ASX Small Caps Lunch Wrap: Is anyone else feeling like we’re being ripped off today?

This better achieve some meaningful change, because we're burning at least 25 grand worth of torches here..." Pic via Getty Images.

Local markets have fallen again this morning, and while it’s hard to tell whether it’s Wall Street’s fault (most likely) or just a sense of profound disappointment that the Matildas’ dream run through the World Cup sadly came to an end last night, the result is the same.

There are some highlights, though – one of which I’d like to tug on your coat about today.

Origin Energy (ASX:ORG) released its yearly report this morning, and it’s a corker, showing that the company has posted a bit of profit surge this year.

And by “a bit”, I mean “up 83.5%”.

Breaking it down, Origin reported that “statutory profit for the full year ended 30 June 2023 rose to $1,055 million, compared to a loss of $1,429 million in the prior year”, leaving underlying profit to increased to $747 million, $340 million higher than the prior year.

Which is lovely, of course – provided you’re a shareholder. Because the fully franked $0.20 per share divvy you’ll pocket will go a long way towards helping you pay your power bill, which (depending on where in the country you’re living) has probably gone up as much as 25% recently.

But here’s the thing… Origin’s turnaround in fortune can be interpreted, as company CEO Frank Calabria would like us to see it:

“In Energy Markets, electricity earnings improved as higher wholesale costs from previous periods were recovered through electricity tariffs and coal supply costs declined following the introduction of the coal price cap,” Calabria said.

“Higher sales revenue and trading benefits also contributed to higher earnings in the natural gas segment,” he added.

But an alternate angle to this success story looks like this one, from the ACTU this morning (emphasis added is mine).

“Origin’s gross profit has nearly doubled on gas up from $3.0/GJ to $5.1/GJ on declining volumes. It nearly tripled on electricity up from $5.8/MWh to $16/MWh on flat volumes,” the ACTU said.

“In other words, all of Origin’s gross profit is attributable to price increases rather than units sold.”

It is extremely difficult not to be cynical about Origin’s performance, when it’s viewed alongside a burgeoning cost of living crisis that is putting an increasing number of families to the sword around the country.

Origin is making all the appropriate noises about being a Good Corporate Citizen, of course.

“We have significantly increased our support for customers, recognising the cost-of-living contribution of higher energy prices,” Calabria said.

“We are targeting $45 million to support customers in hardship this year. This is on top of the $30 million spent helping customers who needed support last year,” he added.

The key word in there for consumers is “targeting” – because it is 100% the kind of weasel word that sounds like the company’s making a promise when it’s actually doing no such thing. But if it making those sorts of soothing noises helps someone sleep better at night, then who am I to argue?

On the face of it, though, there’s a case to be made for breaking out the pitchforks and burning torches, forming an unruly mob and storming the castle gates… but that’s very unlikely to happen.

Petrol near my place was over $2.00 a litre when I filled up earlier this week, putting the cost of Angry Mob torch manufacturing well out of reach, unless I take out a loan.

And that’s obviously crazy talk, because interest rates are sky high… and even though it banked more than… *rubs glasses*… $10 billion in profit last year, I can’t see the CBA lowering rates to help out with that either.

I could keep going, but I think you get the picture.

Mustn’t grumble, it is what it is etc etc.

TO MARKETS

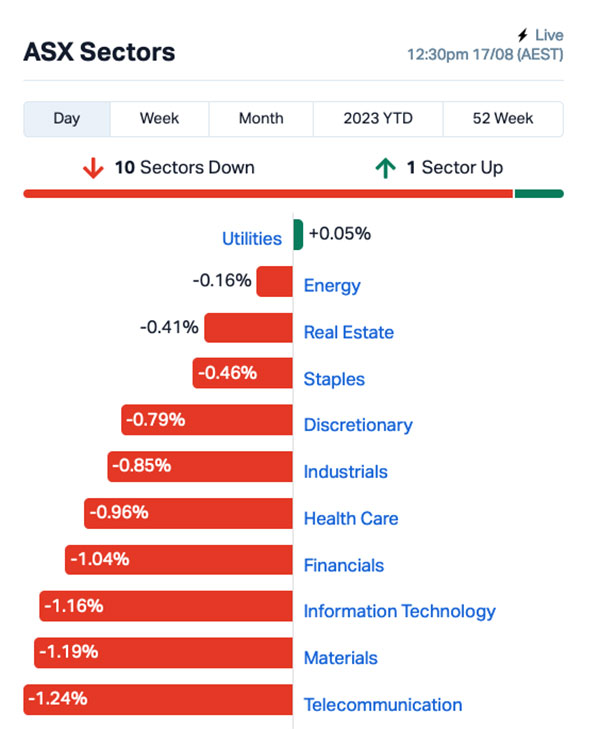

Another sell-off on Wall Street overnight has led the ASX down into the mire again today, leaving the benchmark at -0.8% when the lunch bell rang.

A look at the sectors shows that everything’s down again, with one notable exception: Utilities.

Yep – I’m as shocked as you are.

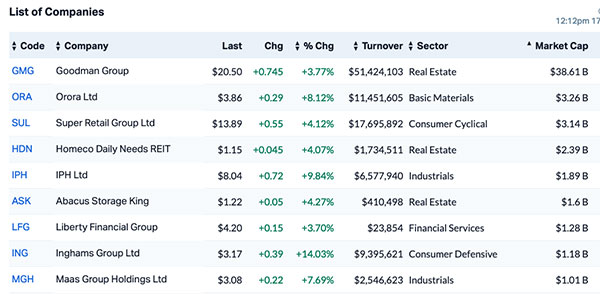

Up the tubby end of town, there’s a laundry list of billion dollar-plus companies performing well today – far too many to dig into individually, so here’s a handy picture.

The two best performers were Intellectual Property group IPH (ASX:IPH) and packaging manufacturer Orora (ASX:ORA), both of which shot up thanks to positive results released earlier today.

They’re not the only ones posting earnings, so the frantically busy Earlybird Eddy has pulled together this highlight reel that you should definitely take a look at, as well.

NOT THE ASX

Wall Street fell sharply again last night, after the release of the Fed minutes for July showed that officials still saw “upside risks” to inflation, which could lead to more rate hikes.

For those of us with short memories, a reminder that rate hikes are Bad Things, hence the market jitters that meant that the S&P 500 tumbled by -0.76%, blue chip Dow Jones by -0.52%, and tech-heavy Nasdaq by another -1.15%.

In US stocks, the mega-techs have had another poor session, leaving the NYSE FANG index down 1.7%, with Tesla’s 3.2% slump the worst of them.

Intel fell almost 4% after announcing that Chinese regulators failed to approve its US$5.4 billion deal with Israel’s Tower Semiconductor, the latest sign of the frayed ties between China and the US.

But retail giant Target rose 3% after a surprising surge in Q2 profits, driven largely by a new shipment of iPhone chargers that don’t work quite right.

In Japan, the Nikkei is down 0.91% because most of the country is busy with Summer Comiket 2023 – a massive anime/cosplay festival that attracts many, many thousands of weirdos from all around the world.

I had planned to link to a video here, but – for real – the only one I could find that was worth sharing was a solid five minutes of someone dressed up as Marvel anti-hero Deadpool, sexually harassing an astonishing array of scantily clad women.

It’s clearly not safe for work, so if you don’t want to see it, then you should definitely not google “Summer Comiket 2023 Deadpool” and click on the “Videos” search tab, because it’s right there at the top of the results list.

I’ve warned you, because I care.

In China, Shanghai markets are surprisingly flat, and in Hong Kong the Hang Seng is down 0.84%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EDE Eden Inv Ltd 0.0045 50% 1,778,007 $8,990,911 CLE Cyclone Metals 0.0015 50% 263,501 $10,264,505 VPR Volt Power Group 0.0015 50% 510,318 $10,716,208 CTO Citigold Corp Ltd 0.005 25% 183,571 $11,494,636 ELE Elmore Ltd 0.005 25% 6,468,593 $5,597,535 MRD Mount Ridley Mines 0.0025 25% 116,028 $15,569,766 MXC MGC Pharmaceuticals 0.0025 25% 1,382,500 $7,784,719 RGS Regeneus Ltd 0.01 25% 757,219 $2,451,495 ARN Aldoro Resources 0.225 22% 2,517,749 $24,905,392 ASQ Australian Silica 0.065 20% 210,451 $15,209,660 AMD Arrow Minerals 0.003 20% 1,886,915 $7,559,413 FAU First Au Ltd 0.003 20% 800,000 $3,629,983 MPP Metro Perf.Glass Ltd 0.14 17% 1,299 $22,245,370 AGR Aguia Res Ltd 0.023 15% 544,154 $8,677,085 CPN Caspin Resources 0.235 15% 130,214 $19,324,461 INP Incentiapay Ltd 0.008 14% 276,924 $8,855,445 MTB Mount Burgess Mining 0.004 14% 140,000 $3,554,764 TAS Tasman Resources Ltd 0.008 14% 374,738 $4,988,685 ING Inghams Group 3.17 14% 2,962,052 $1,033,269,291 ENV Enova Mining Limited 0.009 13% 800 $3,127,435 ATR Astron Corp Ltd 0.5 12% 2,921 $65,211,162 AUZ Australian Mines Ltd 0.019 12% 397,175 $11,114,980 CTP Central Petroleum 0.059 11% 363,655 $38,658,479 ICG Inca Minerals Ltd 0.02 11% 2,304 $8,730,180 NTL New Talisman Gold 0.02 11% 179,696 $7,947,532

Nominally at the top of the winner’s list this morning is Aguia Resources (ASX:AGR), which has spiked 35% for no reason at all – but that’s not unusual for this small copper explorer.

Moving because of some actual fresh information, though, is Aldoro Resources (ASX:ARN), which is up 21.6% after reporting a 40m thick anomalous nickel zone near surface at the company’s Narndee nickel and PGE project in Western Australia.

Aldoro says the results – based on pXRF readings – have come from the third planned diamond hole and follow-up step-out RC drilling that suggests the find is open in all directions, from a depth of just 1m.

The company says it’s named the new find the “Area 32 Nickel Discovery”, and is expecting to report Ni-PGE-Co assays shortly, and plans to move the on-site drills 3.4km to the southwest and investigate a “similar looking nickel anomaly” in the near future.

And in third on the ladder this morning, it’s Australian Silica Quartz (ASX:ASQ), which is up more than 20% on news that the drills have started to spin at the Queensland Quartz Hill project prospective for metallurgical grade silicon quartz lump feedstock.

ASQ says it’s the first subsurface exploration at the site, marking the start of ongoing work planned at Quartz Hill under the recently announced Project Development Heads of Agreement with Private Energy Partners.

Of course that’s all “Caps Own”. As if we’d commit that kind of grammatical travesty.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MCT Metalicity Limited 0.001 -50% 160,275 $7,472,172 NXD Nexted Group Limited 0.7975 -34% 2,363,299 $265,652,128 DXN DXN Limited 0.001 -33% 994,500 $2,581,972 EMP Emperor Energy Ltd 0.011 -27% 445,042 $4,032,937 TD1 Tali Digital Limited 0.0015 -25% 13,085 $6,590,311 CXO Core Lithium 0.415 -24% 48,453,089 $1,012,891,653 RML Resolution Minerals 0.004 -20% 6,739,503 $6,286,459 ROG Red Sky Energy 0.004 -20% 2,905,350 $26,511,136 THR Thor Energy PLC 0.004 -20% 1,840,000 $7,296,457 KRR King River Resources 0.009 -18% 4,500 $17,088,774 BDT Birddog 0.115 -18% 115,266 $27,786,094 AW1 American West Metals 0.29 -17% 14,504,851 $125,050,113 KNG Kingsland Minerals 0.2 -17% 812,183 $10,732,752 LML Lincoln Minerals 0.005 -17% 103,739 $8,524,271 NXL Nuix Limited 1.35 -15% 2,002,399 $510,512,966 DCL Domacom Limited 0.023 -15% 110,000 $11,758,548 AHN Athena Resources 0.006 -14% 32,500 $7,493,273 CPT Cipherpoint Limited 0.006 -14% 99,084 $8,114,692 CXU Cauldron Energy Ltd 0.006 -14% 7,000 $6,660,981 ECT Env Clean Tech Ltd. 0.006 -14% 2,256,987 $17,336,274 HOR Horseshoe Metals Ltd 0.012 -14% 23,567 $9,008,701 PRX Prodigy Gold NL 0.006 -14% 247,508 $12,257,755 RIE Riedel Resources Ltd 0.006 -14% 72,857 $14,415,849 AMX Aerometrex Limited 0.36 -13% 5,000 $39,351,030 AYT Austin Metals Ltd 0.007 -13% 396,400 $8,126,997

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.