ASX Small Caps Lunch Wrap: Which country’s gone full-on Footloose this week?

Chechen drummer Aslan Mayrbuk shows his displeasure at the new musical rules by morphing angrily into a turtle, a traditional form of protest in some parts of Eastern Europe. Pic via Getty Images,

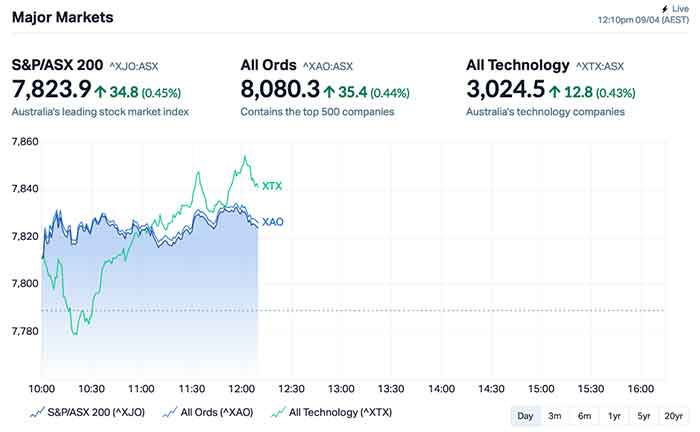

Local markets are up! Woooo! Everybody party, things are great, the benchmark’s up 0.48% in early trade… Looks like Tuesdays are finally getting their act together.

I’ll get into the details shortly, but first to some baffling news from Eastern Europe, where the leaders of Russian republic Chechnya have banned music that is too fast… or too slow.

Chechnya’s culture ministry made the announcement in a statement earlier this week, according to the Moscow Times, mandating that all music “correspond to a tempo of 80 to 116 beats per minute (BPM)”.

That basically means anything slower than Hoobastank’s horrifying The Reason is good to go at the slow end, while Peter Gabriel’s Big Time is the upper limit – and anything either side of that in terms of tempo is un-Chechen, and forbidden.

Culture minister Musa Dadayev made the announcement, saying that “borrowing musical culture from other peoples is inadmissible”, before revealing that the somewhat arbitrary rules were decided upon after a meeting with the republic’s ministry and local musical artists.

The good news for local musicians is that the culture ministry has given them until 01 June of this year to rewrite any of their songs that are either too fast or too slow, to allow them to be played in public.

The bad news for Chechnya is that we’ve all seen how this kind of thing unfolds – and it almost always ends with Kevin Bacon moving to the affected region, nearly killing a local tough guy with a tractor, before dancing alone in a barn for hours and hours until there’s a violent, but superbly choreographed uprising.

As if Chechnya hasn’t already been through enough…

TO MARKETS

Local markets are moving higher this morning, despite a weak effort from Wall Street that left the major indices there flat overnight.

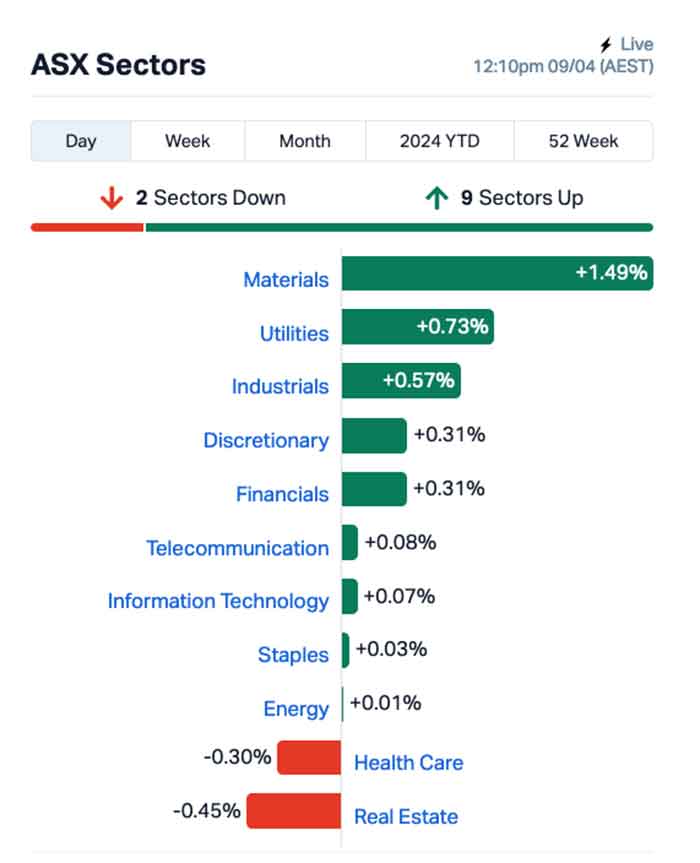

To be fair, the benchmark’s performance has also been flat since the market opened – it just opened 0.4% higher and stayed there, largely supported by the Materials sector, in spite of the goldies taking a breather and dropping -0.55% this morning.

The heavy lifting in the Materials sector is mostly being handled by the Big Guns this morning, with the likes of BHP (ASX:BHP), Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) adding +2.0%, +1.57% and +2.95% as the morning unfolded.

The easy-to-spot reason for that is a handy surge in iron ore prices overnight – it shot up +6.9% to $US105.10/t, which is always well-received by the top end of town, especially since iron ore prices have been slowly dwindling for weeks, shuddering beneath US$100/t in recent days.

Gnawing on the fatty end of the steak this morning, Elders (ASX:ELD) was bouncing back from yesterday’s sell down, adding +7.1% this morning as bargain hunters swooped on the wounded stock.

Ansell (ASX:ANN) was also climbing today, on the heels of announcing a $400 million fully underwritten institutional placement through the issue of approximately 17.8 million new fully paid ordinary shares to eligible investors at $22.45 a pop.

Liontown Resources (ASX:LTR) was up substantially this morning (+6.5%) on no news, as was Lynas (ASX:LYC) (+5.4%).

NOT THE ASX

The party ground to a bit of a halt in New York overnight, with the major indices all finishing the session flatter than Stacy Hedger at the Miss Arizona pageant.

That will never not be funny.

Anyway – Earlybird Eddy Sunarto tells me that the reason Wall Street didn’t do nuthin’ overnight was because US traders mostly stayed on the sidelines last night ahead of the big inflation print this Wednesday.

To US stock news, and Tesla shares jumped +5% as in-house hype-master Elon Musk got everyone excited about Tesla’s robotaxi, with an all-singing, all-dancing announcement that it will be unveiled in August.

Tesla Robotaxi unveil on 8/8

— Elon Musk (@elonmusk) April 5, 2024

Doesn’t take much to get Tesla fans excited, I guess… But I can’t help but feel like I’ve seen how that story’s gonna play out as well…

Meanwhile at Boeing, there are more woes as more bits of another plane decided enough was enough, and parted company with the rest of the aircraft.

This time an engine cover blew off a Southwest Airlines’ Boeing 737-800 flight from Denver to Houston.

Really can’t make this up! Accidents happen, but too many over a short period when it comes to Boeing $BA $SPR

Southwest Flight 3695 headed to Houston from Denver had to return after its engine cowling detached and struck the wing flap during takeoff.

— Special Situations Research Newsletter (Jay) (@SpecialSitsNews) April 8, 2024

That deep rumbling you can hear is, I assume, everyone on that plane crapping their pants in unison. What a nightmare.

Amazon briefly touched its 2021 all-time highs after Morgan Stanley lifted its price target from US$200 to US$215, but things have gone from bad to worse for Florida Bible salesman Donald Trump, as his meme stock fell another 8% overnight.

In Asian market news, Japan’s Nikkei is up 0.41%, Shanghai markets are down 0.31%, and Hong Kong’s Hang Seng is up 0.95%.

Most Middle Eastern markets are closed today for Eid celebrations, and will remain so for about a week in some cases.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 09 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap SLS Solstice Minerals 0.150 50% 5,337,686 $10,033,681 M2R Miramar 0.017 50% 34,499,160 $1,637,565 RGS Regeneus Ltd 0.013 44% 3,541,910 $5,515,864 CVR Cavalierresources 0.205 32% 34,796 $4,933,482 14D 1414 Degrees Limited 0.076 27% 273,650 $14,290,111 HLX Helix Resources 0.005 25% 610,750 $9,292,583 M4M Macro Metals Limited 0.011 22% 33,751,145 $29,088,601 OAU Ora Gold Limited 0.006 20% 1,200,000 $29,030,004 POD Podium Minerals 0.048 20% 1,521,477 $18,189,871 RML Resolution Minerals 0.003 20% 200,000 $4,024,992 RR1 Reach Resources Ltd 0.003 20% 751,253 $8,196,808 VBS Vectus Biosystems 0.285 19% 11,923 $12,770,247 OEQ Orion Equities 0.200 18% 443 $2,660,369 BOA Boadicea Resources 0.034 17% 1,067,622 $3,577,233 AI1 Adisyn Ltd 0.021 17% 51,584 $3,174,292 1MC Morella Corporation 0.004 17% 1,435 $18,536,398 BDG Black Dragon Gold 0.028 17% 5,500 $5,418,424 CCZ Castillo Copper Ltd 0.007 17% 191,295 $7,797,032 CTO Citigold Corp Ltd 0.007 17% 5,839,409 $18,000,000 FHS Freehill Mining Ltd. 0.007 17% 1,141,557 $17,975,067 ORN Orion Minerals Ltd 0.014 17% 43,759 $70,155,416 DTM Dart Mining NL 0.043 16% 324,480 $8,420,446 AEV Avenira Limited 0.008 14% 7,021,832 $16,443,238 EFE Eastern Resources 0.008 14% 400,000 $8,693,625 RGL Riversgold 0.008 14% 11,875 $6,773,630

Solstice Minerals (ASX:SLS) was leading the Small Caps at lunch time, on news that it has entered into a binding Sale and Purchase Agreement with Northern Star, to sell 100% of the Hobbes Exploration Licence for total consideration of $12.5 million.

Solstice held 80% of the licence, while the remaining 20% was held by “an unrelated private company” – Solstice’s words, not mine – which has also agreed to the sale.

Explorer Miramar Resources (ASX:M2R) revealed that it is working toward a maiden drilling campaign at the Bangemall Ni-Cu-Co PGE project and has expanded its 480km2 Eastern Goldfields tenement portfolio.

M2R was briefly up as much as 109% in very early trade, but that eased almost as quickly to be +55% around lunchtime.

Regeneus (ASX:RGS) was continuing its recent positive form, adding another +44.4% on the heels of its announcement of a $3.48 million two-tranche placement, ahead of the company changing its name and ticker tomorrow to Cabrium Bio (ASX:CBM).

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 09 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AVM Advance Metals Ltd 0.025 -43% 88,652 $1,763,738 ENT Enterprise Metals 0.002 -33% 35,000 $2,405,913 BNR Bulletin Res Ltd 0.047 -28% 7,066,099 $19,084,866 IEC Intra Energy Corp 0.002 -25% 130,000 $3,381,563 WAK Wakaolin 0.040 -20% 44,995 $21,189,206 GCM Green Critical Min 0.004 -20% 200,704 $5,682,925 HCD Hydrocarbon Dynamic 0.004 -20% 30,000 $4,042,912 DM1 Desert Metals 0.026 -19% 8,132,216 $8,493,622 DBO Diabloresources 0.018 -18% 1,272,377 $2,267,571 ADD Adavale Resource Ltd 0.005 -17% 567,217 $6,095,878 LNR Lanthanein Resources 0.003 -17% 203,848 $5,864,727 MHC Manhattan Corp Ltd 0.003 -17% 1,469,935 $8,810,939 PRX Prodigy Gold NL 0.003 -17% 210,000 $6,041,322 VML Vital Metals Limited 0.005 -17% 12,724,273 $35,370,402 BUR Burleyminerals 0.059 -16% 8,283 $7,300,773 T92 Terrauraniumlimited 0.135 -16% 70,899 $9,118,364 88E 88 Energy Ltd 0.006 -14% 24,180,611 $175,868,438 AQX Alice Queen Ltd 0.006 -14% 26,647,028 $4,836,930 CUL Cullen Resources 0.006 -14% 9,090 $3,991,213 ME1 Melodiol Glb Health 0.007 -13% 7,030,127 $3,494,685 RKT Rocketdna Ltd. 0.007 -13% 20,000 $5,248,919 IXU Ixup Limited 0.015 -12% 35,000 $20,013,629 RBX Resource B 0.038 -12% 20,000 $3,555,433 HAR Harangaresources 0.115 -12% 184,843 $11,638,819 NOV Novatti Group Ltd 0.054 -11% 1,288,759 $21,594,027

ICYMI – AM EDITION

Mamba Exploration (ASX:M24) will kick off in early-May an inaugural drill program at its Canary project in the Athabasca Basin to test high-priority unconformity-related uranium targets just 11km from IsoEnergy’s super high-grade Hurricane deposit.

Marmota (ASX:MEU) has formed the Golden Moon joint venture with Coombedown Resources just down the road from its Aurora Tank gold deposit. The JV project includes four gold deposits with reported JORC resources.

Prospect Resources (ASX:PSC) has executed two concurrent agreements that effectively unlocked the disputed and potentially world-class Mumbezhi copper-cobalt in the Zambian Copperbelt – a much prized geological jurisdiction.

At Stockhead, we tell it like it is. While Mamba Exploration, Marmota and Prospect Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.