ASX Small Caps Lunch Wrap: Local bourse sleepwalks to lunch, PLS falls 5pc

Pic: Getty Images

- ASX edges down at the half-way point in a quiet session

- Pilbara Minerals falls 5pc as share block sale is reported

- Westpac sells auto finance unit for up to $1.6 billion

The ASX has edged down slightly by 0.04% this morning as traders navigate the ongoing tensions in the Middle East.

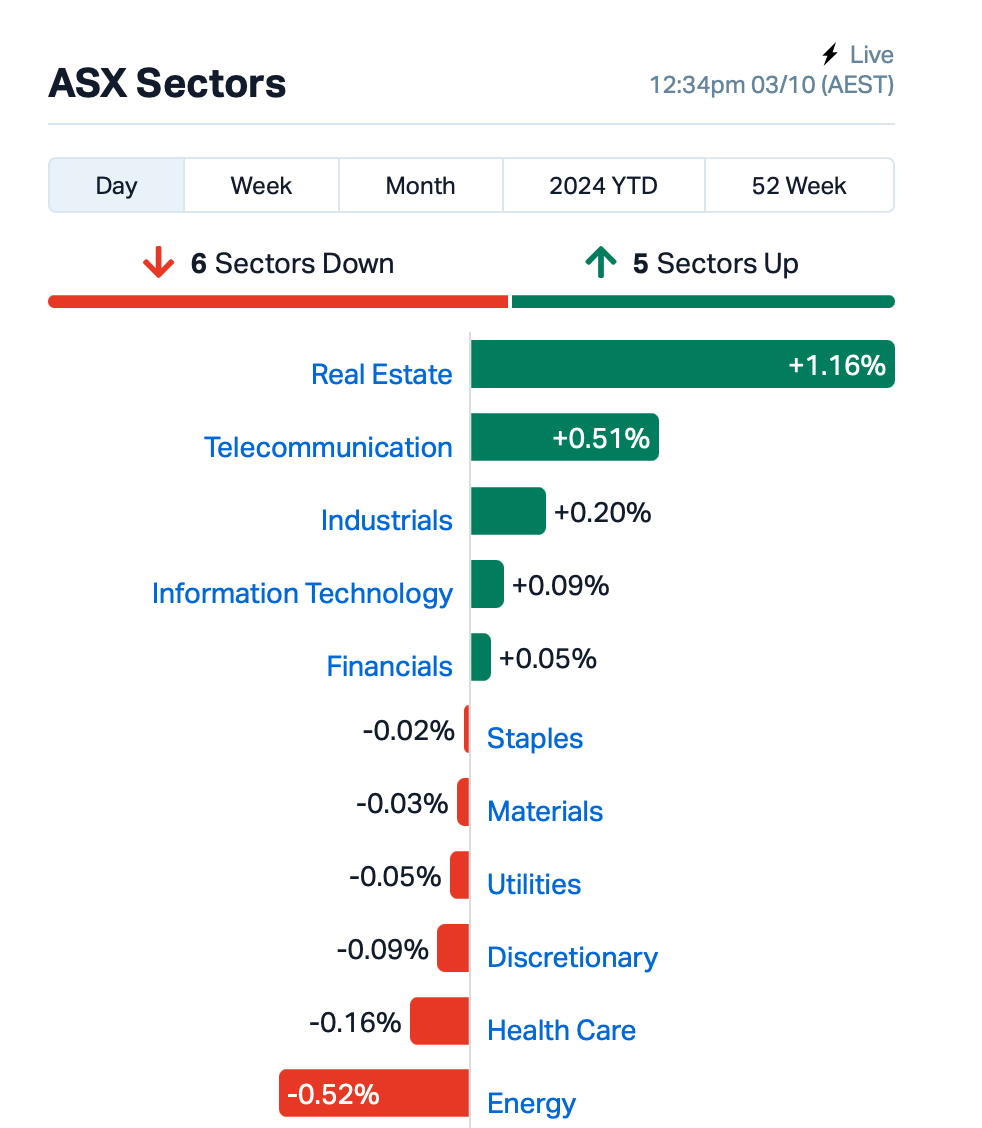

In a quiet trading session no ASX sector has moved more than 1% in either direction aside from real estate.

Overnight, it was similarly quiet with all major indexes moving up less than 0.1%.

Traders are exercising caution following Iran’s recent strike on Israel, anticipating a retaliatory response from Israel but uncertain about when it might occur.

When asked last night if he would support an Israeli retaliatory attack, President Biden replied, “The answer is no.”

Biden added that he was scheduled to speak with PM Benjamin Netanyahu and noted that the G-7 was preparing a statement to help prevent further escalation.

Energy stocks on the ASX pulled back today following yesterday’s rally, as oil prices steadied after a 5% surge.

In the large caps space this morning, lithium miner Pilbara Minerals (ASX:PLS) slumped 5% after a report from the AFR suggested that Morgan Stanley and Bank of America were trying to sell a ~$270m block of PLS shares.

The news pushed other lithium plays like MinRes (ASX:MIN) and IGO (ASX:IGO) lower by over 1%.

Westpac (ASX:WBC) also slipped 1% after announcing that it was selling its auto finance loans and lease receivables to Resimac Group (ASX:RMC) for between $1.4 billion and $1.6 billion, with the deal expected to close in the first half of 2025.

The move wraps up Westpac’s exit from the auto finance sector, following a partial sale in 2021, and is not anticipated to significantly affect its financial results.

NOT THE ASX

Data released on last night indicated that US companies added more jobs than anticipated last month, which contrasts with other signals pointing to a slowing labour market.

The upcoming non-farm payrolls report on Friday will provide another check for the overall health of the US economy, and will influence the Fed’s upcoming interest rate decision.

“Friday’s monthly jobs report will have the final word on the current jobs picture, and more than likely, on near-term market sentiment,” said Chris Larkin at E*Trade.

Oil prices steadied a little after the 5% jump yesterday, with Brent rising by 1.6% to US$74.60 a barrel.

The crude call options market indicates that traders are concerned about potential supply disruptions, as evidenced by the significant buying activity in options with a strike price of US$100 per barrel.

“As long as oil prices remain below $100 per barrel and corporate profits remain strong, that is supportive of higher stock prices,” said Mary Ann Bartels at Sanctuary Wealth.

In stock news, Tesla fell by 3.5% after its Q3 delivery numbers came in lower than expected, as discounts and financing deals didn’t attract enough buyers for its older electric vehicles.

With growing competition and a slowdown in EV demand, experts believe Tesla could be facing its first-ever drop in annual deliveries after years of rapid growth.

But investors are still hopeful about Tesla’s event in Los Angeles on October 10, where the company is set to reveal a new robotaxi and shift focus to AI tech.

Apple was up slightly after a JPMorgan survey found that more people want to buy iPhones compared to last year, but it’s not due to the new AI features.

The report showed that 68% of about 500 surveyed consumers are interested in getting a new iPhone, and they wanted a faster device with 5G connectivity not AI features.

In Asia today, the Japanese Nikkei index rose another 2% today after the nation’s new prime minister damped speculation about another interest-rate increase.

His statement weakening the Yen, which fell to a more than one-month low against the US dollar. As we know, Japan’s export-driven stock market relies on a weaker yen for support.

Bank of Japan official Asahi Noguchi is set to speak later today, potentially offering investors further clarity.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 3 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| XPN | Xpon Technologies | 0.011 | 57% | 2,090,905 | $2,537,090 |

| AKN | Auking Mining Ltd | 0.006 | 50% | 3,304,246 | $1,410,281 |

| ERL | Empire Resources | 0.003 | 50% | 1,418,392 | $2,967,826 |

| VML | Vital Metals Limited | 0.003 | 50% | 6,500,000 | $11,790,134 |

| VAR | Variscan Mines Ltd | 0.01 | 43% | 2,300,628 | $3,101,003 |

| FIN | FIN Resources Ltd | 0.007 | 40% | 244,795 | $3,246,344 |

| ERA | Energy Resources | 0.011 | 38% | 9,341,177 | $177,186,394 |

| ILA | Island Pharma | 0.11 | 38% | 3,061,577 | $10,151,108 |

| H2G | Greenhy2 Limited | 0.004 | 33% | 4,743,788 | $1,794,553 |

| RBR | RBR Group Ltd | 0.002 | 33% | 2,620,000 | $2,451,607 |

| VRC | Volt Resources Ltd | 0.004 | 33% | 1,014,093 | $12,476,034 |

| HPC | The Hydration Company | 0.03 | 30% | 1,779,283 | $7,013,001 |

| NYR | Nyrada Inc | 0.11 | 26% | 1,946,169 | $15,852,157 |

| G88 | Golden Mile Res Ltd | 0.015 | 25% | 1,108,093 | $4,934,674 |

| GTR | Gti Energy Ltd | 0.005 | 25% | 1,717,378 | $11,161,224 |

| IBG | Ironbark Zinc Ltd | 0.0025 | 25% | 944 | $3,667,296 |

| HIQ | Hitiq Limited | 0.017 | 21% | 312,500 | $4,925,830 |

| PH2 | Pure Hydrogen Corp | 0.17 | 21% | 1,236,195 | $50,887,315 |

| CC9 | Chariot Corporation | 0.145 | 21% | 136,644 | $10,755,343 |

| PFT | Pure Foods Tas Ltd | 0.018 | 20% | 21,325 | $1,831,384 |

| GES | Genesis Resources | 0.006 | 20% | 300,000 | $3,914,206 |

| INV | Investsmart Group | 0.13 | 18% | 5,000 | $15,693,753 |

| AJX | Alexium Int Group | 0.013 | 18% | 12,151 | $17,312,666 |

| FRB | Firebird Metals | 0.135 | 17% | 148,815 | $16,371,561 |

Island Pharmaceuticals (ASX:ILA) shot up early doors this morning after coming off a trading halt with some good news. The company has secured $3.5m in new funding from some notable names.

Subject to shareholder approval, the placement was supported by well-known biotech names including Dr Daniel Tillett, the head of cancer drug repurposer Race Oncology (ASX:RAC).

Hong Kong-based fund manager, Angus Walker also chipped in, as did Island co-founder and major investor, Dr Bill Garner, substantial shareholder Jason Carroll and recently appointed director Chris Ntoumenopolous.

The fresh funding will go towards the completion of the company’s ISLA-101 Phase 2a/b clinical trial in dengue fever, following dosing of Phase 2a subjects, announced earlier today. The capital will also help advance the due diligence program for antiviral therapeutic, Galidesivir.

For more coverage on this, read this morning’s Health Check column by Tim Boreham.

Meanwhile, in ressie land, Golden Mile Resources (ASX:G88) has announced further encouraging results from its Pearl Copper project in Arizona, USA. It’s talking sighting of “visible copper” with pXRF results highlighting polymetallic potential including: copper values up to 13.4%, lead values up to 1.29% and zinc values up to 7.22%.

And Chariot Corporation (ASX:CC9) is swinging high after revising its strategy for the Black Mountain hard rock lithium project in Wyoming, US. It notes it will shift from exploring for a large-scale resource to testing the viability of establishing a smaller-scale “pilot mine” at Black Mountain, with the goal of supplying spodumene concentrate to several lithium hydroxide refineries under construction in the southwestern United States.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 3 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WML | Woomera Mining Ltd | 0.002 | -33% | 370,000 | $6,165,223 |

| ALR | Altair Minerals | 0.003 | -25% | 10,474,702 | $17,186,310 |

| PAB | Patrys Limited | 0.003 | -25% | 280,000 | $8,229,789 |

| IBX | Imagion Biosys Ltd | 0.036 | -22% | 285,633 | $1,639,741 |

| XGL | Xamble Group Limited | 0.022 | -21% | 505,040 | $8,292,399 |

| OVT | Ovanti Limited | 0.004 | -20% | 4,115,532 | $7,781,742 |

| IMI | Infinity Mining | 0.035 | -19% | 160,750 | $5,836,998 |

| LPD | Lepidico Ltd | 0.0025 | -17% | 1,077,420 | $25,767,375 |

| PRM | Prominence Energy | 0.005 | -17% | 16,667 | $2,335,058 |

| RIM | Rimfire Pacific | 0.036 | -14% | 4,534,459 | $96,399,845 |

| UCM | Uscom Limited | 0.012 | -14% | 3,101 | $3,506,678 |

| AAU | Antilles Gold Ltd | 0.0035 | -13% | 5,932,907 | $7,422,971 |

| ATH | Alterity Therap Ltd | 0.0035 | -13% | 102,280 | $21,281,344 |

| BNL | Blue Star Helium Ltd | 0.0035 | -13% | 207,496 | $9,724,426 |

| ETM | Energy Transition | 0.022 | -12% | 1,885,077 | $35,217,717 |

| GBZ | GBM Rsources Ltd | 0.008 | -11% | 811,000 | $10,410,200 |

| HLX | Helix Resources | 0.004 | -11% | 550,000 | $14,688,872 |

| BRN | Brainchip Ltd | 0.2275 | -11% | 12,828,978 | $500,429,334 |

| AKG | Academies Aus Grp | 0.125 | -11% | 1 | $18,566,025 |

| BEO | Beonic Ltd | 0.025 | -11% | 50,000 | $17,646,450 |

| PSL | Paterson Resources | 0.017 | -11% | 178,573 | $8,664,720 |

| SYR | Syrah Resources | 0.3 | -10% | 5,725,323 | $346,688,742 |

| MTH | Mithril Silver Gold | 0.49 | -10% | 1,961,262 | $56,176,541 |

| CXU | Cauldron Energy Ltd | 0.02 | -9% | 2,723,443 | $27,214,674 |

| EPM | Eclipse Metals | 0.005 | -9% | 25,000 | $12,379,705 |

IN CASE YOU MISSED IT

Chariot Corporation (ASX:CC9) has revised its strategy for its Black Mountain project in Wyoming, USA, and now envisions a shift from exploring for a large-scale resource to instead testing the viability of a pilot mine at the project that could rapidly produce spodumene concentrate to capitalize on the growing lithium supply deficit in the US market.

The contemplated modular plant design is expected to reduce upfront costs and offer flexibility to scale up rapidly, and the company says its long-term pilot mine strategy could provide short-term cash flow and potentially could optimize the development of larger-scale mining operations in the future.

The plan near-term is for 4,300m of Phase 2 RC drilling to define a high-priority, small-scale lithium resource to underpin the pilot mine and establish the foundation for future larger-scale resource definition.

Antipa Minerals (ASX:AZY) has appointed Mark Rodda as executive chair, effective today.

Rodda has been a director of Antipa since 2010, and brings nearly 30 years of experience as a lawyer and corporate consultant, with an extensive background in legal, commercial, and corporate management roles within the resources sector.

The company says his expertise is well aligned with its exploration and development plans in the Paterson Province, home to its flagship Minyari Dome gold-copper project.

The Paterson Province is attracting significant new investment and investor attention with its world-class gold and copper operations and development projects, including the Telfer mine and processing facility, Greatland Gold’s (LSE:GGP) Havieron development project, and Rio Tinto’s (ASX:RIO) Winu development project.

With Rodda’s particular skill set in legal governance, project development, and corporate strategy, Antipa says its well-positioned to maximise the value of its portfolio of strategic interests, while rapidly advancing the exploration and advancement of the Minyari Dome project.

Summit Minerals (ASX:SUM) has appointed Jamie Wright as a non-executive director, effective immediately.

Wright brings a wealth of experience in the minerals sector, including as the managing director of Global Lithium Resources (ASX:GL1) where he led the company through an IPO and a period of substantial growth.

“His extensive experience in the critical minerals sector from exploration to development will complement our strategic direction as we continue to explore and develop our asset portfolio. Jamie’s insights will be instrumental in guiding Summit Minerals as we progress our Equador niobium and tantalum project,” said managing director Gower He.

At Stockhead, we tell it like it is. While Chariot Corporation, Antipa Minerals, Summit Minerals, Golden Mile Resources and Island Pharmaceuticals are Stockhead advertisers, they did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.