ASX Small Caps Lunch Wrap: Who chain-smoked their way through a Chinese marathon last week?

Just look how young and cool this guy is. No wonder all the smart kids are vaping these days. Pic via Getty Images.

Local markets are up this morning, in the wake of a banger on Wall Street that saw the S&P 500 “officially” stroll majestically into Bull Market territory, closing up 1.23% and hitting an all-time record high at 4,839.81 points.

To celebrate, CNBC has engaged the services of world-leading veterinary surgeon Dr Leon Dogfeeler, who is – as I write this – 14 hours into the surgical process of turning Jim Cramer into a minotaur.

The flow on is a buoyant local market, which is up 0.5% or thereabouts in early trade.

I’ll get into the details of that shortly, but first there’s a story from the Wild of World of Sport, after Chinese officials have disqualified a runner from the 2024 Xiamen Marathon, for breaking the event’s “no smoking” rule.

The runner, known somewhat affectionately as Uncle Chen, is a regular on China’s marathon circuit, and is well known for basically chain-smoking cigarettes for the entirety of each 42km event.

The most remarkable part of this feat of carcinogenic sporting magic is that Uncle Chen manages to finish each marathon he runs in a pretty respectable time, without barfing up a lung or two along the way.

Uncle Chen’s kind of a big deal on Chinese social media, and footage of him sucking back gaspers while running has been pretty popular in a nation where having a ciggie is pretty much a national sport on its own.

What isn’t clear is whether he’s developed a running style all of his own as a result of unusually high levels of nicotine in his bloodstream, or if – as the footage suggests – he recently sharted and is trying to outrun the smell.

This year, Uncle Chen reportedly crossed the finish line in a blistering 3 hours and 33 minutes, which is pretty impressive for a 52-year-old runner.

But his time, unfortunately, won’t count – race officials have disqualified him for breaking a “no smoking on the course” rule, which is as dumb as banning someone from the Olympics for testing positive to marijuana.

If you can win an Olympic event while you’re stoned, you should get two medals, not just one – and if Uncle Chen can slog through a marathon and a packet of smokes at the same time, that’s a medal-winning performance if ever I’ve seen one.

TO MARKETS

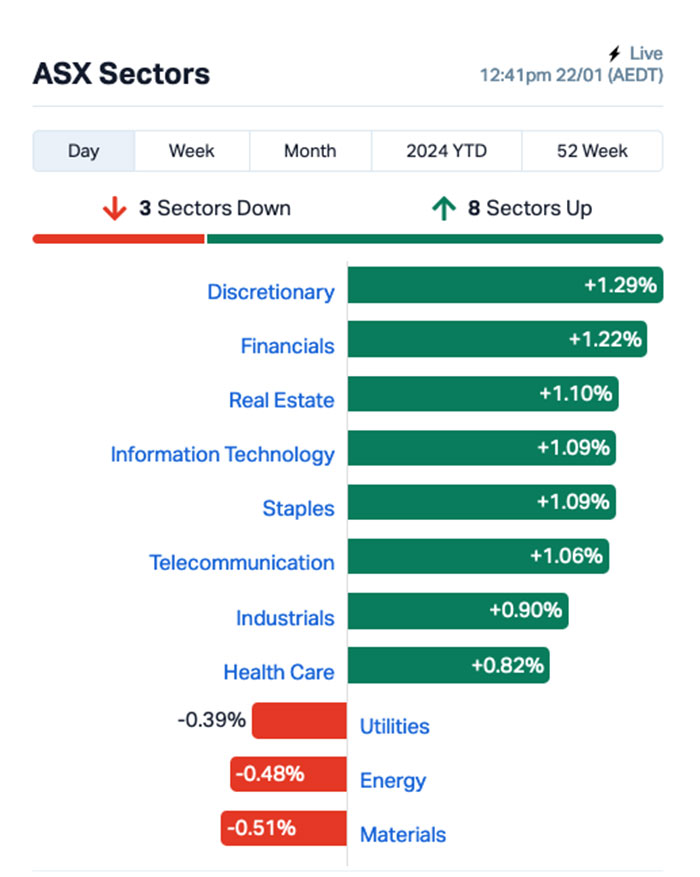

Local markets have been doing “okay” this morning, with the majority of sectors making headway as the ASX 200 benchmark bobbles to a +0.62% rise before lunch.

Across the sectors, we’ve got 6 from 11 showing better than +1.0% gains, and it’s Consumer Discretionary out in front at the moment on +1.29%.

Financials is also well in the hunt for Best in Show today – and that’s coming ahead of the next round of earnings, and there’s more than a couple of sets of eyeballs waiting to see which way the chips have been falling for the Big Four banks.

Like a rectal thermometer up the bum of a champion filly, earnings from the big banks are a fairly good indicator of the health of the nation’s economy – and the predictions about how it’s all likely to pan out have begun.

For example, Earlybird Eddy reported this morning that Morningstar analyst Nathan Zaia believes that bank margins are falling, but earnings are still solid.

“Net interest margins are likely peaked in first-half fiscal 2023, and are expected to fall in fiscal 2024,” Zaia said.

“Net interest income makes up 80% to 85% of revenue. While bad debts are likely to rise, we anticipate cost containment to allow cash profits to grow broadly with revenue.

“Our expectation of low credit growth is consistent with RBA forecasts for gross domestic product growth to average around 1.9% in fiscal 2024 and 2025. Rising house prices and drawdowns of savings add to total credit growth.”

Stay tuned for more riveting crystal ball gazing soon.

NOT THE ASX

Friday was a big one for Wall Street, where a solid market surge pushed the S&P 500 to an all time high and helped the other two majors finish the day more than 1.0% ahead for the session.

The S&P 500 jumped +1.23%, the blue chips Dow Jones index was up by +1.05%, and the tech-heavy Nasdaq rocketed higher by +1.70%. Solid work all round, and a great way to lift everyone’s mood on the way into the weekend.

The rising sentiment in the US is most likely down to an increasing number of market-watchers that have their sights set on a soft landing for the US economy, despite everyone jumping the gun pre-Xmas and forcing the US Fed mouthpieces to spend a month slowly and carefully trying to hose down the confidence.

Which, you won’t be surprised, they’re still trying their best to do – to whit, San Francisco Fed Reserve Bank President Mary Daly’s bearish notes to Fox News on Friday, when she told the network that it was “premature” to think interest-rate cuts are around the corner.

It’s the same songbook the Fed goons have been singing from for months – but the message just isn’t getting through some of the thicker skulls in New York, apparently.

To stock news, Boeing got a +1.6% shot in the arm after India’s newest airline, Akasa Air, decided to roll the dice and order 150 Max jets – and, provided they ticked the box on the order form that says “all parts of the aircraft should be securely attached to other parts”, what could possibly go wrong?

Apple rose 1.55% after vowing to open up its tap-to-pay technology on iPhones to rivals, in a bid to avoid EU antitrust fines.

That decision, alongside Apple’s call to remove the patent-tripping blood oxygen reading tech from the latest iteration of its watch seem to be two of the larger roadblocks out of the way for the company.

Apple is also waiting on a response from Epic Games – the makers of Fortnite and other things that are slowly consuming the lives of children around the globe – after the gaming company was presented with Apple’s legal bill from their recent courtroom stoush.

Apple filed a request to have the gaming company pay its legal fees from the recently-ended fight over Epic’s desire to extract money from its customers, without paying Apple for the privilege of doing so.

The bill for that court battle is mental – Apple has asked the court to make Epic pay costs for the 9 out of 10 claims the gaming company filed, and which failed, which would equal 90% of AUD$123,511,749.50.

And Ford Motor rose 2% as it cut production of its F-150 Lightning electric truck as demand for electric vehicles declined.

In Asia, Japan’s Nikkei is up 1.19% so far today, while Shanghai and Hong Kong markets are losing ground, down 0.62% and 0.93% respectively.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 22 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAV Javelin Minerals Ltd 0.0015 50% 848,726 $1,633,729 CST Castile Resources 0.085 33% 584,290 $15,481,755 KP2 Kore Potash PLC 0.012 20% 151,100 $6,694,489 NZK NZK Salmon Ltd 0.27 17% 104,937 $124,534,583 ASR Asra Minerals Ltd 0.007 17% 9,069,147 $9,818,974 RGS Regeneus Ltd 0.007 17% 1,069,610 $1,838,621 RVT Richmond Vanadium 0.315 17% 1,386 $23,276,108 TX3 Trinex Minerals Ltd 0.007 17% 550,000 $8,922,148 GMN Gold Mountain Ltd 0.004 14% 510,100 $7,941,775 VAL Valor Resources Ltd 0.004 14% 1,576,227 $14,606,672 PAA Pharmaust Limited 0.165 14% 1,325,719 $55,820,012 DTC Damstra Holdings 0.21 14% 1,227,888 $47,708,187 RMI Resource Mining Corp 0.034 13% 248,070 $16,870,434 SPQ Superior Resources 0.017 13% 557,453 $30,018,306 PVW PVW Res Ltd 0.051 13% 57,489 $4,563,215 EQS Equity Story Group 0.035 13% 27,144 $1,321,059 KOB Koba Resources 0.135 13% 1,875,797 $12,650,000 88E 88 Energy Ltd 0.0045 13% 7,286,296 $98,901,682 ARD Argent Minerals 0.009 13% 738,076 $10,334,072 ATH Alterity Therapeutics 0.0045 13% 1,018,590 $15,245,305 DOU Douugh Limited 0.0045 13% 30,000 $4,328,276 HCD Hydrocarbon Dynamic 0.0045 13% 445,600 $3,078,664 WML Woomera Mining Ltd 0.009 13% 1,956,432 $9,745,112 RTH Ras Tech 1.05 12% 101,463 $42,538,867 ACR Acrux Limited 0.068 11% 197,650 $17,667,490

Resource Mining Corporation (ASX:RMI) is making a move this morning, climbing about 30% with gains most likely being driven by a sluggish market response to its news from last week about assay results from the Liparamba diamond drill program in Tanzania.

Resource told the market on 17 January that drilling had uncovered anomalous Ni-Cu values within a number of the drill holes, with 0.35-0.40% Ni and 0.20-0.23% Cu sulphide mineralisation occurring at 133-135m in hole LPDD009 among the highlights.

Also appearing to move belatedly is New Zealand King Salmon (ASX:NZK), which is recovering sharp end-of-the-week losses today, on the heels of news that the company has received notice of a positive ‘aquaculture decision’ for Blue Endeavour from Fisheries New Zealand – which, in short, means that the project can go ahead.

RAS Technology Holdings (ASX:) has some big news today, though – the company says that it’s entered into a partnership with global online casino and sportsbook Stake.com, which will see RTH provide an all-in-one “racing solution” to enable them to launch a racing offering to their extensive global customer base.

Local ‘rapid animal and small human’ enthusiasts, however, won’t be able to take advantage of RTH’s tech, as Stake.com doesn’t offer its services to Australians, which sounds racist, but isn’t.

PharmAust (ASX:PAA) is climbing this morning as well, as the market continues to digest its big news from last week that the company has partnered with leading MND/ALS clinical study design and statistical analysis specialists Berry Consultants, to get its Phase 2/3 study for monepantel in patients with Motor Neurone Disease (MND)/ Amyotrophic Lateral Sclerosis (ALS) off the ground.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 22 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.