ASX Small Caps Lunch Wrap: The ASX is flat, but Energy is flying through the chop today

Pic via Getty Images

- The ASX has been struggling for traction following a mixed result on Wall Street overnight

- Energy stocks are keeping things on an even keel, but that largesse might not last the day

- Some chunky wins among the Small Caps is keeping us happy here today

Local markets opened higher this morning but the Good Times, it seems, were not to last past lunch, as the ASX 200 benchmark has slipped into negative territory at lunch time and things are lookin’ a little moribund.

Except for the Energy sector. It’s cranking out a big win today, and pretty much single handedly keeping the rest of the market from sliding into the sea.

There’s a bit to unpack behind that this morning – but if you’re in a hurry, the short version is that Woodside’s having a banger, there’s a bit of a carryover of yesterday’s surge for uranium stocks and the price of oil has spiked because there’s a war or two in the Middle East.

Or there’s about to be. It’s getting increasingly difficult to tell.

But before we get to that (and yes, I’m aware that we don’t do this here any more, but I’m gonna and y’all need to live with it for today) – I wanted to re-mention something that blipped on our collective radars a while ago.

If you remember, on May 28, I wrote about a couple of intrepid space travellers who were about to blast off from Cape Canaveral Space Force Station in Florida, aboard a Boeing-built spaceship that there were some concerns about.

They were meant to be in space for eight days – but it turned out that everyone’s concerns about the spaceworthiness (totally a word, no need to look it up) of the Boeing spacecraft were valid.

On June 28, those astronauts were still in space, and Boeing was making all kinds of indignant noises about what it said was the unfair characterisation that they were “trapped in orbit, and unable to get home”.

Well… tomorrow is August 28 – two months since I wrote that, and guess what?

Astronauts Suni Williams and the still hugely improbably named Butch Wilmore are still in space. Their eight-day trip outside Earth’s atmosphere is now into its 83rd day, but the end of the mission is in sight. Kind of.

The Boeing Starliner test pilots have been given a timeline for when they will be brought home, and two things about the plan really stand out.

- They’ll be coming home in February next year.

- They’re hitching a ride on a SpaceX rocket.

They say in space, no one can hear you scream – but I reckon if you were in space right now, you’d be able to hear the bellowing of anguish coming from the Boeing boardroom.

Here’s what happened on the markets this morning.

TO MARKETS

The ASX started off doing okay, but then things went south and now it isn’t. By lunchtime, the ASX 200 benchmark was just below flat, down 0.04% and it was only a crackerjack surge in the Energy sector that is keeping things afloat today.

Energy is enjoying a day in the sun because of a few different factors – namely, a bangin’ earnings call from Woodside Energy Group (ASX:WDS) that has seen the Energy behemoth spike 4.8% this morning.

On top of that, there’s a bit of late-to-the-uranium-party action among the ASX yellowcake stocks, after they went soaring yesterday on news that the world’s biggest supplier of uranium is shaping up to have a terrible year in Kazakhstan.

Plus oil prices have been rising steadily this week because the Middle East is having yet another brawl – crude oil is up more than 7.2% for the week, but it has eased a little as this morning wore on.

But as you can see, everything else is – by comparison – not enjoying itself at all. There’s a smaller rise among Materials stocks, but that’s also largely due to one big player heaving its bulk around – BHP (ASX:BHP) delivered its earnings this morning, and the market has rewarded it with a 2.16% bump in share price.

Importantly, iron ore prices have rebounded, and at the time of writing, the Singapore iron ore price was back in triple digit town, up 0.45% to US$100.80 per tonne.

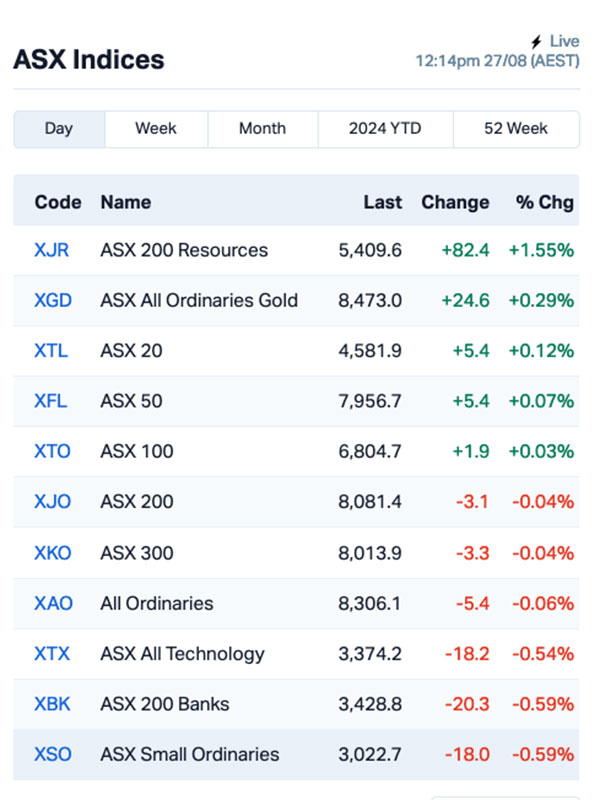

The ASX indices tell a similar story to the sector results. Resources are out in front, the goldies are performing well, and the top 100 ASX stocks are above break-even, with that result getting better each time the list is shortened – the ASX 20 (twenty, not a typo) is up 0.12%.

There’s probably other news around the traps, but I’ve been in meetings this morning, so you’ll need to tune in for Closing Bell to see the rest of the day’s news, around 4:00pm.

NOT THE ASX

In the US overnight, the Dow hit a new record high, because ‘Murica. But the rest of Wall Street struggled, leaving the blue chips Dow Jones up by 0.16%, while the S&P 500 slipped by 0.32%, and the tech-heavy Nasdaq tumbled by 0.85%.

Earlybird Eddy Sunarto reported this morning that US mega tech stocks led the declines to start Wall Street’s week, with the gauge of the “Magnificent Seven” stocks sliding by 1.2%.

Traders, meanwhile, remain focused on US policymakers, with Fed Bank of San Francisco president Mary Daly saying “the time is upon us” to cut interest rates, likely beginning with a 0.25% cut.

Her Richmond counterpart, Thomas Barkin, reckons inflation might still rise, but he also supports lowering rates because the job market is slowing down.

In more detailed US stock news, Apple Inc rose slightly after announcing a product launch event at its headquarters on September 9, where it will reveal details about the iPhone 16 and other new devices.

And, Applied Materials Inc, a semiconductor supplier, dropped 3% after revealing that the US Department of Justice has requested details about its federal grant applications, adding to the ongoing government scrutiny of its operations.

Boeing stocks fell another 0.85% overnight, and the former high-flyer is off by more than 31% since the start of the year.

In Asian markets this morning, the mood is mercurial. Japan’s Nikkei is down 0.14%, the Hang Seng is off by 0.22% and Chinese shares are down 0.2% as that country’s EV makers grapple with a fresh set of tariffs from Canada.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 27 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap FAU First Au Ltd 0.003 50.0 11,090,295 $3,623,987 JAV Javelin Minerals Ltd 0.003 50.0 1,387,682 $8,553,692 M2R Miramar 0.013 44.4 34,079,736 $3,553,016 ATH Alterity Therap Ltd 0.004 33.3 1,246,548 $15,961,008 CNJ Conico Ltd 0.002 33.3 5,573,000 $3,302,291 GMN Gold Mountain Ltd 0.004 33.3 2,914,134 $11,722,420 ICU Investor Centre Ltd 0.004 33.3 163,742 $913,534 MRQ Mrg Metals Limited 0.004 33.3 6,513,227 $8,134,556 SI6 SI6 Metals Limited 0.002 33.3 700,000 $3,553,289 BAS Bass Oil Ltd 0.1 33.3 5,455,587 $21,782,367 BCB Bowen Coal Limited 0.013 30.0 21,474,707 $28,491,791 SRN Surefire Rescs NL 0.0065 30.0 1,325,974 $9,931,539 HTG Harvest Tech Grp Ltd 0.018 28.6 520,090 $11,373,710 AAU Antilles Gold Ltd 0.005 25.0 5,766,753 $5,845,711 PKO Peako Limited 0.005 25.0 243,216 $3,513,899 PUR Pursuit Minerals 0.0025 25.0 37,321 $7,270,800 TTI Traffic Technologies 0.005 25.0 595,427 $3,891,541 TYX Tyranna Res Ltd 0.005 25.0 2,031,294 $13,151,701 QPM Queensland Pacific 0.037 23.3 22,320,697 $75,635,366 CSX Cleanspace Holdings 0.405 22.7 90,664 $25,534,902

Miramar Resources (ASX:M2R) was up on news that the company has been granted Exploration E08/3676 over the high-grade copper-lead-silver occurrence at the Joy Helen prospect, in the Gascoyne region of Western Australia. Miramar has previously announced rock chimp sampling from an initial reconnaissance field trip returned results including 5.49% Cu, 42.0% Pb and 73.48g/t Ag, and 5.43% Cu, 36.7% Pb, 36g/t Ag and 0.27% Zn.

Gold Mountain (ASX:GMN) was up on news of further results from its fieldwork at its Iguatu Project area, showing “extensive copper-gold anomalies indicative of IOCG copper mineralisation”. The company says there’s been a major area of anomalous copper detected, with 38km2 of anomaly within tenement and 14 km2 of very highly anomalous copper. Gold anomalies are in most areas of copper anomalies, with few gold anomalies not associated with copper.

Bass Oil (ASX:BAS) was rising early on Tuesday after the company announced that initial results from the Kiwi 1 Extended Production Test (EPT) indicate gas flow rates in line with expectations and condensate yields far exceeding the company’s expectations. Bass says that the well has been flowing 4.1 million cubic feet per day (mmcfd) of gas and 988 barrels of condensate per day at a flowing wellhead pressure of 1585 psi.

Surefire Resources (ASX:SRN) was up on news that is executed a Joint Cooperation Agreement with Mid West Ports Authority to determine optimal solutions for export of product through the Port of Geraldton, with the aim of securing port access for 1.25Mtpa of export capacity, allowing the company to accelerate a supply chain solution to support the development of Victory Bore vanadium project with the export of concentrate to the Kingdom of Saudi Arabia.

Antilles Gold (ASX:AAU) was up after releasing a supplemental announcement to its 21 August notice, outlining its find at the Nueva Sabana gold-copper deposit in central Cuba. In the gold column, Antilles is reporting intercepts including 2m @ 25.26g/t Au from 38.5m (incl 1m @ 45.39g/t Au), while on the copper side the results have turned up 25m @ 1.76% Cu from 52m (incl 4m @ 5.56% Cu).

Peako (ASX:PKO) was up this morning on news that it has appointed Ryan Skeen as CEO, effective today. Skeen currently serves as a Non-Executive Director of Heavy Rare Earths Limited (ASX: HRE), sports a Master of Applied Finance (Distinction) and a B.Bus (Financial Risk Management), and brings “expertise in financial markets, strategic leadership, and corporate governance” with him to the table.

Queensland Pacific Metals (ASX:QPM) was up on Tuesday on news that the company has signed new contracts to cover Townsville Power Station (“TPS”) dispatch rights and North Queensland Gas Pipeline (“NQGP”) gas transport and storage service, which the company says will provide it with ‘a significant reduction in fixed operating charges and ensures it will be financially robust with capacity to accelerate its’ gas production growth plans”.

Cleanspace (ASX:CSX) delivered a financial snapshot this morning, and the news was good. The company reports revenue $15.7 million, representing growth of 30% v PCP (H2 + 32%) and has delivered annual expense savings of $4 million, leaving the company with $9.8 million in cash on hand.

Identitii (ASX:ID8) was up earlier on news of a milestone in the patent infringement case it is fighting against JP Morgan in the US, after the US Patent and Trademark Office rejected JP Morgan’s call for Identitii’s patent to be set aside. As such, the matter remains pending in the United States District Court for the District of Delaware, and there is currently a motion to dismiss the case in front of the district court that has not yet been ruled upon.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 27 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap GCR Golden Cross 0.002 -33.3 800,000 $3,291,768 GW1 Greenwing Resources 0.053 -26.4 206,385 $14,180,507 JLG Johns Lyng Group 4.17 -25.1 9,668,864 $1,551,353,855 EXL Elixinol Wellness 0.003 -25.0 500,000 $5,284,729 PAT Patriot Lithium 0.036 -23.4 344,541 $4,863,582 PAM Pan Asia Metals 0.073 -22.3 385,453 $17,438,724 5EA 5Eadvanced 0.0935 -22.1 1,115,064 $39,850,237 KNB Koonenberrygold 0.011 -21.4 1,000,000 $4,029,025 AMD Arrow Minerals 0.002 -20.0 61,536,296 $26,348,413 HLX Helix Resources 0.004 -20.0 2,560,003 $16,320,968 LPD Lepidico Ltd 0.002 -20.0 250,186 $21,472,812 SMM Somerset Minerals 0.004 -20.0 296,107 $5,154,994 MXO Motio Ltd 0.017 -19.0 224,433 $5,632,165 MYG Mayfield Group Ltd 0.76 -16.9 143,719 $83,694,181 DTM Dart Mining NL 0.015 -16.7 2,900,787 $4,651,792 PUA Peak Minerals Ltd 0.0025 -16.7 8,000,715 $4,453,935 TON Triton Min Ltd 0.01 -16.7 102,999 $18,820,665 8VI 8Vi Holdings Limited 0.066 -16.5 19,146 $3,311,002 NVQ Noviqtech Limited 0.023 -14.8 238,891 $4,085,329 DUN Dundasminerals 0.035 -14.6 1,801,987 $3,469,750

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.