ASX Small Caps Lunch Wrap: Sigma-Chemist merge a done deal; Quickstep kicks up 95pc

Quickstep soars on takeover bid. Picture via Getty Images

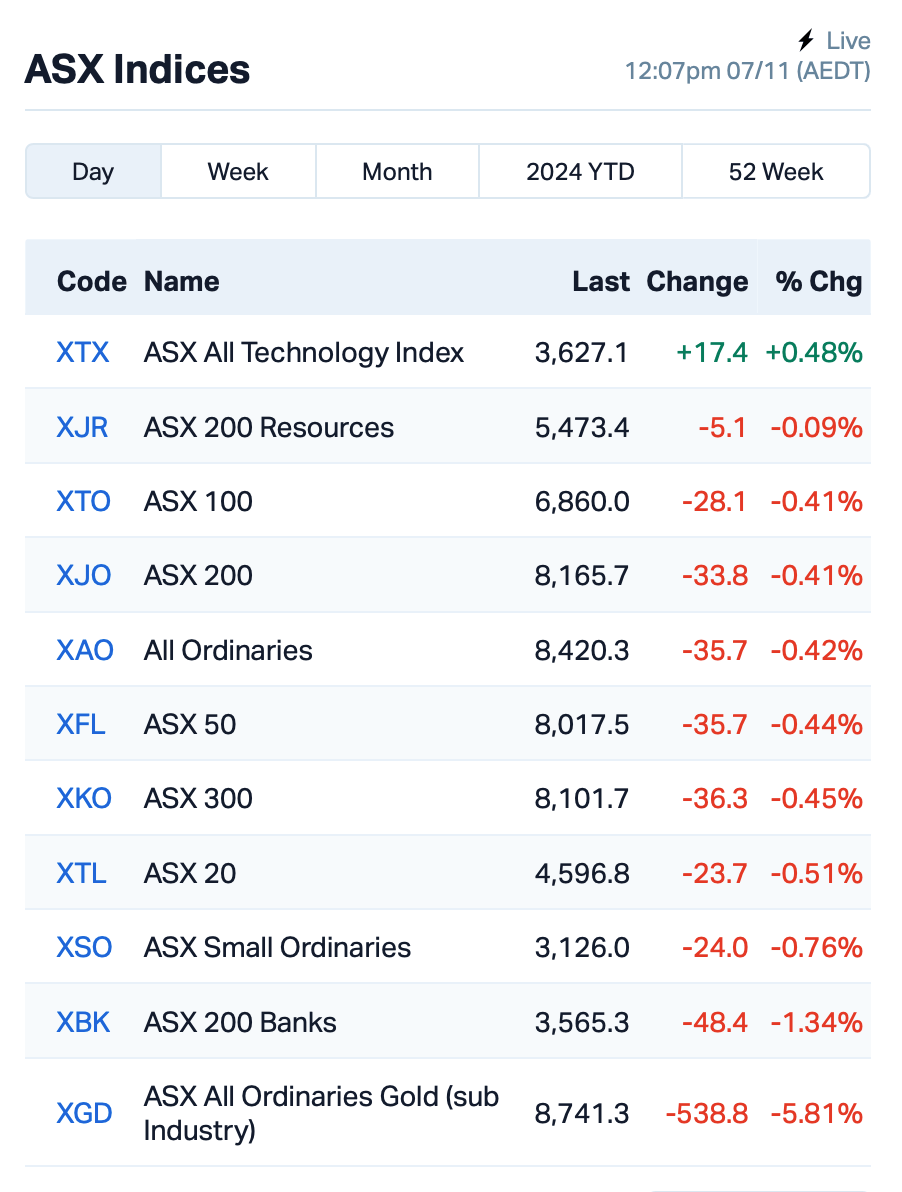

- ASX slips into negative after early gains

- Energy sector, Tesla, Bitcoin boosted as Trump’s win drives US rally

- Sigma Healthcare and Quickstep both soar

The ASX rose in early trading but has since slipped away into negative territory. At 1pm, the S&P/ASX 200 was down about 0.27%.

The Energy sector led gainers early, though, helping offset losses in property stocks.

This came on the back of Donald Trump’s decisive win in the US election, which sent Wall Street’s major indices and Bitcoin to new record highs.

Across the 11 sectors on the ASX, only three were in the green this morning.

Real Estate losses were driven by a 2% fall in sector heavyweight, Goodman Group (ASX:GMG).

Bank stocks also struggled, with National Australia Bank (ASX:NAB) taking the biggest hit, falling 2% after reporting an 8% drop in cash profit for FY24, coming in at $7.1 billion. NAB, however, did raise its annual dividend slightly.

Pharmaceutical distributor Sigma Healthcare (ASX:SIG) saw its stock skyrocket 28% after the Australian Competition and Consumer Commission (ACCC) approved its merger with Chemist Warehouse.

Buy-now-pay-later company Zip Co (ASX:ZIP) slipped 1% despite reporting a massive 234% increase in cash earnings for the first quarter of FY25, compared to the same period last year.

Read later: Zip rises from the ashes with 830pc surge; so are we about to see a BNPL comeback?

Still in large caps, market darling stock Neuren Pharmaceuticals (ASX:NEU) had a strong morning, up 8%, after forecasting $216 million to $218 million in income for FY24.

This comes as Neuren’s US partner, Acadia Pharmaceuticals, reported impressive sales for its neurological drug Daybue, with net sales of $251.7 million year-to-date and full-year guidance of $340 million to $350 million.

For more on that, read >Health Check: Neuren’s ‘Willy Wonka’ voucher shows how a piece of paper can be worth US$50m

NOT THE ASX

On Wall Street overnight, the mood was extremely upbeat.

The Dow, S&P 500, and Nasdaq all hit fresh records, as investors anticipated that Trump’s return to the White House could usher in sweeping tax cuts and pro-business policies, though concerns lingered about inflationary pressures from potential new tariffs.

The 10-year Treasury yield jumped 13 basis points, Bitcoin hit a new all-time high, and the US dollar surged, all driven by the election result.

The small-cap Russell 2000 soared more than 5%.

Trump’s win also sent the VIX Index – often called the “fear gauge” – tumbling with its second-largest one-day drop since 2021.

“The removal of uncertainty and the positive implications for growth have unleashed powerful advances in US equity markets, Treasury yields and the US dollar,” said Stephen Dover, Head of the Franklin Templeton Institute.

“Those moves are likely to continue in the weeks and months to come. The Trump trade is likely going to run further, in our view, but we urge investors to be discriminating in the investment conclusions they draw from the election results.”

Financial stocks led the rally, with JPMorgan and Goldman Sachs reaching new record highs.

Tesla’s stock jumped 15%. The electric vehicle giant is expected to benefit from a Trump administration, with CEO Elon Musk having personally contributed over $130 million to Trump’s campaign and strongly voiced his support on social media platform X.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 7 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AKN | Auking Mining Ltd | 0.005 | 67% | 5,546,249 | $1,174,051 |

| AVE | Avecho Biotech Ltd | 0.003 | 50% | 179,075 | $6,338,594 |

| SI6 | SI6 Metals Limited | 0.002 | 50% | 128,700 | $2,767,292 |

| WEL | Winchester Energy | 0.003 | 50% | 600,000 | $2,726,038 |

| GTI | Gratifii | 0.004 | 33% | 250,000 | $12,008,879 |

| RML | Resolution Minerals | 0.002 | 33% | 50,000 | $2,415,033 |

| CDX | Cardiex Limited | 0.125 | 30% | 422,980 | $28,240,759 |

| RMX | Red Mount Min Ltd | 0.013 | 30% | 5,317,610 | $3,873,578 |

| LRD | Lordresourceslimited | 0.038 | 23% | 2,645,655 | $2,269,188 |

| WEC | White Energy Company | 0.060 | 20% | 8,908 | $9,949,214 |

| PUR | Pursuit Minerals | 0.003 | 20% | 60,000 | $9,088,500 |

| PV1 | Provaris Energy Ltd | 0.025 | 19% | 373,500 | $13,298,989 |

| EVG | Evion Group NL | 0.034 | 17% | 540,256 | $10,061,932 |

| AUK | Aumake Limited | 0.007 | 17% | 845,441 | $16,279,446 |

| BP8 | Bph Global Ltd | 0.004 | 17% | 125,000 | $1,189,924 |

| RGL | Riversgold | 0.004 | 17% | 500,533 | $4,882,388 |

| BNZ | Benzmining | 0.300 | 15% | 1,011,866 | $27,787,351 |

| BMG | BMG Resources Ltd | 0.015 | 15% | 10,879,131 | $8,889,363 |

| CXU | Cauldron Energy Ltd | 0.015 | 15% | 3,453,470 | $18,987,788 |

| ENV | Enova Mining Limited | 0.008 | 14% | 2,853,758 | $6,894,505 |

| SHO | Sportshero Ltd | 0.016 | 14% | 48,000 | $9,349,660 |

| TAL | Talius Group Limited | 0.008 | 14% | 3,572,266 | $18,021,055 |

| NOX | Noxopharm Limited | 0.120 | 14% | 30,168 | $30,684,985 |

Quickstep Holdings (ASX:QHL) , an aerospace manufacturer, saw its shares soar 95% after receiving a takeover bid from one of its biggest customers, Asdam Operations, at 40 cents a share. The bid is a significant premium to Quickstep’s current share price of 20 cents, and is conditional on 90% shareholder approval.

TrivarX (ASX:TRI) has announced a significant breakthrough in its research and development program with the advancement of its MEB-001 algorithm, designed to screen for current Major Depressive Episodes (cMDE) using a single-lead ECG. This new algorithm, which uses heart rate and heart rate variability as biomarkers, can accurately perform sleep staging and screen for cMDE, achieving 87% sensitivity and 67% specificity in initial testing.

This development opens up new market opportunities beyond sleep centres, including cardiology, sports and performance monitoring, military applications, and consumer wearables. The technology could also be licensed for remote patient monitoring. A provisional patent application has been filed to protect the innovation, and further clinical trials and testing are underway to explore additional potential applications.

Archer Materials (ASX:AXE) has successfully miniaturised its Biochip graphene field effect transistor (gFET) design, reducing the size of the chip by 97%. This advancement, fabricated by Archer’s foundry partner Applied Nanolayers in the Netherlands, makes the gFET more cost-effective to produce while improving its foundry readiness. The miniaturised chips have already undergone wafer dicing and assembly at AOI Electronics in Japan and are now being tested by Archer.

This new design is a key step towards Archer’s goal of using the Biochip for at-home testing of chronic kidney disease, with the miniaturised gFET sensors playing a crucial role in the functionality. The company aims to reduce fabrication costs and increase the production scale, with over a thousand chips expected to be produced in future wafer runs. This progress also strengthens Archer’s partnerships with semiconductor supply-chain partners and moves the Biochip closer to commercialisation.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 7 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FCG | Freedomcaregrouphold | 0.077 | -41% | 443,154 | $3,104,908 |

| AMD | Arrow Minerals | 0.002 | -25% | 7,190,910 | $26,447,256 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 82,777 | $7,814,946 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 92,592 | $3,059,413 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 2,912,161 | $13,632,593 |

| RIL | Redivium Limited | 0.004 | -20% | 468,700 | $13,734,274 |

| PPY | Papyrus Australia | 0.013 | -19% | 709,448 | $7,883,081 |

| JBY | James Bay Minerals | 0.465 | -18% | 561,470 | $18,895,013 |

| CUL | Cullen Resources | 0.005 | -17% | 152,977 | $4,160,411 |

| GES | Genesis Resources | 0.005 | -17% | 50,000 | $4,697,048 |

| M2R | Miramar | 0.005 | -17% | 1,815,333 | $2,380,940 |

| ILT | Iltani Resources Lim | 0.190 | -16% | 312,843 | $9,902,364 |

| LML | Lincoln Minerals | 0.006 | -14% | 50,000 | $14,393,817 |

| MOH | Moho Resources | 0.006 | -14% | 65,999 | $3,774,247 |

| S66 | Star Combo | 0.130 | -13% | 144,451 | $20,262,447 |

| BSX | Blackstone Ltd | 0.029 | -13% | 422,017 | $17,625,079 |

| AAU | Antilles Gold Ltd | 0.004 | -13% | 1,128,542 | $7,422,971 |

| AQX | Alice Queen Ltd | 0.007 | -13% | 10,000 | $9,175,121 |

| HHR | Hartshead Resources | 0.007 | -13% | 4,880,808 | $22,469,457 |

| STM | Sunstone Metals Ltd | 0.007 | -13% | 2,986,763 | $41,191,229 |

| USL | Unico Silver Limited | 0.273 | -12% | 1,678,200 | $109,464,231 |

| AGC | AGC Ltd | 0.225 | -12% | 457,264 | $65,432,292 |

| AQD | Ausquest Limited | 0.008 | -11% | 169,000 | $7,435,343 |

| GTR | Gti Energy Ltd | 0.004 | -11% | 1,086,333 | $13,322,023 |

| SRK | Strike Resources | 0.032 | -11% | 8,846 | $10,215,000 |

IN CASE YOU MISSED IT

Raiden Resources (ASX:RDN) has carried out maiden drilling on the Andover South project in WA with 3,500m completed to date.

The company initially focused on targets 1 and 2 but the program has since expanded to include target areas 3, 4 and 7 with the arrival of a second drill rig. Operations are now proceeding on schedule and budget with the first batch of samples dispatched to the laboratory for assay analysis. Based on the anticipated timetable, Raiden expects results to be on track for release within November.

At Stockhead, we tell it like it is. While Raiden Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.