ASX Small Caps Lunch Wrap: Who else fancied some duck for lunch this weekend?

"And someone's been eating my ducklings," said Mama Bear. Pic via Getty Images.

Things are “mostly good” on the market this morning, with the ASX 200 benchmark up by around +0.5%, and most sectors doing okay, except for Industrials, which is not.

That’s all happening against a backdrop of a solid upswing in New York on Friday night, and a slew of quarterlies coming in that are painting a fairly rosy picture of what life must be like at the top end of town.

I’ll get into all that in a minute, but first some news out of Seattle on the weekend, when a child’s birthday party jaunt to the zoo turned into a brutal lesson of how things work in the wild.

A woman, identified only as “Rachelle” had taken her daughter and some friends to the Woodland Park Zoo for a nice birthday outing, when they stopped to marvel at one of the zoo’s star attractions, a young female bear called Juniper.

Rachelle told local media they were thrilled to see Juniper “looking so active”, but when it became apparent that the bear was really only interested in a bunch of ducklings that had wandered into her enclosure, things went south pretty fast.

I’ve been advised to give you plenty of warning on this one, so… here’s plenty of warning. If you don’t want to see what happens when some cute, innocent ducklings get coldly, methodically hunted down and eaten by a very hungry bear, scroll on past.

If you are keen to see it, you’re a monster… and here it is.

Brown bear eats ducklings in front of horrified children at the Woodland Park Zoo in Seattle.

The 2-year-old bear named ‘Juniper’ noticed the ducklings in her water and decided to pounce.

The bear was seen picking up each duckling one at a time and eating them like they… pic.twitter.com/rcNjD7dVDU

— Collin Rugg (@CollinRugg) May 1, 2024

Probably the most remarkable part of this story is that this isn’t even the first time Juniper’s performed her Amazing Disappearing Duckling trick – video posted from the same pond last year showed that the bear has form when it comes to this sort of thing.

Rachelle did tell local media that she wanted to stress that her children were not traumatised by the event, but the video shows quite clearly that Rachelle might have been stretching the truth.

TO MARKETS

There’s a bit happening this morning, so a quick recap is all anyone’s going to get I’m afraid.

I’ll start with Qantas (ASX:QAN), where the ghost of Alan Joyce has risen once again from the grave to fill the national carrier’s hallowed halls with the foul, fetid stench of terrible decision making.

Qantas has “apologised” for its devious practice of selling tickets on flights that it had already cancelled – so-called “ghost flights” – and agreed to pay $20 million in compo to affected passengers.

I don’t know how they’ve arrived at the sums, but it works out to $225 to domestic ticketholders and $450 to international ticketholders, on top of whatever they’d been given by the airline already… so, $225 and a meal voucher that doesn’t work at any of the shops at Sydney Airport is all you’re gonna get for the aggravation of a ruined holiday.

Sky News has exclusive footage of the fallout from this morning’s events.

Meanwhile, Telco giant Optus has announced it has a new CEO – you could tell by the colour of the smoke coming out of the top of the Optus building in North Sydney – naming Stephen Rue as the new boss.

Rue has been in charge of the NBN since 2018, so Optus customers might want to get used to the idea of a few more years of ‘close enough is good enough’, because nothing sends the message of “excellent service with zero outages” like Australia’s Amazing 100% Future-proof Internet Backbone™.

Optus chairman Paul O’Sullivan said Rue’s appointment to the role followed a “rigorous process”, which I am told involved a written maths test and an obstacle course that was all muddy and gross, so he’s definitely earned the gig.

And Westpac (ASX:WBC) delivered a half-yearly result this morning, slamming it down on the table with a triumphant smirk, as if to tell both National Australia Bank (ASX:NAB) and Macquarie (ASX:MQG) “This is how you do it, beeyatches.”

Westpac has managed to turn around its fortunes somewhat, posting an above-expectation cash profit for the half of $3.34 billion and that, coupled with a bunch of other banking gobbledygook, left the bank able to pay out a better than expected divvy of $0.75 and extend its buyback program by a cool billion dollars.

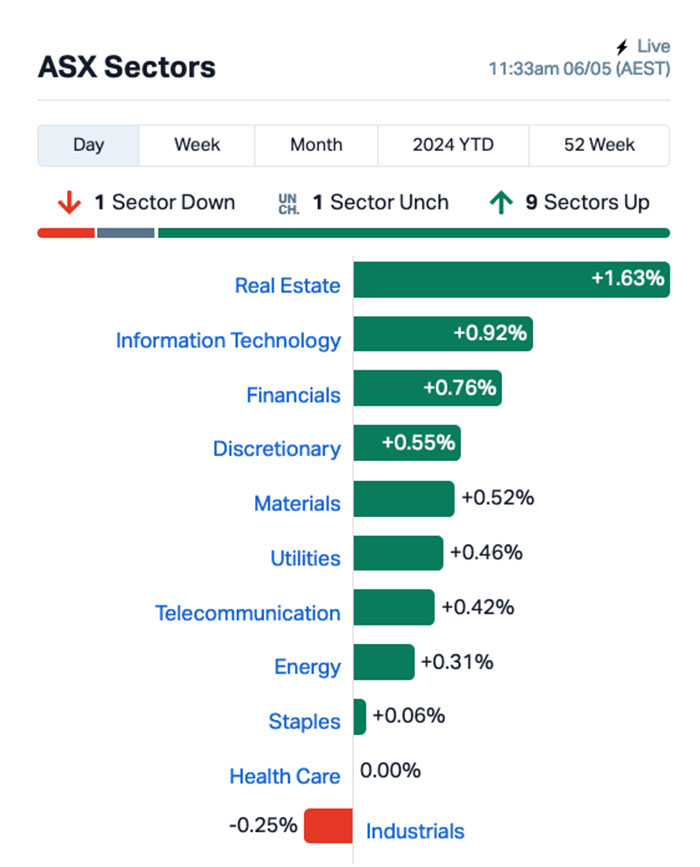

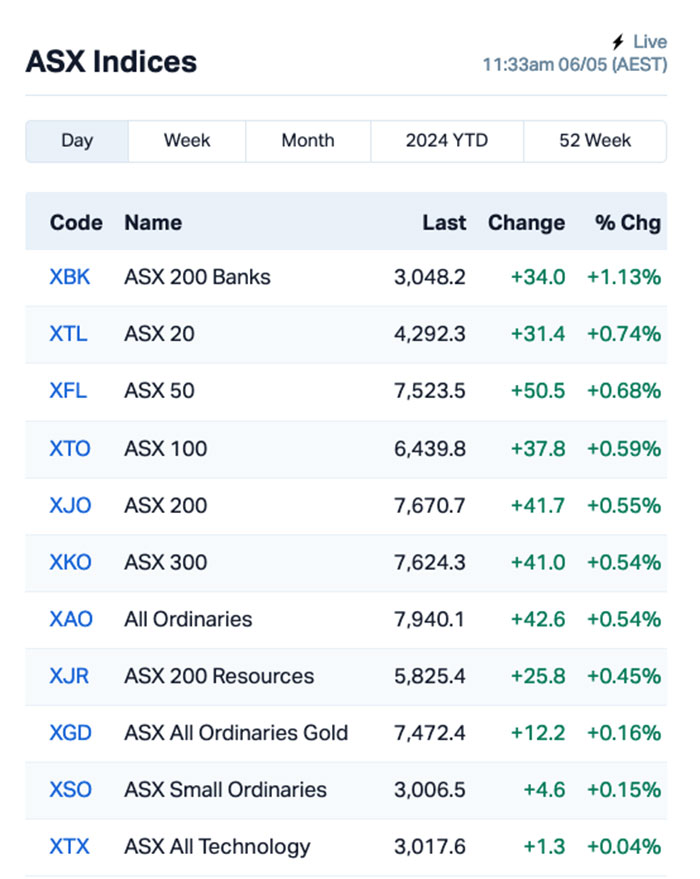

To the nuts and bolts of the ASX this morning, and it’s smoothish sailing across the board today, with the benchmark up more than 40 points and everything except Industrials at least treading water.

Real Estate and InfoTech are leading the way today, but Health Care is best described as in a serious but stable condition. The only thing holding it up this morning is large cap Mesoblast, doing all the heavy lifting with a +8.5% lurch on no news.

On a more granular level, it’s the Banks that are leading the charge, thanks to Westpac’s shockingly good result that has bumped its stock +2.5% higher since the start of the day.

NOT THE ASX

On Friday, Wall Street rallied once again after a softer-than-estimated non-farm payrolls number, which left the S&P 500 up by +1.26%, the blue chips Dow Jones index up by +1.18%, and the tech-heavy Nasdaq surging ahead by +1.99%.

US non-farm payrolls rose by 175k jobs in April, versus the 240k consensus in the Bloomberg survey – boosting expectations of a September Fed rate cut.

“…The market is fully discounting a 25bp September interest rate cut once again, with a second one before the end of the year,” said ING’s chief economist, James Knightley.

“The payroll miss hands the baton to the bulls,” said Jose Torres at Interactive Brokers.

In US stock news, Apple surged by 6% following its announcement of sales exceeding expectations in the previous quarter, and a forecast of resurgence in growth for the current quarter.

Biopharma Amgen jumped by +11% following the CEO’s optimistic remarks about early findings from a study of the company’s potential obesity treatment, MariTide.

Eddy Sunarto reported this morning that Berkshire Hathaway held its annual general meeting in Omaha over the weekend, as Warren Buffett made it clear that his empire will continue to be a major shareholder in Apple, even after offloading billions of dollars’ worth of shares in the tech giant.

At 93, Buffett has been gradually passing the torch to a new generation of leaders. Greg Abel, currently overseeing Berkshire’s non-insurance ventures, is poised to take the reins when he passes. Buffett said that when that happens, “the stock would go up tomorrow.”

But, notably, he’s making no promises about the day after that, like the wily old fox he is.

In Asia, you’ll be shocked to learn that it’s Japan’s turn to have a day off, so Tokyo’s markets are closed for “Children’s Day”, which I assume is a chance for Japanese kids to invade the exchange and write crude things about the Nikkei on the walls with crayons.

There’s a bunch of markets closed for Easter today, because someone’s calendar’s completely out of whack, and it’s a bank holiday in London today, so good luck getting anything done over there today as well.

Chinese markets are open, though, and they’re back from their recent extended holidays with some pep in their step. Hong Kong’s Hang Seng is up +0.15%, and Shanghai’s +1.0% higher this morning as well.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 06 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap 1TT Thrive Tribe Tech 0.014 75% 2,384,912 $3,012,972 PRX Prodigy Gold NL 0.003 50% 306,666 $4,027,548 IXU Ixup Limited 0.015 36% 6,824,641 $16,548,612 MTL Mantle Minerals Ltd 0.002 33% 954,000 $9,296,169 NGY Nuenergy Gas Ltd 0.026 30% 25,000 $29,619,110 AEV Avenira Limited 0.007 27% 2,411,339 $12,919,687 SCN Scorpion Minerals 0.028 27% 1,591,011 $9,008,036 ANX Anax Metals Ltd 0.033 27% 13,405,702 $15,374,245 TG1 Techgen Metals Ltd 0.035 25% 1,469,839 $3,587,712 BFC Beston Global Ltd 0.005 25% 2,058,185 $7,988,188 ME1 Melodiol Glb Health 0.0025 25% 2,915,000 $1,346,974 MKL Mighty Kingdom Ltd 0.005 25% 4,807,163 $9,990,399 GSR Greenstone Resources 0.011 22% 3,936,073 $12,359,315 SXE Sth Crs Elect Engnr 1.475 20% 1,910,262 $322,438,368 ATH Alterity Therap Ltd 0.006 20% 1,360,968 $26,225,577 AYT Austin Metals Ltd 0.006 20% 1,667 $6,425,957 ICG Inca Minerals Ltd 0.006 20% 830,600 $4,023,694 IVX Invion Ltd 0.006 20% 342,252 $32,122,661 LRL Labyrinth Resources 0.006 20% 149,423 $5,937,719 5EA 5Eadvanced 0.21 17% 355,688 $60,041,851 BDG Black Dragon Gold 0.021 17% 74,596 $4,063,818 EXR Elixir Energy Ltd 0.14 17% 2,431,081 $136,077,464 IS3 I Synergy Group Ltd 0.007 17% 85,714 $1,824,482 LPD Lepidico Ltd 0.0035 17% 16,568 $22,914,924 PRM Prominence Energy 0.007 17% 436,864 $1,170,758

Gold minnow Prodigy Gold (ASX:PRX) enjoyed a bump on Monday morning after announcing an update from its 100% owned Hyperion deposit in the Tanami region of the Northern Territory.

The company said that metallurgical testwork on material from the Hyperion deposit “reinforces potential for excellent gold recoveries through a conventional Carbon In Leach (CIL) plant”.

“A significant reduction in sodium cyanide consumption compared to the initial testwork did not negatively impact the overall 48-hour gold recovery, with recovery levels remaining between 96.8% and 98.0% at a P80 150μm grind size for the oxide, transitional and fresh sample material,” Prodigy said, adding that it did need to add just a touch of lime to the process to really get things cooking.

Meanwhile, security-focussed tech company IXUP (ASX:IXU) was moving on Monday morning on news that “discussions regarding the secure cloud deployment of the IXUP platform in a project involving several of the country’s largest companies, and government / educational organisations have now progressed to the commercial negotiation phase”.

The company has been developing its platform to allow for the secure sharing and analysis of sensitive information using advanced encryption technology, so the move to a commercial negotiation phase is a big step forward in bringing the tech to market.

And mineral exploration and development company Mantle Minerals (ASX:MTL) was up this morning on news that its gold exploration drilling program is about to commence on the recently granted tenements at Mt Berghaus.

This is quite newsworthy as the Mt Berghaus tenement covers an 84km2 patch of ground immediately north of De Grey’s monstrous Hemi discovery.

Mantle has 122 aircore drillholes planned, which the company says “will be drilled to refusal”, which sounds needlessly aggressive but I’m told that just how the mining industry does things.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 06 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap OAR OAR Resources Ltd 0.001 -50% 1,638,571 $6,306,622 THL Tourismholdings 1.625 -38% 738,199 $569,565,707 RCR Rincon 0.094 -35% 40,036,517 $32,219,198 CT1 Constellation Tech 0.001 -33% 4,989 $2,212,101 VRC Volt Resources Ltd 0.004 -33% 1,123,737 $24,952,069 88E 88 Energy Ltd 0.003 -25% 34,037,779 $115,570,688 MOV Move Logistics Group 0.38 -24% 25,122 $58,192,565 AME Alto Metals Limited 0.029 -22% 4,626,378 $26,696,357 CCO The Calmer Co Int 0.004 -20% 166,932 $6,804,398 RML Resolution Minerals 0.002 -20% 52,631 $4,025,055 ROG Red Sky Energy. 0.004 -20% 405,996 $27,111,136 ZEU Zeus Resources Ltd 0.008 -20% 40,000 $4,592,810 ADD Adavale Resource Ltd 0.005 -17% 2,606,832 $6,095,878 NRZ Neurizer Ltd 0.0025 -17% 315,082 $4,959,538 RLG Roolife Group Ltd 0.005 -17% 50,000 $4,694,290 HCH Hot Chili Ltd 1.045 -16% 601,886 $149,306,508 GIB Gibb River Diamonds 0.026 -16% 70,000 $6,556,793 ICL Iceni Gold 0.023 -15% 272,223 $6,657,148 AX8 Accelerate Resources 0.042 -14% 1,253,325 $29,888,595 GLL Galilee Energy Ltd 0.048 -14% 95,000 $19,025,700 RFT Rectifier Technolog 0.012 -14% 293,000 $19,347,775 DTR Dateline Resources 0.0095 -14% 4,177,788 $15,980,636 LM1 Leeuwin Metals Ltd 0.065 -13% 14,646 $3,513,875 CUS Coppersearchlimited 0.085 -13% 95,257 $9,043,970 ADY Admiralty Resources. 0.007 -13% 100,000 $13,035,792

ICYMI – AM EDITION

Queensland Pacific Metals (ASX:QPM) has received a cash refund of $16.1m from the Australian Tax Office comprising $15.8m under the Research Development Tax Incentive Scheme and associated interest.

The refund is related to eligible research and development activities the company carried out in FY2023 on expenditure related to the TECH nickel project in Queensland.

Proceeds have been used to repay a short-term loan of $12.6m the company had taken out against the tax refund.

Western Yilgarn (ASX:WYX) has executed a contract for an airborne electromagnetic survey of 1800 line kilometres covering 350km2 of ground over its Ida Holmes Junction project in Western Australia.

The Phase 1 survey will be run concurrently with the ongoing auger geochemistry campaign with results from both playing a key role in planning for the maiden aircore/reverse circulation drill program.

Ida Holmes Junction is ~50km southwest of Gold Fields’ Agnew Gold project and is highly prospective for copper, nickel and platinum group elements as well as lithium-caesium-tantalum pegmatites.

Anson Resources (ASX:ASN) has appointed current chief operating officer (COO) Tim Murray as director, effective immediately.

Murray was instrumental in securing the binding offtake term sheet with LG Energy Solution and will continue to pursue offtake agreements to fulfill the initial planned production capacity of 10,000tpa for ASN’s Paradox Basin project.

ASN executive chairman and CEO Bruce Richardson says since his appointment as COO in January 2023, Murray has made a significant contribution to the company, not only on the LG agreement, but in many aspects of its growth.

“Tim’s appointment strengthens the board’s commercial skill base, particularly in relation to doing business in Asia, which is required at this stage of the company’s development.”

Iltani Resources (ASX:ILT) has begun the next phase of drilling at the Orient silver-indium project in Northern Queensland.

The explorer plans to drill 11 reverse circulation holes for 2,300m as it works its way towards establishing an exploration target at the Orient West prospect.

Results will form the basis for subsequent resource estimate drilling with the program estimated to take between three to four weeks to complete.

“We’re marking the start of what we believe will be an exciting period of drilling at Orient where we plan to extend the known mineralisation by over a 1,800m strike length,” ILT managing director Donald Garner says.

At Stockhead, we tell it like it is. While Queensland Pacific Metals, Western Yilgarn, Anson Resources and Iltani Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.