ASX Small Caps Lunch Wrap: Have US investors gone a bit meme-stock mad this week?

Donald Trump, pictured here winning the 1552 Eurovision Song Contest with "Hey. Nonny Nonny". Pic via Getty Images.

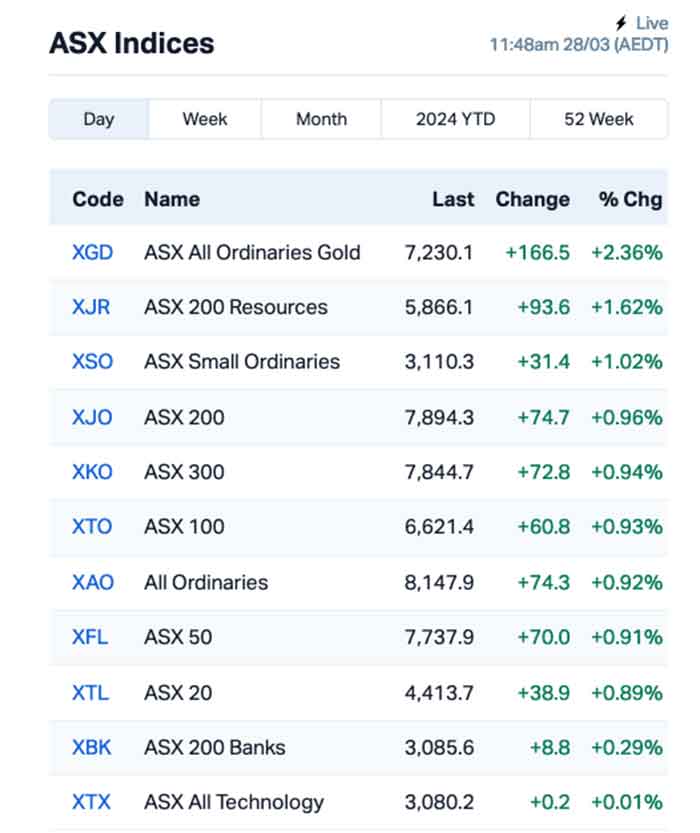

Local markets are up this morning, with the ASX 200 benchmark tracking gains on Wall Street overnight, helped out by some great results among the junior miners and explorers, particularly those with exposure to gold.

There’s a bit to unpack today, so bear with me – but first, a quick dive into the weird, wild world of meme stocks – this time with an all-too familiar mug on the front of the latest baffling instalment of IPO madness.

On Tuesday, former US President Donald Trump’s social network – Truth Social – went public, and managed to rocket to a valuation of US$8 billion. Yesterday, it rose again – this time hitting US$9.6 billion, rocketing the beleaguered Trump into actual billionaire territory (on paper, at least) for (probably) the first time.

Truth Social, in case you don’t know, is that Twitter-X-esque monstrosity that consists largely of Donald Trump shattering gag orders in ALL CAPS and generally being more unhinged than a home in a hurricane.

So… the question around the company hitting that kind of valuation is “how?”, given that the company itself – Trump Media & Technology Group Corp – has achieved a grand revenue total for the past nine months of just US$3.3 million, at a loss of US$49 million for the period.

While it bears all the hallmarks of a meme stock – Gamestop, I’m looking at you – the underlying issue here isn’t that there’s a cabal of secretly clever confederate flag-waving yokels in an underground trailer park facility deep beneath the swamps of Florida.

And there’s literally nothing underpinning nearly US$10 billion of market cap – other than the chance for people to either A) “invest their money in the Trump brand”, or B) Fleece someone else down the road, who wants to “invest” in Trump himself.

But what it does do is give savvy punters a chance to get in on the winnings – unlike Trump’s other current moneymaking move, which is … *checks notes* … flogging $60 bibles with his name on the front.

Whether that’s a legit operation, or just a vehicle for churches in the US to skirt rules about donating money to political candidates, is something I’m gonna leave for the Feds to figure out.

TO MARKETS

The ASX is rising nicely this morning thanks to a decent showing on Wall Street, and significant interest in a number of Materials and Energy companies across the market today.

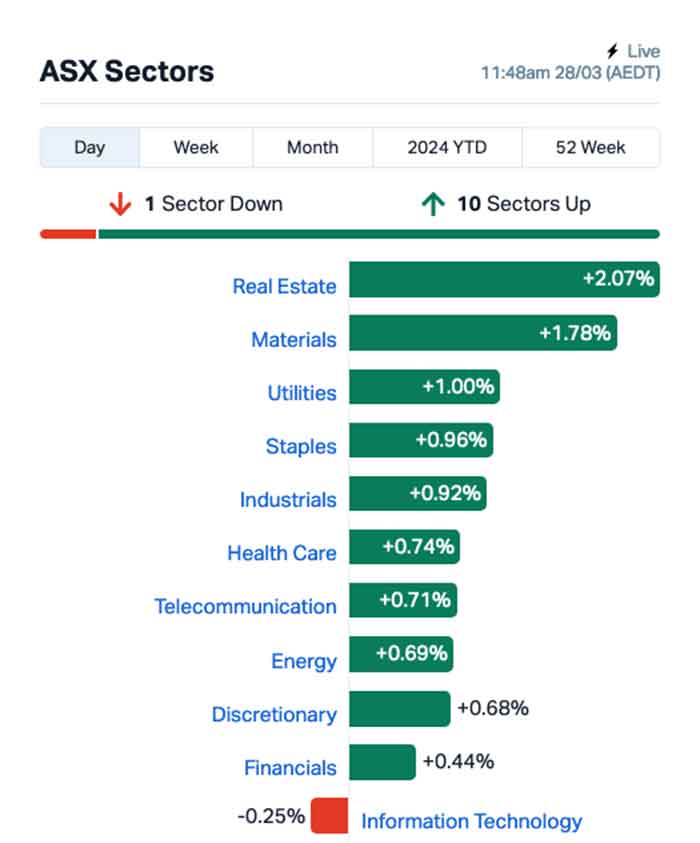

Here are some quick charts that can tell that story better than I can.

As you can see, the goldies are making a decent fist of things this morning – and I will leave it to the incomparable big brain of Guy Le Page to explain why.

It’s shaping up to be a pretty solid day, except for a drag on tech stocks – which could probs be attributed to an overweight Xero dropping a shade over 1.0% this morning for reasons that I have neither the time, nor the inclination, to dig into right now.

That’s because we need to talk about Osteopore (ASX:OSX), as the jury is still out on precisely what’s happened in the past couple of weeks, which saw the stock price rocket through +1000% for a while yesterday.

I’ll admit that I got a bit excited about it – but the longer I (and a few other much smarter people around here) looked at it, the less it made complete sense. The news behind was good … not great, but good … but almost certainly not 10-bagger good.

The news this morning is that OSX has gone into voluntary suspension, with the company announcing that it wanted the suspension “due to unexpected delays in completing the 31 December 2023 Annual Report due to compiling information requested by the Company’s auditors”.

“The Directors do not consider that trading of the Company’s securities should occur while the Annual Report remains un-lodged,” the announcement reads – the day after it briefly touched +1076% before it closed at $0.30 a share, up from $0.065 the day before.

OSX has asked that the suspension remain in place for more than a month – April 30th – or until it files its loooong overdue December 2023 annual report, whichever comes first.

There are all kinds of wild theories as to what’s happening behind the scenes – I’m not prepared to speculate on those here, as I don’t fancy heading back to court again any time soon – but I suspect that there’s going to be some pretty significant fallout when the dust settles on this one.

(OK – Just so we’re 100% clear – I’m not suggesting any kind of malfeasance or anything here. So… we cool? Yeah? Great…)

(Because y’know, sometimes humans make mistakes. And decimal spots can be slippery little buggers, right?)

There’s better news up the fat end of town this morning, especially for a rump of Energy and Materials companies worth north of $1 billion today.

Whitehaven Coal (ASX:WHC) is up 5.5%, Alumina (ASX:AWC) is up 5.6% and Arcadium Lithium (ASX:LTM) is the best of the big boys, firing off a 7.7% jump this morning.

NOT THE ASX

Wall Street took a breather from its breather overnight, notching its first gain since setting a record last week.

The S&P 500 rose by +0.86%, the blue chips Dow Jones index was up by +1.22%, and tech-heavy Nasdaq lifted by +0.51% – nothing earth-shattering there, but it’s moving in the right direction again after a couple of sessions on its heels.

Earlybird Eddy Sunarto reports that last night’s rally came despite Bloomberg data suggesting that fundies sold an estimated $US32 billion in equities to rebalance their portfolio as we head into the last session of the quarter.

The banner news out of the US were the meme stocks – as mentioned at the top of this piece, Trump Media and Technology continued its baffling rise to the surface of the swamp, gaining another +14% after rising by +16% on its first day of trading.

Reddit did what Reddit does best, sinking -11%. As a long-time creature of habit (my main reddit account is older than my high-school aged son), I was curious to see how the market was going to react to the internet’s largest pocket of bellowing malcontents, and -11% for no reason at all looks about right.

Robinhood shares were up almost 4% after the company launched its first credit card … I just want you to sit with that sentence for 20-30 seconds … breathe it in, swirl it around in your brain a little.

Robinhood has launched a credit card. Lawd, have mercy on us all.

Meanwhile, the Baltimore Bridge incident is expected to have a ripple effect across the US economy. Cruise operator, Carnival Corp, noted the accident will impact its EBITDA by up to US$10m as it seeks to move its home port to somewhere that doesn’t have a collapsed bridge out the front. Carnival stock was down -0.5% after the announcement.

In Asian market news, things aren’t looking all that rosy this morning. Japan’s Nikkei is down -0.96%, while both Hong Kong and Shanghai are struggling to shake off losses from the previous session, after both markets had poor performances in their respective tech sectors.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 28 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

CODE COMPANY PRICE % TODAY VOLUME MARKET CAP APS Allup Silica Ltd 0.08 176% 16,493,259 $1,115,836 MCL Mighty Craft Ltd 0.028 47% 1,165,475 $6,937,511 RIE Riedel Resources Ltd 0.004 33% 2,153,742 $6,671,507 LSA Lachlan Star Ltd 0.039 26% 38,461 $6,434,769 AVE Avecho Biotech Ltd 0.005 25% 37,086,085 $12,677,188 ECT Env Clean Tech Ltd. 0.005 25% 215,394 $11,457,242 ME1 Melodiol Glb Health 0.005 25% 2,537,300 $1,627,343 MTB Mount Burgess Mining 0.0025 25% 152,081 $2,089,627 CCZ Castillo Copper Ltd 0.006 20% 33,333 $6,497,527 COY Coppermoly Limited 0.012 20% 83,189 $7,076,574 EPM Eclipse Metals 0.006 20% 130,000 $11,048,278 MEG Megado Minerals Ltd 0.012 20% 85,000 $2,544,556 TMR Tempus Resources Ltd 0.006 20% 271,300 $3,654,994 AGN Argenica 0.7 19% 491,760 $58,847,085 FHS Freehill Mining Ltd. 0.007 17% 157,142 $17,975,067 POS Poseidon Nick Ltd 0.007 17% 1,022,459 $22,281,209 PUA Peak Minerals Ltd 0.0035 17% 29,540 $3,124,130 TGP 360 Capital Grp 0.62 16% 386,022 $124,106,469 HYT Hyterra Ltd 0.022 16% 1,315,559 $10,687,475 SRT Strata Investment 0.185 16% 1,648 $27,107,772 GLH Global Health Ltd 0.115 15% 10,000 $5,804,954 KOB Kobaresourceslimited 0.115 15% 20,000 $13,041,667 ROC Rocketboots 0.11 15% 88 $6,339,696 NES Nelson Resources. 0.004 14% 149,000 $2,147,580 RGL Riversgold 0.008 14% 71,067 $6,773,630

Way out in front on Thursday morning was a surging Allup Silica (ASX:APS), a microcap explorer that had punched through +240% at one point in early trade on news that it’s sitting on a deposit of very high quality silica in southern WA.

The company reports that results from 43 surface samples have returned SiO2 grades greater than 98%, with an average grade of 98.6% – and the best of them coming in at 99.4% SiO2.

What it means is that the silica is of sufficient purity for use in important applications, such as photovoltaic cells, with a minimum of processing required to have it application-ready.

That, coupled with the location of the Cabbage Spot project less than 200km from a couple of major WA ports, has investors pretty excited.

Megado Gold (ASX:MEG) enjoyed a boost off the back of its (late) December 2023 Annual Report – which I haven’t had time to read all of, because it’s quite long and very complicated. I’m assuming the news is good.

Argenica Therapeutics (ASX:AGN) surged on news that the first patient in the company’s Phase 2 clinical trial in acute ischaemic stroke patients has been successfully dosed.

HyTerra (ASX:HYT) is rising on news it is undertaking a capital raising of approximately A$6.1 million (before costs) through a placement to sophisticated and professional investors, and a subsequent fully underwritten non-renounceable rights issue to eligible shareholders, with the money slated for use in a multi-well exploration drilling campaign planned to begin in Q3 2024 at its Kansas operation.

And 360 Capital Group (ASX:TGP) rose after it announced that it has sold its strategic stake in Hotel Property Investments (ASX:HPI), for $96.9 million. Happy days.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 28 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NGY Nuenergy Gas Ltd 0.02 -29% 324,085 $41,466,754 1MC Morella Corporation 0.003 -25% 372,640 $24,715,198 AXP AXP Energy Ltd 0.0015 -25% 448,370 $11,649,361 TKL Traka Resources 0.0015 -25% 7,500,000 $3,501,317 CHK Cohiba Min Ltd 0.002 -20% 100,694 $8,970,610 FGL Frugl Group Limited 0.004 -20% 80,000 $7,448,873 ROG Red Sky Energy. 0.004 -20% 324,006 $27,111,136 LNR Lanthanein Resources 0.0025 -17% 1,051,636 $5,864,727 WML Woomera Mining Ltd 0.005 -17% 954,992 $7,308,834 AVA AVA Risk Group Ltd 0.135 -16% 298,231 $40,981,779 CR1 Constellation Res 0.11 -15% 20,000 $6,487,705 MGL Magontec Limited 0.33 -14% 65,241 $30,552,958 TMG Trigg Minerals Ltd 0.006 -14% 492,475 $2,929,845 AHK Ark Mines Limited 0.13 -13% 42,339 $8,316,962 LML Lincoln Minerals 0.007 -13% 1,227,223 $13,632,362 LM1 Leeuwin Metals Ltd 0.066 -12% 149,771 $3,513,875 C29 C29Metalslimited 0.079 -11% 300,151 $4,803,055 GBZ GBM Rsources Ltd 0.008 -11% 211,111 $10,183,648 BEZ Besragoldinc 0.094 -10% 3,736,467 $43,900,595 CMX Chemxmaterials 0.045 -10% 8,600 $4,667,159 LGM Legacy Minerals 0.135 -10% 47,241 $15,818,250 TIA Tian An Aust Limited 0.225 -10% 94 $21,652,208 PUR Pursuit Minerals 0.0045 -10% 275,574 $14,719,857 SUV Suvo Strategic 0.037 -10% 352,582 $39,527,951 GSM Golden State Mining 0.01 -9% 667,822 $3,073,077

ICYMI – AM EDITION

Greenvale Energy (ASX:GRV) expects to receive ministerial approval soon for its agreement to farm-in to EP145 in the Amadeus Basin, Northern Territory, that is prospective for high-grade helium, hydrogen and hydrocarbons.

Preparations are also underway for the Wild Horse 2D seismic program with the assessment program expected to be completed by Q2 and seismic acquisition on track for completion by August.

EP145 has a best estimate prospective resource of 440Bcf of total gas that provides a springboard for initial exploration.

MTM Critical Metals (ASX:MTM) has completed its acquisition of private company Flash Metals, securing its control of highly-prospective tenements in the West Arunta and Mukinbudin areas of Western Australia.

This allows the company to progress native title and freehold land access to enable in-field exploration planning.

It has also completed the second tranche of its two tranche placement of shares priced at 8c each to raise a total of $7m.

Proceeds will be used for exploration work on the company’s newly acquired ground in the West Arunta and at Mukinbudin, as well as its existing niobium-REE assets at East Laverton and Pomme in Canada.

At Stockhead, we tell it like it is. While Greenvale Energy and MTM Critical Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.