ASX Small Caps Lunch Wrap: Market climbs while Star gets handed another huge fine

You'd be cranky, too, if your arms were that short and your nose was itchy. Pic: Getty Images

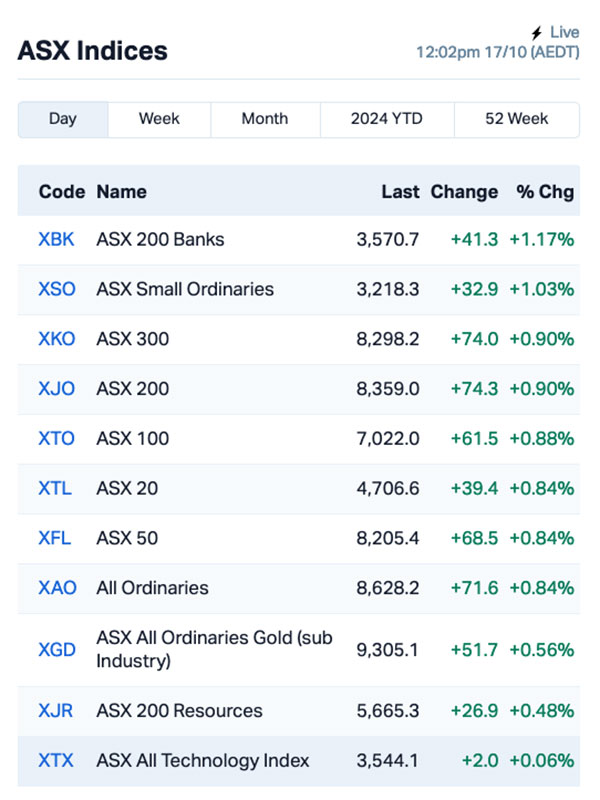

- ASX 200 benchmark powered to a 0.8pc jump before lunch

- Star Entertainment Group copped another $15m whack on the nose with a rolled up newspaper

- Small Caps are making big gains today, including a 200pc+ surge for Ovanti

Local markets have climbed this morning, after a pretty solid night on Wall Street – which saw the Dow reach a new record high – and non-dramatic movement among commodities set the scene for a positive session today.

By lunchtime, the ASX 200 was up around 0.8%, with the gains led by Real Estate, the banks, the goldies and a surge in small caps, as the rotation into the smaller end of the market hit its stride.

The headline news, though, is that Star Entertainment Group (ASX:SGR) has narrowly avoided what would be tantamount to a death sentence, after regulators opted to issue yet another massive fine and keep the group’s licence to operate in New South Wales “suspended”.

Here’s everything in a bit more detail for October 17 – a date that seems doomed to remain stuck in my head forever, because it’s the birthday of a girl I had a crush on in 1988, and brains are dumb.

TO MARKETS

At lunchtime, the ASX 200 benchmark was up around 0.8%, with the gains led by solid movement among Real Estate stocks, while the Small Ordinaries index far outpaced the rest of the market as well.

The banks have had another banger today – despite the outage for some Westpac customers rolling into its fourth day – while Industrials and the goldies are offering strong support to keep the rest of the market heading in the right direction.

Here’s how the charts looked at lunchtime:

Uranium stocks are positively glowing this morning, with Deep Yellow (ASX:DYL) (+12.5%), Paladin Energy (ASX:PDN) (+10.9%) and Boss Energy (ASX:BOE) (+7.0%) leading the charge up the fat end of town.

AMP (ASX:AMP) has gone gangbusters today as well, soaring 13.8% before lunch after the company revealed this morning that it is performing really well in a number of key areas, including driving net cashflows to $750 million, up 76% on pcp and the company lifting its assets under management 4.6% to $78.1 billion.

As I mentioned earlier, Star Entertainment Group has once again dodged the regulator’s bullet, after the NSW Independent Casino Commission (NICC) announced that the company’s Sydney property still isn’t technically fit to operate.

The NICC has reconfigured the conditions under which Star is allowed to operate its Sydney property, and slugged the company with another whopping fine, this time stinging it for $15 million.

NICC Chief Commissioner Philip Crawford noted that while things have improved, they’re still far from perfect at the beleaguered gambling den – while also noting that tearing up Star’s NSW licence had been considered as an option.

“We just regard it as a very final act and there’s no coming back if you take the licence away,” Crawford said.

“If Sydney Star fails, the Star group will fail and that’s a group that employs 9,000-plus people, and if you add onto that the huge number of suppliers to the business, it would affect the lives of a lot of people.”

Not to mention the devastating effect it would have on Sydney’s “going out” tracksuit and ugg boot sales.

This has all unfolded in the wake of a report last month that found the Sydney casino operator unfit to hold the licence at all, leading to Star being given 14 days to convince regulators why it should be allowed to keep its doors open.

In broader economic news, if you have had one eye on the market charts this morning, you will have noticed that there was quite a dip around 11.30am today – that’s when Australia’s latest unemployment figures landed, and they’re… unspectacular, I think is the right word.

The national unemployment rate remained steady in September at 4.1%, after the number of employed grew 64,100, and the number of unemployed people fell 9,200 in seasonally adjusted terms.

Best I leave that there – I’ve made enough frenemies at Star over the years (I used to work for them, about 1,000 years ago) and adding more names to that list today hardly seems worth the effort.

NOT THE ASX

Overnight, the S&P 500 rose by 0.47%, the blue chips Dow Jones lifted by 0.79%, and the tech heavy Nasdaq climbed by 0.28%.

The Russell 2000 index, which tracks small caps in the US, hit its highest level in nearly three years.

“Investors may be looking to rotate away from large technology companies, which are widely owned and may have fewer clear catalysts going forward,” said David Russell at TradeStation.

Nicholas Lentini at Morgan Stanley added,” We recently upgraded small caps to neutral vs large caps after a persistent 3 1/2 year period of underperformance.”

To US stocks, while most big tech stocks dropped, Nvidia Corp rose by over 3%.

Traders also dug through a bunch of corporate earnings reports. Morgan Stanley rose 6.5% to an all-time high after posting better-than-expected revenue and a 32% profit jump for Q3.

United Airlines soared 12% after beating earnings estimate.

Qualcomm will hold off on deciding whether to pursue a buyout of Intel Corp until after the US presidential election in November, according to people in the know.

Speaking of the election, billionaire Stan Druckenmiller believes the markets are pricing in a Donald Trump win. In a Bloomberg TV interview, he said, “You can see it in the bank stocks and in crypto.”

Airbus plans to cut up to 2,500 jobs in its defence and space division as the European aircraft maker looks to streamline operations amid losses and tough competition. Shares rose by 0.15% in Paris.

The best moving US stock overnight, however, was biotech firm 180 Life Sciences Corp, which skyrocketed by over 325% after a strategic pivot into the online gaming industry. The company said it will use blockchain technology, and has just acquired a back-end gaming platform with plans to launch a business-to-consumer online casino.

Earlybird Eddy Sunarto reported this morning that Martin Currie is “bullish on lithium” – I didn’t have my glasses on, and thought he was onto the story of the decade, considering she’d been dead for 90 years.

(I’ll give you a minute on that one if you need it… it’s obscure, even for me).

Meanwhile in Japan, the Nikkei was flat today, as the nation comes to grips with the loss of pop star Liam Whathisname from One Direction, who apparently fell out of a hotel in Argentina, ending any hope that the group would get back together for a reunion concert any time soon.

And the ABC reported this morning that Amazon has signed three agreements on developing small modular nuclear reactors – which I’m not entirely thrilled about, given the company’s stubborn inability to deliver two boxes of the same product to my house on the same day.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap OVT Ovanti 0.014 250.0% 115,106,477 $6,225,393 CY5 Cygnus Metals 0.135 68.8% 8,165,887 $30,382,791 CDE Codeifai 0.0015 50.0% 2,304,580 $2,641,295 KNB Koonenberry Gold 0.017 41.7% 20,725,645 $3,453,450 PV1 Provaris Energy 0.031 40.9% 1,192,086 $13,881,281 SLM Solis Minerals 0.11 35.8% 329,499 $6,267,966 MOM Moab Minerals 0.004 33.3% 2,014,938 $2,426,443 TYX Tyranna Resources 0.004 33.3% 5,158,108 $9,863,776 NSM North Stawell 0.029 31.8% 209,951 $3,537,067 AIV Activex 0.009 28.6% 353,613 $1,508,518 RC1 Redcastle Resources 0.01 25.0% 1,151,919 $3,282,607 TMK TMK Energy 0.0025 25.0% 219,101 $15,183,224 LGP Little Green Pharma 0.11 25.0% 932,728 $26,554,933 NAG Nagambie Resources 0.021 23.5% 2,286,784 $13,542,807 AUZ Australian Mines 0.011 22.2% 2,686,306 $12,586,609 EG1 Evergreen Lithium 0.085 21.4% 55,029 $3,936,100 BLZ Blaze Minerals 0.006 20.0% 2,649,441 $3,142,791 BXN Bioxyne Ltd 0.012 20.0% 6,406,147 $20,466,454 HFY Hubify 0.012 20.0% 2,922,715 $5,111,363 POS Poseidon Nickel 0.006 20.0% 7,546,748 $21,019,377 Code Name Price % Change Volume Market Cap OVT Ovanti 0.014 250.0% 115,106,477 $6,225,393 CY5 Cygnus Metals 0.135 68.8% 8,165,887 $30,382,791 CDE Codeifai 0.0015 50.0% 2,304,580 $2,641,295 KNB Koonenberry Gold 0.017 41.7% 20,725,645 $3,453,450 PV1 Provaris Energy 0.031 40.9% 1,192,086 $13,881,281 SLM Solis Minerals 0.11 35.8% 329,499 $6,267,966 MOM Moab Minerals 0.004 33.3% 2,014,938 $2,426,443 TYX Tyranna Resources 0.004 33.3% 5,158,108 $9,863,776 NSM North Stawell 0.029 31.8% 209,951 $3,537,067 AIV Activex 0.009 28.6% 353,613 $1,508,518 RC1 Redcastle Resources 0.01 25.0% 1,151,919 $3,282,607 TMK TMK Energy 0.0025 25.0% 219,101 $15,183,224 LGP Little Green Pharma 0.11 25.0% 932,728 $26,554,933 NAG Nagambie Resources 0.021 23.5% 2,286,784 $13,542,807 AUZ Australian Mines 0.011 22.2% 2,686,306 $12,586,609 EG1 Evergreen Lithium 0.085 21.4% 55,029 $3,936,100 BLZ Blaze Minerals 0.006 20.0% 2,649,441 $3,142,791 BXN Bioxyne Ltd 0.012 20.0% 6,406,147 $20,466,454 HFY Hubify 0.012 20.0% 2,922,715 $5,111,363 POS Poseidon Nickel 0.006 20.0% 7,546,748 $21,019,377

Ovanti (ASX:OVT) was up after revealing that, following a lengthy search, the company has appointed former US CFO of Zip Co Simon Keast as Chief Executive Officer, which will take effect from 1 November 2024. This is, apparently, huge news – Ovanti was up more than 200% by lunchtime.

Cygnus Metals (ASX:CY5) was up early in the session this morning, on news that the company has received firm commitments for A$11 million via a share placement to institutional and sophisticated investors amid “overwhelming demand” ahead of Cygnus’ planned merger with TSXV-listed Dore Copper Mining Corp. The placement was priced at A$0.072 per share, being a 10% discount to the last sale price of A$0.08.

Koonenberry Gold (ASX:KNB) was up for a few reasons today, most notably its decision to acquire 100% of the Enmore gold project in New South Wales from Global Uranium and Enrichment (ASX:GUE), in exchange for 35 million fully paid ordinary shares in KNB.

On top of that, KNB is also buying the Lachlan Project from Gilmore Metals, taking KNB’s landholding in NSW to 4,410km2, while building a “one of the most significant portfolios in NSW” across “a portfolio of projects in frontier, emerging and world class terranes”. To help fund it all, Lion Selection Group (ASX:LSX) has committed $350,000 towards the $4.5 million fundraising and transformation for Koonenbery.

North Stawell Minerals (ASX:NSM) was up after it announced the completion of the Shortfall Bookbuild which concludes the four for five non-renounceable pro-rata entitlement offer at an Offer Price of $0.01 per New Share, fully underwritten by Henslow, to raise approximately $1.1 million.

Redcastle Resources (ASX:RC1) was up on news that the company is set to increase its tenement footprint in the highly prospective Redcastle–Queen Alexandra gold corridor following the acquisition of a strategic tenement, allowing it P access to new multiple exploration targets along a trend of historical workings at the site.

Little Green Pharma (ASX:LGP) jumped after it delivered a heathy quarterly report, showing record revenue of $10.2 million (unaudited), up 40% on prior quarter and cash receipts of $10.8 million, up over 30% on prior quarter. The company’s net operating cash inflow of over $1.0 million has resulted in a cashflow positive quarter of $0.6 million.

Blaze Minerals (ASX:BLZ) was up on news it has has executed a binding agreement with Gecko Minerals, an Australian unlisted public company, to acquire a 60% interest in Gecko Minerals Uganda, the legal and beneficial owner of the Ntungamo project (three granted exploration licences) and the Mityana Project (one granted exploration licence) which are prospective for critical metals including beryllium, rubidium, lithium, tin and tantalite in western and central Uganda. The company also has an option to acquire the remaining 40% of Gecko Uganda within a two-year period.

Bioxyne (ASX:BXN) was rising after delivering a quarterly this morning that showed quarterly revenue of $4.6 million, up 48% on Q4 FY2024 and an 119% increase on Q1 FY2024, and quarterly cash receipts of $5.8 million, generating positive operating cash flow for the quarter of $1.2 million.

Hubify (ASX:HFY) climbed after the company released a statement from chairman Anthony Ghattas which said a lot of words but was a little thin on actual performance data – but the news must be good, because people with a better attention span than mine have obviously been able to make sense of it.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 17 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy 0.001 -33.3% 2,040 $8,737,021 EEL Enrg Elements 0.002 -33.3% 2,656,666 $3,135,048 LPD Lepidico 0.002 -33.3% 2,020,791 $25,767,375 OFX OFX Group 1.555 -31.8% 8,036,998 $547,138,919 TGH Terragen 0.042 -30.0% 4,650 $22,144,868 ALR Altair Minerals 0.003 -25.0% 3,081,075 $17,186,310 CDT Castle Minerals 0.003 -25.0% 10,000 $5,491,256 PAB Patrys 0.003 -25.0% 500,000 $8,229,789 CUS Coppersearch 0.035 -20.5% 630,059 $4,997,758 88E 88 Energy 0.002 -20.0% 723,750 $72,334,530 GCR Golden Cross 0.002 -20.0% 399 $2,743,140 IVX Invion 0.002 -20.0% 2,039,325 $16,916,479 PRX Prodigy Gold 0.002 -20.0% 2,200,000 $5,831,140 WNXDA Wellnex Life 0.65 -19.8% 26,058 $22,710,499 PVW PVW Resources 0.019 -17.4% 133,344 $4,574,810 AGC AGC 0.195 -17.0% 2,787,252 $60,300,347 ADD Adavale Resources 0.0025 -16.7% 452,362 $3,671,296 CMD Cassius Mining 0.005 -16.7% 279,500 $3,252,027 MEL Metgasco 0.005 -16.7% 1,052,582 $8,745,520 1CG One Click Group Ltd 0.011 -15.4% 2,960,336 $10,072,315

ICYMI – AM EDITION

Anson Resources (ASX:ASN) has raised $2.3m via an oversubscribed share purchase plan following the company’s $5m institutional placement.

Funds from the placement and SPP will be spent towards developing existing assets in the Tier 1 jurisdictions of Australia and the US.

“We are very encouraged by the response to the SPP,” ASN executive chairman and CEO Bruce Richardson said.

“The number and value of applications is a strong endorsement of our growth strategy for Anson and the development of our flagship assets.”

Besra Gold’s (ASX:BEZ) Jugan project leader, Matthew Antill, has kicked off work as managing director.

Antill will have responsibility for moving the Jugan project in Malaysia towards commercialisation, through pilot plant production and delivery of a definitive feasibility study (DFS). He will also implement a greater focus to the tailings recovery project.

“I am excited to join the Besra team ahead of schedule,” Antill said.

“I see enormous potential for the Bau projects with an immediate focus on Jugan – it is a rare opportunity to be able to join a company like Besra that has as many ounces in resource and is so well capitalised with ambitious, but realistic, production aspirations.”

Godolphin Resources (ASX:GRL) has raised $614,000 through a strongly supported share purchase plan (SPP), providing the company with funding to advance exploration at the Lewis Ponds gold-silver-base metals project in the Lachlan Fold Belt.

Activities will include diamond drilling and metallurgical test work to increase the confidence level in the upper portion of the resource and update the 2012 inferred resource of 6.20 Mt at 2.0g/t gold, 80g/t silver, 2.7% zinc, 1.6% lead and 0.2% copper.

The explorer exceeded its expectations, initially targeting to raise $300,000 via the SPP.

The issue price of $0.0125 represented a 17.8% discount to the volume average market price of shares traded on ASX in the five days on which sales of the shares were recorded by the ASX prior to Monday, September 23, 2024.

At Stockhead, we tell it like it is. While Anson Resources, Besra Gold, Bioxyne, Koonenberry Gold and Godolphin Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.