ASX Small Caps Lunch Wrap: Who else is going to be checking for monsters under the bed tonight?

"Yeah, sorry... the photos on my Tinder profile are from a while ago." Pic via Getty Images.

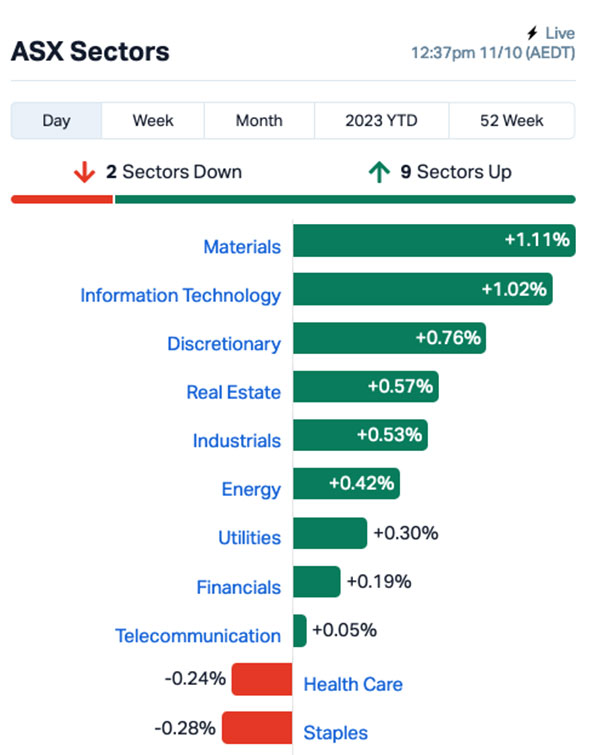

Local markets are up at lunchtime today, pretty much in line with gains made on Wall Street overnight and driven for the most part by better-than +1.0% gains for both Materials and InfoTech this morning.

I’ll get into the details of that shortly, but first there’s news out of Mexico that Halloween has come early, resulting in the arrest of a man, and his “Chucky” doll.

Chucky, for those of you who never owned a VCR in the late 1980s, is the bad guy from director Tom Holland’s classic trashy horror film Child’s Play, in which a murderer uses a voodoo spell to evade police by transferring his soul into a child’s toy.

Naturally, this has devastating consequences for the hapless family who purchase the possessed doll for their son “Andy”, after the doll comes to life and goes on a murderous rampage.

A truly cerebral moment in cinema history – and one that really seems to have stuck with audiences through the decades, spawning a stack of sequels and reboots, including Pixar’s Toy Story franchise, which sees “Andy” terrorised mercilessly by the voice of Tom Hanks.

It also spurred a short-lived crime spree in Mexico, when a suspect known only as Carlos ‘N’ armed his own replica Chucky doll with a very real knife, and used it to menace his victims into giving him money.

Carlos N was quite quickly apprehended, and police took him and the doll into custody, where the pair of them were handcuffed and had mugshots taken.

Yes, even the doll.

Carlos N was reportedly released shortly afterwards, the police involved in taking that mugshot have been reprimanded for not taking their jobs seriously, and – in super-spooky news – the whereabouts of the Chucky doll are currently unknown.

TO MARKETS

It’s a not-too-shabby day for local investors, with the majority of the market sectors performing quite well and the benchmark up 0.46% around lunchtime, in the wake of a similar level of positivity in the US overnight.

Materials and InfoTech are the best of the winners this morning, both up more than 1.0%.

Tellingly, the XGD All Ords Gold index has trickled lower this morning in the face of predictions that the fresh crisis in the Middle East would send investors scrambling for a safe haven.

In the expensive seats, Health Care large capper Summerset Group (ASX:SNZ) is surging today on yesterday’s news that things are going pretty well for the company at present.

CEO Scott Scoullar said sales were up 19% compared to Q3 2022 despite a challenging market, citing figures of 260 sales for the quarter ending 30 September 2023, comprising 133 new sales and 127 resales, taking the company’s total to 743 settlements for year-to-date 2023.

“This is a very pleasing result, the residential property market has been unpredictable at times, but we’ve been able to continue our momentum. We’re seeing positive signs that the property market is improving,” Scoullar said.

NOT THE ASX

Wall Street put in a positive performance overnight, which saw the S&P 500 rise by +0.52%, the blue chips Dow Jones index up by +0.40%, and the tech-heavy Nasdaq lifting by +0.28%.

Earlybird Eddy reports that US bond yields eased as traders bet the Fed is done with rate hikes following recent dovish comments from Fed Reserve officials.

The latest comment came from Atlanta Fed President Raphael Bostic, who said that current rates were already high enough to get inflation back to the Fed’s 2% target.

The VIX index, sometimes called the stock market’s fear index, fell by 4% on his comments.

To stock news, Amazon rose 1% after kicking off its 2023 Amazon Prime Day. Pepsi rose 2% after its Q3 earnings beat forecasts by a long shot.

Block Inc shares on the NYSE surged 5% after Bank of America maintained a Buy rating on the stock.

In Japan, the Nikkei is up 0.45% this morning after news broke that Japanese Emperor Naruhito and Empress Masako have visited a company that grows and processes sweet potatoes in the southwestern Japan prefecture of Kagoshima.

According to The Japan News, Emperor Naruhito was surprised to learn that it is possible to store the favoured Beniharuka variety of sweet potato – much loved in Japan as part of a candied dessert – for “quite some time”.

However, market sentiment was dulled somewhat as a planned walk out into the middle of a sweet potato field by Emperor Naruhito and Empress Masako was cancelled because of rain.

In China, Shanghai markets are up 0.54%, while Hong Kong’s Hang Seng is 1.62% better off in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap KP2 Kore Potash PLC 0.011 38% 142,723 $5,342,426.56 ZAG Zuleika Gold Ltd 0.015 36% 1,401,180 $5,753,556.88 AXP AXP Energy Ltd 0.002 33% 14,907 $8,737,021.01 DDT DataDot Technology 0.004 33% 9,360,861 $3,632,858.35 LNU Linius Tech Limited 0.0025 25% 1,661,261 $8,459,581.43 DTR Dateline Resources 0.011 22% 729,072 $7,968,985.53 MOB Mobilicom Ltd 0.011 22% 645,862 $11,940,090.25 BEZ Besra Gold 0.165 22% 6,035,820 $56,443,622.31 5EA 5E Advanced 0.45 22% 603,720 $112,695,961.60 PNX PNX Metals Limited 0.003 20% 5,003,386 $13,451,561.80 EVR Ev Resources Ltd 0.013 18% 1,044,993 $10,295,824.78 AGH Althea Group 0.035 17% 2,755,024 $11,881,318.56 PUA Peak Minerals Ltd 0.0035 17% 120,000 $3,124,129.85 14D 1414 Degrees Limited 0.043 16% 26,200 $8,812,235.28 HAS Hastings Tech Met 0.79 16% 244,277 $87,969,323.36 NYR Nyrada Inc. 0.023 15% 35,000 $3,120,174.00 PXS Pharmaxis Ltd 0.039 15% 132,898 $24,550,419.44 CZR CZR Resources Ltd 0.2 14% 463,819 $41,253,563.05 VKA Viking Mines Ltd 0.012 14% 2,000,000 $10,765,213.53 CUS Coppersearchlimited 0.205 14% 6,000 $14,833,429.56 AZL Arizona Lithium Ltd 0.017 13% 4,392,836 $47,920,345.17 KRR King River Resources 0.017 13% 12,550,076 $23,302,874.21 SER Strategic Energy 0.017 13% 2,205,148 $7,287,227.10 IIQ Inoviq Ltd 0.64 13% 40,317 $51,990,566.63 RVS Revasum 0.18 13% 26,607 $16,946,664.64

Zuleika Gold (ASX:ZAG) is up 54.5% at lunchtime today, following the after-hours announcement of a handsome $3 million private placement to underpin the Company’s ongoing exploration and development programs across multiple targets at its Kalgoorlie gold projects.

The company behind the placement, Yandal Investments, is owned and controlled by “prominent West Australian prospector and investor” Mark Creasy – for more details on the deal with Zuleika, Rob Badman’s got you covered here.

Creasy’s been busy of late, sinking far larger chunks of his enormous fortune into a significant iron-focussed play in WA, as the inimitable Josh Chiat reported very early this morning.

Besra Gold (ASX:BEZ) is back in the news today, simply by announcing that the company is “very pleased to advise receipt of US$10,000,000 from Quantum Metal Recovery”, in accordance with the terms and conditions US$300 million Gold Purchase Agreement (GPA) announced to ASX on 9 May 2023.

The payment takes the total for Besra to US$15,000,000 – and it’s given Besra’s executive chair, Dato’ Lim Khong Soon reason to be proud.

“Coming on the second anniversary of Besra’s listing, the transfer of the first US$10,000,000 underscores the progress Besra has made since listing and sets the company up well for its move back into commercial production, unlocking the undoubted potential of our exciting Bau project,” Dato’s Lim Khong Soo said.

5E Advanced Materials (ASX:5EA) is also performing well this morning, up more than 20% so far on news that Step-Rate Testing has commenced at its 5E Boron Americas (Fort Cady) Complex in the United States.

This specific testing “seeks to establish the porosity of the ore body and measure the fracture gradient, [to] form a base-line parameter for operation of the wellfield”, the company said.

The SRT program will span approximately 12 days, during which a series of water injections will take place in accordance with the EPA-approved testing protocol.

On the downside today is Kazia Therapeutics (ASX:KZA) , which has dropped around 35% on news that the company has decided to voluntarily de-list from the ASX, with a date yet to be confirmed.

KZA will retain its NASDAQ listing, however, and is citing “considerable corporate and administrative costs, including listing fees”, and better access to capital markets overseas as the main reasons for the decision.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 11 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap KZA Kazia Therapeutics 0.11 -31% 2,029,242 $37,815,900 VN8 Vonex Limited. 0.018 -25% 1,547,966 $8,683,887 CR1 Constellation Res 0.12 -20% 7,676 $7,485,814 AVM Advance Metals Ltd 0.004 -20% 50,214 $2,942,794 MCT Metalicity Limited 0.002 -20% 1,200,000 $9,340,215 NES Nelson Resources 0.004 -20% 1,614,545 $3,067,972 RBR RBR Group Ltd 0.002 -20% 1 $4,046,012 DCL Domacom Limited 0.018 -18% 269,000 $9,581,039 SRJ SRJ Technologies 0.082 -18% 20,000 $15,118,171 BCA Black Canyon Limited 0.1 -17% 4,000 $7,877,325 RML Resolution Minerals 0.005 -17% 787,000 $7,543,751 SIT Site Group Int Ltd 0.0025 -17% 1,000,000 $7,807,471 PCK Painchek Ltd 0.046 -16% 6,621,805 $77,347,749 TNY Tinybeans Group Ltd 0.12 -14% 19,831 $11,737,403 TSL Titanium Sands Ltd 0.006 -14% 243,937 $12,402,633 VAL Valor Resources Ltd 0.003 -14% 100,000 $13,556,672 JPR Jupiter Energy 0.019 -14% 39,633 $27,947,266 W2V Way2Vat 0.013 -13% 196,297 $9,518,826 CMG Critical Mineral Group 0.23 -13% 2,955 $8,178,052 IAM Income Asset 0.1 -13% 41,594 $32,202,394 CCO The Calmer Co Int 0.0035 -13% 363,105 $3,268,477 WC1 West Cobar Metals 0.066 -12% 14,521 $7,285,025 RHY Rhythm Biosciences 0.27 -11% 354,098 $67,448,490 AUR Auris Minerals Ltd 0.008 -11% 224,635 $4,289,634 BAT Battery Minerals Ltd 0.025 -11% 69,131 $3,348,926

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.