands with AUD transactions.

Let’s start with Binance Australia’s latest Twitter announcement posted last night, which really is only a reiteration and further confirmation of what we largely already knew was happening. But it’s not great news, frankly.

Fellow Binancians,

We regret to inform you that AUD deposits and withdrawals by bank transfer are no longer available to Binance users in Australia. Binance has ceased all AUD trading pairs as of June 1. In order to facilitate withdrawals and trading activities after June 1, you…

— Binance Australia (@Binance_AUS) June 1, 2023

The local version of the world’s biggest crypto exchange had previously posted, on May 18, that it had to suspend its PayID AUD deposit service.

“We can confirm that Cuscal, our payment processor’s partner bank, has made the decision to end AUD deposit services,” Binance Australia confirmed with Stockhead at the time.

Now, however, all “deposits and withdrawals via bank transfer are no longer available to Binance users in Australia”.

The same assurance has come from the exchange, however, that users’s funds are safe and that they “can still buy and sell crypto using credit or debit card and our Binance P2P marketplace will also continue to operate as usual”.

Additionally, the exchange notes that Binance Aus users can still convert their AUD balances to USDT for the facilitation of withdrawals and trading activities after June 1.

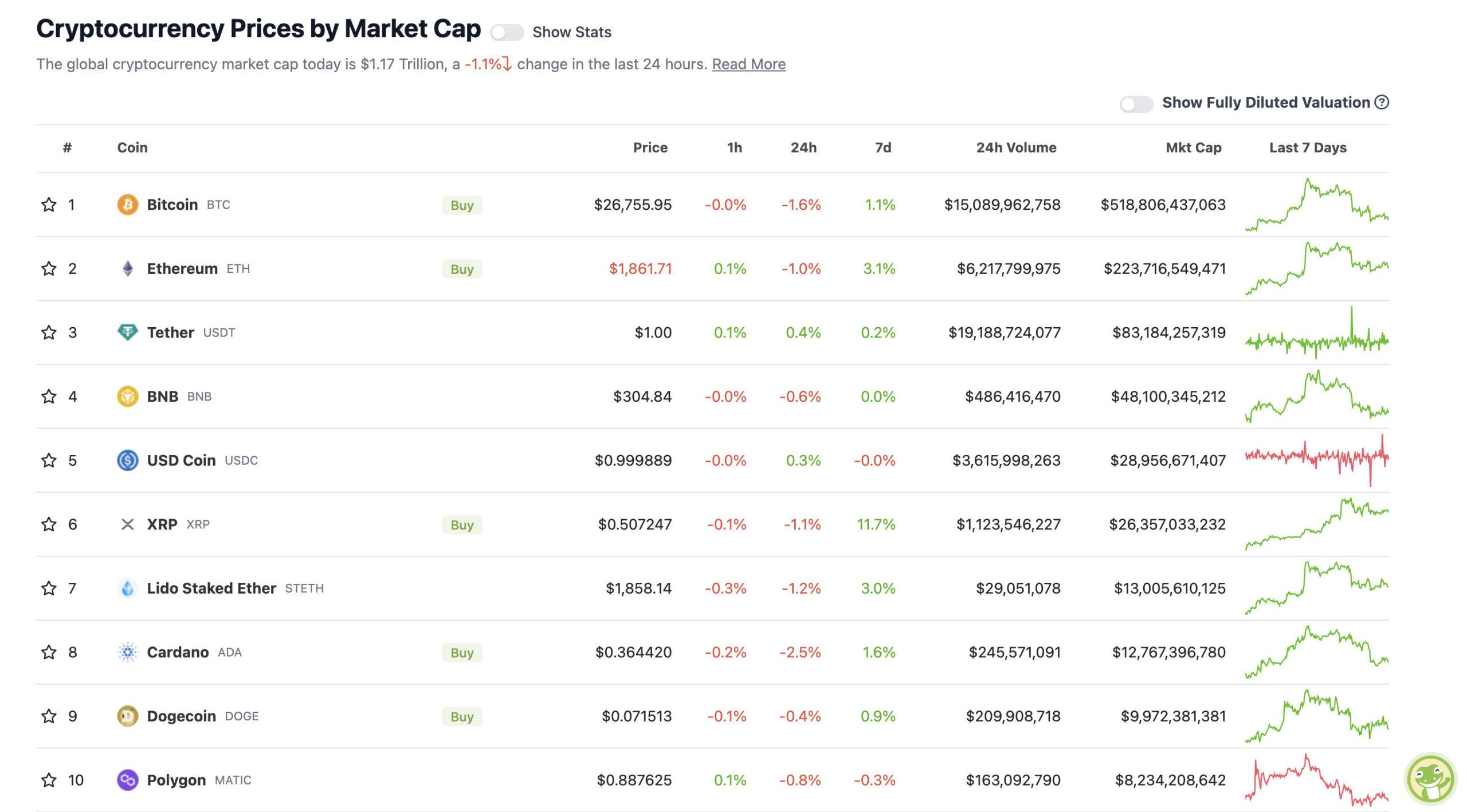

Top 10 overview

With the overall crypto market cap at US$1.17 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Flat, flat, prices are flat… well, a fraction down, really. Bitcoin and pals haven’t actually moved higher with the US stock market, as is so often the case in a long story of correlation.

Is it highway to the danger zone for Bitcoin and crypto, then? Some will certainly think so, but then again, not some of the Twittering analysts we regularly check in with. For example…

$BTC 1D

This is exactly what I want to see to predict a move upwards.

Price moving down, volume moving down is bullish Price Action or bearish price action exhaustion.

I’m actively looking for long setups.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/bcvY5izD5X

— Roman (@Roman_Trading) June 1, 2023

Although Rekt Capital might not be enjoying the fact BTC appears to have just slipped below his “red box”…

Technically, #BTC is still trying to retest this downtrending channel that kickstarted the most recent move to ~$28000

Needs to retest the top of the pattern

But also needs to keep inside the red box to have a chance at invalidating the bearish H&S$BTC #Crypto #Bitcoin https://t.co/Hxc6ALwE2j pic.twitter.com/v8gA90jp3u

— Rekt Capital (@rektcapital) June 1, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Litecoin (LTC), (market cap: US$6.84 billion) +4%

• The Sandbox (SAND), (market cap: US$1.02 billion) +3%

• Radix (XRD), (market cap: US$692 million) +3%

• Bitget Token (BGB), (market cap: US$670 million) +3%

Litecoin, the world’s second-oldest crypto, is up today as the token’s halving narrative continues to gain some momentum, and as the blockchain’s network activity and unique, non-zero addresses continue to rise.

Some recent positive tweeting from prominent blockchain analytics firm IntoTheBlock has also been creating some buzz for the token.

Litecoin had a strong month. Total addresses with a balance has increased more intensely since the end of April and we now observe nearly 8.5 million LTC addresses with a balance!#Litecoin https://t.co/beYBnYLzm8 pic.twitter.com/seMsdiJEup

— IntoTheBlock (@intotheblock) May 30, 2023

PUMPERS (lower, lower caps)

• Energy Web Token (EWT), (market cap: US$134 million) +25%

• Selfkey (KEY), (market cap: US$58 million) +20%

• Nuls (NULS), (market cap: US$26 million) +17%

SLUMPERS

• Gate (GT), (market cap: US$582 million) -8%

• XDC Network (XDC), (mc: US$512 million) -7%

• The Graph (GRT), (mc: US$1.13 billion) -7%

• Sui (SUI), (mc: US$489 million) -5%

• Kava (KAVA), (mc: US$543 million) -4%

SLUMPERS (lower, lower caps)

• Refund (RFD), (market cap: US$19 million) -23%

• PIVX (PIVX), (market cap: US$19 million) -18%

• Ben (BEN), (market cap: US$34 million) -17%

• Turbo (TURBO), (market cap: US$19 million) -16%

• Lybra Finance (LBR), (market cap: US$19 million) -14%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Where are we #BTC? pic.twitter.com/N8talwNvOQ

— CRYPTO₿IRB (@crypto_birb) June 1, 2023

Here is a complete list of every #crypto alt I am watching or accumulating 👀

My team and I research projects every single day to find the most exciting and promising new cryptos. There are quite a few new projects added this month, especially in #DeFi😘

So, let's get started👇…

— Lady of Crypto (@LadyofCrypto1) June 1, 2023

https://twitter.com/WarMonitors/status/1664351431355244546

$DXY 1W

I’m still confident in my theory that the dollar is forming a bear flag and not a DB. Breaking 101 confirms the pattern.

If confirmed, risk and equities will sky rocket upwards.#bitcoin #stocks #cryptocurrency pic.twitter.com/jnx90rz0En

— Roman (@Roman_Trading) June 1, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.