ASX Small Caps Lunch Wrap: Who else has been left running for their lives this week?

Pic via Getty Images.

Local markets have fallen this morning, tracking Wall Street into a -0.9% gutter before staging a fairly wan rally on the way into lunch.

But before I get too deep into the market stuff today, there’s some stunning news from the World University Games, a reasonably large sporting event taking place in China this week.

The competition, which is a lot like the Olympics, only far less interesting, is underway in the city of Chengdu, providing an opportunity for tertiary students to compete in events like the Political Lurch, where the winner is chosen by a panel of judges based on how quickly they become radicalised.

Similarly popular are the 1500m Walk of Shame, Bicycle Theft (Individual and Teams) and perennial crowd favourite, Basket Weaving.

The thing is that these Games are meant to be very inclusive, a glittering jewel of rampant ableism plucked from the one-size fits-all environment of learning… and that means, from time to time, the world will get to meet an athlete who, by any rational measure, definitely shouldn’t be competing.

One shining example is that of Eddie “The Eagle” Edwards, who set out to become the first competitor to represent Great Britain in Olympic ski jumping, a sport he chose because no one else in Britain was dumb enough to hurl themselves off the side of a mountain.

Edwards trained for months, and then – clad in borrowed gear and his signature bullet-proof specs – he came stone-cold motherless last at the 1988 winter games.

Likewise, the story of Equatoguinean swimmer Eric “the Eel” Moussambani’s dream to compete at the Sydney 2000 Olympics is incredible, given that he only learnt to swim eight months out from the competition, and had never even dipped so much as a toe into a 50m pool before arriving in Australia.

Moussambani was entered into the 100m freestyle, and after a gruelling nine-day swim, set a new national record and landed a gig as a swimming coach.

Both are inspiring stories of sacrifice, hard work and inspirational determination – which is what makes today’s news story even more patently absurd by comparison.

Somalia is a small coastal nation on the East Coast of Africa, whose principal exports are violent high-seas piracy and epic levels of government corruption and incompetence.

Somalia sent a team of athletes to University Games, but – for some reason I’ve not been able to glean – decided to send 20-year-old Nasra Abukar Ali to compete in the women’s 100m athletics event.

This is despite the very obvious fact that she has never trained a day in her life, and – according to local sources – got her spot on the team by being the niece of Somalia’s national athletics federation chairwoman, Khadija Aden Dahir.

Her first, and probably final, crack at the event went about as well as you’d expect.

The Ministry of Youth and Sports should step down. It’s disheartening to witness such an incompetent government. How could they select an untrained girl to represent Somalia in running? It’s truly shocking and reflects poorly on our country internationally. pic.twitter.com/vMkBUA5JSL

— Elham Garaad ✍︎ (@EGaraad_) August 1, 2023

Her competitors beat her over the 100m course by nearly 10 seconds.

I’ll refrain from making uncharitable comments about how the young woman was visibly unprepared for a sprint event, or the fact that the highlight of her run was a toddler-like skip of misplaced accomplishment over the finish line.

Because I’m not a complete prick.

But the upshot of one of the most embarrassing sporting moments in recent history is that Minister of Youth and Sports Mohamed Barre Mohamud has called for the national athletics federation chairwoman to step down.

The fate of athlete Nasra Abukar Ali remains unclear.

TO MARKETS

It’s another woeful morning for the benchmark today, in the wake of a US sell-off sparked by the spiteful move by Fitch Ratings to downgrade America’s credit rating earlier in the week.

When the bell rang to kick off proceedings this morning, the ASX 200 fell like a badly-balanced baby to -0.9% in the first hour of trade, before a lacklustre recovery effort pushed it 0.5% at lunch.

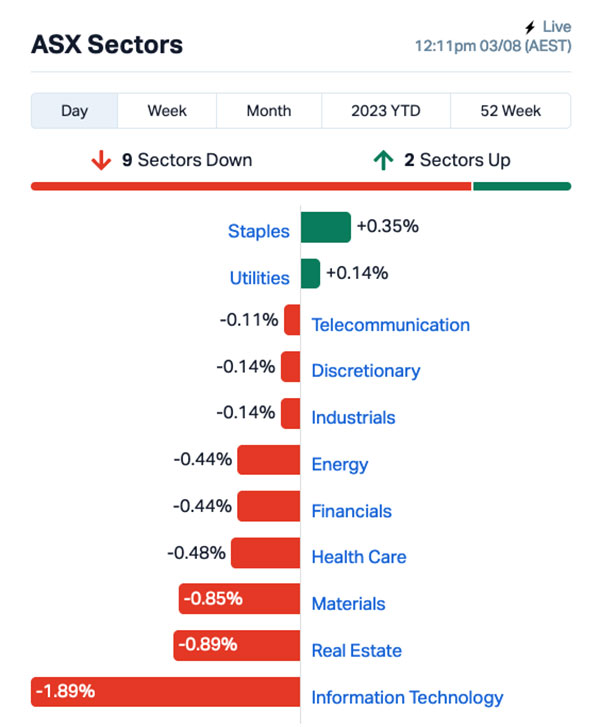

InfoTech is largely to blame (again), with the entire sector flashing the Blue Screen of Death on its way to a 1.9% loss so far, after it bounced from a low of -2.9% around morning tea time.

Both Real Estate and Materials are well in the dumps this morning as well, falling 0.89% and 0.85% respectively, while the two sectors showing gains this morning – Staples (+0.35%) and Utilities (+0.14%) are unlikely to make much of a difference at all.

Up the fat end of town, investors are really on board with the theory that Strike Energy (ASX:STX) has dodged a bullet, after talks to acquire Talon Energy (ASX:TPD) broke down a few days ago.

Strike’s pushed up 3.7% this morning, adding to yesterday’s +1.85% drive as the company claws back recent losses incurred since news that the company had approached talon broke in the final few days of July.

Worthy of a mention is some cracking news for United Malt Group (ASX:UMG), after the ACCC gave a sagely nod to French mob Malteries Soufflet to buy UMG holus-bolus.

The suds will absolutely be flowing at United Malt HQ today, because the deal will see shareholders bag a frothy $5 per share once the paperwork’s finalised – and given the state of Australia’s post-boom craft brewing scene, United getting out of the game couldn’t have come at a better time.

Meanwhile, the Australian Bureau of “I’m Thinking of a Number Between 1 and 10” has dropped another dollop of sour news this morning, releasing the June quarter Retails sales volumes data showing that it fell 0.5%, on the heels of the 0.8% fall in March.

It’s a big deal because when it’s matched to the monthly data released on Friday showing a 0.8% fall in June, we’ve left with a dataset that may as well be several rounds of ammo being loaded into the RBA Rate Rise cannon in preparation for it to be fired again when the board meets early next month.

NOT THE ASX

Wall Street had a shocker overnight, as investors slowly realised that the nation’s credit rating had been dealt a fairly serious blow by the bean counters at Fitch Ratings.

It was an obvious bloodbath, which left the S&P 500 down by -1.38% – its worst performance since April – while the blue chips Dow Jones fell -0.98% and tech-heavy Nasdaq crashed -2.17%.

My contacts in the United States have assured me that they’ve jiggled the mouse, and tried turning it off and then back on again, but that Nasdaq result means the sector will probably need to lodge a ticket with the IT department, who will most likely say it’s “a user issue” before taking the phone off the hook to play Magic: the Gathering all afternoon.

Earlybird Eddy reports that the Fitch downgrade also pummelled sentiment in equities, pushing the VIX (also called the fear index) higher by more than 15%, and sparked a selloff in Treasuries that sent 10-year yields to the highest levels since November.

As always, JP Morgan’s got its finger on the pulse, with the company’s chief Jamie Dimon calling Fitch’s decision “ridiculous”.

“It doesn’t really matter that much, because it’s the market, not rating agencies, that determines borrowing costs,” Dimon told CNBC, cheerfully neglecting the obvious fact that it’s also the market that s..ts itself when bad news like this gets dropped on their heads.

“To have them be triple-A and not America is kind of ridiculous. It’s still the most prosperous nation on the planet, it’s the most secure nation on the planet,” Dimon continued, at which point it became entirely unclear if he was talking about the downgrade, or throwing his hat in the ring to be Trump’s Vice-Presidential candidate next year.

The only thing missing from Dimon’s crazed ranting was a breathless assertion that Fitch is welcome to downgrade America’s credit rating “when they pry it from my cold, dead hands”.

In Japan, the Nikkei is down 1.42% on news that the Harajuku Nescafé coffee shop in downtown Tokyo has plans to introduce vertical sleeping booths to its premises.

They look like a cross between Dr Who’s Tardis and the interior of every Scandinavian sauna ever built, with enough room inside each one to allow one sleepy person (or up to 5 very patient, flexible children) to catch a quick 40 winks.

I’m not sure if it’s a damning indictment on modern Japanese society, or the world’s worst advertisement for the Nescafe coffee brand – but either way, Japan is now one more step closer to coin-operated Glowing Happy Shame Stopper™ suicide booths being rolled out nationwide.

In China, everyone’s pretty much accepted that the former foreign minister won’t be seen in public for at least a few months, when he will emerge from a lengthy period of introspection with a shaved head and severe sunlight sensitivity.

That realisation brings to an end the National Period of Mockery for Qin Gang, leaving Shanghai markets down 0.33%.

And in Hong Kong, the Hang Seng is down 0.66% after France promised to stop sending “daredevils” to the city, after French climber Remi Lucidi left a giant, gruesome mess on the terrace of the 219-metre Tregunter Tower.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.0015 50% 1,743,472 $10,264,505 LLI Loyal Lithium Ltd 0.465 45% 4,583,907 $21,596,800 EEL Enrg Elements Ltd 0.004 33% 21,654,701 $3,027,703 OKJ Oakajee Corp Ltd 0.02 33% 25,000 $1,371,690 TMB Tambourahmetals 0.345 31% 1,185,590 $11,095,666 EQN Equinox Resources 0.15 25% 305,949 $5,400,000 BXN Bioxyne Ltd 0.018 20% 5,000 $28,524,681 LML Lincoln Minerals 0.006 20% 1,023,196 $7,103,559 PAM Pan Asia Metals 0.27 17% 139,843 $35,825,130 BDX Bcaldiagnostics 0.14 17% 827,987 $16,331,365 AJL AJ Lucas Group 0.014 17% 78,571 $16,508,756 AVM Advance Metals Ltd 0.007 17% 34,451,113 $3,531,352 SRZ Stellar Resources 0.014 17% 1,083,138 $12,071,571 PFT Pure Foods Tas Ltd 0.115 15% 2,394 $10,973,991 EPN Epsilon Healthcare 0.023 15% 75,000 $6,007,080 CUS Copper Search 0.295 13% 39,504 $13,726,673 ADD Adavale Resource Ltd 0.017 13% 4,760,630 $10,323,275 ECG Ecargo Holdings 0.044 13% 15,290 $23,994,750 RLG Roolife Group Ltd 0.009 13% 111,222 $5,756,465 W2V Way2Vatltd 0.018 13% 416,242 $10,045,964 KZR Kalamazoo Resources 0.15 11% 622,738 $20,938,444 1ST 1St Group Ltd 0.01 11% 311,163 $12,752,921 LSA Lachlan Star Ltd 0.01 11% 5,224,056 $11,871,114 NC6 Nanollose Limited 0.061 11% 153,257 $8,188,750 MAU Magnetic Resources 0.79 10% 15,426 $169,422,135

Loyal Lithium (ASX:LLI) is at the top of the Small Caps ladder this morning, flashing a 51.5% rise on its return to the ASX trading floor.

LLI’s been out of the game since March this year, but has continued its day-to-day work alongside endeavours to hit recompliance requirements under Chapters 1 and 2 of the ASX Listing Rules.

This morning’s spike has been credited to news that Loyal has initiated a comprehensive exploration program at its recently acquired Hidden Lake project in lithium-rich Canada.

The Hidden Lake project is in the emerging Yellowknife Lithium Belt in the glacial, northwest part of the country.

Some 315 untested individual pegmatite outcrops have been by the company identified via high-resolution satellite imagery.

These, Loyal Lithium notes, are in addition to four other main spodumene-rich dykes, which have a drill and channel tested cumulative strike length of 2,250m and remain open along strike and depth.

Meanwhile, Tambourah Metals (ASX:TMB) is up another 33.3% this morning, building on recent – albeit very swingy – results in the wake of the company announcing plans to raise $3.7m at 23.5c per share — a 30.9% discount to the last closing price – to fund aggressive drilling of its Pilbara lithium projects.

And Equinox Resources (ASX:EQN) is up 25% on no fresh news, someone dropped a cool $90 to move the Bioxyne (ASX:BXN) needle 20% and Bcal Diagnostics (ASX:BDX) is climbing again today, as it pursues a fresh clinical trial of its breast cancer diagnostic tool.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 03 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SVR Solvar Limited 1.11 -36% 6,747,058 $362,952,249 AXP AXP Energy Ltd 0.001 -33% 10,827,187 $8,737,021 MTL Mantle Minerals Ltd 0.001 -33% 323,750 $9,221,169 MXC MGC Pharmaceuticals 0.002 -33% 1,959,094 $11,677,079 KPO Kalina Power Limited 0.007 -22% 5,274 $13,636,762 ZMM Zimi Ltd 0.024 -20% 388,013 $3,344,847 BOD BOD Science Ltd 0.089 -19% 319,288 $16,843,364 CTQ Careteq Limited 0.025 -17% 602,583 $3,604,246 AIS Aeris Resources Ltd 0.225 -17% 12,451,884 $186,555,311 SGC Sacgasco Ltd 0.005 -17% 302,454 $4,641,496 RXM Rex Minerals Limited 0.21 -16% 4,922,863 $148,196,897 BSN Basin Energy 0.11 -15% 3,140 $7,803,901 ADY Admiralty Resources 0.006 -14% 50,000 $9,125,054 MTC Metalstech Ltd 0.19 -14% 103,145 $41,493,010 ELE Elmore Ltd 0.007 -13% 1,066,424 $11,195,071 KTA Krakatoa Resources 0.028 -13% 2,666,159 $13,644,051 AZL Arizona Lithium Ltd 0.021 -13% 62,168,939 $66,311,684 WC1 Westcobar Metals 0.08 -11% 122,000 $7,774,537 AYT Austin Metals Ltd 0.008 -11% 13 $9,142,872 RMX Red Mount Min Ltd 0.004 -11% 5,348,076 $10,403,330 MCL Mighty Craft Ltd 0.041 -11% 78,578 $16,764,355 STM Sunstone Metals Ltd 0.025 -11% 1,288,636 $86,295,577 BIR BIR Financial Ltd 0.07 -10% 356 $22,353,699 CAZ Cazaly Resources 0.035 -10% 145,000 $14,661,561 MRL Mayur Resources Ltd 0.22 -10% 610,353 $78,577,434

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.