ASX Small Caps Lunch Wrap: Which fruity tech giant is crushing all your dreams this week?

A graphic representation of just how badly shattered the hearts of every true Apple fan were, thanks to the company's tone deaf campaign. Pic via Getty Images

Local markets are slightly higher this morning thanks to a surge in gold and other resources stocks, following a decent enough session on Wall Street overnight.

I’ll get into the specifics of it all in a minute, but first, there’s just time to take a look at the new advertising blitz from Apple for its new Apple iPad Pro, and revel in what it looks like when a major tech company effectively squats over the heads of 80% of its users, and drops a huge, steaming dump on the things that they love.

The advertisement doesn’t have a lot of moving parts – just the haunting (not in a good way) sounds of Sonny and Cher singing a creepy love song, and the rather bizarre visuals of countless symbols of human creativity being crushed in a hydraulic press.

It all gets squished down to become the new iPad, which is no doubt how the creative agency that made the ad would have pitched it.

Meet the new iPad Pro: the thinnest product we’ve ever created, the most advanced display we’ve ever produced, with the incredible power of the M4 chip. Just imagine all the things it’ll be used to create. pic.twitter.com/6PeGXNoKgG

— Tim Cook (@tim_cook) May 7, 2024

In response, pretty much anyone with any sort of artistic bent has pitched a fit right back in the tech giant’s face. The inexorable and seemingly unstoppable march of AI already has a lot of people who work in creative industries sweating bullets – and the ad from Apple really does take on a horrible, sinister overtone when you look at it from pretty much any angle other than “how much money is Apple going to make off this thing?”

As much as it pains me to do this, largely because combining “Hugh Grant” and “Sensible Thought Processes” isn’t something that sits well with anyone of sufficient vintage to remember his appallingly schadenfreude-laden fall from grace, the actor’s response to the ad is actually right on the money.

“The destruction of the human experience. Courtesy of Silicon Valley.” Grant wrote – a statement that is both chillingly accurate, and egregiously hypocritical, coming from the leathery sex pest that belched “Bridget Jones’ Diary” into the public consciousness, and infected every nightclub in the world with an army of stuttering foppish goofballs, trying ever-so-hard to charm the knickers off anything with a heartbeat.

”Imagine all the things it will be used to create,” Apple CEO Tim Cook said on Twitter.

Imagine advertising just how intent you are on crushing your own consumer base into a cube.

TO MARKETS

Local markets lifted on Friday morning, which is not unusual. A dedicated journalist would, at this point, pore back through screeds of historical data, and tell you – to two decimal places – the percentage of Friday mornings that the ASX has moved north instead of losing ground.

The best I can manage today is “I’m pretty sure I’ve seen it happen before, like heaps of times”.

If only there was a giant, super-smart computer I could ask and it would just tell me the answer. I guess we’ll never know.

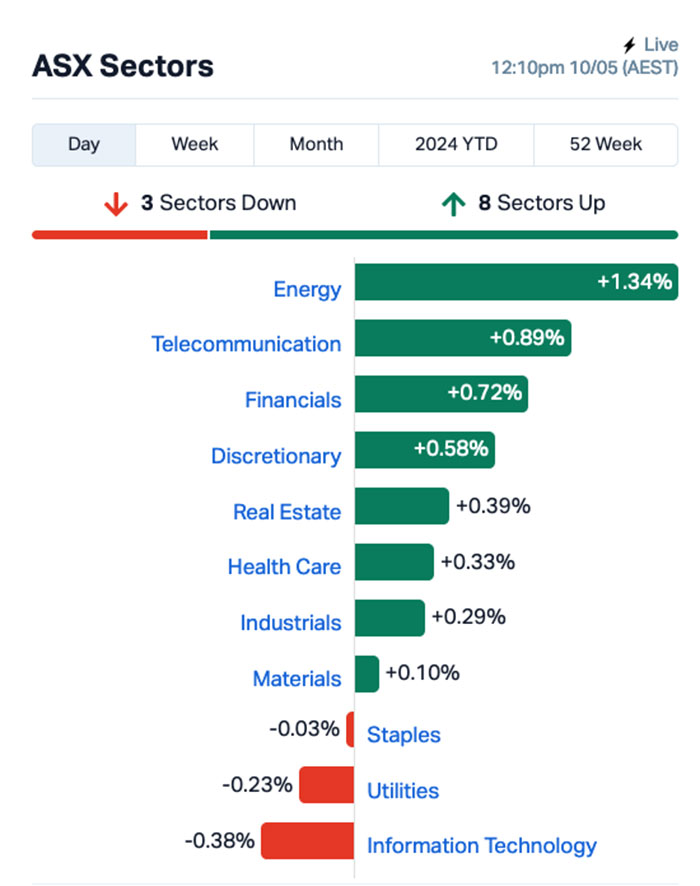

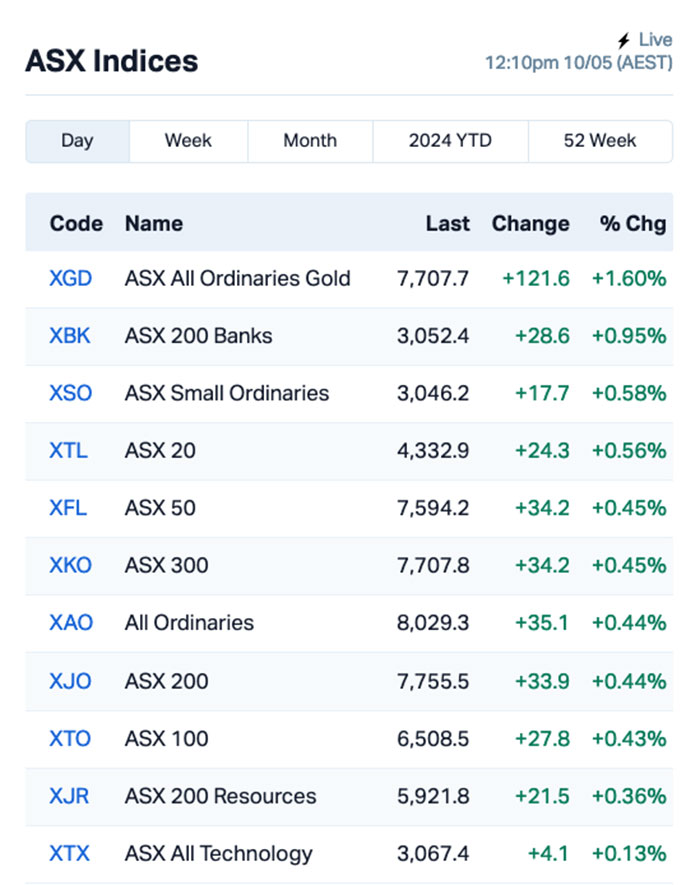

Anyhoo… the ASX is gaining ground thanks to strong performances from the goldies, the Energy Sector and the Banks.

The Energy sector is enjoying a morning in the sun thanks to Resources Minister Madeleine King unveiling her plans for an expansion of the Aussie gas industry, part of the Federal Government’s long overdue pipe dream to defibrillate Australia’s manufacturing sector, and finally give Australia’s union bosses something to kick that isn’t each other at their respective state Labor conferences.

The goldies and the banks are up because of basic human greed.

At the top end of town, the attractively packaged spyware company Life360 (ASX:360) is suffering at the hands of local investors, down -5.5%n after revealing a Q1 net loss of $9.8 million.

“We continue to make meaningful progress on our path to profitability,” the company said, baffling a number of people (including me) who were surprised to learn that there are still people prepared to invest their money in a $3 billion company that still hasn’t made any money.

The good news for investors is that the money the company does have is being spent very, very cautiously and wisely, revealing it has signed a non-binding letter of intent to partner with, and make a small investment in Hubble Network, which is “a space technology company led by Life360 Co-founder, Board director and former CTO, Alex Haro”.

Because of course they are.

NOT THE ASX

Overnight, the S&P 500 rose by +0.51%, its highest level since early April. The blue chips Dow Jones index was up by +0.85%, and the tech-heavy Nasdaq lifted by +0.27%.

Earlybird Eddy Sunarto reported that US stocks were mostly up on higher-than-estimated jobless claims, which totalled 231,000 for the week, up by 22,000 from the week before, giving the ever-hopeful yet another reason to frantically text their mates and claim that this time, for sure, the Fed will start getting serious about a rate cut.

In US stock news, Boeing was up +0.5% despite the US Securities and Exchange Commission (SEC) saying it will look into statements made by the aeroplane maker regarding its safety procedures after a scary incident on one of its 737 Max 9 planes in January.

The SEC is focused on whether Boeing said things that might have misled investors – a task that could turn out to be shockingly easy as there are reportedly at least 10 more whistleblowers preparing to go public with what they know about the airliner manufacturer, and possibly follow the first two who spoke out into an early grave.

Arm Holdings dropped -2% after its full year revenue forecast missed expectations. Although Arm’s sales beat expectations in the March quarter, its the full year guidance shows that there’s some uncertainty about how quickly AI computing will expand.

Warner Bros. Discovery jumped +3% after its CEO told his top team to look for more ways to save money so it can meet its financial goals for the next few years.

In Asian markets, things are looking a little mixed. Shanghai markets are down -0.37%, but Hong Kong’s Hang Seng is up 1.22% and JApan’s Nikkei is up 0.68%.

Copenhagen and Indonesian markets are closed for holidays today.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 10 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap ION Iondrive Limited 0.011 57% 2,971,992 $3,403,997 AVW Avira Resources Ltd 0.0015 50% 699,500 $2,663,790 FAU First Au Ltd 0.003 50% 13,419,536 $3,323,987 MRD Mount Ridley Mines 0.0015 50% 162,000 $7,784,883 JAV Javelin Minerals Ltd 0.002 33% 45,000 $3,264,346 DXN DXN Limited 0.042 31% 294,972 $5,916,459 EMP Emperor Energy Ltd 0.014 27% 5,966,162 $4,218,112 PUR Pursuit Minerals 0.005 25% 152,016 $11,775,886 M4M Macro Metals Limited 0.038 23% 19,356,751 $100,194,069 PEC Perpetual Res Ltd 0.017 21% 20,934,345 $8,960,412 SXG Southern Cross Gold 3.24 21% 790,689 $260,087,686 GAS State GAS Limited 0.145 21% 998,289 $32,907,215 SOC Soco Corporation 0.12 20% 74,467 $13,825,027 MCT Metalicity Limited 0.003 20% 2,666,667 $11,212,737 PLC Premier1 Lithium Ltd 0.025 19% 41,571 $3,666,056 BMR Ballymore Resources 0.165 18% 192,872 $24,742,282 AEV Avenira Limited 0.007 17% 28,301 $14,094,204 LNR Lanthanein Resources 0.007 17% 7,130,882 $11,729,453 TMK TMK Energy Limited 0.0035 17% 1,501,635 $20,267,144 WNX Wellnex Life Ltd 0.023 15% 1,301,503 $25,790,912 ILT Iltani Resources Lim 0.195 15% 3,904 $5,781,786 BLU Blue Energy Limited 0.016 14% 2,652,227 $25,913,630 BNL Blue Star Helium Ltd 0.008 14% 615,830 $13,595,857 IPB IPB Petroleum Ltd 0.008 14% 2,725,180 $3,955,857 UVA Uvrel Limited 0.12 14% 19,622 $3,475,314

Macro Metals (ASX:M4M) maintained its upward trend this morning, adding another +22.6% to take its tally for the week to +245%, and push it well through the +1,100% mark for the year to date.

Similarly, Southern Cross Gold (ASX:SXG) was up, probably just because it is Southern Cross Gold.

TMK Energy (ASX:TMK) was up this morning, on the back of yesterday’s news that the company has raised $623,589 through a share purchase plan that provided eligible shareholders with the opportunity to subscribe for up to $30,000 worth of fully paid ordinary shares at $0.004 a pop.

State Gas (ASX:GAS) was up on news that the company has been awarded $5.5 million of exploration grant funding through the Queensland Government’s Frontier Gas Exploration Program.

And IPB Petroleum (ASX:IPB) was showing a gain this morning on news that it has received firm subscriptions for a placement to professional and sophisticated investors of approximately 141.3 million new ordinary shares at an issue price of 0.7 cents per share to raise about $0.988 million before costs.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 10 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CNJ Conico Ltd 0.001 -33% 323,719 $2,707,643 RML Resolution Minerals 0.002 -33% 2,199,000 $4,830,065 RMX Red Mount Mining 0.001 -33% 619,000 $4,010,364 EDE Eden Innovations Ltd 0.0015 -25% 1,050,000 $7,356,542 ERL Empire Resources 0.003 -25% 1,178,618 $5,935,653 EXL Elixinol Wellness 0.004 -20% 318,919 $6,505,370 ID8 Identitii Limited 0.008 -20% 635,985 $4,302,380 NRZ Neurizer Ltd 0.002 -20% 20,728,474 $4,132,948 BKG Booktopia Group 0.052 -17% 2,420 $14,376,921 AHN Athena Resources 0.0025 -17% 201,000 $3,211,403 LRL Labyrinth Resources 0.005 -17% 174 $7,125,262 ME1 Melodiol Glb Health 0.0025 -17% 1,519,072 $2,140,462 VRC Volt Resources Ltd 0.005 -17% 381,736 $24,952,069 RTR Rumble Resources 0.04 -15% 3,352,860 $33,035,935 BCT Bluechiip Limited 0.006 -14% 45,500 $7,705,368 KOR Korab Resources 0.006 -14% 11,785 $2,569,350 RDS Redstone Resources 0.003 -14% 22,727 $3,238,825 ADC Acdc Metals Ltd 0.061 -14% 116,393 $3,523,198 KAL Kalgoorlie Gold Mining 0.026 -13% 22,535 $4,755,022 HAL Halo Technologies 0.068 -13% 41,958 $10,033,639 88E 88 Energy Ltd 0.0035 -13% 25,755,371 $115,570,688 AVE Avecho Biotech Ltd 0.0035 -13% 762,551 $12,677,188 HOR Horseshoe Metals Ltd 0.014 -13% 7,332,939 $10,364,459 ZNO Zoono Group Ltd 0.028 -13% 1,041,638 $6,839,170 ZEU Zeus Resources Ltd 0.008 -11% 1,501,684 $4,133,529

ICYMI – AM EDITION

Nothing to see here this morning. Move along.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.