ASX Small Caps Lunch Wrap: Real Estate on top as local markets wander towards record territory

Pic via Getty Images

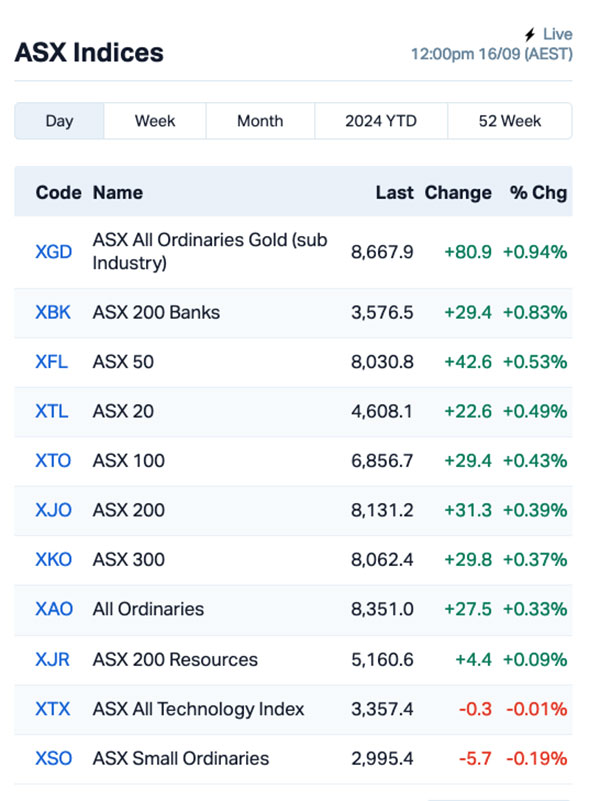

The ASX 200 benchmark is breathing rarified air this morning, having meandered like a wayward bovine towards the greenest of record-setting fields – the intra-day high of 8148.7 that was set in August of this year.

We’re not quite there yet, though – but we are past the best closing price the benchmark has ever had, so we could be in for a rewriting of the record books… we just need to believe.

Or something, I dunno. Maybe I’m getting this all confused with Peter Pan. I really don’t know.

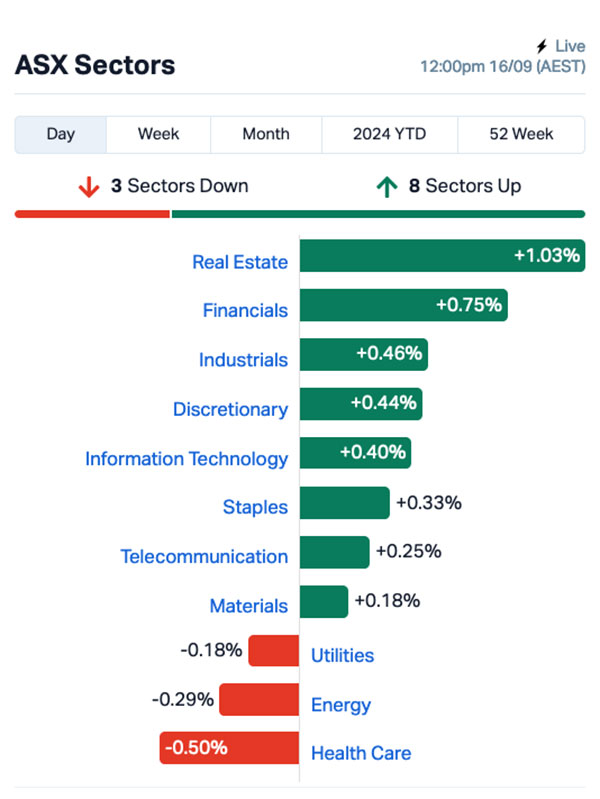

What I do know is that Energy stocks were taking a kicking again – but they got better. The same can’t be said for Health Care and Utilities, however Real Estate is shining again today, after a couple of bumper weeks for that sector.

Here’s the market in a bit more detail:

TO MARKETS

With a new record close in its sights, the ASX 200 benchmark opened 0.4% higher this morning, on the heels of a solid performance on Wall Street on Friday where everyone was getting ready for this week’s Big Rate Cut by the US Fed.

The buoyant mood there carried over the weekend to help our markets off to a decent enough start, but it wasn’t long before the writing was on the wall for local Energy stocks, which led the losses in the opening half hour of trade.

By the time word went round that we should start unwrapping our sandwiches, Health Care and Utilities had joined Energy stocks below the water line.

Among the Big Kids losing ground from those sectors was Telix Pharmaceuticals (ASX:TLX), off by nearly 5.0% this morning for no apparent reason.

And gold miner Ramelius Resources (ASX:RMS) was down 4.4% this morning. It went ex-div on Friday, so that probably accounts for the brisk sell-off today.

Up the top of the charts, though, it’s Real Estate – yes, again.

It’s been a fairly solid, but unremarkable, run for Real Estate over the past two weeks – on Friday 6 it had posted a 4.8% gain over the previous five sessions, and by Friday just gone it had stacked on another 2.3%.

This morning, Real Estate was up another 1.0%, thanks to big guns such as Scentre Group (ASX:SCG) and Lendlease (ASX:LLC) , both up 1.36% the last time I looked.

A look at the ASX sub-indices shows that the goldies are performing well again today, leading that chart on +0.94% – unsurprising with gold prices rising steadily over the past few sessions, and showing a 0.2% increase to US$2,582 an ounce around midday today.

Outside of that action, it’s been a fairly quiet morning in BusinessLand – the only big news coming from global mining giant Alcoa (ASX:AAI), which has announced that it’s about to be $1.1 billion cash-richer after it sells its 25.1% interest in the Saudi-based Ma’aden project to its joint venture partner.

The JV is described as “a fully integrated mining complex in the Kingdom of Saudi Arabia”, made up of the Ma’aden Bauxite and Alumina Company (MBAC) which is a bauxite mine and alumina refinery, alongside the Ma’aden Aluminium Company (MAC), comprised of an aluminium smelter and casthouse.

“We deeply value our partnership with Ma’aden. We are confident that under the new arrangement, MBAC and MAC are well-positioned for success,” said William F. Oplinger, Alcoa’s president and CEO.

“The transaction simplifies our portfolio, enhances visibility in the value of our investment in Saudi Arabia and provides greater financial flexibility for Alcoa, an important part of improving our long-term competitiveness.”

That lit a bit of a cracker under Alcoa’s share price this morning, and it’s up 5.2% as of lunchtime today.

NOT THE ASX

Looking overseas, Wall Street was in a generous mood on Friday, which left the S&P 500 0.54% higher, the Dow Jones was up by 0.72% and the tech heavy Nasdaq lifted by 0.65% by the end of the session.

The big buzz there is around the highly-anticipated interest rate cut by the US Fed on Wednesday (US time), and trading in interest-rate futures contracts now shows there’s almost as much chance the Fed will make a big interest rate cut (50 basis points) as a smaller one (25 basis points).

Although the consensus still favours a 25 basis points cut, traders now see a 49% chance of a 50 basis point cut when the Fed announces its decision, Eddy Sunarto reported this morning.

In US stock news, it appears that there’s simply no way of keeping Donald Trump out of the headlines, after there was apparently another attempted assassination on the former US president near his Florida golf club.

Prior to that, however, Trump was asked if he was selling off his shares in his social media company Trump Media & Technology Group, which has sunk around 73% from its all-time high in March of this year.

He quickly said no, he wasn’t selling, sending shares of the company behind Truth Social shooting up by 12% – however, that seemingly off-the-cuff response has put Trump in a bit of a pickle.

Trump’s lockdown provision preventing him from selling those shares ends soon, and should the former president elect to bail out of the holding, he may run afoul of US securities fraud laws that govern stock manipulation, as it is illegal for major shareholders and company principals to mislead investors on their intention with that stock.

Getting on the wrong side of those laws can carry a sentence of up to 20 years.

In other US stock news, Boeing shares dipped 4% after factory workers went on strike, causing manufacturing to come to a halt at the company’s biggest Seattle facility.

Fitch, the credit rating agency, warned that a prolonged strike could lead to a credit rating downgrade and disrupt Boeing’s operations.

Adobe fell sharply by 9% after the company issued guidance that disappointed investors who had hoped to see more AI thrown into the mix.

Investors were looking for more updates on Adobe’s AI plans, which many believe were not adequately addressed in the guidance statement.

In Asian markets this morning, the mood is less buoyant than our local markets.

Japan’s Nikkei is down 0.68%, the Hang Seng is down 0.41% and Shanghai markets are off by 0.48% as the Great Chinese Slowdown continues to gather pace.

Societe Generale’s economics wonks have put together some new analysis, and the picture they’re painting is pretty grim.

Beijing has been quite public about wanting to nail a 5% GDP growth target, but it has been consistently coming up short – Q3 GDP is currently tracking at 4.7%, which puts Chinese policymakers in a position where a lot more stimulus is going to be required to kickstart the labouring beast.

“Domestic activity data deteriorated more than market expectations in August again,” the Societe Generale said.

“More worryingly but not surprisingly, the timid easing measures so far are very far from enough to stem the downward trend in domestic demand.

“The decline in housing prices picked up pace again; infrastructure growth slowed sharply despite a notable acceleration in government borrowing; and retail sales growth slipped further, despite better home appliances sales on the back of subsidies.”

As bad as that is, though, we should spare a thought for Russian citizens caught in a worsening inflation spiral, after the Russian central bank raised interest rates there 100 basis points to a soul-crushing 19%.

Imagine trying to run a war-time economy on the world’s biggest credit card.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 16 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Lepidico (ASX:LPD) was climbing on Monday morning, thanks to an announcement from the UK Secretary of State for Housing Communities and Local Government, that the Trelavour Hard Rock Project in Cornwall, which will employ Lepidico’s proprietary hydrometallurgical lithium processing technologies under licence, has been designated as a Nationally Significant Infrastructure Project.

Mithril Silver and Gold (ASX:MTH) was rising on news that the company has completed a LiDAR survey over its entire 70km2 of mining concessions that cover the Copalquin gold-silver district in Durango State, Mexico, revealing a network of historical workings – including mine tunnels and prospecting pits across the site. Exploration at the site is continuing, and sampling from completed holes have been sent for assaying, with that batch of results expected soon.

Ironbark Zinc (ASX:IBG) got a speeding ticket from the ASX, and the company’s response hadn’t cleared embargo as of the time of writing – we’ll cover this in Closing Bell.

RooLife Group (ASX:RLG) was rising on news that it has signed an agreement for the production and supply of health and wellness products, manufactured in Australia by Careline Australia, including including its most popular skincare range “featuring products with patented technology including plant and animal stem cell technology, antioxidant blends and natural essential oils”.

Future Metals (ASX:FME) got a boost from news that heritage clearance surveys have been completed across the Alice Downs Corridor and Panton North tenures. The completion of these surveys “marks a key step forward in advancing the exploration strategy within the Alice Downs Corridor” the company says.

Similarly, Lycaon Resources (ASX:LYN) was up on news that a heritage clearance survey over its high-priority Stansmore Nb-REE/IOCG target has been received, paving the way for the company’s first ever drill campaign in theWest Arunta region.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 16 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

ICYMI – AM EDITION

CuFe (ASX:CUF) has completed a maiden wide-spaced reverse circulation drilling program at its North Dam lithium, rare earths and niobium project east of Kambalda, WA, that intersected multiple large pegmatites.

Pegmatites intersected by the 18 hole program totalling 2068m vary in mineralogy and had down-hole thicknesses ranging from 10-47m with a top intersection of 85m. The first batch of downhole samples have been dispatched to a Perth laboratory for assaying with results for all holes expected to be received in October.

Lumos Diagnostics (ASX:LDX) has appointed Thermo Fisher Scientific’s Fisher Healthcare as the US distributor for its FebriDx rapid point-of-care respiratory test for a viral from bacterial acute respiratory infection.

The test was cleared in July 2023 by the US Food and Drug Administration for use by healthcare professionals with patients presenting in urgent care or emergency care settings and is intended to be used in conjunction with clinical signs and symptoms, including other clinical and laboratory findings, to evaluate patients for acute respiratory infection.

“We are very pleased to announce this partnership with Fisher Healthcare for FebriDx distribution,” LDX managing director Doug Ward said. “We look forward to working together to accelerate the growth of FebriDx via their network of customers across the US.”

At Stockhead, we tell it like it is. While CuFe and Lumos Diagnostics are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.