ASX Small Caps Lunch Wrap: Who else feels markets are a little more… cromulent today?

'This new iPhone is mid AF, you feel me?' (Pic via Getty Images)

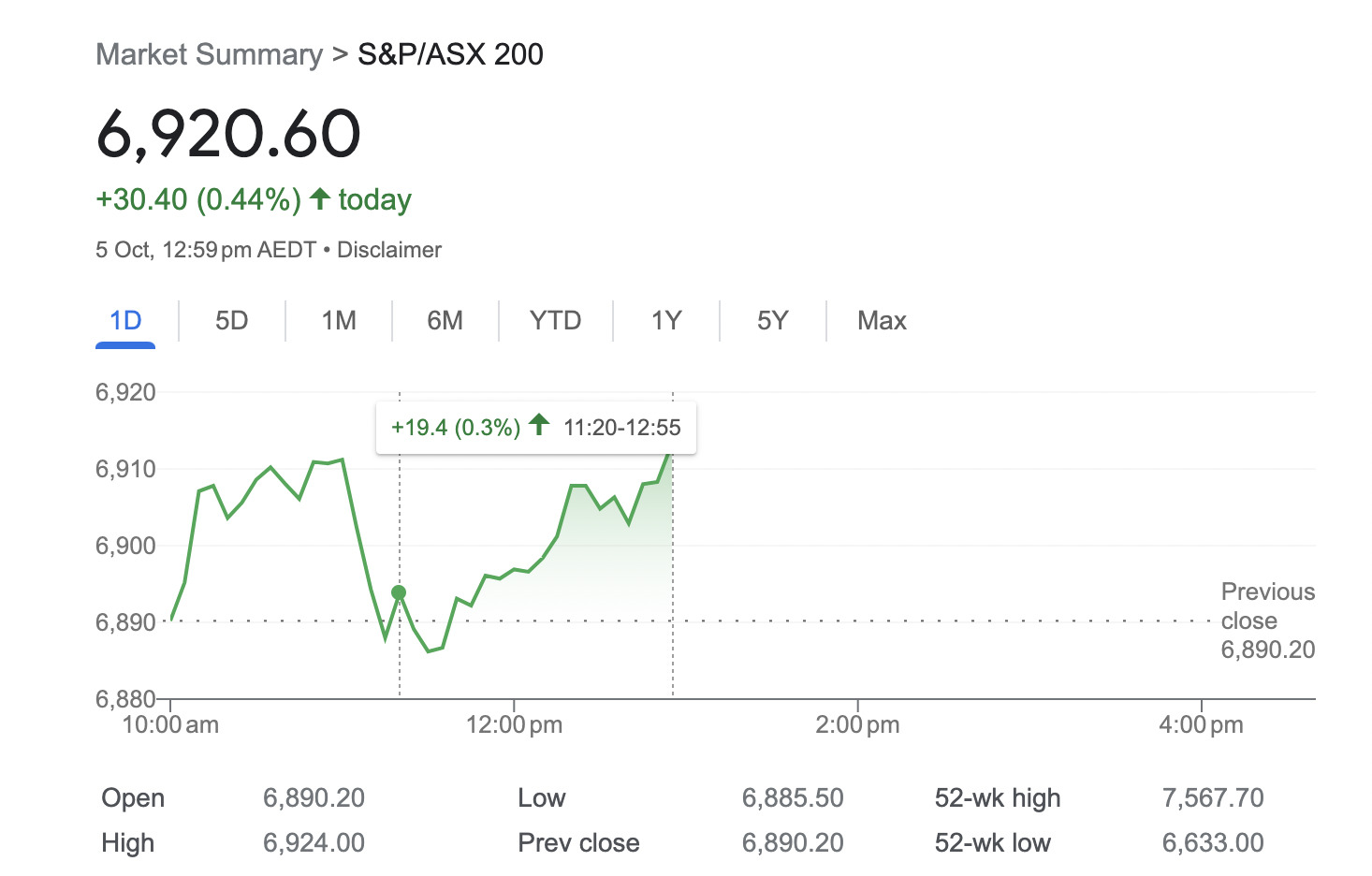

Unlike the disappointing droop it saw on hump day, the ASX200 has generally been firming up on Thursday, which is appealing. At the very least, it’s certainly a bit more ‘cromulent’ (see further below).

Stockhead‘s Christian Edwards covered it very well in his chook-pun-tastic Market Highlights earlier, but today’s green shoots can be partly put down to a counter-offer on US jobs data made overnight by US payroll payments processing firm ADP.

Its read was pleasingly pissweak in comparison with Tuesday’s strong JOLTs report, “which sucked the oxygen out of midweek trade”.

The power of data when combined with words, eh? Speaking of the latter… here’s a ‘cromulent’, if clumsy segue/segway into today’s non-finance-related headlining topic…

You might’ve missed this, but… due to the ever-evolving nature of the English language, and the inordinate amount of time “young adults” spend on the interwebs talking smack, a whole nosegay of words have recently been added to the dictionary.

And when we say the dictionary we mean specifically America’s oldest one – Merriam-Webster, which is a resource we rarely/never use, mainly because we live in Australia, generally don’t like the letter Z and use proper English ‘n’ that.

And when we say nosegay, we actually mean about 690 new words. So a bit more than a small bunch of sweetly scented flowers, then. We just wanted to use the word nosegay.

And the new words? Short (by a long way) of listing every single one of the 690 for you, here are some highlights, most of which are pretty Gen-Z-tastic:

cromulent: A nonce word made up by writers of The Simpsons, which means ‘acceptable’ or satisfactory.

padawan: A young, inexperienced person. One who probably doesn’t like the coarse texture of sand.

simp: To show excessive devotion to or longing for someone or something = you, with that underperforming lithium/gold/crypto play you should’ve dumped by now, right?

bussin: What my most excellent, LeBron wannabe, 5ft, 13-year-old son says when he nails a three-pointer.

rizz: An ability to score with someone you find attractive. Just be sure not to rizz in your pants.

rizzler: Someone who holds an unfair amount of rizz, leaving the less rizzed-up scrounging around and feeling a bit…

mid: So-so, average, meh – which is about 100% better than lithium’s spot price recently.

goated: Considered to be the greatest of all time, right Nathan Lyon?

jumpscare: You know what that is, schlock horror fans.

grammable: Nope, we don’t want to waste energy explaining this one. But FFS.

That’ll do then, but you can read the full list here. And here are some annoyingly posh people talking about it on CNN…

New words, who dis? https://t.co/scqy5JG1hQ

— Merriam-Webster (@MerriamWebster) September 28, 2023

As for Simpsons additions, we’re a bit disappointed they didn’t go for ‘chazwazzer’. Maybe next time.

TO MARKETS

So then, here’s where things stand around tummy-rumbling time today. Whatever the opposite of zhuzh is in the Merriam-Webster, it just happened to the ASX200, with a reprise of that sagging feeling from yesterday.

Let’s hope it chazwazzers its way back up before the closing bell.

But, soft! What light through yonder Google Finance chart breaks? It just broke back up again. F**kin’ bussin.

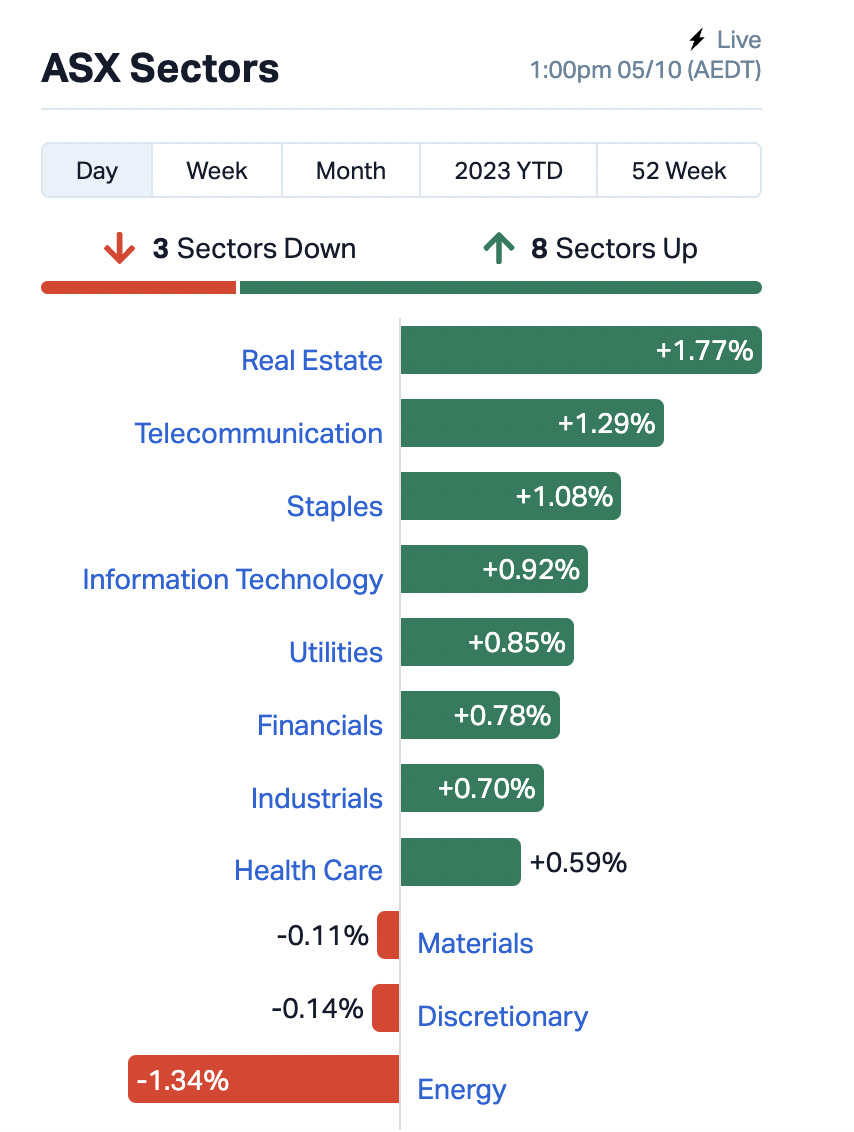

Honing in on the sectors, this is what we’re seeing, via Market Index… And it’s a good deal easier on the eye than this time yesterday when Utilities was the only sector showing any semblance of form.

Energy is clearly lacking, though. In fact, it’s having a shocker. But there’s at least one reasonably large-capped stock in the sector that’s preventing it from an even worse meter read. And that’s the $1.06bn-valued:

Strike Energy (ASX:STX), which is up about 7% on the news of successful appraisal results from the SE2 well at the company’s 100% owned South Erregulla gas field.

While we’re sniffing round that end of town, elsewhere in the larger caps, healthcare stock Summerset Group (ASX:SNZ), which has a $2.23bn market cap, is also up impressively for its size, with a current 6.8% gain – on no news we’re seeing at the time of writing.

NOT THE ASX

US politics, eh? Interesting times. If you’ve been keeping half an eye, you’ll know by now that, as Christian put it earlier, Republicans in the Lower House trolled and then removed their own Speaker – Kevin McCarthy.

He’ll be, likely temporarily at least, replaced by another Republican Macca – the bow-tie-wearing Gary Gensler grilling Patrick McHenry. Who, if you like Bitcoin and Ethereum, is somewhat of an innovation-friendly, free-markets champ (ahem, left/right political directional preferences aside).

Scenes from the Lower House… It all makes perfect sense when you think about it, and that tiger-scared bloke Matt Gaetz – he really should’ve paid for dinner.

It was always going to go this way#Gaetz #McCarthy pic.twitter.com/l9RW8HFPRT

— Bad Lip Reading (@BadLipReading) October 3, 2023

A quick look at what’s doing what where, before we head into the more exciting nether regions of the ASX.

On Wall Street

S&P500 closed +0.81%

Tech-tastic Nasdaq closed +1.35%

Dow Jones closed +0.39%

China

Shaghai Comp: +0.10%

Hong Kong

Hang Seng: -0.78%

Japan

Nikkei: -2.28%

Meanwhile, the…

Gold price moved up 0.28% to US$1,840 an ounce.

Oil is also slightly up, -0.34%, with Brent crude now trading at US$86.10 a barrel.

And the Aussie dollar has gained 0.3%: US63.45c.

Bitcoin, meanwhile, is doing pretty damn well, all things (not actually all) considered. It’s ticked back up to US$27,740 at the time of writing, with a 2% daily gain and a 5% increase over the past week.

Maybe there’s some seller exhaustion going on there, maybe the HODLers are digging in? In any case, BTC is up 60% YTD so far. And, while we like gold here, how’s that spot price return going comparatively? Not so good. If you’d only held gold so far this year, you’d be down 0.28%. Sobering.

It hasn’t exactly been a year for splashing out on too much, really, has it…

Game over pic.twitter.com/2LvKu0YXdN

— zerohedge (@zerohedge) October 4, 2023

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 5 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| Security | Description | Last | % | MktCap |

| DXB | Dimerix Ltd | 0.13 | 113% | $24,104,100 |

| MRD | Mount Ridley Mines | 0.002 | 33% | $11,677,300 |

| BLG | Bluglass Limited | 0.049 | 32% | $56,537,700 |

| PUA | Peak Minerals Ltd | 0.005 | 25% | $4,165,500 |

| RBR | RBR Group Ltd | 0.0025 | 25% | $3,236,800 |

| TMH | The Market Herald | 0.265 | 23% | $69,009,100 |

| TTT | Titomic Limited | 0.016 | 23% | $11,260,700 |

| GTE | Great Western Exp. | 0.049 | 23% | $10,107,900 |

| B4P | Beforepay Group | 0.455 | 21% | $13,128,500 |

| AHF | Aust Dairy Limited | 0.023 | 21% | $12,461,500 |

| AEV | Avenira Limited | 0.012 | 20% | $17,300,100 |

| LML | Lincoln Minerals | 0.006 | 20% | $7,103,600 |

| AJQ | Armour Energy Ltd | 0.14 | 17% | $12,374,400 |

| MOB | Mobilicom Ltd | 0.007 | 17% | $7,960,100 |

| NET | Netlinkz Limited | 0.007 | 17% | $21,363,200 |

| GDM | Greatdivideminingltd | 0.325 | 16% | $7,630,000 |

| GAP | Gale Pacific Limited | 0.19 | 15% | $46,862,400 |

| IBX | Imagion Biosys Ltd | 0.016 | 14% | $18,280,700 |

| NGS | NGS Ltd | 0.016 | 14% | $3,517,200 |

| SGC | Sacgasco Ltd | 0.008 | 14% | $5,415,100 |

| VAL | Valor Resources Ltd | 0.004 | 14% | $13,556,700 |

| TTM | Titan Minerals | 0.035 | 13% | $47,103,100 |

| POD | Podium Minerals | 0.0395 | 13% | $12,751,800 |

| EMC | Everest Metals Corp | 0.135 | 13% | $15,994,000 |

| REC | Rechargemetals | 0.18 | 13% | $16,893,500 |

A coupla standouts here:

Healthcare stock Dimerix (ASX:DXB) comes off its trading halt with an announcement that’s given DXB a stonking +100% gain so far today.

Global pharma company ADVANZ PHARMA and clinical-stage biopharm firm Dimerix today announced they have entered into an exclusive license agreement for the European Economic Area, the UK, Switzerland, Canada, Australia, and New Zealand for the commercialisation of Dimerix’ Phase 3 drug candidate DMX-200. And that’s a treatment in development for focal segmental glomerulosclerosis (FSGS) kidney disease, following regulatory approval.

We are delighted to announce an exclusive license agreement with ADVANZ PHARMA to register & commercialise DMX-200 for #FSGS in the EU, UK, Switzerland, Canada & ANZ: https://t.co/s5FrjJdnSI

— Dimerix (@dimerixltd) October 4, 2023

Meanwhile, clean tech stock and global semiconductor developer BluGlass (ASX:BLG) is also up impressively, about 32% so far today.

News? BluGlass has been named a member of the Commercial Leap Ahead for Wide-bandgap Semiconductors (CLAWS) Hub, one of eight Microelectronics Commons regional innovation hubs announced by the US Department of Defense.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 5 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| MXC | Mgc Pharmaceuticals | 0.001 | -50% | $8,855,900 |

| C1X | Cosmosexploration | 0.18 | -39% | $13,120,100 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | $14,368,300 |

| JTL | Jayex Technology Ltd | 0.008 | -20% | $2,812,800 |

| G88 | Golden Mile Res Ltd | 0.024 | -17% | $9,552,300 |

| ADV | Ardiden Ltd | 0.005 | -17% | $16,130,000 |

| AHN | Athena Resources | 0.005 | -17% | $6,422,800 |

| BEX | Bikeexchange Ltd | 0.005 | -17% | $8,595,800 |

| CRB | Carbine Resources | 0.005 | -17% | $3,310,400 |

| A1G | African Gold Ltd. | 0.035 | -15% | $6,941,800 |

| BUY | Bounty Oil & Gas NL | 0.006 | -14% | $9,593,500 |

| MHC | Manhattan Corp Ltd | 0.006 | -14% | $20,558,900 |

| RIM | Rimfire Pacific | 0.006 | -14% | $14,736,700 |

| NOX | Noxopharm Limited | 0.086 | -14% | $29,223,800 |

| PVL | Powerhouse Ven Ltd | 0.038 | -14% | $5,312,700 |

| DTC | Damstra Holdings | 0.1 | -13% | $29,656,400 |

| ESR | Estrella Res Ltd | 0.007 | -13% | $11,868,600 |

| IBG | Ironbark Zinc Ltd | 0.007 | -13% | $11,734,300 |

| PRX | Prodigy Gold NL | 0.007 | -13% | $14,008,900 |

| CBE | Cobre | 0.05 | -12% | $16,353,900 |

| TKM | Trek Metals Ltd | 0.03 | -12% | $16,800,100 |

| LNR | Lanthanein Resources | 0.008 | -11% | $10,094,200 |

| OLL | Openlearning | 0.016 | -11% | $4,821,600 |

| TEM | Tempest Minerals | 0.008 | -11% | $4,602,500 |

| KNG | Kingsland Minerals | 0.21 | -11% | $11,604,100 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.