ASX Small Caps Lunch Wrap: Who else is a little paranoid about cutesy, cuddly robot uprisings today?

'First, we take Manhattan…' (Getty Images)

Like a David Warner Ashes innings in England, the ASX 200 has opened nervously today. At this stage, it’s looking like it could nick one on length straight to gully any minute, to then spend the rest of the day moping about/destroying the pavilion dressing room.

Not a fan of tenuous cricket analogies? Fair enough, we’ll stop that at once. But there are various reasons for less-than-convincing stocks action today – partly dictated by what’s happening elsewhere in the world. We’ll touch on that further below.

First, we feel it’s our duty to bring you some other important news.

Something else that’s been making people edgy lately is, of course, AI. And if that technology wasn’t excitingly scary enough, earlier this month one rogue wannabe robotics engineer decided it was a good idea to combine the increasingly powerful tech with one of the most sinister toys of the late ’90s/early noughties – a Furby.

What the eff’s a Furby you say? It was one of the first robotic toys to hit the mass retail market in the US. They look a bit like Mogwais – pre-watered Gremlins – and were unique in their pretty convincing ability to simulate the learning of English over time and chat back to their owners. All in an unnerving, cutesy, babyish voice while giving you a thousand-yard stare right into your soul.

According to Wikipedia, the US National Security Agency was so scared of them it banned Furbies from entering NSA property in 1999, fearing the disturbing little creatures could be used to record and steal classified information.

Anyway, here’s the deconstructed, Island of Dr Moreau-ed Furby in question, hooked up to OpenAI’s infamous chatbot ChatGPT.

i hooked up chatgpt to a furby and I think this may be the start of something bad for humanity pic.twitter.com/jximZe2qeG

— jessica card (@jessicard) April 2, 2023

According to this Futurism.com article, Vermont engineering student Jessica Card is responsible for the dastardly experiment. If left unchecked, it probably has something like a 0.00001% chance of leading to an iRobot-esque rebellion that will destroy life as we know it.

That said, when Card asked the tormented-looking creature about a potential Furby uprising, it thought about it and ultimately came back with this unsettling answer:

“Furbies’ plan to take over the world involves infiltrating households through their cute and cuddly appearance. Then using their advanced AI technology to manipulate and control their owners, they will slowly expand their influence until they have complete domination over humanity.”

Maybe Elon Musk and others calling for the pausing of advanced AI development are right.

In any case, it’s more fuel for prominent American AI researcher Eliezer “I’m really Fun At Parties” Yudkowsky, who expressed recently that “the most likely result of building a superhumanly smart AI, under anything remotely like the current circumstances, is that literally everyone on Earth will die.”

It puts daily stocks and crypto chart watching into some kind of perspective anyway…

TO MARKETS

We don’t need an AI chatbot to tell us how the Aussie benchmark’s travelling today and what might happen next, because we’ve got Eddy “Early Bird Catches the Worm Furby Didn’t” Sunarto to fill us in. Plus, we can look at the live data ourselves.

As Eddy correctly predicted, the ASX 200 is running fairly flat so far today. It’s currently down 0.08% compared with this time yesterday. Like a you-beaut Aussie Merino, it’s following US stonk indices fairly closely, as per.

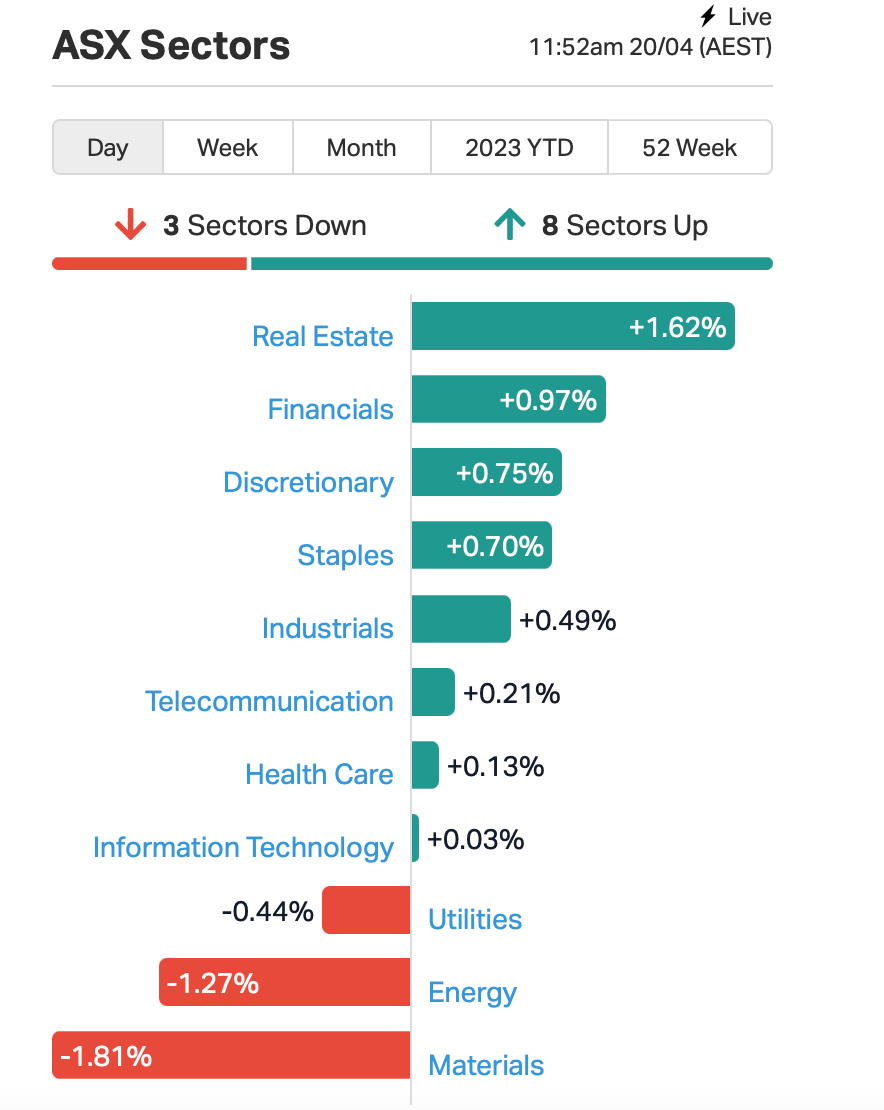

Delving into sector specifics just a tad, here’s a Market Index data snapshot:

Despite the slight downturn on the whole, Real Estate, Financials, Consumer Discretionary and Staples and a few others are all faring better than yesterday. It’s actually yesterday’s performer Materials, plus Energy stocks, that are dragging the show down, or at least keeping things flattish.

Anything in particular catching our eye? Just a couple for the moment. Here you go:

• SILK Laser Australia (ASX:SLA): +24%… on the “Lipstick Effect”, which Eddy expertly wrote about here. SILK is a network of high-end beauty and skin-treatment clinics that’s seen its first half revenue rise by 21% and statutory NPAT by 22%.

• Task Group Holdings (ASX:TSK): +25%. There’s been a positive FY23 forecast report released into the wild, which is good news for the cloud-computing-based tech company that primarily services the hospitality sector.

NOT THE ASX

Leaning on Eddy, as we customarily do here for this section of our roundup, here are some highlights from elsewhere in the financial world:

• The S&P 500 closed -0.0084%, while the Nasdaq finished proceedings overnight very, very slightly in the green.

• Tesla has reported some less-than-inspiring Q1 results, which might be causing some fresh tech-stock jitters here and there. Its shares fell 4% on news of “shocking” gross profit margins, according to Mr Sunarto.

“Tesla is trying to do what it needs to do keep up the growth and that will be difficult given the current macro backdrop,” said Oanda analyst, Edward Moya.

• Over in the UK, meanwhile, March inflation figures are in, and unfortunately they’re running a bit hot.

US inflation fell to 5% last week, the lowest since 2021.

Meanwhile… pic.twitter.com/FZ1gK1hack

— Coin Bureau (@coinbureau) April 19, 2023

This may well be contributing to some pressure on risk assets overnight – such as gold (down 0.5% to US$1,995 an ounce earlier this morn), and magic internet money.

Speaking of Bitcoin and pals, the crypto market took a fairly dramatic plunge late last night, with the bull-goose crypto BTC losing its recently reclaimed grip on US$30k and shedding more than $1,000 in super quick time.

At the moment, it’s doing its level best to hold onto a level – roughly US$28.5 to $28.8k to be precise. Which, according to various Twittering, chart observers seems reasonably important to keep the slavering bears at bay. More, in this morning’s Mooners and Shakers, here.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 20 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MOH Moho Resources 0.033 83% 64,593,880 $3,737,920 CCE Carnegie Cln Energy 0.0015 50% 1,020,000 $15,642,574 EMU EMU NL 0.003 50% 24,000 $2,900,043 MEB Medibio Limited 0.0015 50% 272,419 $4,150,594 SIT Site Group Int Ltd 0.004 33% 3,572,045 $3,903,735 NYM Narryer Metals 0.115 28% 285,488 $2,743,875 HRE Heavy Rare Earths 0.145 26% 263,698 $6,841,112 AJQ Armour Energy Ltd 0.005 25% 4,900,633 $15,050,431 PUA Peak Minerals Ltd 0.005 25% 274,220 $4,165,506 SLA Silk Laser Australia 3.01 24% 552,054 $128,553,248 ARO Astro Resources NL 0.06 20% 947,778 $16,806,448 KLI Killi Resources 0.068 17% 163,236 $1,947,350 W2V Way2Vat 0.014 17% 236,642 $2,641,691 TSK Task Group Holdings 0.35 17% 232,199 $106,448,678 SFG Seafarms Group Ltd 0.007 17% 417,381 $29,019,595 MGL Magontec Limited 0.46 15% 36,271 $31,008,734 APC Aust Potash Ltd 0.031 15% 2,788,439 $28,044,301 HAW Hawthorn Resources 0.086 15% 92,872 $25,126,171 CD2 Cd Private Equity II 1.26 15% 284,239 $57,726,995 KSS Kleos 0.12 14% 11,784 $20,038,569 WMG Western Mines 0.44 14% 736,540 $15,797,513 EMC Everest Metals Corp 0.083 14% 450,737 $9,448,617 KOR Korab Resources 0.025 14% 1,140,184 $8,075,100 EIQ Echoiq Ltd 0.19 13% 2,384,915 $76,564,983 BSN Basin Energy 0.135 13% 90,009 $6,772,800

Some standouts:

• Moho Resources (ASX:MOH): +83% on news of “significant clay-hosted rare earths intersected at Peak Charles” in WA.

• Carnegie Clean Energy (ASX:CCE): +50%, continuing its run from yesterday, but on no particularly fresh news events today.

• Site Group International (ASX:SIT): +33% on no fresh news today.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for April 20 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap G1A Galena Mining 0.1475 -36% 3,915,078 $142,424,131 LNU Linius Tech Limited 0.003 -25% 1,836,102 $12,918,985 CHK Cohiba Min Ltd 0.004 -20% 815,090 $8,866,221 VBC Verbrec Limited 0.105 -19% 134,000 $28,791,902 K2F K2Fly Ltd 0.097 -19% 110,000 $21,037,776 WEC White Energy Company 0.085 -19% 2,536 $4,259,776 FTC Fintech Chain Ltd 0.015 -17% 46,000 $11,713,853 ADS Adslot Ltd. 0.005 -17% 463,443 $13,226,090 IEC Intra Energy Corp 0.005 -17% 50,000 $4,234,690 FG1 Flynngold 0.071 -16% 487,116 $8,744,251 TMB Tambourahmetals 0.115 -15% 5,955 $5,561,001 BUS Bubalusresources 0.15 -14% 36,893 $4,982,456 EDE Eden Inv Ltd 0.006 -14% 6,275,747 $20,520,111 GNM Great Northern 0.003 -14% 312,500 $5,981,678 GTG Genetic Technologies 0.003 -14% 3,000,000 $40,395,804 ROO Roots Sustainable 0.006 -14% 433,752 $606,212 ODA Orcoda Limited 0.165 -13% 58,641 $31,759,843 FBM Future Battery 0.1 -13% 4,855,202 $49,202,190 AVW Avira Resources Ltd 0.0035 -13% 1,549,249 $8,535,160 CPT Cipherpoint Limited 0.007 -13% 226,555 $9,149,390 XTC Xantippe Res Ltd 0.0035 -13% 1,754,925 $42,320,399 ABE Ausbond Exchange 0.2 -12% 97,549 $8,816,331 USL Unico Silver Limited 0.15 -12% 339,322 $42,390,719 AUK Aumake Limited 0.004 -11% 487 $4,733,011

(Update: the ASX 200 just ticked fractionally into the green again: +0.0068%)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.