ASX Small Caps Lunch Wrap: Local markets bounce back +0.5pc after a wobbly start

Pic via Getty Images.

- ASX rebounds to +0.5pc after opening lower this morning

- Investors shrug off RBA news that suggests we need to wait a bit longer for rate cuts

- Small Caps lead the charge as punters go bargain hunting today

Local markets opened lower this morning, despite a solid session on Wall Street and pretty much everywhere else on the list of major markets.

The morning slump came after the RBA met yesterday to do nothing about interest rates, while RBA officials have spent the morning appearing before a senate committee to answer a barrage of questions about why it’s getting too expensive to exist in Australia.

However, it’s not all grim news – the benchmark has rebounded to 0.5% at lunchtime, 9 out of the 11 ASX sectors are in positive territory and there’s a handful of Small Caps making some very tidy gains.

Let’s dive in.

TO MARKETS

Yesterday’s RBA board meeting wrapped up with very few surprises from Governor Michele Bullock during a post-lunch media scrum.

We all knew that interest rates weren’t going to budge, and we all knew why there wasn’t any movement at the station – inflation is still too high, so the RBA kept interest rates on hold at 4.35%.

Indeed, yesterday the RBA issued a statement, which read in part:

“Financial markets have been volatile of late and the Australian dollar has depreciated.

“Geopolitical uncertainties remain elevated, which may have implications for supply chains.

“The board will rely upon the data and the evolving assessment of risks to guide its decisions.

“In doing so, it will continue to pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.”

So… nothing we haven’t heard before.

What was surprising, though, was Bullock’s fairly frank admissions on possible rate cuts, as the RBA has typically been fairly coy when it comes to crystal ball gazing.

“Based on what I know today … we can say that a near-term reduction in the cash rate doesn’t align with the board’s current thinking,” Bullock said.

“I understand that this is not what people want to hear. I know there are many households and small businesses that are struggling with interest rates where they are.

“Are we heading for recession? I don’t believe so, and the board doesn’t believe so, because we still believe that we’re on that narrow path.

“Having said that, we are data dependent, and there’s a number of things … that could result in the economy slowing much more quickly than we expect and we need to be alert to those.

“If they come to pass, then yes, interest rate cuts would be on the agenda,” she said.

It’s a brave, yet predictable, stance from the RBA – especially in light of the number of pundits that were pointing to the turmoil on US markets in recent days and asking aloud if the US Fed is moving too slowly on rates.

So… when can we expect things to change? The RBA’s own Statement on Monetary Policy points out that it’s going to be a long wait until we see any sort of rate relief, with its data revealing that the inflation is slowing, but not fast enough support a reduction in the cash rate.

More importantly, it is moving slower than the RBA thought it would be – which means, according to Bullock, that we’re as much as six months away from any significant movement.

There are representatives of the RBA that have been locked in a room with some senators in Canberra this morning, being grilled on the cost-of-living issues that are making things very tough for lots of Australians.

The general gist of the explanations are easily summed up: “We know you’re hurting, but for the moment, our hands are tied.”

Investors have had time to digest Bullock’s comments, and while the market did open lower this morning, there’s been a rally strong enough to push the benchmark back into positive territory at lunchtime today.

The ASX 200 dipped 0.3%, but has rebounded to be up 0.27% just after midday, with strong investor support for the Energy sector, which has taken some significant damage over the past few days.

A look at the sector performance overall shows Energy out in front by a considerable margin, with Consumer Staples the lone laggard as we begin our journey through to the closing bell.

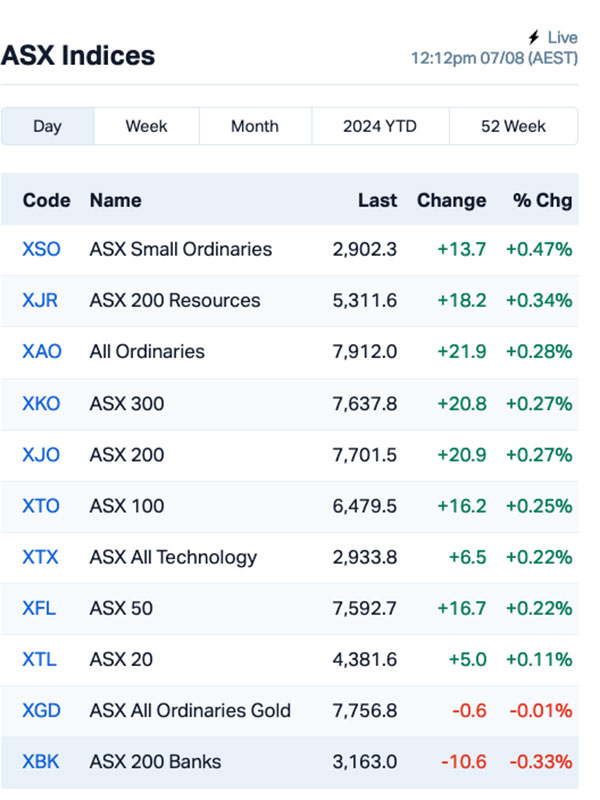

A look at the ASX indices reveals that it’s the Small Caps doing a lot of the heavy lifting, with the XSO Small Ordinaries index in front on +0.47%, and working hard to claw back from of the steep losses it endured since Friday.

Yesterday’s strong performance from the banks is slowly being unwound, and the ASX goldies are essentially flat, for now.

There will undoubtedly be more to report from the senate hearings later on today – if anything startling happens, we’ll let you know.

NOT THE ASX

US investors appear to have taken a bit of a chill pill overnight, taking a break from punishing themselves and taking Wall Street back towards the far happier, greener fields of positivity with a solid burst of bargain hunting overnight.

The S&P 500 bounced back 1.04%, the blue chips Dow Jones index lifted by 0.74%, and the tech heavy Nasdaq rallied by 1.03%.

Wall Street’s ‘fear gauge’ – the VIX – retreated by 30%, its biggest one-day drop since 2010, after surging by 65% the previous day.

Demand for haven assets have waned, with Treasury prices dropping and gold slumping. Bitcoin and Ether recovered from steep losses, Eddy Sunarto reported this morning.

But… and there’s always a but… Goldman Sachs has issued a note to say that it’s factoring in a 25% chance that the US is going to slide into recession, which has tempered enthusiasm in some quarters of New York.

In US stock news, Nvidia Corp surged 4%, leading the rise among chipmakers.

Both the “Magnificent Seven” index of major tech stocks and the Russell 2000 of small companies increased by over 1%.

In late trading, Airbnb sank by 16% to a weak outlook, as it reported Q2 profit of US$555m compared with last year’s US$650m.

Super Micro Computer fell 11% despite providing a strong sales forecast as businesses invest in equipment for advanced AI tasks.

And, Reddit fell 3% post-market despite exceeding analysts’ expectations on sales growth and narrowing its loss in Q2.

In other markets overnight, things were going reasonably well, considering the heart-stopping shake-up from earlier in the week.

In the UK, the FTSE added 0.23%, which isn’t bad considering that a lot of England currently resembles a warzone, with rioting and looting by far-right agitators over the past week in the wake of a horrifying knife attack that claimed the lives of three young girls.

Japan has bounced back in a big way since losing a breathtaking 12.4% in a single session on Monday, with the Nikkei popping a 10% climb in yesterday’s session and backing that up with a more modest, but stil significant, +1.8% so far today.

Hong Kong’s Hang Seng is up 1.4%, and Shanghai markets are steady at +0.7%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 07 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MHI Merchant House 0.15 114.3 276,766 $6,598,655 AMD Arrow Minerals 0.003 50.0 7,037,308 $21,078,730 HCD Hydrocarbon Dynamic 0.003 50.0 100,000 $1,617,165 TKL Traka Resources 0.0015 50.0 250,000 $1,945,659 CRR Critical Resources 0.007 40.0 749,351 $8,901,751 ICL Iceni Gold 0.042 35.5 169,226 $8,455,593 IEC Intra Energy Corp 0.002 33.3 325,000 $2,536,172 POS Poseidon Nick Ltd 0.004 33.3 1,976,355 $11,140,604 YAR Yari Minerals Ltd 0.004 33.3 26,227 $1,447,073 LBT LBT Innovations 0.02 33.3 21,264,877 $23,515,417 GSM Golden State Mining 0.013 30.0 306,708 $2,793,706 BPH BPH Energy Ltd 0.0205 28.1 12,396,512 $18,360,771 BUY Bounty Oil & Gas NL 0.005 25.0 6,908,467 $5,994,004 CTO Citigold Corp Ltd 0.005 25.0 10,000 $12,000,000 CTM Centaurus Metals Ltd 0.38 24.6 576,845 $151,345,779 HCL Highcom Ltd 0.215 22.9 5,643,176 $17,969,468 MHK Metalhawk. 0.084 20.0 379,218 $7,046,900 AUA Audeara 0.03 20.0 200,000 $3,630,603 BXN Bioxyne Ltd 0.006 20.0 3,060,613 $10,233,227 GTI Gratifii 0.006 20.0 642,839 $8,780,238

Arrow Minerals (ASX:AMD) was moving early on Wednesday after releasing an exploration target estimate for its Niagara Bauxite Project, which the company says has come in at approximately 170 – 340Mt at a grade range of approximately 40-46% Al2O3, and 1-4% SiO2, which the company has reminded investors is a “conceptual” figure, not an official mineral resource estimate.

Centaurus was gaining nicely after delivering a presentation at the Diggers and Dealers conference in Kalgoorlie, which no doubt focussed heavily on its recent news of a major increase in its Mineral Resource Estimate for the Jaguar Nickel Project in Brazil, which puts the project on a whopping 138.2Mt @ 0.87% Ni for 1.20 million tonnes of contained nickel, which Centaurus says “cements its place as a Tier-1 project”.

Manhattan Corp (ASX:MHC) was up early after revealing that the entitlement offer announced by the company on Tuesday, 30 July 2024 is now open. The company is looking to raise up to $1.5 million, through a 1 for 2 non-renounceable pro-rata entitlement offer of 1,468,490,084 new Shares on a pre-Consolidation basis, at an issue price of $0.001 per New Share.

Australian med-tech LBT Innovations (ASX:LBT) gained on news that it has inked a deal to sell five of its APAS Independence instruments – used for environmental monitoring during drug manufacturing – to AstraZeneca AB and to provide annual maintenance and support services over seven years, with the contract worth between $3.4 million and $4.1 million.

HighCom (ASX:HCL) was back in the winner’s circle on Wednesday, after providing fresh guidance for its FY24 results, revealing that revenue has come in at the lower end ($46 million) of the estimate given to the market in May. The company says that a delay in finalising a recent contract has pushed that revenue out to FY25, and that the company has seen an improvement in cash holdings from $1.6 million to $6.2 million, with new orders of ballistic products for US domestic and international customers valued at $13.7 million to be delivered soon.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 07 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap TEG Triangle Energy Ltd 0.007 -50.0 87,071,662 $29,121,876 OVT Ovanti Limited 0.003 -25.0 171,488 $4,960,422 TIG Tigers Realm Coal 0.003 -25.0 203,467 $52,266,809 MOZ Mosaic Brands Ltd 0.036 -21.7 1,344,115 $8,211,296 EVR Ev Resources Ltd 0.004 -20.0 30,000 $6,981,357 SKN Skin Elements Ltd 0.004 -20.0 300,052 $2,947,430 JBY James Bay Minerals 0.11 -18.5 19,499 $4,514,738 CAZ Cazaly Resources 0.018 -18.2 3,533,390 $10,148,666 QEM QEM Limited 0.115 -17.9 39,076 $21,194,840 ECT Env Clean Tech Ltd. 0.0025 -16.7 16,437 $9,515,431 EEL Enrg Elements Ltd 0.0025 -16.7 1,015,000 $3,029,895 NYR Nyrada Inc. 0.036 -16.3 580,254 $7,834,974 DAF Discovery Alaska Ltd 0.011 -15.4 3,180 $3,045,051 IXU Ixup Limited 0.023 -14.8 643,901 $41,789,320 BMO Bastion Minerals 0.006 -14.3 198,176 $3,045,587 EPM Eclipse Metals 0.006 -14.3 180,000 $15,755,989 PAB Patrys Limited 0.006 -14.3 248,888 $14,402,131 SRN Surefire Rescs NL 0.006 -14.3 317,000 $13,904,155 PLN Pioneer Lithium 0.155 -13.9 8,247 $5,148,000 ATC Altech Batt Ltd 0.04 -13.0 2,272,579 $78,686,309

ICYMI – AM EDITION

Altech Batteries (ASX:ATC) is raising up to $8.5m through a partially underwritten entitlement offer and a further $405,000 through a placement of shares priced at 4c each.

The placement of 10.125 million shares will be made to sophisticated and professional investors while the entitlement offer of one share for every eight shares held will be partially underwritten to the tune of $5m by major shareholder MAA Group Berhard.

Participants in both the placement and entitlement offer will also receive one free attaching offer exercisable at 6c and expiring on 31 December 2025 for every two shares subscribed for.

Proceeds will be used to progress the company’s Cerenergy solid state sodium chloride battery and Silumina Anodes projects.

At Stockhead, we tell it like it is. While Altech Batteries is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.