ASX Small Caps Lunch Wrap: Who else is up to something totally pointless today?

Pic via Getty Images.

Local markets have fallen this morning, down 0.7% after Wall Street grumbled and moaned its way through yet another tech sell-off.

It’s probably Apple’s fault – the iPhone 15 launch went about as well as you’d expect for the 15th iteration of a product we love to hate.

I’ll dig into the whats, wheres and whys shortly, but to kick things off today I’ve got some groundbreaking news from the world of modern art, after a major milestone was recently reached in one of the most singularly pointless expressions of artistic endeavour that’s ever been launched.

It’s called The Zeitpyramide, which is German for either “Time Pyramid” or “I took too many drugs” – I’m waiting to hear back from some German friends of mine for clarification.

It’s a piece of modern public sculpture, the brainchild of German artist Manfred Laber who, sadly, will never get to see his creation complete.

There are two reasons for this sad fact:

- Construction of the sculpture is set to be completed in the year 3183, and

- He’s been dead since 2018.

The idea is simple enough – Laber wanted to build a pyramid made of massive concrete blocks, with one block placed every 10 years until its completion 1,160 years from now, when it will stand proudly at a height of 9.2 metres in the town of Wemding, Germany.

The town itself was founded in the year 793 and celebrated its 1,200 year anniversary in 1993 – hence the 1,200 year project due to be completed to celebrate the town turning 2,400 years old.

I mention all this because one of the concrete blocks was recently added to the project, so now – as you can see – there are now four concrete blocks standing on a slab, which looks like something you’d park a caravan on by the seaside.

There is an ongoing public art project in Germany called the Time Pyramid (Zeitpyramide). It will consist of 120 concrete blocks, but only one block is placed every 10 years. So far, 3 blocks have been placed. It is scheduled to be completed in the year 3183. pic.twitter.com/nxqQVdlXN8

— Bad Spit (@BadSpit) June 25, 2023

I’m not a huge fan of sculpture, mostly because I don’t understand it – and, as I wrote many years ago, I nearly got a handle on it, thanks to some sage advice from my old man.

In my late teens, I decided that I would like to take up sculpture, so I told my dad that I wanted to carve a large elephant in the backyard, but that I needed his help.

His advice was invaluable… he told me that if I wanted to carve an elephant, I should get myself a lump of concrete, making sure that the concrete is slightly larger than the elephant I want to create.

Then, I was to get myself a hammer and chisel, assess the block of stone, and then simply knock off the bits that didn’t look like an elephant.

He’s lucky I didn’t start knocking off all the bits of him that did look like an elephant.

Anyway – as pointless endeavours go, Laber’s Zeitpyramide is a fairly obvious metaphor about the passage of time, and the permanency of impermanent (and clearly terrible) ideas – plus it’s obviously a Laber of love. *baddum-tish*

Speaking of which, I should stop waffling and go see what the markets are doing today, because – unlike that sculpture – things are moving quickly and they’re actually rather important.

TO MARKETS

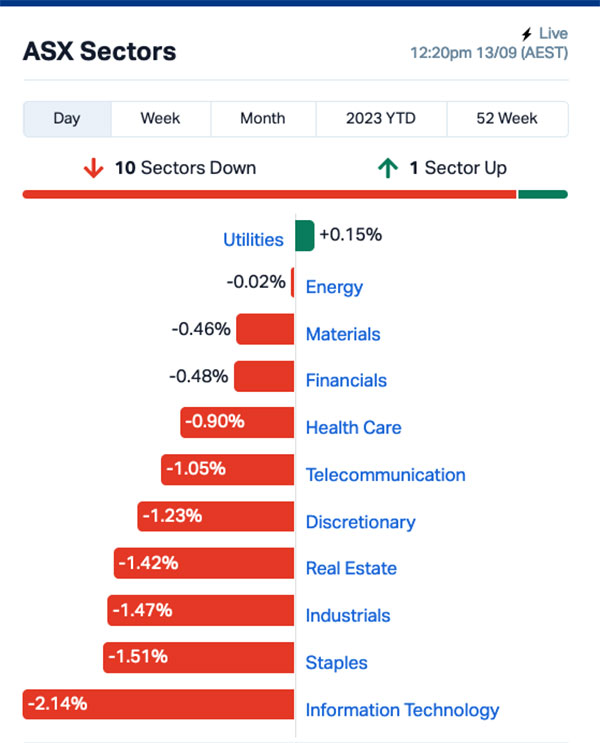

Well, would you look at that? Local markets are down again, sinking to -0.7% at lunchtime on the back of a solidly poor effort from InfoTech, Staples, Industrials and the rest of the sectors except for Utilities.

And here’s a picture:

There’s one big company doing well today, and – of course – it’s a lithium player. Core Lithium (ASX:CXO) has added 5.6% since the market opened, largely because lithium’s so hot right now.

But there have been some losses up the top end of town today, too, including Energy Resources of Australia (ASX:ERA) dumping 7.5%, recent hard-charger Cettire (ASX:CTT) falling 6.3% and Neuren Pharmaceuticals (ASX:NEU) shedding 6.72%.

In business news, Qantas (ASX:QAN) has finally decided to issue an apology to the 1,700 workers it illegally laid off when the pandemic hit, and the company raided the public piggybank to the tune of $2.7 billion, which it reckons doesn’t need to be paid back.

And all it took to extract a “sorry” from the Flying Kangaroo was losing a High Court battle to have a Federal Court decision that Qantas had broken the law, and – probably – the sudden premature (and, some might say, a tad cowardly) departure of Alan Joyce as CEO.

In case you missed it, Joyce scampered out the door a couple of months early, in the wake of an absolute pantsing before a parliamentary committee that left a giant emu egg on Qantas’ face over some clearly unethical corporate behaviour.

Michael Kaine (with a K), national secretary of the Transport Workers Union, summed it up in a statement to the Qantas board this morning when the High Court announced its decision.

“The final act of this board should be to strip Alan Joyce of his bonuses and follow him out the door.”

Joyce left the company with a reported $27 million golden parachute, Qantas shares dipped 0.7% and the world kept turning.

NOT THE ASX

There was a big tech sell-off on Wall Street last night, which dragged everything down along with it and left the S&P 500 down by -0.57%, blue chips Dow Jones flattish at -0.05%, and tech-heavy Nasdaq lower by -1.14%.

Apple’s hotly anticipated iPhone 15 launch went about as well as a North Korean missile launch – lots of light and noise, and an embarrassing 2% drop once the smoke had cleared.

For any of you struggling under the weight of total self-loathing and an all-consuming need to punish yourself, here’s 85 minutes of footage from Apple, explaining that they have built a slightly better version of the thing they’ve been building since 2007.

The major headline is that the company has been forced to ditch its Lightning cable chargers, so the new phone will get its battery charged using an industry-standard USB-C cable… making the dozens of Lightning cables that every iPhone user has inadvertently collected over the years completely useless, and destined for landfill.

Earlybird Eddy also reported that Oracle Corp sank by -13.5%, the biggest one day fall since 2002, after the company’s Q1 earnings fell flat compared to its AI expectations.

US-traded BP shares slid 1% after CEO Bernard Looney resigned effective immediately, citing that he was not “fully transparent in his previous disclosures” about relationships with colleagues prior to becoming CEO.

And the long awaited Arm IPO is almost here, which will value the company upon listing around US$54.5 billion.

German shoe manufacturer Birkenstock has also filed for an IPO, which could value the company at over US$6 billion, which comes as something of a shock for every Man Bun-wearing yahoo who wants comfy footwear, but is way too hip to wear Crocs.

In Japan, the Nikkei has fallen 0.3% despite the nation’s soccer team claiming another international scalp on its way to becoming something of a regional powerhouse.

Japan beat Türkiye, the nation formerly named after a bird, 3-1 at the home of Belgian Pro League side KRC Genk, with Japanese forward Keito Nakamura cracking home a brace of goals, and defensive specialist Atsuki Ito belting home his maiden international point.

The Japanese squad recently caused quite a sensation with its 4-1 destruction of Germany, a beating so comprehensive it forced Germany head coach Hansi Flick into an Alan Joyce-like scuttle out the door.

In China, Shanghai markets have fallen 0.6%, while in Hong Kong the Hang Seng is down 0.15%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 13 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.0015 50% 494,336 $10,264,505 MEB Medibio Limited 0.0015 50% 850,000 $6,100,744 TMR Tempus Resources 0.023 35% 1,054,934 $5,301,250 MTH Mithril Resources 0.002 33% 150,000 $5,053,207 SPL Starpharma Holdings 0.1675 29% 5,154,003 $53,364,100 JBY James Bay Minerals 0.385 28% 3,985,253 $9,733,500 PPY Papyrus Australia 0.028 27% 140,000 $10,836,487 SPX Spenda Limited 0.01 25% 1,566,013 $29,371,377 PUR Pursuit Minerals 0.011 22% 4,669,491 $26,495,743 IMC Immuron Limited 0.089 20% 519,449 $16,857,078 CHW Chilwa Minerals 0.18 20% 2,800 $6,881,250 PRX Prodigy Gold NL 0.006 20% 399,500 $8,755,539 ESK Etherstack PLC 0.31 19% 82,091 $34,256,821 BDT Birddog 0.13 18% 204,893 $21,831,931 ECT Env Clean Tech 0.007 17% 2,987,986 $17,085,331 GCR Golden Cross 0.0035 17% 200,000 $3,291,768 OMA Omega Oil & Gas 0.18 16% 301,564 $27,407,171 RDN Raiden Resources 0.036 16% 20,996,585 $70,970,155 WIN Widgie Nickel 0.225 15% 2,607,581 $58,015,752 AFL AFLegal Group 0.19 15% 25,075 $12,962,634 SPA Spacetalk Ltd 0.023 15% 1,012,846 $6,917,313 BDM Burgundy D Mines 0.1775 15% 1,999,520 $220,286,811 BEX Bikeexchange Ltd 0.008 14% 1,895,000 $8,324,051 ENT Enterprise Metals 0.004 14% 1,000,256 $2,798,148

Top of the Small Caps ladder today is Tempus Resources (ASX:TMR), up 47% in the space of a few hours on no news, and, literally as I write this, the company’s been pushed into a trading halt thanks to an ASX speeding ticket.

In second place, Starpharma (ASX:SPL) is up 36% after announcing that interim clinical data from its Phase 1/2 clinical trial of DEP irinotecan will be presented at a key international oncology conference.

The data being presented for DEP irinotecan are obtained from heavily pre-treated, advanced metastatic colorectal cancer (CRC) or platinum-resistant/refractory ovarian cancer patients.

It shows that the drug prompts durable responses for up to 72 weeks in CRC patients receiving DEP irinotecan monotherapy, with a disease control rate (DCR) of 48%.

Additionally, the data shows a 100% disease control rate in patients receiving DEP irinotecan in combination with 5-fluorouracil (5-FU) and leucovorin (LV).

100% is good, right?

Meanwhile, yesterday’s market debutante James Bay Minerals (ASX:JBY) is climbing steadily again, up more than 28% today to reach $0.385, a solid climb from its $0.20 listing price.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 13 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap FRE Firebrick Pharma 0.076 -77% 16,109,712 $37,459,686 MXC MGC Pharmaceuticals 0.002 -33% 166,265 $13,283,905 CCE Carnegie Clean Energy 0.0015 -25% 664,164 $31,285,147 KNM Kneomedia Limited 0.003 -25% 1,600,000 $6,019,141 92E 92Energy 0.265 -24% 1,886,545 $37,231,286 MEL Metgasco Ltd 0.009 -18% 6,053,895 $11,702,754 C29 C29 Metals 0.074 -18% 204,336 $3,723,022 EDE Eden Innovations 0.0025 -17% 239,356 $10,090,911 PNX PNX Metals Limited 0.0025 -17% 200,000 $16,141,874 PUA Peak Minerals Ltd 0.0025 -17% 190,113 $3,124,130 ROG Red Sky Energy 0.005 -17% 1,111,700 $31,813,363 TMX Terrain Minerals 0.005 -17% 3,266,361 $6,499,196 JGH Jade Gas Holdings 0.028 -15% 708,327 $33,204,739 NIS Nickelsearch 0.051 -15% 11,710,258 $5,737,823 ENV Enova Mining Limited 0.006 -14% 322,518 $3,420,632 IEC Intra Energy Corp 0.006 -14% 905,070 $11,345,471 LRL Labyrinth Resources 0.006 -14% 350,000 $8,312,806 LSR Lodestar Minerals 0.006 -14% 959,667 $14,146,281 CTQ Careteq Limited 0.025 -14% 315,000 $6,441,563 NSM Northstaw 0.039 -13% 25,400 $5,405,715 RCW Rightcrowd 0.02 -13% 14,675,654 $6,058,612 NXL Nuix Limited 1.375 -13% 1,624,002 $508,073,316 BFC Beston Global Ltd 0.007 -13% 17,742,016 $15,976,375 CRB Carbine Resources 0.007 -13% 1,100,000 $4,413,902 ESR Estrella Res Ltd 0.007 -13% 17,090 $11,868,575

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.