ASX Small Caps Lunch Wrap: It’s a case of ‘hurry up and wait’ ahead of US rate call

Pic via Getty Images

Local markets were up this morning, and after hitting a record closing high yesterday, the benchmark seems to have one eye firmly fixed on breaking through the current record level of 8,148 points – it’s at 8,144.5 at midday – and the other eye looking ahead to the hugely important rate call in the US on Wednesday.

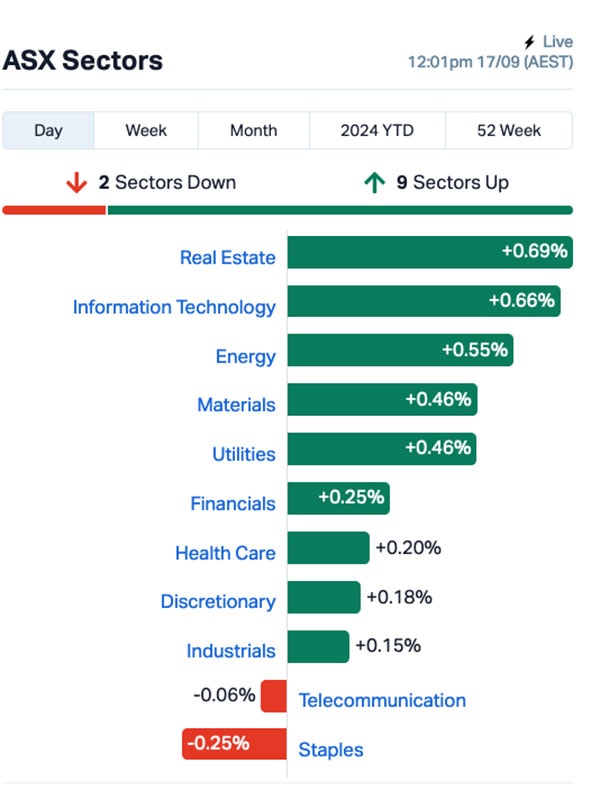

Real Estate and InfoTech are doing well, Staples and the Telcos not so much… and there’s talk at the top end of town about a takeover that could be worth hundreds of millions of dollars…

That said, there’s a sense of expectation in the air, as the US rate call hangs in the balance. It’s definitely coming – but whether it’s 25 basis points or a more serious 50 points is the question on everyone’s lips.

What does it mean for us? Will it change everything? Should I sell all my stuff and go live in a cave?

None of those questions will be answered… so let’s go take a look at what’s happening on the market instead.

TO MARKETS

The ASX 200 benchmark rose this morning, despite a tremulous effort from Wall Street where investors are getting themselves ready for a long-awaited – and possibly long overdue – rate cut by the Federal Reserve.

So far, it’s been another good morning at the top end of the Real Estate sector, with the big guns gently adding to their already impressive totals for the past few weeks, including a 1.3% gain for Vicinity Centres, and a 1.04% rise for Goodman Group.

It’s a similar story in the Tech sector this morning as well, with solid (if slightly pedestrian) gains for Technology One, up 1.55%, and market heavyweight Xero, up 1.25%.

Lagging, however, are Consumer Staples and the Telcos – the former suffering as A2 Milk and Elders gave up 1.7% and 1.2% respectively, and the latter all but stagnant after Telstra and TPG both dropped around 0.5% in early trade.

The headline news from the expensive seats was confirmation of rumours that have been swirling in recent days of a non-binding offer from investment management firm Regal Partners (ASX:RPL) for competitor Platinum Asset Management (ASX:PTM).

The companies have confirmed that there have been talks, but nothing is set in stone as the pair work together to figure out the best way forward for everyone involved – but as it stands, the Regal Proposal would see Platinum shareholders receive 0.274 Regal shares for each Platinum share held.

Additionally, prior to implementation of the scheme, Platinum would be permitted to pay a fully franked special dividend to its shareholders, from its own cash reserves, of $0.24 per Platinum share.

At lunchtime, Platinum shares were trading 12.4% higher, while Regal shares were flat.

NOT THE ASX

Overnight, both the Dow and S&P 500 also hit new record highs as traders wait for this week’s Federal Reserve rates decision.

The S&P 500 closed 0.13% higher, the Dow Jones was up by 0.55%, but the tech heavy Nasdaq slipped by 0.52%.

Tech stocks came under pressure mostly on the back of Apple’s 3% decline, as early figures indicate that demand for the new iPhone 16 is falling short of last year’s models, Eddy Sunarto reported this morning.

Although the iPhone 16 features new AI tech and the well-publicised iOS 18, delays in these features, combined with strong competition and consumer fatigue, appear to be dampening initial excitement.

Intel’s 6% surge, however, helped the Dow Jones index hit a record high.

Intel rallied after scoring a US$3 billion grant from the Biden Administration for chip production, and on news that the company was extending its partnership with Amazon’s AWS to produce an AI chip. Intel shares jumped another 8% after hours.

Microsoft shares stayed flattish as the company revealed it was ramping up its AI-powered Copilot tech in Microsoft 365 apps including Excel, PowerPoint, Outlook, and Teams.

Trump Media & Technology slipped by 4% after news broke of a second assassination attempt on the former president yesterday.

Meanwhile, markets are ready for a 50 basis point rate cut from the Fed tomorrow night (US time), with a 59% chance now priced in – up from 49% yesterday.

It really is line ball which way the Fed will move tomorrow, but the consensus seems to be falling on the side of the bigger slash.

“I think the Fed would be reluctant to surprise the market,” Matthew Luzzetti at Deutsche Bank told Yahoo.

Experts are also generally bullish on the outlook for equities ahead of the US Fed Reserve’s first interest rate cut in over four years.

“We remain positive on equities,” said John Stoltzfus at Oppenheimer. “Pullbacks experienced thus far this year have mostly looked like ‘trims’ and ‘haircuts’ for the S&P 500.”

In Asian markets this morning, things are once again mixed. Japan’s Nikkei is down 1.47%, and Shanghai markets have fallen 0.48%, but the Hang Seng is up 0.93%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap OCT Octava Minerals 0.089 85.4 15,296,875 $2,151,001 RNE Renu Energy 0.0015 50.0 500,000 $764,134 BTH Big Tin Can 0.16 33.3 4,365,828 $98,601,112 AJX Alexium Int Group 0.01 25.0 764,058 $12,496,468 PUA Peak Minerals 0.0025 25.0 1,163,953 $2,969,290 TRM Truscott Mining 0.072 20.0 351,666 $10,979,914 AUK Aumake 0.006 20.0 649,442 $9,641,205 SFG Seafarms Group 0.003 20.0 85,000 $12,091,498 SLB Stelar Metals 0.09 18.4 1,468,468 $4,830,402 PVT Pivotal Metals 0.013 18.2 1,676,572 $7,745,301 IBX Imagion Biosys 0.027 17.4 15,000 $819,871 CRI Critica 0.014 16.7 4,804,617 $32,049,609 DGR DGR Global 0.014 16.7 341,696 $12,524,322 NRZ Neurizer 0.0035 16.7 439,884 $6,543,358 AVD Avada Group 0.57 15.2 30,089 $42,042,837 AOK Australian Oil 0.004 14.3 81,821 $3,306,240 GLL Galilee Energy 0.016 14.3 277,000 $5,339,758 PTR Petratherm 0.049 14.0 1,892,381 $9,731,754 LMS Litchfield Minerals 0.125 13.6 11,508 $3,031,875 PER Percheron 0.11 13.4 2,517,105 $87,449,862

Octava Minerals (ASX:OCT) was flying on Tuesday morning, after the company announced that historical drilling from 2015/16 at its Discovery project in WA had returned significant levels of antimony, with the best of the drill results offering 3m @ 6.83% Sb from 21m including 1m @ 13.6% Sb from 22m, and 7m @ 3.27% Sb from 12m including 1m @ 11.5% from 18m.

Bigtincan (ASX:BTH) was up on news that the company has received a revised non-binding proposal from Vector Capital Management, at an offer price of $0.20 per share. Vector points out that the offer is unconditional, does not have a financing contingency and is subject only to legal due diligence and entering into binding long form documents, and Bigtincan’s board is currently weighing up its options.

Stelar Metals (ASX:SLB) was up on news of rock chip samples from its Lone Pine copper prospect, 7.5 kilometres west of the Baratta Copper Mine on the western flank of the doubly plunging Bibliando Dome. Preliminary results include rock chip assays up to 12.7% copper, with 7 of the 8 samples collected assaying over 5% copper.

Critica – formerly known as Venture Minerals (ASX:VMS) – was rising on news that regional, reconnaissance-style drilling has identified broad zones of high-grade, rare earth mineralisation, 40 kilometres to the east of the company’s flagship Jupiter Project. The results include significant values of Dysprosium and Terbium, with intercepts up to 8m @ 4,256ppm TREO occurring within broader zones of rare earth mineralisation at the site.

Petratherm (ASX:PTR) was up Tuesday morning on news it has received firm commitments to raise $1.6M by way of a placement of new shares with funds to be used to expedite exploration on the Company’s Muckanippie Titanium Project. Drilling of the high priority Rosewood and Claypan Prospects for titanium rich heavy mineral sands scheduled to start from the second week of October, and a share purchase plan of up to $1 million will be offered to eligible retail shareholders on the same pricing terms as the placement.

Earlier, Lincoln Minerals (ASX:LML) was gaining on news that a recent field sampling program at the Company’s 100%-owned Eridani uranium project, located around an abandoned quarry site, shut down by the South Australian Government in 1944 due to the presence of high radioactivity in surface geology. Surface pXRF sampling has returned results up to 9250ppm uranium at the site, with lab assays due back in October.

Bastion Minerals (ASX:BMO) is resampling historical drill samples from the ICE prospect, which currently boasts an “historical, foreign non-JORC resource” of 4.56Mt @1.48% Cu in the Yukon Territory, Canada. The company says that the core is “in good condition and is laid out on site in an orderly manner … Reviewing and re-assaying the core is an important step towards defining a JORC-compliant resource for the project.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 17 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap FAU First Au 0.001 -33.3 300,000 $2,717,990 88E 88 Energy 0.0015 -25.0 3,520,163 $57,867,624 TMX Terrain Minerals 0.003 -25.0 61,750 $7,064,115 ADD Adavale Resources 0.002 -20.0 14,179 $3,059,413 NAE New Age Exploration 0.004 -20.0 950,200 $8,969,495 RGL Riversgold 0.004 -20.0 1,297,500 $6,637,313 TX3 Trinex Minerals 0.002 -20.0 2,800 $4,571,631 ASV Asset Vision 0.022 -18.5 1,050,192 $19,881,762 ASR Asra Minerals 0.005 -16.7 857,017 $13,389,348 DTR Dateline Resources 0.005 -16.7 6,077 $14,968,079 LPD Lepidico 0.0025 -16.7 4,597,002 $25,767,375 PFT Pure Foods Tas 0.017 -15.0 52,630 $2,441,846 TMK TMK Energy 0.003 -14.3 5,296,818 $24,225,642 AUZ Australian Mines 0.007 -12.5 4,147,614 $11,188,097 BNL Blue Star Helium 0.0035 -12.5 32,727 $9,724,426 CDT Castle Minerals 0.0035 -12.5 3,609,452 $5,491,256 LNR Lanthanein 0.0035 -12.5 487,107 $9,774,545 M2R Miramar 0.007 -12.5 9,171,579 $3,158,236 KCC Kincora Copper 0.043 -12.2 259,045 $10,093,173 REZ Resource Energy 0.024 -11.1 1,650,512 $18,066,756

ICYMI – AM EDITION

Nickel X (ASX:NKL) says the acquisition of the Penny South gold project has been approved by shareholders with completion due to occur shortly.

The project is in the world class gold district and ~550m south of one of Western Australia’s highest grade producing gold mines owned and operated by Ramelius Resources (ASX:RMS), and is estimated to contain 440,000t of ore at a grade of 22g/t gold.

Shareholders have also approved the change of the company’s name to Strata Minerals, due to take effect shortly along with new ASX code (ASX:SMX). Plus, the second tranche of the recent $2m capital raise in which all directors participated has now been completed.

Raiden Resources (ASX:RDN) has made new technical appointments ahead of commencing drilling on the Andover South lithium project in the Pilbara, including Sean Halpin as chief operating officer, Aaron Hawley as acting project manager for the Andover South lithium campaign and Mike Roche as a geologist for the Andover South drilling program.

“With these new appointments, the company has significantly boosted its technical and operational capacity ahead of a highly active period,” MD Dusko Ljubojevic said.

“Our team has gained critical leadership and operational expertise, essential to unlocking the full potential of our projects, particularly within the Andover Complex.

“This includes valuable experience from the Andover lithium discovery itself, giving us confidence that the upcoming drilling program will be executed to the highest technical and safety standards.”

Comet Ridge (ASX:COI) says its working closely with operator, Santos, to commence upstream project Front End Engineering Design (FEED) as a precursor for a final investment decision for the Mahalo JV project – which the company plans to transition into meaningful gas supply for the east coast gas market.

In addition to the above upstream activities, the Mahalo JV participants have recently received a draft offer from Jemena to perform a FEED scope of work for the Mahalo Gas Hub Pipeline (MGHP) to connect the Mahalo JV Project infrastructure to nearby domestic and export pipelines.

The MGHP FEED will enable the construction and provision of gas transportation services via a DN250 (10 inch diameter) Class 900 pipeline capable of transporting up to 80 TJ/d of gas from the proposed Mahalo JV compression facilities to end user markets.

Alma Metals (ASX:ALM) has received firm commitments to raise $0.75m via a placement at 0.75c per share to extend its drilling campaign at the Briggs porphyry copper deposit in Queensland and to follow up on the recent best intersection of 276m at 0.45% copper from surface.

The placement amount includes director participation of $140,000, which is subject to shareholder approval, and the drill contractor has agreed to take up to $75,000 of their fees related to the additional drilling in Alma shares priced at 0.75c per share, following their initial agreement of up to $240,000 in Alma shares, priced at 1.2c per share.

“New funding will be used to extend the current drill program to improve resource confidence and potentially allow commencement of a scoping study later this year,” MD Frazer Tabeart said.

At Stockhead, we tell it like it is. While Nickel X, Raiden Resources, Comet Ridge and Alma Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.