ASX Small Caps Lunch Wrap: Who else is feeling the Real Estate rage today?

"We're sorry... there's been a bit of a mix up, bur you're gonna have to leave anyway..." Pic via Getty Images.

Local markets are running pretty well today, with the benchmark up around 0.4% at lunchtime, driven largely by solid Resources movement, while Utilities and Staples drag.

Real Estate is doing okay, mostly keeping to itself for the morning, probably just trying to keep a low-ish profile after a profound act of Property Manager bastardry hit the headlines in the US on the weekend.

The story revolves around Johnny Abney, a resident (kind of) in the Dallas suburb of Deep Ellum, in the US state of Texas.

Abney was living in an apartment complex, enjoying life with his 9-year-old daughter, when he received a phone call that everything he owned was being hauled out of his apartment and stuffed into a dumpster.

“Clothing items. All of my groceries. They cleared out my refrigerator full of groceries,” Abney said. “Right down to the shower curtain.”

Abney, understandably furious, got hold of the building managers for the high-end apartment block, and was told that the maintenance crew that had entered his home and binned all of his stuff was supposed to have cleared out the apartment next door.

The tenant there was being evicted, but a mix-up meant that Abney’s apartment was cleared out, despite Abney being able to show that he was up to date with his US$3000 a month rent payments.

It’s at this point that you’d expect the building managers to have a few quiet heart attacks, realising that they’re about to be on the receiving end of one of America’s World-Famous Massive Lawsuits, as is local custom whenever something goes wrong.

“They told me it was a mistake. They apologised,” Abney said. “They were overly apologetic, saying ‘Let us know if anything’s missing.’”

“Not only did they put my stuff out. They watched people take my property all day,” he said.

However, following Abney’s quite justifiable fury, management started investigating how the mix-up could have occurred – and after initially issuing an apology for the misunderstanding, promptly changed tack and evicted him as well.

Turns out that Abney was illegally subletting the apartment from his ex-girlfriend, which meant his name’s not on the lease – a point that management has since used to completely ignore his repeated requests to at least be reimbursed for the cost of his destroyed property.

“We are binded, like, by law. We cannot discuss anything with you or anybody who is not her lease,” the apartment manager reportedly told Abney.

And so, this one’s destined to turn into another Great American Courtroom Drama, with Abney filing a $200,000 lawsuit against the company for illegally breaking into his home and turfing his stuff into the bin.

It’s a crackin’ yarn, which has a real low-budget David v Goliath, and Slick Texas Lawyer kinda feel to it.

I reckon if we give it about 6-8 weeks, some coked-up Netflix exec will probably greenlight it and rush it into production, starring Idris Elba as Abney, 10kg of rich, creamy butter as The Building Manager, and the Ghost of Anna Nicole Smith in a special appearance as the dumpster.

TO MARKETS

Local markets are up this morning, mirroring Friday’s efforts on Wall Street that left the market there a little higher, despite an underperforming tech sector. Again.

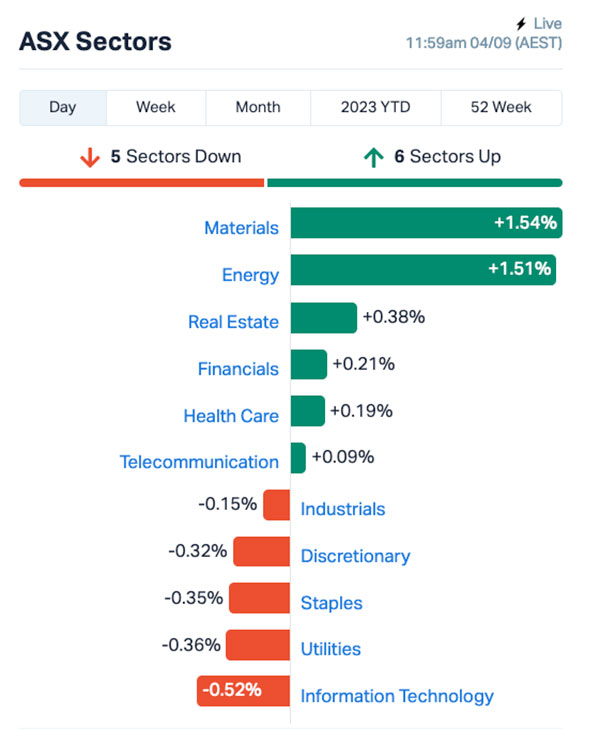

A solid surge from the Resources sector has seen both Materials and Energy climb more than 1.5% apiece this morning, however Utiities and InfoTech are lagging behind the rest of the market, as this highly attractive chart illustrates:

In Expensive Stuff news, Liontown Resources (ASX:LTR) is soaring again this morning, after Albemarle came back with a fresh takeover bid, this time lobbing a $3.00 in cash per share onto the boardroom table.

That’s a full $0.38 per share higher than Liontown’s $2.62 closing price on Friday, and so – obviously – the price has been heading skyward since the news broke.

Elsewhere, fashion retailer Cettire is also barreling north, buoyed (apparently) by news that the company has made it to the Big Leagues, and has been added to the ASX 300 list.

It’s either that, or the completely unfounded rumours that CEO Dean Mintz has inherited a “mysterious amulet” that possesses “unimaginable powers” from a distant fourth cousin in the wilds of Hungary.

I’ll let you know if I figure it out.

On the downswing today, however, is SkyCity Entertainment Group (ASX:SKC), operator of a number of casinos in New Zealand, on news that it is facing a 10-day suspension of its licence to operate a casino in Auckland in the wake of a very serious customer complaint.

According to local media, the customer alleges that SkyCity Auckland “did not comply with requirements in its SkyCity Auckland Host Responsibility Programme relating to detection of incidences of continuous play by the customer”.

Translation: Someone went on a massive, probably multi-day no-sleep gambling bender, lost a sh-tload of money, and now wants it back.

NOT THE ASX

On Friday, Wall Street did okay; The S&P 500 finished +0.18% higher, blue chips Dow Jones by +0.33%, while tech heavy Nasdaq finished flat.

Nothing massively spectacular, but a win’s a win, even if the tech stocks decided to ditch the party to stay home and play Quake II instead.

Most of the gains elsewhere on the US market were driven (broadly speaking) by the August non-farm payrolls report, which came in higher at 187,000 vs 157,000 in July.

Importantly, as Earlybird Eddy reported this morning, unemployment in the US remained steady at 3.8%.

The report “continues to point to a labour market that is softening but not falling off a cliff, keeping a hike in September off the table in our view,” according to Morgan Stanley.

In US stock news, Tesla dropped 5% despite unveiling a slicker look for its Model 3 sedan, and Dell Technologies surged 21% and hit a new high after reporting better-than-expected Q2 sales.

A bearish outlook for major Apple supplier Broadcom saw it drop around 5%.

Eddy said this morning that after nearly two years of concerns about a recession, “growing optimism about the economy is starting to filter down into Wall Street’s expectations for companies’ quarterly results, with analysts growing more upbeat about corporate profit in the months ahead”.

Analysts over the past two months have nudged their profit forecasts higher for the first time in two years, according to a FactSet report released Friday.

If that sounds exciting and you can’t wait to see it all unfold, you’re gonna have to wait. There will be no news from the US markets later today, because it’s Labor Day.

In Japan, the Nikkei is rising this morning, with the nation’s mood buoyed by news that regional neighbour North Korea conducted a simulated “tactical nuclear attack” drill on Saturday.

The drill included the usual North Korean Festival of Doom activities – Dear Leader looked at some empty 44 gallon drums floating past a wharf submarines, and a team of highly-skilled armed forces technicians scored not one, but two direct hits on the vastness of the ocean with long range missiles.

Due to the nature of the drill, approximately 600,000 North Koreans were vaporised to add an element of realism to proceedings, to the delight of both Japan, and the enormous number of international military types in-country for joint exercises this week.

In China, Shanghai markets are running about 1.1% higher this morning, but it looks like Hong Kong markets are still closed afterTyphoon whats-its-name blew through over the weekend and put 55 people in hospital.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 04 Septemeber [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVW Avira Resources Ltd 0.0015 50% 200,001 $2,133,790 EEL Enrg Elements Ltd 0.006 50% 3,008,615 $4,039,860 EMU EMU NL 0.003 50% 10,401,227 $2,900,043 KEY KEY Petroleum 0.0015 50% 1,000,000 $1,967,928 EMD Emyria Limited 0.105 31% 10,906,414 $24,667,945 ASR Asra Minerals Ltd 0.009 29% 6,041,851 $10,082,710 PEX Peel Mining Limited 0.13 24% 816,206 $60,980,626 VKA Viking Mines Ltd 0.011 22% 811,294 $9,227,326 GLH Global Health Ltd 0.17 21% 52,169 $8,126,935 ARV Artemis Resources 0.046 21% 15,731,415 $59,656,898 GRE Greentechmetals 0.465 21% 454,787 $21,789,289 BCB Bowen Coal Limited 0.12 20% 3,287,041 $213,598,588 CYQ Cycliq Group Ltd 0.006 20% 200,000 $1,787,583 NES Nelson Resources 0.006 20% 111,278 $3,067,972 SI6 SI6 Metals Limited 0.006 20% 1,555,129 $9,969,297 LYN Lycaon Resources 0.255 19% 354,015 $8,367,531 JAY Jayride Group 0.13 18% 25,025 $22,400,158 RDN Raiden Resources Ltd 0.033 18% 38,356,594 $57,547,530 AHF Aust Dairy Limited 0.02 18% 388,285 $11,149,736 GSS Genetic Signatures 0.52 17% 184,540 $63,815,668 RCW Rightcrowd 0.021 17% 100,000 $4,737,453 CXU Cauldron Energy Ltd 0.007 17% 19,286,921 $5,709,412 RLC Reedy Lagoon Corp 0.007 17% 7,040 $3,700,102 SKN Skin Elements Ltd 0.007 17% 1,104,082 $3,416,917 MRZ Mont Royal Resources 0.25 16% 1,251,211 $17,693,411

Leading the Small Caps today is clinical stage biotech Emyria (ASX:EMD), up 31.3% this morning on news that it has secured firm commitments from new and sophisticated investors to raise $2 million (before costs) through an oversubscribed placement.

In conjunction with the placement, Emyria will initiate a non-renounceable pro rata entitlement offer to raise approximately $3.1 million (before costs) at the same terms.

The company says it’s already earmarked the funds for fast-tracking development of its MDMA-assisted therapy for PTSD, the usual “revenue growth and data collection” stuff, as well as “payer engagement”.

For clarity: “Payers” are the people and/or organisations that pay for medical procedures and care, and engaging them is crucial to growing market share in the medical world.

I know that because I had to look it up.

Next on the list, early market leader Global Health (ASX:GLH) is up 21.4% on razor-thin volume this morning, off the back of positive FY23 news, including Customer Revenue growth of 20% to $7.81 million, and Annual Recurring Revenue up 11% to $5.73 million.

Viking Mines (ASX:VKA) is up more than 20% this morning on news of a solid vanadium find at its Fold Nose deposit, where the company says it’s hit significant vanadium pentoxide (V2O5) intercepts, such as 42m at 0.74% V2O5 (>0.5%) from 79m, including 17m at 0.80% V2O5 (>0.8%) from 83m and 8m at 0.99% V2O5 (>0.8%) from 108m.

Artemis Resources (ASX:ARV) is up more than 21% on news that recent laboratory XRD analysis – by JV partner Greentech Metals (ASX:GRE) – of a known lithium bearing sample collected within the Osborne JV tenement in the Pilbara has returned 3.6% Li20 from a sample that was 44% spodumene and 43% quartz.

Greentech Metals is up 7.73% on, obviously, the same news.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 04 Septemeber [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LLL Leo Lithium 0.5425 -52% 56,208,815 $1,125,447,873 MTH Mithril Resources 0.001 -33% 225,190 $5,053,207 TD1 Tali Digital Limited 0.001 -33% 1,078,529 $4,942,733 VPR Volt Power Group 0.001 -33% 300,010 $16,074,312 AXP AXP Energy Ltd 0.0015 -25% 961,295 $11,649,361 DDT DataDot Technology 0.003 -25% 35,987,516 $4,843,811 MRD Mount Ridley Mines 0.0015 -25% 2,291,668 $15,569,766 NZS New Zealand Coastal 0.0015 -25% 4,797,245 $3,308,020 NTM Nt Minerals Limited 0.008 -20% 773,543 $8,006,989 OPN Oppen Negotiation 0.008 -20% 723,100 $11,166,796 DM1 Desert Metals 0.08 -18% 1,424,502 $7,109,026 PVW PVW Res Ltd 0.066 -18% 7,309 $7,877,088 SOM Somnomed Limited 0.6 -17% 41,948 $60,148,477 JCS Jcurve Solutions 0.03 -17% 314,741 $11,820,364 THRDD Thor Energy PLC 0.03 -17% 276,232 $5,253,434 H2G Greenhy2 Limited 0.01 -17% 1,616,696 $5,025,070 LNU Linius Tech Limited 0.0025 -17% 16,361 $12,689,372 ROG Red Sky Energy 0.005 -17% 1,170,555 $31,813,363 SKC Skycity Entertainment 1.8125 -16% 4,697,005 $1,649,645,304 LKY Locksleyresources 0.042 -16% 418,456 $7,333,333 KRM Kingsrose Mining 0.059 -16% 2,326,790 $52,676,856 AW1 American West Metals 0.255 -15% 14,977,058 $108,159,634 MFD Mayfield Childcare 0.74 -15% 299,145 $56,822,053 AOA Ausmon Resorces 0.003 -14% 803 $3,392,513 PKO Peako Limited 0.006 -14% 168,000 $3,295,120

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.