ASX Small Caps Lunch Wrap: Local benchmark up 0.3pc at lunch after another win on Wall Street

Pic: Getty Images

- ASX 200 lifted early before settling at around 0.3pc at lunchtime

- It’s been a relatively quiet day, except for Real Estate big gun Dexus, which is having a shocker

- Small Caps have been led by funding boosts from various channels and uranium in Canada

Local markets kicked off the day a little higher than yesterday’s close, after yet another win on Wall Street put a bit of starch in investors’ collars and a spring in their step as well.

The ASX 200 spiked 0.56% shortly after the bell went off at 10:00am AEST, and through the morning it’s done its best to hang on to about 0.3% of that gain, with the goldies, resources and small caps providing the motivation, with real estate the anchor that no one really needs.

And aside from the usual chatter about gold prices, and – by golly, I’m excited – even more talk about the RBA and interest rates, there’s not exactly a huge quantity of exciting, breaking news today.

But let’s dive in, anyway – because if I don’t write something, I’ll almost definitely get in trouble… and we can’t have that now, can we?

Let’s go.

TO MARKETS

Aussie markets have taken a well-worn cue from Wall Street this morning, turning on the smiles and the charm in the wake of another solid session in New York – the eighth on the trot.

It was enough to propel the ASX 200 benchmark almost 0.6% higher in the opening minutes of today’s session on the local bourse, but that early impetus was short lived and at lunchtime the benchmark was closer to 0.3%.

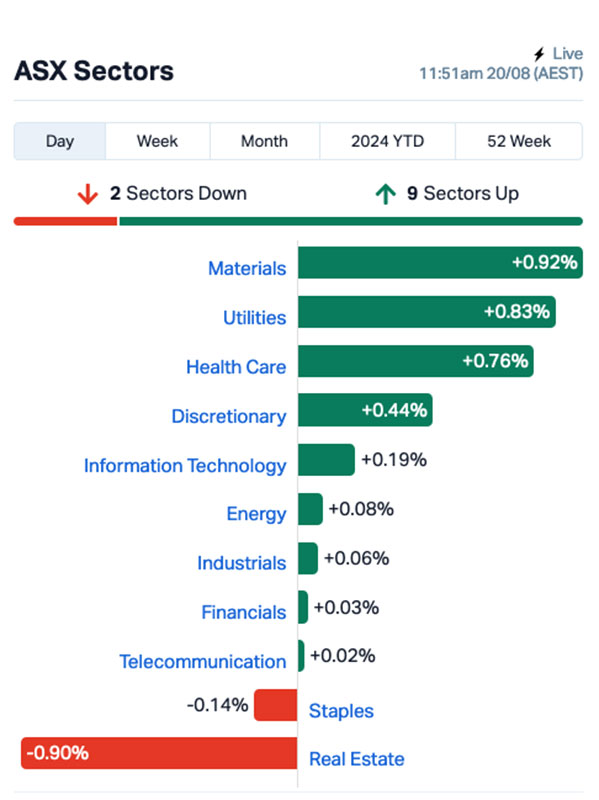

Here’s a quick look at the sectors:

Materials was out in front of the pack around midday, rising steadily thanks to decent gains from the top end of Digger Town – BHP (ASX:BHP) was up 1.2%, Sandfire Resources (ASX:SFR) was up more than 2.1% and there’s a host of large (and small) goldies enjoying the sunshine today.

Little wonder, considering that gold prices have managed to find a toehold above US$2,500 an ounce for a few days now, with some analysts already touting $2,600/oz in 2025, off the back of some serious chatter about BRICS.

If you’re out of the loop, that stands for Brazil, Russia, India, China, and South Africa – who have all been furiously buying up gold in recent times, reportedly as part of a push to spark divorce proceedings with the US dollar.

The Utilities sector was also tracking well for its third-straight day of significant gains, which is coming close to undoing the damage done last Thursday when it shed more than 4.1%.

One of the solid performers of the past couple of days has been Thursday’s villain, Origin Energy (ASX:ORG) – it lost a horrifying 9.9% when it told the market that it had made lots of money recently, but the future was looking a little grim.

But, it’s made 4.4% back in the past couple of days, and helped keep Utilities in general in the green since then, so I guess all is forgiven… or 4/9ths is forgiven, if we’re being strictly accurate.

Real Estate is taking a bit of a bath today, though, and the headline news from that sector is real estate management company Dexus (ASX:DXS) has suffered an eye-watering loss.

Analysts knew a loss was coming, and the hot money was on a $500 million drop – but the company revealed this morning that the loss is above $1.5 billion, which is (as they say in the classics) a catastrophe.

Dexus has all but admitted that it’s a massive problem, noting that it has already figured out $2 billion of its assets that will be sold off to help cover the gruesome blowout – but investors are doing what investors do, voting with their feet and steering Dexus into a sharp 6.73% loss for the day so far.

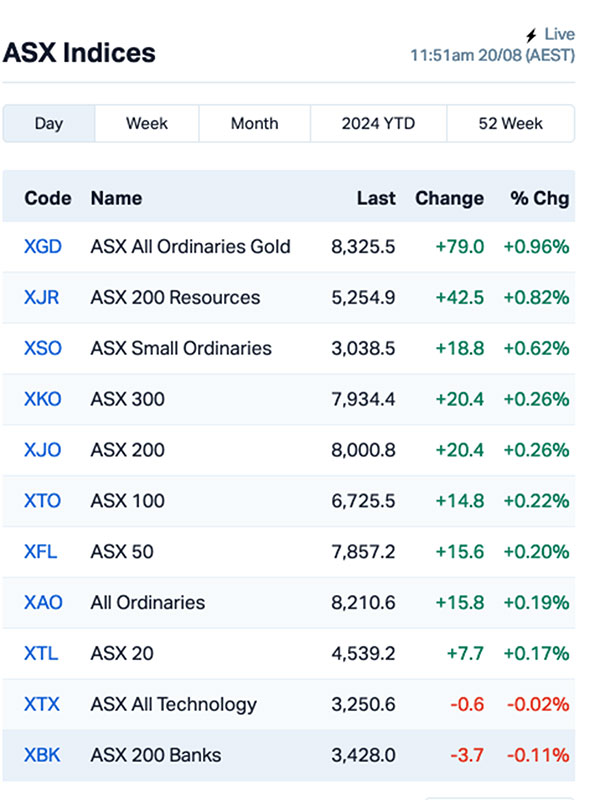

Here’s what the ASX indices looked like at lunch time.

There were no surprises there at all.

Outside of the market, people who are interested in such things have been digesting the minutes of the last RBA Board meeting, and that little document holds some mildly shocking news.

A number of people on the board were making some fairly strong noises in favour of a rate rise last month, as the RBA grapples with an inflation rate that won’t behave and a mid- to long-term outlook that ongoing high inflation is making look very, very ugly indeed.

But, it seems cooler heads prevailed and the board left rates where they were – but knowing that there’s a sizeable rump of rate hawks making the decisions at the RBA is likely to cause some consternation among investors. And among people with mortgages, because the rate relief that Bill and Barbara Bankloan are screaming out for seems to be getting further and further away every time they try to grab a hold of it.

The minutes clearly suggest that board members are going to be paying even more attention to data over the coming weeks – which is terrifying for at least two reasons.

First, it suggests that they’re not at all afraid to yank the rate rise/jackpot lever at least one more time, and secondly that they haven’t been paying close enough attention to the data so far.

I’m kidding, obviously. I’m sure they’re all very, very thorough.

NOT THE ASX

Overnight, the S&P 500 was up by 0.97% to notch its longest rally in 2024, the blue chips Dow Jones lifted by 0.58%, and the tech heavy Nasdaq edged higher by 1.39%.

The good news for US investors doesn’t stop there, though – those remarkable, trustworthy boffins at Goldman Sachs’ trading desk believe that momentum traders and a wave of corporate buybacks are likely to further fuel the US stock rally over the next four weeks.

“We just witnessed one of the largest and fastest unwinds that I have ever seen,” said Goldman’s Scott Rubner. “The August to September corporate repurchase window is historically strong.”

“I am bullish until September 16. This is when seasonals change. 2H of September is the worst two-week trading period of the year. I will not stick around for this,” Rubner added.

He didn’t say where he was going, but I’m guessing it’s Mexico.

Anyway – US investors are laughing it up, and will probably continue to do so right up until Friday (their time), when Jerome Powell is due to address the annual Moneylover’s Ball at the US central bank’s major annual meeting in Jackson Hole, Wyoming.

This year’s theme is “Money” and rumour has it that Powell will be spinning a few bangin’ tunes at the afterparty. Tickets are $10 million apiece.

In US stock news, Palo Alto Networks rose by 3% after it beat Wall Street’s expectations on quarterly profit forecast, and expanded its share buyback program.

Advanced Micro Devices jumped 4.5% after agreeing to acquire server manufacturer ZT Systems in a cash-and-stock deal worth US$4.9 billion, adding a data centre technology that will bolster its efforts to challenge Nvidia Corp.

Estée Lauder slipped 2% after forecasting annual revenue growth that falls short of analysts’ expectations.

And General Motors climbed 1% after reducing its workforce by more than 1,000 software engineers as it streamlines its software and services division.

In Asian markets this morning, the news is mixed. Japan’s Nikkei is up 1.65%, but the Hang Seng is down 0.31% and Shanghai markets are even worse off, dipping 0.84% so far this session.

In Hungary, markets are closed for the second half of St Stephen’s Day celebrations. He must have been pretty cool to warrant a double-header, but I bet no one in Hungary’s questioning why.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 20 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap JAV Javelin Minerals Ltd 0.002 100.0 2,689,334 $4,276,846 ICU Investor Centre Ltd 0.003 50.0 555,440 $609,023 CR9 Corellares 0.007 40.0 8,217,162 $2,325,462 ENT Enterprise Metals 0.004 33.3 133,342 $3,309,952 POS Poseidon Nick Ltd 0.004 33.3 475,057 $11,140,604 VRC Volt Resources Ltd 0.004 33.3 103,390 $12,476,034 YAR Yari Minerals Ltd 0.004 33.3 19,628 $1,447,073 FFG Fatfish Group 0.012 33.3 3,620,522 $12,659,157 GT1 Green Tech. Metals 0.084 31.3 1,542,737 $20,592,134 M2R Miramar 0.009 28.6 38,456,740 $2,763,457 88E 88 Energy Ltd 0.0025 25.0 1,174,774 $57,867,624 AX8 Accelerate Resources 0.01 25.0 921,019 $4,974,031 BDG Black Dragon Gold 0.018 20.0 805,782 $4,012,765 BSX Blackstone Ltd 0.03 20.0 305,506 $13,159,070 ADD Adavale Resource Ltd 0.003 20.0 363,333 $3,028,580 BP8 Bph Global Ltd 0.003 20.0 260,333 $991,604 ESR Estrella Res Ltd 0.006 20.0 3,092,957 $8,796,859 HHR Hartshead Resources 0.006 20.0 9,688,395 $14,043,411 TEG Triangle Energy Ltd 0.006 20.0 3,311,310 $10,400,670 VML Vital Metals Limited 0.003 20.0 1,515,000 $14,737,667

Corella Resources (ASX:CR9) was up Tuesday morning on news that it has been granted government funding to fast track an R&D program to investigate a new and alternative HPA Flowsheet for its Tampu kaolin deposit in Western Australia, in conjunction with an industry partner and the Chemical Engineering division of the University of Queensland.

Green Technology Metals (ASX:GT1) was climbing early on news of the execution of a Framework Agreement and corporate Subscription Agreement with leading South Korean EV battery metals producer EcoPro Innovation Co, which will bring in $8 million via a two-tranche placement at a premium of 40% over the company’s 90-day VWAP, as part of GT1’s strategy to become the first integrated lithium producer in Ontario.

Earlier, and also in Canada, Koba Resources (ASX:KOB) was gaining on Tuesday after announcing “exceptionally high-grade rock chip assays” from its inaugural sampling and prospecting program at the Harrier Uranium Project, including samples as high as 74,800ppm (7.48%) U3O8, and 72,000ppm (7.20%) U3O8, with a further 5 samples assaying >30,000ppm (3.0%) U3O8.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 20 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap KBC Keybridge Capital 0.046 -29.2 50,001 $13,476,959 1TT Thrive Tribe Tech 0.0015 -25.0 15,746,388 $1,223,243 BCT Bluechiip Limited 0.003 -25.0 245,000 $4,728,158 MEL Metgasco Ltd 0.003 -25.0 30,272,117 $5,790,347 VR1 Vection Technologies 0.011 -21.4 11,911,056 $15,772,246 BYH Bryah Resources Ltd 0.004 -20.0 3,132 $2,516,434 PRX Prodigy Gold NL 0.002 -20.0 35,000 $5,294,436 RGL Riversgold 0.004 -20.0 1,780,512 $6,637,313 YAL Yancoal Aust Ltd 5.66 -18.7 15,667,949 $9,190,258,482 BIS Bisalloy Steel 3.14 -18.7 493,508 $184,066,787 AUA Audeara 0.025 -16.7 471,538 $4,356,724 LML Lincoln Minerals 0.005 -16.7 1,919,999 $12,337,557 PRM Prominence Energy 0.005 -16.7 152,846 $1,868,258 RNE Renu Energy Ltd 0.0025 -16.7 346,448 $2,178,402 WMG Western Mines 0.265 -15.9 210,848 $25,483,839 QHL Quickstep Holdings 0.27 -15.6 213,491 $22,952,388 MCM Mc Mining Ltd 0.076 -15.6 15,000 $37,261,201 RHI Red Hill Minerals 3.65 -14.3 64,558 $273,183,683 MM1 Midasmineralsltd 0.061 -14.1 114,727 $7,336,407 MAD Mader Group Limited 5.56 -13.4 923,641 $1,284,000,000

ICYMI – AM EDITION

Chariot Corporation’s (ASX:CC9) K-feldspar testing program carried out at the Black Mountain hard rock lithium project has confirmed the moderately to high-fractionated state of outcropping LCT pegmatites.

A pXRF (portable X-ray fluorescence) device was used on 218 potassium-feldspar samples, with many of these displaying anomalous caesium-tantalum values, supporting the existence of LCT pegmatites in the area.

D3 Energy (ASX:D3E) has received notice from the Petroleum Agency of South Africa (PASA) of the renewal of its flagship methane and helium exploration asset, ER315 in the country’s Free State.

The renewal marks the second renewal period and means the exploration right is valid for a further two years from the renewal date.

Venture Minerals (ASX:VMS) is conducting a series of reviews on mineralogical data as follow up work from the initial resource drill-out at the 40km2 Jupiter rare earth discovery.

This metallurgical program is designed to follow in stages and will be conducted across several independent laboratories to deliver results as efficiently and effectively as possible.

At Stockhead we tell it like it is. While Chariot Corporation, D3 Energy and Venture Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.