ASX Small Caps Lunch Wrap: Who else has a horror living in their head, rent free?

"This is Ground Control... Are you sure you remembered to wash your hands, Commander Tobias?" Pic via Getty Images.

Local markets are up this morning, tracking Wall Street higher and making some fairly significant hay while the sun shines on our mighty, mighty resources sector.

I’ll get the to the details shortly, but first I need to let you all know that a 100% bona fide horror show has taken place in Canberra – but this time, it doesn’t involve Barnaby Joyce talking about sex.

This story involves a 64-year-old woman from southeastern New South Wales, who rocked up to her local hospital after enduring what would normally be considered a fairly terrible three weeks of abdominal pain and diarrhoea, followed by a constant dry cough, fever and night sweats.

That, of course, sounds bad enough. But it gets worse, by quite a considerable margin.

After coming up empty, doctors sent the old dear home. That was in early 2021.

The following year, the poor old dear was still feeling pretty crook, and had managed to add “forgetfulness and depression” to the list of symptoms, so she was shipped off to Canberra, so doctors there could do what hospital doctors do best… order a bunch of scans to see if there was anything obvious that might show up.

An MRI revealed that there was something wrong inside her brain, the neurosurgeons decided to go digging around, and that was when infectious diseases expert Dr Sanjaya Senanayake got a phone call.

“Oh my god, you wouldn’t believe what I just found in this lady’s brain – and it’s alive and wriggling.”

It turned out to be an 8cm long parasitic roundworm that had taken up residence in the woman’s brain, where it was happily growing plump and juicy and generally being a terrible tenant… and here’s the picture you didn’t ask for:

It took a specialist at the CSIRO to identify it as Ophidascaris robertsi, one of nature’s grossest living parasites, named (I presume) after former British Prime Minister Margaret Thatcher, whose maiden name was, obviously, Gross-Parasite.

(Her maiden name was, for real, Roberts – a small nugget of trivia that I had been storing in my head, like a parasitic worm, apparently for this very occasion).

Anyway, Ophidascaris robertsi is a parasite that is usually only found in pythons, and the medicos reckon that the patient most likely picked it up after a carpet python crapped in her veggie patch.

The moral of the story, of course, is to make sure that you’re washing your food and your hands if you’ve been out in the garden, and – importantly – don’t eat stuff with snake s..t on it.

TO MARKETS

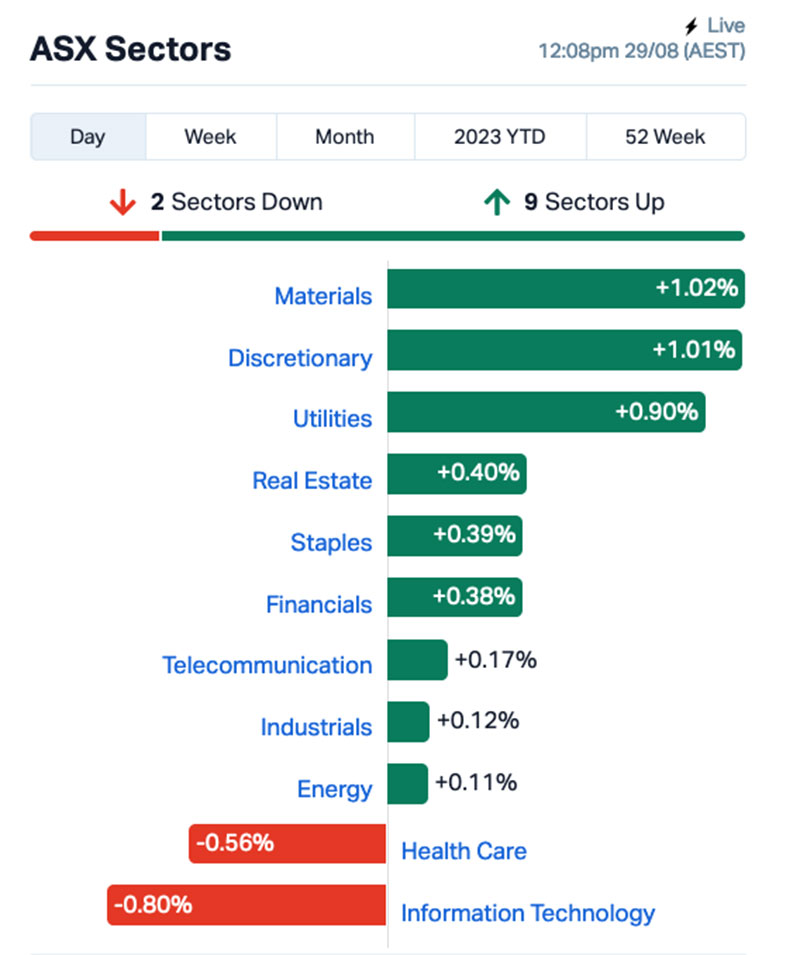

Local markets are on the rise this morning, even though the mercurial InfoTech sector has continued its earnest efforts to shed value in as many and varied ways as possible.

Leading the charge sector-wise, Materials is well out in front, with Consumer Discretionary and Utilities punching out solid performances as well.

The rest of the sectors are puddling along like wayward, distracted toddlers – and Health Care has joined InfoTech for a solid morning’s sulk in the corner.

The XGD All Ords Gold index in particular is tracking well so far today, up more than 1.6%, the more general XJR Resources index is around +0.85% and then it’s daylight to the next specific index, the Banks, which are up 0.3% or thereabouts.

Up the expensive end of town, Australia’s Swingiest Large Cap™ Sayona Mining (ASX:SYA) is up to its old tricks again, dealing with yesterday’s -27% catastrophe by lurching nearly 21% back towards the nicer things in life.

MinRes (ASX:MIN) has packed on close to 6.3%, and Johns Lyng Group (ASX:JLG) has climbed 5.3% since the ASX doors opened as well.

NOT THE ASX

Wall Street was singing from a much happier hymn book overnight, with the session there bearing fruit that saw the S&P 500 and Dow Jones rise by +0.6%, while tech-heavy Nasdaq climbed +0.84%.

Of note, there’s some big news for Nasdaq-listed Vietnamese electric-vehicle maker VinFast Auto, which jumped 20% to become the world’s third most valuable automaker, behind Toyota and Tesla.

To put VinFast’s current market cap in perspective, it’s sitting at US$190 billion – a very tidy sum compared to the likes of Boeing (US$137 billion) and Ferrari (US$54 billion).

Different customer bases, obviously, but still… $190 billion company based in what is clearly still a developing country is as impressive as it is nuts.

In other automaker news, Chinese EV maker Xpeng rose more than 5% after announcing it will pay up to US$744 million for ride-sharing giant DiDi Global’s electric car development business.

And in shocking news, Exxon Mobil has declared that the world will fail to reach the 2 degrees celsius Paris Accord goal on emissions by 2050, projecting the world’s CO2 emissions will reach 25 billion metric tons that year.

Whether that’s a tacit admission that the company is responsible for an enormous amount of the environmental damage being done, or just an horrendously tone-deaf and completely unnecessary global sledge remains unclear.

In Japan, the Nikkei is up slightly on news that the government there has summoned China’s ambassador for a “quiet chat”, due to an enormous volume of nuisance phone calls from China to Japanese businesses over Japan’s decision to dump radioactive waste water into the sea.

“There have been numerous harassment calls believed to originate from China and instances of stones being thrown into the Japanese embassy and Japanese schools. It must be said these are regrettable,” Japanese PM Fumio Kishida.

“Suck it,” China said in response, clearly happy that it’s someone else in trouble for a change.

Shanghai markets are up 0.36%, driven higher by Chinese telcos reporting a staggering increase in international call volumes, while in Hong Kong the Hang Seng is up 1.32% because they’ve been rich enough to fly seafood in from Australia for ages.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap GCX GCX Metals Limited 0.05 79% 637,441 $5,201,803 VAL Valor Resources Ltd 0.004 33% 224,750 $11,485,004 REZ Resources & Energy Group Ltd 0.02 33% 3,503,587 $7,497,087 TMG Trigg Minerals Ltd 0.022 29% 229,820 $3,423,539 AON Apollo Minerals Ltd 0.036 29% 9,745,895 $14,744,321 BCB Bowen Coal Limited 0.11 28% 12,744,751 $183,694,786 EMP Emperor Energy Ltd 0.015 25% 383,334 $3,226,350 OLI Oliver'S Real Food 0.015 25% 50,689 $5,288,783 ADS Adslot Ltd. 0.005 25% 15,714 $13,066,471 APC Aust Potash Ltd 0.005 25% 3,993,919 $4,154,749 CYQ Cycliq Group Ltd 0.005 25% 667,588 $1,430,067 INP Incentiapay Ltd 0.01 25% 311,768 $10,120,509 MXC MGC Pharmaceuticals 0.0025 25% 1,892 $7,784,719 EML EML Payments Ltd 0.915 23% 6,604,902 $278,618,176 4DS 4Ds Memory Limited 0.21 20% 43,351,697 $293,369,264 EEL Enrg Elements Ltd 0.006 20% 90,000 $5,049,825 LNU Linius Tech Limited 0.003 20% 501,000 $10,574,477 SKN Skin Elements Ltd 0.006 20% 162,143 $2,847,430 CVR Cavalierresources 0.125 19% 260,000 $3,342,036 A8G Australasian Metals 0.17 17% 3,058 $7,557,472 BUR Burley Minerals 0.14 17% 127,781 $12,155,611 AVE Avecho Biotech Ltd 0.007 17% 1,889,997 $12,972,982 DOU Douugh Limited 0.007 17% 302,594 $6,341,852 TMX Terrain Minerals 0.007 17% 46,344 $6,499,196 MPG Many Peaks Gold 0.32 16% 85,781 $10,002,983

Leading the Small Caps at lunch time today is GCX Metals (ASX:GCX), flying 78.5% this morning on news that it has entered into a binding conditional agreement to acquire the Dante nickel-copper-platinum group elements project located in the West Musgrave region of Western Australia.

Dante contains advanced large-scale magmatic Ni-Cu-PGE targets and PGE-Au Reef targets, including about 23km of outcropping mineralised strike grading an average of 1.1g/t PGE3ii, 1.13% V2O5, and 23.2% TiO2, with grades up to 3.4g/t PGE3.

It’s almost a turnkey operation at this stage, with a signed Native Title Agreement with the Ngaanyatjarra Land Council and initial heritage surveys already completed – and a strong enough proposition to attract experienced geologist and resource company executive Thomas Line as managing director & CEO of GCX, from his most recent role as CEO of Taruga Minerals (ASX:TAR).

Resources & Energy Group (ASX:REZ) is sporting a 33% gain this morning, on news that gold processing is about to kick off at East Menzies Gold Field, with the company’s ore from Maranoa identified as a prime candidate for the vat leach gold production campaign.

The campaign will initially treat 5000 tonnes of ore with a diluted grade of ~4.6g/t Au, and – once that’s up and running – REZ will get cracking on developing a larger-scale vat leach campaign to treat additional shallow resources which have been identified at the Maranoa (8,000oz) and Goodenough (43,000oz) gold deposits.

And in third place today, Apollo Minerals (ASX:AON) is up 28.5% on news that it has entered into a conditional agreement to acquire 100% of the shares in Edelweiss Mineral Exploration, which holds the Belgrade copper project in Serbia.

It’s huge news, mostly because of the history of the area – the Belgrade Copper Project consists of four licences covering 202km2 which formed part of the Serbian copper exploration project portfolio held by Reservoir Minerals.

Reservoir was acquired by Nevsun Resources (TSX:NSU) in 2016 in a deal worth US$365 million, which was subsequently part of a US$1.4 billion takeover by Zijin Mining Group in 2018.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCE Carnegie Clean Energy 0.001 -33% 37,314 $23,463,861 AXP AXP Energy Ltd 0.0015 -25% 16,148 $11,649,361 ENT Enterprise Metals 0.003 -25% 185,282 $3,197,884 GAP Gale Pacific Limited 0.18 -22% 714,490 $63,570,400 KNO Knosys Limited 0.04 -20% 655,950 $10,806,935 BC8 Black Cat Syndicate 0.215 -19% 2,091,771 $70,722,260 MRZ Mont Royal Resources 0.175 -17% 38,000 $17,281,936 EXR Elixir Energy Ltd 0.069 -16% 3,994,859 $76,410,659 VGL Vista Group Int Ltd 1.45 -16% 20,775 $406,338,032 AM7 Arcadia Minerals 0.097 -16% 111,964 $12,044,824 MEL Metgasco Ltd 0.011 -15% 88,430 $13,830,528 AVD Avada Group Limited 0.665 -15% 96,945 $57,149,319 ANR Anatara Ls Ltd 0.029 -15% 117,347 $4,077,415 NMR Native Mineral Res 0.048 -14% 1,391,652 $9,426,402 SRJ SRJ Technologies 0.06 -14% 251,141 $9,151,783 TAS Tasman Resources Ltd 0.006 -14% 814,965 $4,988,685 EYE Nova EYE Medical Ltd 0.185 -14% 656,762 $40,982,202 SDG Sunland Group Ltd 0.93 -14% 750,986 $147,862,276 PUR Pursuit Minerals 0.01 -13% 14,508,601 $33,855,671 ABC Adbri Limited 2.39 -13% 1,761,211 $1,790,122,948 NET Netlinkz Limited 0.007 -13% 754,477 $28,244,227 OMX Orange Minerals 0.035 -13% 97,645 $1,986,695 BMM Balkan Mining and Minerals 0.19 -12% 37,615 $13,130,483 WBT Weebit Nano Ltd 4.04 -12% 2,385,501 $856,788,462 BEZ Besra Gold 0.155 -11% 1,824,596 $63,870,275

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.