ASX Small Caps Lunch Wrap: Which great ape has been busted self-medicating this week?

Rakus (real name: Simon) was understandable pretty stoked that he'd somehow managed to discover some potent drugs in the jungle. Pic via Getty Images.

- Local markets are up, tracking a recovery on Wall Street overnight

- Macquarie Bank says bank’s full-year net profit was just $3.5 billion, down a whopping 32% on the previous financial year

- Small Cap Winners: PPK Group, Rincon, Emu, Savannah Goldfields

Local markets were up this morning, mostly because we were about due for a win. I’m pretty sure that none of us really felt like hitting the weekend with the taste of another bad day on the bourse in our mouths.

It’s largely down to local markets tracking a recovery on Wall Street overnight, but it’s not all fabulous news for the ASX, as one of the market’s big names reports a stunning drop in profit.

I’ll tell you who it was in a few minutes, but first there’s news that will strike fear into the hearts and minds of millions, because it looks like a certain species of great ape has become even greater, after discovering the art and science of medicine.

Researchers in Sumatra were doing what they normally do – stalking an orangutan through the jungle and spying on it, the dirty sods – when they heard a ruckus.

Two male orangutans were having a scrap about something – probably the footy, I reckon – and one of them ended up with a nasty injury on his face, and in his mouth, after suggesting that South Sydney might have acted too hastily in its decision to dump Jason Demetriou as head coach at the club.

A foolish stance to take in any situation, let alone the deep, dark Sumatran jungle – but the orangutan the researchers call Rakus (his real name, I’ve been told, is actually Simon) ended up sporting an open wound just under his eye.

It was what Rakus did next that set researcher’s tongues a-wagging. Obviously hurt, Rakus was observed chewing on chewing liana leaves and spitting them out.

This was curious because liana leaves are not a normal part of the orangutan diet, but they are known by local humans as a reasonably potent pain reliever, suggesting that Rakus was not only a terrible footy pundit, but also a doctor of sorts.

This was apparently confirmed when the great ape was spotted making a paste from the leaves and applying it gingerly to the open wound on his face, which the researchers claim helped stop the injury from becoming infected.

The dawning realisation that orangutans have discovered basic medicine has sent shockwaves through the scientific community, and has truly alarmed other avid monkey watchers, who are now convinced that human supremacy on this planet is now under significant threat.

Luckily, another recent discovery may hold the answer to that problem, after space boffins announced that they had discovered an earth-like planet that appears to be home to something that farts.

The planet is called K2-18b (pronounced Kaytoowanatebee), and it’s about 2.6 times the size of earth, looks otherwise pretty similar and – according to scientists – is awash with a gas “produced only by living organisms”.

That’s gotta mean farts, and that means we’re probably not alone in the universe – but while it means there’s a tiny chance that the planet could make a new home for humans now that the apes are smarter than we thought, there’s some bad news.

It’s 124 light years away – which means that at current top space speeds, it’s going to take us about 2.15 million earth years to get there, depending on traffic.

So for now, we’re stuck with super-brainy apes out-learning us in the deep, dark jungles of Sumatra. The day they discover how Menulog works, we’re all doomed.

TO MARKETS

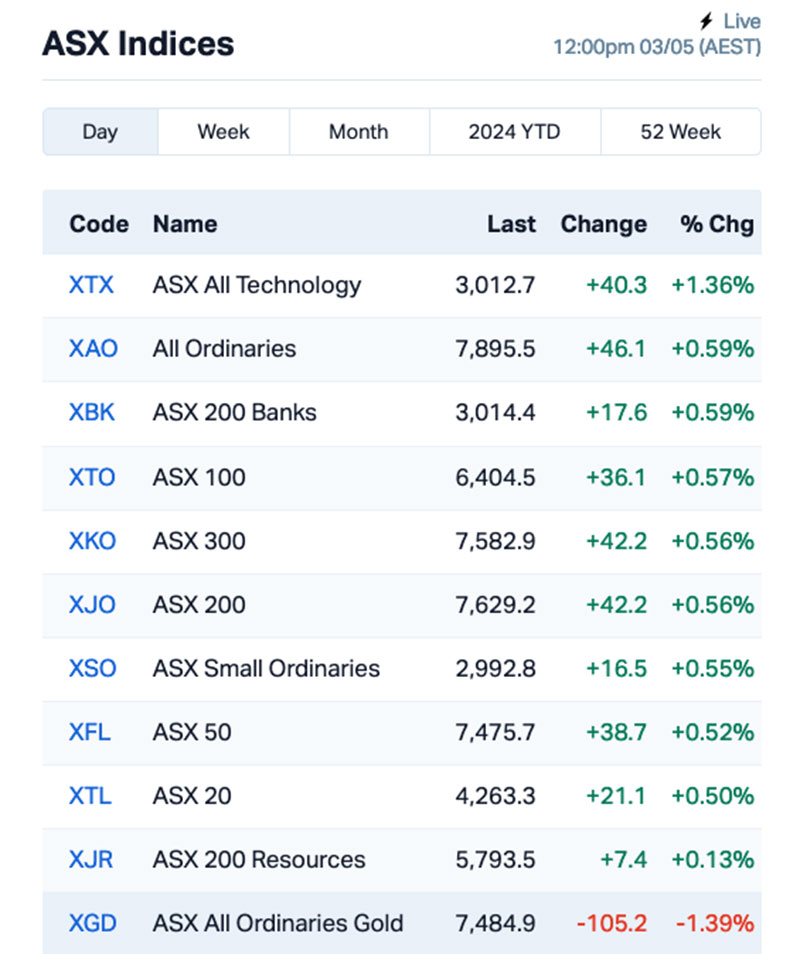

Local markets were up this morning, climbing to +0.56% by midday and generally chugging along in a pretty decent mood for a Friday.

It’s mostly thanks to a decent session on Wall Street overnight, and has been helped along by a handful of Large Caps putting out some great numbers this morning, including Temple & Webster (ASX:TPW) (+4.1%) and Silex Systems (ASX:SLX) (+6.4%).

Also doing well this morning was Block Inc (ASX:SQ2) , which has made a great recovery from yesterday’s sharp drop on talk that the company could be in some hot water with US regulators and prosecutors.

However, SQ2 shrugged off the bad news with a banger of a quarterly overnight, showing that in Q1 2024, gross profit grew 22% year over year to $2.09 billion, and yesterday’s -5.0% fall has been met with a +9.6% jump this morning.

The shocker of the morning came from the so-called Millionaire Factory at Macquarie Bank, which has fumbled badly and delivered a shocking report showing that the bank’s full-year net profit was just $3.5 billion, down a whopping 32% on the previous financial year.

That’s seen the bank’s return on equity (ROE) dive from 16.9% to 10.8%, despite things looking a little better in the second half of the year versus the first, and left some very red faces as Macquarie CEO Shemara Wickramanayake struggled to apply lipstick to an obvious pig, noting that despite the clearly terrible performance, it’s still the company’s 55th consecutive year of profitability.

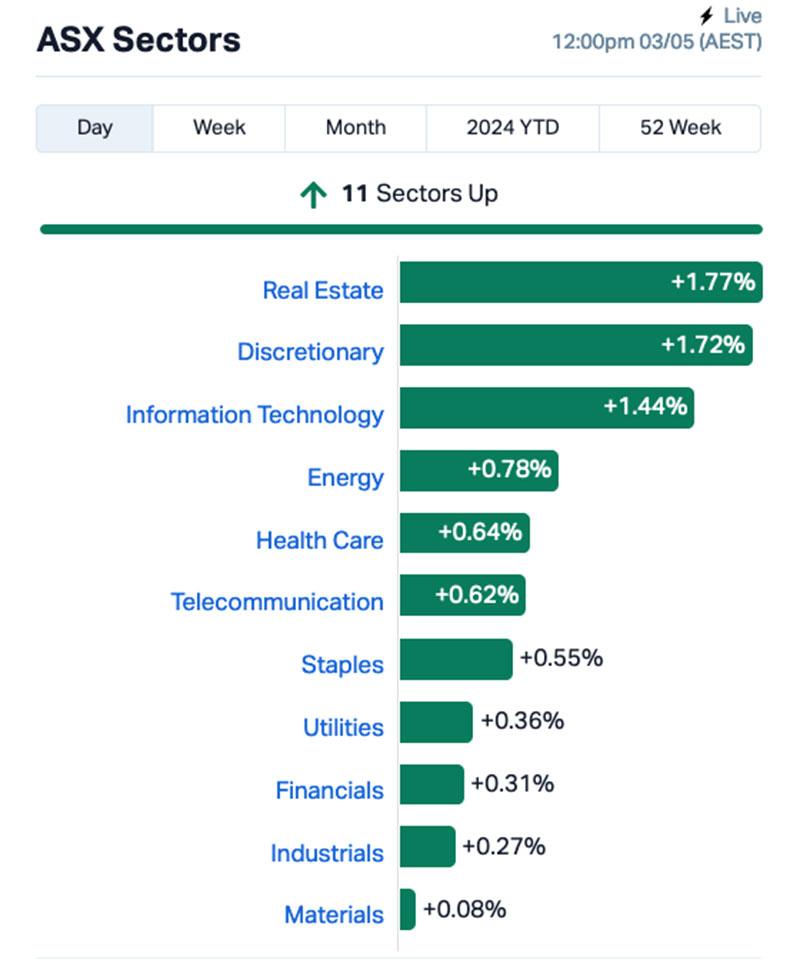

Sector-wise, it’s green across the board in the middle of the day, with the tallies lookin’ a little bit like this:

And Block Inc’s jump this morning has helped push the XTX Tech Index to the top of the ladder, well out in front of the broader market.

NOT THE ASX

In the US overnight, everything was terrible… except on Wall Street, where things are on the improve against the flubbing that’s been a feature of the action in New York this week.

The S&P 500 rose by +0.91%, the blue chips Dow Jones index was up by +0.85%, and the tech-heavy Nasdaq surged ahead by +1.51%.

Earlybird Eddy reported this morning that US stocks are recovering from Wednesday’s volatile session dominated by Jerome Powell’s message that had left more questions than answers on the Fed’s likely rate path.

Earnings season continues, as Apple topped Wall Street’s Q2 expectations. The company reported an an all-time high on services revenue, but the iPhone, iPad, and wearables missed expectations.

Of note was Apple’s additional program to buy back US$110 billion of its stock. Apple’s stock price rallied by +6% in post-market trading.

Chip stock Qualcomm rose roughly 10% after the company beat quarterly expectations and guided the market to an upbeat sales outlook.

Shares of Paramount Global jumped +13% after a potential bid from Sony Pictures Entertainment and private equity firm Apollo Global Management was reported.

Block Inc lifted +7% post-market after disclosing its intentions to reinvest a portion of its Bitcoin-derived profits back into the cryptocurrency, showcasing Jack Dorsey’s firm views on the prospects of BTC.

The biggest mover last night however was Carvana, an online used car retailer based in Arizona, which rose over +30% after posting record quarterly results.

But all is not well in crypto-land, with the price of Bitcoin slumping to its lowest level since 27 February, on the back of fading expectations of future Fed Reserve interest rate cuts.

Outflows from Bitcoin exchange-traded investment funds have continued for five consecutive days.

In Asia, everything’s closed for market holidays. Again.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

PPK Group (ASX:PPK) was out in front Friday morning, making gains on Thursday’s news that investee company Craig International Ballistics has been handed a very juicy $30 million order for body armour by the Australian Defence Force.

The remit for the contract will see Craig International Ballistics manufacture and deliver a new order of body armour components to help protect troops from moving threats like fragmentation, and low and high velocity rounds, from its factory in Queensland.

The Rincon Resources (ASX:RCR) gains machine just keeps on cranking, and on Friday morning it added another 26% as investors piled in after news earlier in the week that the company has kicked off initial reverse circulation drilling program of up to 2,000m at Pokali to test four target areas that are looking great for solid copper hits.

Emu (ASX:EMU) was showing a healthy uptick on Friday morning after announcing the completion of it’s 1:30 consolidation.

And Savannah Goldfields (ASX:SVG) was up on news that definitive transaction agreements have been entered into for the sale of the company’s remaining shareholding in Renison Coal, the entity that owns the Ashford coking coal project, to Clara Resources Australia for $3.95 million, and a tidy $0.75 per tonne royalty on coal sales as the cherry on top.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 03 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

ICYMI – AM EDITION

BPH Energy (ASX:BPH) investee company Advent Energy has been offered and accepted a five-year renewal of Retention Licence 1 (RL1) in the onshore Bonaparte Basin, Northern Territory.

While most of the prolific Bonaparte Basin is offshore, Advent holds 166km2 of ground in the onshore portion, which covers the Weaber gas field that was discovered in 1985.

Weaber was previously assessed to host best estimate (2C) contingent resources of 11.5 billion cubic feet of gas.

Kula Gold (ASX:KGD) has started reverse circulation drilling for gold and rare earths at the Boomerang prospect within its Marvel Loch project near Southern Cross, Western Australia.

The drilling tests a newly defined gold anomaly that sits in a magnetic low and in the vicinity of geochemistry results that include a previous hole drilled by the company that returned a 1m intersection grading 2.6g/t gold from 54m.

Assays will also be carried out for REEs following positive indications from historical drilling in the tenement.

Lanthanein Resources (ASX:LNR) has raised $2.2m through a placement of 488 million shares priced at 0.45c each to fund exploration at its Lady Grey project near Southern Cross, WA.

It expects the placement to accelerate work programs and approvals processes to allow drilling of the anomalies by mid-year.

The company recently identified multiple new gold, copper and nickel anomalies through soil sampling, adding another dimension to its prospectivity following the discovery of the large Godzilla and Avenger lithium anomalies.

At Stockhead, we tell it like it is. While BPH Energy, Kula Gold and Lanthanein Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.