Resources Top 5: Zuleika Gold gets Creasy’s Midas touch, while Besra makes a $10m sale

A display from the Fifty Years of Bond Style exhibition in London, 2012. Pic via Getty Images

- When the world zigs, Mark Creasy ZAGs. Small goldie Zuleika is up today on billionaire prospector investing news

- Besra Gold and King River Resources are also helping lead the yellow metal corner of the small caps market today

Here are the biggest resources winners in early trade, Wednesday October 11.

Zuleika Gold (ASX:ZAG)

Zuleika, a small goldie focused on four gold projects near Kalgoorlie, is seeing its share price move up today on financial matters of import.

Yesterday, it announced it had entered into a subscription agreement with Yandal Investments, a company owned and controlled by legendary West Australian prospector and investor Mark Creasy, for the raising of $3 million.

The company noted that the subscription price comes at a 28% premium to its prior closing price.

Proceeds from the private placement will be funnelled straight into the company’s ongoing exploration and development programs across multiple targets at its four Kalgoorlie projects – Zuleika, Credo, Menzies and Goongarrie.

It’s not the first time ZAG has seen a Creasy pump. Here’s a jump back in time for you, to January 2022…

Resources Top 5: Tiny goldie gets $3m thumbs-up from Mark Creasy, shares explodehttps://t.co/LalOlNk2ee #ASX $ZAG @AutecoMinerals @MTHResources @rarex_asx @KaiserReef pic.twitter.com/OI3vPco2Uc

— Stockhead (@StockheadAU) January 18, 2022

Meanwhile, Creasy has been particularly busy lately. His majority owned CZR is eyeing the iron throne. Per a report from Stockhead resources expert Josh Chiat:

“The famous Perth prospector owns more than 50% of CZR Resources (ASX:CZR), owner of the Robe Mesa deposit adjacent to Rio Tinto’s (ASX:RIO) Robe Valley mines, which include the Robe River JV from where over 1.7 BILLION TONNES have been shipped over the past 51 years.”

Read here for more on that story. The CZR share price, by the way, is also well up today with a 20% gain at the time of writing.

This is not to say anything of Creasy’s massive stakes in IGO (ASX:IGO), Galileo Mining (ASX:GAL) and Azure Minerals (ASX:AZS).

ZAG share price

Besra Gold (ASX:BEZ)

Besra, which wants to pull up gold at the Bau Goldfield in East Malaysia, is surging after announcing receipt of US$10 million from Quantum Metal Recovery.

And that’s in accordance with the terms and conditions set by a US$300 million Gold Purchase Agreement set in stone back in May.

READ: $300m gold sale deal to supercharge Besra’s ~3Moz Bau project development

Quantum is Besra’s largest CDI (CHESS Depositary Interest) holder and under the terms of the GPA, Besra has agreed to sell to Quantum a quantity of refined gold from the Bau project (or any other gold project owned by the company or its subsidiaries) until: 3,000,000 ounces has been received by Quantum, or aggregate deposits hit US$300,000,000 equivalent.

Besra’s Executive Chair, Dato’ Lim Khong Soon, said: “Coming on the second anniversary of Besra’s listing, the transfer of the first US$10,000,000 underscores the progress Besra has made… and sets the Company up well for its move back into commercial production.”

BEZ share price

King River Resources (ASX:KRR)

Goldie KRR is up double digits on the completion of its 2023 geophysics program in the Tennant Creek region in the NT, and the allocation of a $2m drilling budget to test resulting targets, which kicks off on November 10 this year.

King River Resources (formerly King River Copper) has holdings at Mt Remarkable in the Kimberley region of northern Western Australia, as well as at Tennant Creek.

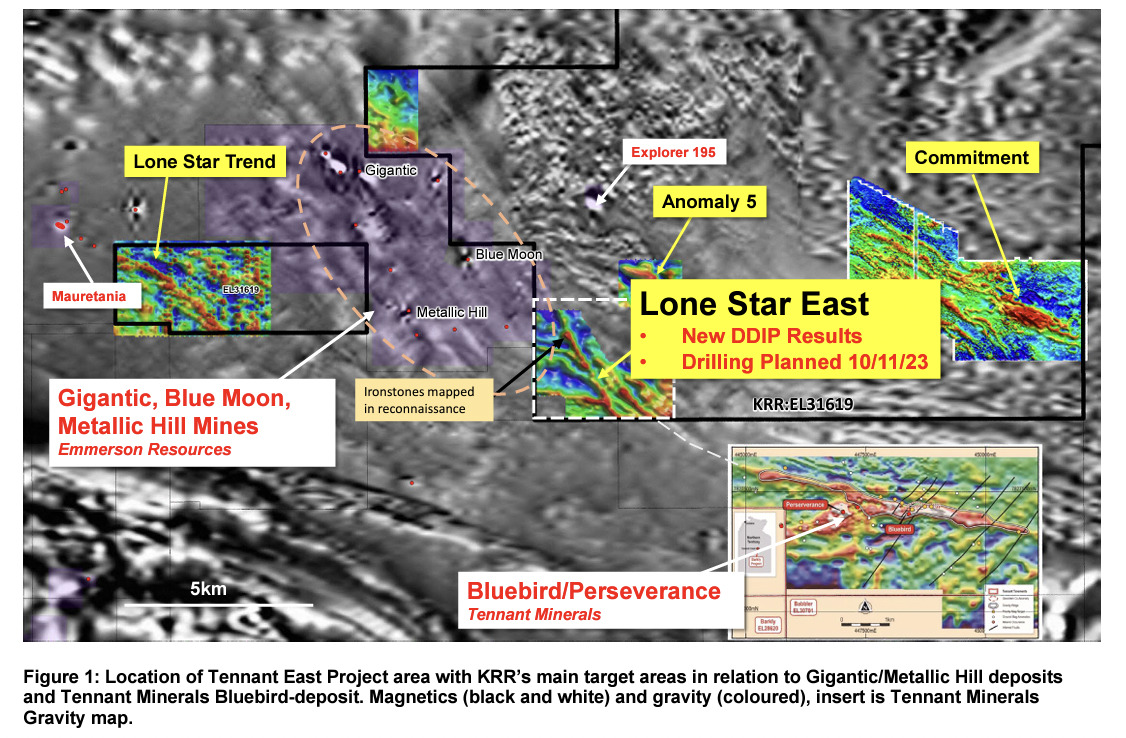

The company’s geophysical program has been targeting prospective iron ore copper oxide areas at Rover East, Tennant East, Barkly and Kurundi, including multiple targets along strike of geophysical and geological trends associated with other known significant deposits of high-grade copper and gold including Rover, Bluebird and Mauretania.

Now the program is done and dusted, processing and interpretation is underway. Apparently results received to date “are excellent” with new drill targets generated at several locations, particularly Lone Star East (see below).

King River Resources (ASX: KRR) presses on high-grade gold hunt at Tennant Creek and Mt Remarkable@KingRiverASX #gold #TennantCreek #ASX $KRRhttps://t.co/5uxMoknLje

— Kalkine Media Australia (@kalkineau) October 9, 2023

5E Advanced Materials (ASX:5EA)

This boron and lithium explorer received good news late last month when it was granted the US Environmental Protection Agency (EPA) approval it had been seeking to conduct step-rate testing under its existing permit.

What’s… all that about? Very briefly, step-rate testing is used to accurately measure the fracture pressure of geological formations.

Today, 5E Advanced Materials’ share price is moving up on news the step-rate testing is underway, with EPA approval, under the company’s existing Underground Injection Control (UIC) permit.

The testing process seeks to establish the porosity of the ore body and form a base-line parameter at the company’s Fort Cady Borate project in California.

That’s a project which hosts a multi-generational borate resource where boric acid, borate specialty materials, gypsum, and potassium sulphate will be produced.

The company plans to conduct a process to inject water into its wellfield, initiating the testing process and, says 5EA, this represents a meaningful step towards conducting full boric acid and lithium carbonate extraction operations.

“The commencement of Step-Rate Testing marks a significant milestone in our development sequence and an encouraging step towards operational production and mineral extraction, bringing 5E closer to becoming the first new boric acid producer in decades,” said Susan Brennan, CEO at 5E Advanced Materials.

5EA share price

EV Resources (ASX:EVR)

Also in rude health this fine day is global battery-metals-hunting small cap, EV Resources.

The company has today provided shareholders with an update on a revised strategy to focus on copper assets in the Americas, following its acquisition of the high-grade Parag copper-molybdenum project (70% owned by EVR) in Peru, the world’s second biggest copper mining jurisdiction behind neighbouring Chile.

Following several months of “engagement and building relationships”, EVR’s 50% owned subsidiary, Minera Montserrat, signed the final and definitive three-year Land Access Agreement with the community of Quero, near the Don Enrique Copper-Silver project.

The company is currently preparing minor environmental filings at the Don Enrique project, required to finalise the set of agreements under which EVR can execute a drilling program.

EVR says it’s well advanced in the preparation of its first drill campaign at the Parag project.

At $EVR.AX Don Enrique #Copper–#Silver Project, a Land Access Agreement has been signed with the community of Quero.

Deeper holes have been planned to test for a porphyry system below the “breccia zone” at the Parag Copper- #Molybdenum Project.https://t.co/4ycGuqtwcY pic.twitter.com/9EwRo0TZVM

— EV Resources Limited (@EVResources_EVR) October 9, 2023

The company recently raised US$3.4m to advance the company’s copper exploration in the Americas and earlier this year, shares in EVR surged after the company announced a $25m investment commitment from Sapphire Global Energy to further develop its battery minerals portfolio.

Aside from its Americas copper hunting exploits, EVR owns a number of projects including the Shaw River lithium project in Western Australia’s Pilbara region and the Austrian Alps lithium projects in the Eastern Alps.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.