ASX Small Caps Lunch Wrap: Which little lambs had a lot of Mary Jane this week?

"I'm high as baaa baaa baaaaals, dude!" Pic via Getty Images.

Local markets are up at lunchtime today. I know, right? I can barely believe it myself.

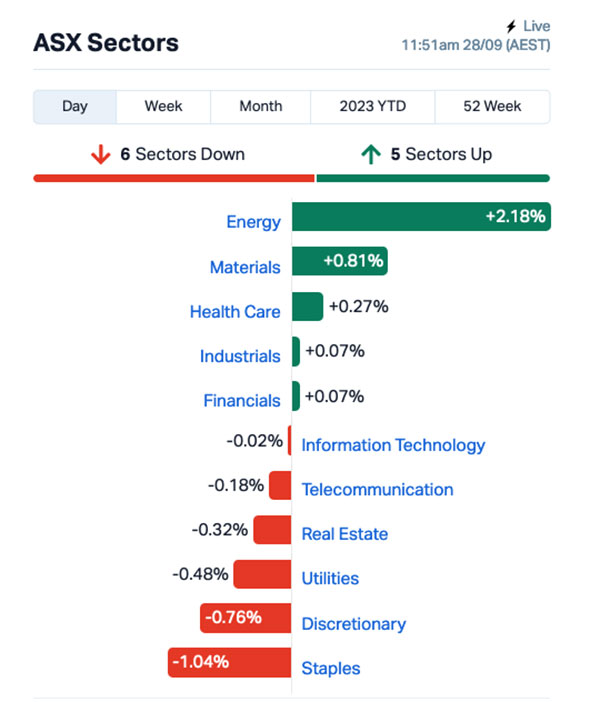

But yup – there it is…the benchmark is up 0.2% after a rapid decline at open had a lot of hearts sinking this morning, but a surge in Energy and a mini-surge in Materials has turned things around for the market as a whole.

There’s a lot happening around the place – including a 4.0% spike in crude oil prices and a local market newbie landing to a lot of happy fanfare.

But before I get into all that, there’s the small matter of a roving band of sheep in Greece who, in a moment of ovine madness, broke into a greenhouse to feast upon a marijuana crop.

And it wasn’t a small crop, either… local news outlets are reporting that the crop, grown legally for therapeutic purposes, totaled more than 600lb (about 270kg), which was gone even quicker than if the farmer had simply dropped it off beside a Snoop Dogg / Willie Nelson tour bus.

The sheep reportedly began “behaving strangely”, which is hardly a surprise. Even a massive flock of sheep would have trouble standing up after eating its way through 9,700 ounces of pot.

The reason for the sheep deciding the time was right to suddenly become really big fans of The Grateful Dead isn’t all that funny… Greece has been in the grip of a severe weather event called Storm Daniel.

Everything’s underwater, and there’s nothing else around for the local animal herds to eat, so they can’t really be blamed for smelling the unmistakably herby stench of the dope farm and making a beeline to the source.

But, on the plus side, those Greek sheep are apparently a lot better at holding their smoke (as the old saying goes) than their counterparts in Wales.

In May 2016, after a lout dumped a large quantity of pot in the quiet village of Rhydypandy in the Swansea valley in South Wales, and the local sheep got stuck right into it before going on a “psychotic rampage”.

At the time, County councillor Ioan Richard said that the sheep were so stoned, they were breaking into houses, and many of them so high that they’d wandered into the middle of the road in a daze, and been hit by cars and lorries.

The Greek farmer whose crop is that latest to be consumed by sheep told local media that he’s unsure quite how to feel about it all.

“I don’t know if it’s for laughing or crying,” he said. “We had the heatwave and we lost a lot of production. We had the floods, we lost almost everything.

“And now this. The herd entered the greenhouse and ate what was left. I don’t know what to say, honestly.”

When asked for comment, the sheep said “yeah, you can use it” and went back to searching for “like, a beanbag or some corn chips. Yeah, Oh dude, I could really go for some corn chips right now. Man, I feel fuzzy… so fuzzy…”

TO MARKETS

The benchmark fell early this morning in a heart-stopping 23 points in 10 minute plunge that set the market mood all a-jitter again, because – let’s be honest – it’s been a pretty poor week thus far for the ASX.

But, there’s been a turnaround, the market’s at +0.2, there’s been a belter of an debut for newcomer Pioneer Lithium and things are feeling kinda buoyant for the first morning in what feels like forever.

The Energy sector’s doing a lot of the heavy lifting, up better than 2.0% for the day so far, with Materials doing its best to keep pace, up just over 0.8%.

But the Consumer Twins, Staples and Discretionary, are holding things back a little, languishing like a morose, bitter old couple on a public bench outside Woolies and bickering over whose life is shittier than the other.

It’s a fight that Staples is winning, apparently.

Up the fancy end of town, Whitehaven Coal (ASX:WHC) and Karoon Energy (ASX:KAR) are providing a chunk of the Energy sector’s momentum, adding 4.7% and 4.9% respectively.

And the ever-swinging Sayona Mining (ASX:SYA) is up to its usual volatile tricks, up around 8.9% at lunchtime but that can, and probably will, change quite rapidly, as it often does.

NOT THE ASX

In the US overnight, the likelihood of another government shutdown has hit, according to Goldman Sachs, about 90% – not exactly the boldest of predictions, considering the US is about three days away from seizing up like a poorly-serviced chainsaw in dire need of lube.

The short-term hope for avoiding the shutdown – a bipartisan Senate bill that would have kept everything open while a ‘proper, long-term’ solution – has been labelled dead in the water by Republican House Speaker Kevin McCarthy.

Kev’s refusing to take up the bill from the Senate on the basis that it includes $12 billion in aid and war money for Ukraine, but precisely $0 billion for border protection – so, even though budget money for border protection could very easily be added into whatever long-term measures are negotiated over the coming weeks, the US is once again dancing merrily on the edge of the shutdown cliff.

To put how breathtakingly dumb this level of brinksmanship is in perspective, Australia had a similar issue develop once, in 1975. That’s when the Australian Senate “blocked Supply” – basically turned off the money tap so the government was unable to function – and it brought down the Whitlam government.

But America’s turned this sort of rampant idiocy into an annual event, it would seem… and it’s playing havoc with the US economy.

The only potential ‘upside’ to it all is that the damage a shutdown would do to the economy would force the US Fed’s hand and put a stop to interest rate rises, for now.

Last night, despite the crazy talk, the S&P 500 rose by +0.02%, the blue chips Dow Jones index was down by -0.2%, and the tech-heavy Nasdaq lifted by +0.22%.

Earlybird Eddy Sunarto reports, in US stock news, Meta Platform was down -0.4% after Mark Zuckerberg unveiled two new high-tech headsets built for the metaverse at the Meta Connect conference.

Palantir surged 6.5% after signing a US$250m artificial intelligence contract with the US Army. Costco meanwhile was up 2% after its quarterly earnings per share came in above Wall Street expectations.

Elsewhere, oil stocks will be ones to watch today after crude prices jumped by almost 4% last night to one-year high, with Brent trading now at US$96.67 a barrel.

“Oil price rally is likely to continue, but it’s not sustainable in the longer run,” says a note from ING’s commodities analyst, Warren Patterson.

Patterson adds that he can’t see crude prices over US$100/bbl, because weaker demand and political pressure to increase supply would help bring oil prices back to levels slightly above US$90/bbl.

In Japan, the Nikkei is down 1.73% because, weirdly, nothing weird has happened, while Shanghai markets are flat and Hong Kong’s Hang Seng is down 1.21%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 27 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCE Carnegie Cln Energy 0.002 100% 100,556 $15,642,574 MXC Mgc Pharmaceuticals 0.002 100% 3,067,946 $4,427,968 PLN Pioneer Lithium 0.33 65% 1,013,889 $5,685,000 MEB Medibio Limited 0.0015 50% 3,000,000 $6,100,744 MTC Metalstech Ltd 0.25 47% 576,074 $32,062,780 FL1 First Lithium Ltd 0.26 44% 4,901,635 $12,609,300 LPI Lithium Pwr Int Ltd 0.3375 30% 4,529,167 $163,601,766 VAR Variscan Mines Ltd 0.014 27% 848,695 $3,922,762 IVX Invion Ltd 0.005 25% 12,838,579 $25,686,529 JTL Jayex Technology Ltd 0.01 25% 246,314 $2,250,228 ROO Roots Sustainable 0.005 25% 236,477 $554,889 SNS Sensen Networks Ltd 0.055 25% 33,696 $29,973,864 RAS Ragusa Minerals Ltd 0.039 22% 247,387 $4,563,161 CXU Cauldron Energy Ltd 0.012 20% 21,536,138 $9,515,687 CKA Cokal Ltd 0.125 19% 2,167,674 $113,289,643 GMR Golden Rim Resources 0.026 18% 417,520 $13,014,944 ODE Odessa Minerals Ltd 0.013 18% 2,090,719 $10,418,230 DMM Dmcmininglimited 0.068 17% 409,271 $1,737,100 BFC Beston Global Ltd 0.007 17% 2,041,306 $11,982,281 NAE New Age Exploration 0.007 17% 200,000 $8,615,393 KCC Kincora Copper 0.036 16% 52,777 $4,971,751 BLU Blue Energy Limited 0.016 14% 1,044,193 $25,913,630 HOR Horseshoe Metals Ltd 0.008 14% 1 $4,504,351 VAL Valor Resources Ltd 0.004 14% 982,226 $13,556,672 PEB Pacific Edge 0.125 14% 8,370 $89,178,882

New kid on the block, Pioneer Lithium (ASX:PLN) has topped the charts this morning with a belter of a debut, going live on the market after a heavily oversubscribed $5 million IPO, thanks to the company’s “multi-asset portfolio of strategically located lithium projects in Ontario and Quebec, Canada”.

That includes the Root Lake (90% owned) and Lauri Lake (100% owned) Projects in Ontario and the LaGrande (100% owned) Lithium Project in Quebec’s world-class James Bay region.

It’s the Root Lake project that will be the immediate focus for PLN, positioned directly between Green Technology Metals (ASX:GT1) Root Bay and Morrison/McCombe lithium deposits, and its James Bay Quebec LaGrande Project.

PLN’s trading price is showing a bump of 67.5% at lunchtime.

In second place, it’s a company making a return to the bourse this morning. First Lithium (ASX:FL1) – formerly known as Ookami) returns to trading today after a long suspension to a +41.6% welcome.

As Reuben and Josh pointed out this morning, FL1 is hunting spodumene in Mali, just down the road from Goulamina where China’s Ganfeng and $700 million capped ASX developer Leo Lithium (ASX:LLL) plan to open Africa’s first major spod mine next year at a world class 500,000tpa.

You should read Reub’s and Josh’s work on this one – it’s complicated, and they’re far better at explaining it than I am.

Meanwhile, in third place, it’s MetalsTech (ASX:MTC), up 35.2% because “lithium”, which seems to be the hard driver for Small Caps today.

MTC recently announced that it bought a hard rock lithium project in… you guessed it… James Bay, and this morning announced that “highly respected lithium industry executive” Robert Sills has been added to the board as a non-executive technical director.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 27 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VPR Volt Power Group 0.001 -33% 5,000,011 $16,074,312 MTB Mount Burgess Mining 0.003 -25% 3,091,833 $4,062,587 AMD Arrow Minerals 0.0025 -17% 25,321,872 $9,071,295 EMU EMU NL 0.0025 -17% 286,511 $4,350,064 MZZ Matador Mining Ltd 0.042 -16% 113,863 $15,771,702 FFT Future First Tech 0.009 -14% 155,000 $7,505,784 AYT Austin Metals Ltd 0.006 -14% 1 $7,111,123 NAE New Age Exploration 0.006 -14% 22,950 $10,051,292 TGM Theta Gold Mines Ltd 0.13 -13% 50,000 $105,761,251 AJL AJ Lucas Group 0.013 -13% 232,064 $20,635,944 VN8 Vonex Limited. 0.013 -13% 25,000 $5,427,429 EXL Elixinol Wellness 0.007 -13% 721,511 $5,011,862 YPB YPB Group Ltd 0.0035 -13% 243,950 $2,973,846 DEL Delorean Corporation 0.022 -12% 99,626 $5,393,023 KTA Krakatoa Resources 0.022 -12% 329,200 $10,872,448 ASE Astute Metals NL 0.037 -12% 4,261 $17,241,819 DES Desoto Resources 0.12 -11% 46,125 $8,090,078 L1M Lightning Minerals 0.12 -11% 278,346 $5,307,957 OPN Oppenneg 0.008 -11% 602,607 $10,050,117 BML Boab Metals Ltd 0.125 -11% 155,701 $24,424,788 JNO Juno 0.076 -11% 3,527 $11,530,930 ALV Alvomin 0.17 -11% 39,462 $14,534,262 TRE Toubaniresourcesinc 0.094 -10% 88,888 $12,340,529 OAR OAR Resources Ltd 0.0045 -10% 1,600,000 $13,065,679 PVE Po Valley Energy Ltd 0.036 -10% 226,754 $46,358,465

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.