ASX Small Caps Lunch Wrap: Which little piggy didn’t quite make it to market this week?

Pic via Getty Images.

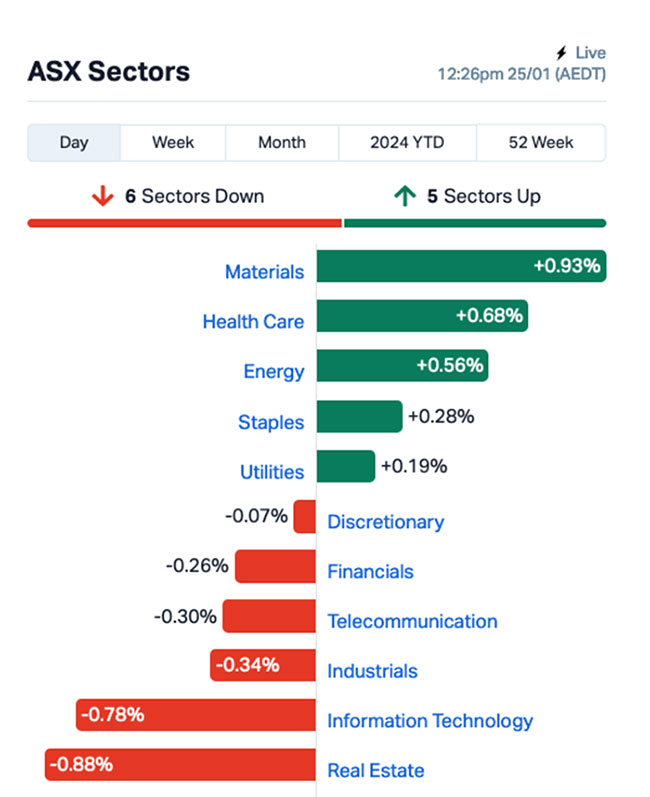

Local markets are up 0.15% around lunchtime today, as yesterday’s rush on mining stocks continued into this morning’s session, and local investors decided that today is the day that we go our own way, ignoring the tech rally on Wall Street overnight in favour of large holes in the ground.

Whether that’s misplaced optimism in the wildly swinging commodities markets, or an early burst of patriotic Australia Day zeal, remains to be seen.

It’s not all amazing news – and there’s a lot to get through today – but I’ll get to that in a minute.

But first, this quick bit of news out of Texas caught my eye this morning, after a black metal band was forced to issue a public apology because the crowd was busted throwing a pig’s head around during the band’s performance.

Members of the band Martyrdom, which was supporting Devoured Trachea and Accosted at the The White Swan in Houston a few nights back, took to social media to say sorry that their idea of a bit of gimmicky black metal fun wasn’t to everyone’s liking.

Footage from the incident on social media shows the severed head of a pig hurtling through the air, while the band’s objectively terrible music drones in the background.

The wording of the apology tells a very clear story about who’s unhappy about the incident, with the band specifically listing “vegans” at the top of the list – because the last thing a self-respecting black metal band would want to endure is the spectacle of a gaggle of enraged vegans picketing out the front of their upcoming shows.

“Most importantly we want to apologise to the White Swan, and Harry, the sound guy, specifically,” the band members wrote – which, honestly, raises a lot more questions than it answers.

there is a pigs head in the swan pic.twitter.com/sUC6bkb8fT

— 100k crimson beherit ☽ (@SALVIATALKSHOW) January 20, 2024

I honestly don’t know what the fuss is about – but I definitely want to know the details of the horrors of Harry the sound guy.

TO MARKETS

Local markets are up a bit this morning, recovering after yesterday’s weird tax cut paralysis that knocked the wind out of what could have been a bumper day, thanks to a surge among the miners.

The dust from Albo’s promise-shattering explosion of economic largesse is settling, we’re all, on average, gonna be $800 richer each year as a result and we’re not ever going to hear the end of how much of a ‘massive betrayal’ that policy shift was, as a predictable portion of Australia’s population bitches and moans like a kid on Christmas morning whose new $800 bike is the wrong shade of blue.

Mining and resources stocks are leading the charge this morning, with Health Care along for the ride.

However, local punters have ignored the siren song of a tech rally on Wall Street overnight, and turned their backs on local techies leaving that sector gasping for air.

Meanwhile, Woolworths (ASX:WOW) boss Brad Banducci has – again – made a media appearance to try, with the patience of god-damned saint, to explain that the company’s decision to not stock Australia Day merchandise was an entirely financial one.

I’m paraphrasing, of course, but it turns out that sales of bucket hats, temporary flag tattoos and weaponised Australian flag capes and undies have tapered to the point where it’s not worth the supermarket stocking them any longer.

The smart money is on Woolies reintroducing those product lines, to much fanfare, this time next year, so that everyone around the nation can blithely ignore the real story here, which is just how appallingly easy it has become to lead political discourse in this country around by the nose.

Meanwhile, Domino’s Pizza Enterprises (ASX:DMP) released its half-year report last night, piping hot and right on time for dinner at 7:17pm, and the market has responded by heaving the pizzamaker out the window.

Domino’s is down close to 30% this morning, after it delivered what’s known in the pizza biz as a half-n-half, with great sales growth in Germany, Australia and New Zealand, and a positive operational performance in Europe… except in France.

That was evidently more than offset by a woeful performance in the famously not-pizza-mad Asian market, with sales falling 8.9% across the region, led by a massive national snub by Japan.

All that’s left Domino’s with an H1 24 preliminary NPBT expected to come in around $87-90 million – which is madness, considering the company sold more than $2 billion worth of culinary disasters over that period, clear evidence that the only thing thinner than the paper-thin crusts on its pizza is Domino’s profit margin.

ICYMI – AM EDITION

Sovereign Metals (ASX:SVM) has announced that it’s secured the services of African-based social specialist consultancy SocialEssence, to lead development programs and design, implement, and manage several social and community initiatives which will feed into the DFS and permitting requirements.

Meanwhile, Power Minerals (ASX:PNN) is in the money this morning, after securing a a $1 million funding facility to support the near-term project-advancing activities and working capital requirements across its project portfolio. The six-month loan is on top of an expected $1.5 million from the sale of its non-core Santa Ines Copper-Gold Project to Fuyang Mingjin Development Co, and a US$1 million payment on the way from the second tranche of the strategic investment from its direct lithium extraction (DLE) technology provider Summit Nanotech.

Aura Energy (ASX:AEE) has tied up a string of Option Funding Agreements, under which certain investors have agreed to prepay the Company approximately A$4.3 million – which is equal to the exercise monies for all remaining options expiring 30 June 2024.

Annnd Lithium Universe (ASX:LU7) has hired in a new pair of hands, bringing John Sobolewski on board as chief financial officer. Described as a “career mining industry CFO”, Sobolewski most recently crunched the numbers for Galaxy Resources, where he was instrumental in the funding of Mt Cattlin Mine and Jiangsu Refinery, and prior to that he was running the show at Mintrex Engineering.

NOT THE ASX

Wall Street had another tech rally, partly because it was Wednesday and that’s what generally happens on a Wednesday – and partly because Netflix has taken the next step its corporate narrative arc, as per Aristotle’s classic three-act structure for lengthy, tedious drama.

We’re up to Act 2 for Netflix. Act 1 was the expositional phase, where we all met Netflix for the first time and the company presented as the entertainment superhero that we had all been longing for, for years.

Act 2 is where the conflict arises. As the story’s hero starts looking like they might actually be some kind of surprise anti-hero, hell-bent on replacing the villainous Cable and Commercial TV offerings, all the while slowly morphing into cut-rate versions of the same evil character.

To wit: Netflix is making noise about binning its basic ad-free service in several overseas markets – that’s the $12 Basic one where users could watch potato-quality streams of their favourite programs, without being force-fed advertising.

Act 3 (the Resolution phase) is where we all just go back to fiddling with VPNs and Torrent clients, like the good old days. Either that, or Netflix hires in M. Night Shebangabang (or whatever his name is) to write a surprise twist ending, and it turns out we’ve all actually been dead for 20 years.

Anyway – Netflix’s slow descent into the realm of antihero is making investors happy, and that in turn helped put Wall Street on the path to a Basic Plan tech gain, with the Nasdaq up 0.36%.

Chipmaker ASML also jumped 9% after posting a 30% surge in full-year revenue. However it warned that sales in 2024 will be flat versus 2023.

Microsoft and Nvidia have set new highs, with the former breaking through the Magical US$3 trillion mark for the very first time.

The S&P was close to flat on +0.08%, still catching its breath in the low-oxygen atmosphere of those dizzying all-time highs – and the Dow’s back to being a surly old tart, down 0.26% out of sheer spite.

After hours, Tesla delivered its earnings report, and the news was… not fantastic.

In a quarter most notable for the arrival of the company’s long-awaited, much-vaunted (and, in my opinion, rightfully-lampooned) Cybertruck, Tesla managed to squeak out a very modest revenue climb, but still came up short on EPS of $0.71 – about 3.5% below expectations.

The news was about as well received as you’d expect, with the automaker losing more than 6.0% within hours of the announcement.

Meanwhile in Asian market news, Japan’s Nikkei was still smashing it out of the park yesterday, still thundering along at late-80s levels of leg-warmers and denim jacket-clad excellence, closing at 36,226.48 overnight.

That’s still a couple of thousand points shy of the all-time record of 38,195 set in December 1989, but that’s now looking increasingly within reach, and this morning…

In contrast, Hong Kong’s Hang Seng is not doing so well – around this time last year, it was plump and full of golden dragons and good fortune and other vaguely racist Asian iconography, rocking a index value of 22,688.90 points.

Since then, however, the trend has been way down, and the Hang Seng closed yesterday at 15,899.87, down 30% over the past 12 months.

Shanghai’s markets are headed the same way – down 13.5% since this time last year (17.5% down from 2023’s high water mark, set in April) – and the rumblings about a possible Beijing Mega-Stimmy worth 2 trillion yuan are growing ever-louder.

Today, though, the Hang Seng is up 0.38%, Shanghai is up 0.98% and Japan’s Nikkei has fallen -0.75% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 25 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP NRZ Neurizer Ltd 0.016 129% 13,358,728 $9,645,620 DXN DXN Limited 0.0015 50% 621,788 $2,153,340 MRD Mount Ridley Mines 0.002 33% 595,544 $11,677,324 CUF Cufe Ltd 0.02 33% 2,227,134 $17,191,685 CST Castile Resources 0.088 26% 114,105 $16,933,170 AI1 Adisyn Ltd 0.021 24% 135,000 $2,744,643 BME Black Mountain Energy 0.011 22% 5,210,998 $3,449,018 KSN Kingston Resources 0.088 22% 1,588,731 $35,853,252 W2V Way2Vatltd 0.011 22% 332,799 $5,864,476 ACW Actinogen Medical 0.029 21% 9,115,954 $55,375,442 LML Lincoln Minerals 0.006 20% 6,948,888 $8,520,226 M4M Macro Metals Limited 0.003 20% 3,708,000 $6,167,694 HTG Harvest Tech Grp Ltd 0.02 18% 2,033,803 $12,001,377 EVG Evion Group NL 0.028 17% 1,381,375 $8,303,020 MOM Moab Minerals Ltd 0.007 17% 42,279 $4,271,781 VAL Valor Resources Ltd 0.0035 17% 1,002,345 $12,520,004 WML Woomera Mining Ltd 0.007 17% 4,682,204 $7,308,834 CCM Cadoux Limited 0.064 16% 62,400 $20,158,467 NGX Ngxlimited 0.15 15% 115,190 $11,779,539 CG1 Carbonxt Group 0.11 15% 389,791 $30,325,278 BUY Bounty Oil & Gas NL 0.008 14% 1,250,906 $10,489,507 CDT Castle Minerals 0.008 14% 65,866 $8,571,451 FGH Foresta Group 0.016 14% 805,173 $31,428,423 PEC Perpetual Res Ltd 0.008 14% 65,000 $4,480,206 TOY Toys R Us 0.008 14% 124,899 $6,877,245

Up the pointy end of the Small Caps this morning is NeuRizer (ASX:NRZ) , which is showing a 114% jump at lunchtime today, after some to-ing and fro-ing with the ASX over disclosures by the company in the lead-up to it releasing its quarterly and Appendix 5B on 18 January.

It’s all very complicated and I don’t have the time to completely unpack it here, but the short version is that there have been some legislative and oversight changes affecting the Neurizer Urea Project, which in turn has had a knock-on effect on investment negotiations for NRZ.

The company has assured the ASX that it is solvent, and working through other potential investment options to keep the project on track.

Meanwhile, CuFe (ASX:CUF) has jumped 33% this morning despite nothing to say to the ASX for a while, most likely on the back of renewed enthusiasm for copper among local investors.

Similarly, Castile Resources (ASX:CST) is continuing to whipsaw in value today, up more than 28% today after shedding 18% in recent days, which in turn was a major step down from the 27% spike the company enjoyed between Friday and COB Monday.

Black Mountain Energy (ASX:BME) has posted a decent gain off the back of a crowd-pleasing quarterly that includes a little tidbit about the company’s divestment of its Half Moon project, which has brought in a pre-tax windfall of US$6,577,810.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 25 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP NRZ Neurizer Ltd 0.016 129% 13,358,728 $9,645,620 DXN DXN Limited 0.0015 50% 621,788 $2,153,340 MRD Mount Ridley Mines 0.002 33% 595,544 $11,677,324 CUF Cufe Ltd 0.02 33% 2,227,134 $17,191,685 CST Castile Resources 0.088 26% 114,105 $16,933,170 AI1 Adisyn Ltd 0.021 24% 135,000 $2,744,643 BME Black Mountain Energy 0.011 22% 5,210,998 $3,449,018 KSN Kingston Resources 0.088 22% 1,588,731 $35,853,252 W2V Way2Vatltd 0.011 22% 332,799 $5,864,476 ACW Actinogen Medical 0.029 21% 9,115,954 $55,375,442 LML Lincoln Minerals 0.006 20% 6,948,888 $8,520,226 M4M Macro Metals Limited 0.003 20% 3,708,000 $6,167,694 HTG Harvest Tech Grp Ltd 0.02 18% 2,033,803 $12,001,377 EVG Evion Group NL 0.028 17% 1,381,375 $8,303,020 MOM Moab Minerals Ltd 0.007 17% 42,279 $4,271,781 VAL Valor Resources Ltd 0.0035 17% 1,002,345 $12,520,004 WML Woomera Mining Ltd 0.007 17% 4,682,204 $7,308,834 CCM Cadoux Limited 0.064 16% 62,400 $20,158,467 NGX NGX Limited 0.15 15% 115,190 $11,779,539 CG1 Carbonxt Group 0.11 15% 389,791 $30,325,278 BUY Bounty Oil & Gas NL 0.008 14% 1,250,906 $10,489,507 CDT Castle Minerals 0.008 14% 65,866 $8,571,451 FGH Foresta Group 0.016 14% 805,173 $31,428,423 PEC Perpetual Res Ltd 0.008 14% 65,000 $4,480,206 TOY Toys R Us 0.008 14% 124,899 $6,877,245

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.