ASX Small Caps Lunch Wrap: Has science unveiled Australia’s ultimate Murder Bird this week?

Faaaaark. Pic via Getty Images.

Local markets have that sinking feeling about them again, which is probably because the ASX 200 benchmark was heading south again this morning, falling -0.4% in the opening hour of trade.

Early doors, it was Industrials taking a kicking this morning, with the tech sector and the goldies also seemingly off the menu.

I’ll get into that in more detail shortly, but first to the wild, wild world of science, where palaeontologists digging in remote South Australia have unearthed definitive proof that Australia was once home to some of the largest birds on the planet.

The find included fossilised parts of a creature known as Genyornis newtoni, colloquially known as a “thunder bird”, which had previously been discovered, but only in fragments – until now.

Standing about 2m tall, and – according to the boffins – tipping the scales at up to 240kg, they are thought to have gone extinct about 45,000 years ago.

For reference, take your garden variety, ultra-violent Cassowary (1.5m tall, roughly 60kg) and pile on an extra 33% in height and quadruple its weight.

While we don’t know what kind of temperament they had, I’d still be willing to bet that at that kind of size, they are pretty much purpose built to completely ruin your day.

The most recently announced find has filled in an important blank, giving the boffins a better idea of what this giant feathered bastard would look like, shortly before crushing everything that looked at it funny.

Introducing the updated look of Genyornis newtoni, a giant, extinct bird from Australia, based on new fossil discoveries published today. Incredible artwork by @Blokoweka 1/2 https://t.co/fywvF4Unns pic.twitter.com/8oyZxTaPhq

— Dr Phoebe McInerney (@Phoebyornis) June 3, 2024

Awww… it actually looks kind of benign, and definitely more of a “giga-goose” than a “thunder bird”.

But that’s probably just what it wants you to think…

TO MARKETS

Local markets were having a tough time on Friday morning, with broad sell-offs across most sectors driving the ASX 200 down -0.4% by lunchtime.

A quick glance suggests that’s largely down to an overnight shift in key commodities – Gold was down -0.75% to US$2,303 an ounce, oil prices fell by -0.9% but iron ore rose by +2% to US$106.85/t.

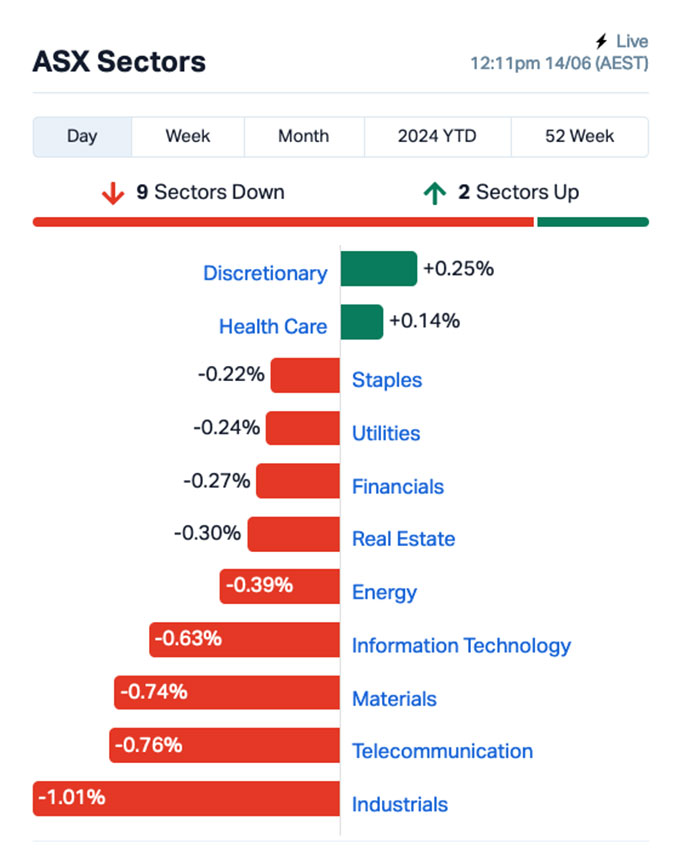

That left the local sectors struggling, for the most part, with the sector chart looking like this:

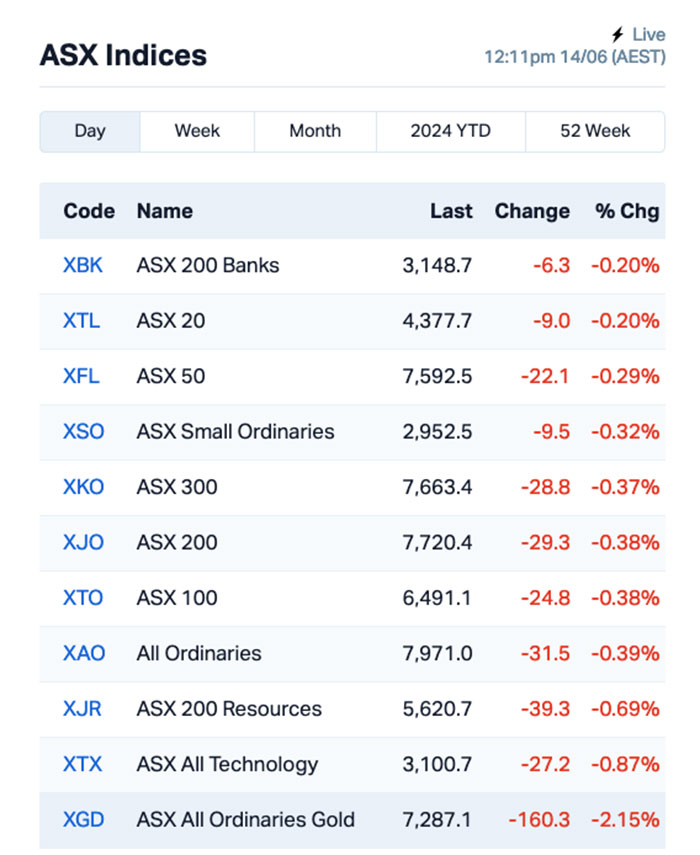

And the ASX indices looking thusly:

All that’s really left this week, barring any last minute craziness, is to ride out the bumps ‘til close and then collectively hold our breath until Tuesday, when the RBA board will emerge from its monthly mega-luncheon to announce that nothing’s going to change this month.

For what it’s worth, there’s some division among the forecasters on Aussie interest rates. The CBA boffins are still holding out for a cut before Christmas, but the ANZ is now saying that we’re going to have to wait until at least next year.

NOT THE ASX

In the US overnight, S&P 500 rose by +0.23% to another all-time high, the blue chips Dow Jones index was down by -0.17%, and the tech-heavy Nasdaq lifted by +0.34%, also to a new record high.

And – *deep sigh* – let’s get the headline out of the way. Elon Musk has been gifted some great news from shareholders, who have voted to approve his US$56 million (or US$45 million, depending on which article you’re reading) pay packet, after Tesla’s Chief Man-Baby threatened to take his bat and ball and go home.

Meanwhile, new unemployment claims in the US went up by 13,000 to a total of 242,000 in the week ending June 8, according to the Labor Department, higher than what all the economists had predicted.

The jobless claims rose to their highest in nine months, led by California – where, by sheer coincidence, Tesla recently let another 600 workers go from its Fremont and Palo Alto campuses – part of its plan to slash 3,300 jobs from that state alone.

Anyway – Tesla’s price went up +3.0%, so… hooray.

In other US stock news, Adobe jumped +16% post market, despite announcing recently that it’s going to be rolling out AI-driven “moderation” capabilities that demand access to users’ current projects, even as they’re working on them.

Nvidia rose by +3.5% and Broadcom, a company that supplies parts to Apple, saw its stock soar by 12%, reaching a record high.

In Asian market news, the news out of Japan today is that the Central Bank is meeting to decide whether to officially move back into the realm of positive interest rates.

The rate has famously been sitting at 0% since March, up from a prolonged period of negative interest rates, with that position taken by the BoJ is meeting again today to decide what to do next. to try to fight wage stagnation and giant radioactive lizards looking for somewhere to grow their pension.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 14 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap JAV Javelin Minerals Ltd 0.002 100% 1,300,000 $2,501,231 TD1 Tali Digital Limited 0.002 100% 270,162 $3,295,156 BCT Bluechiip Limited 0.005 67% 2,777,701 $3,302,300 ENT Enterprise Metals 0.004 33% 247,952 $2,654,163 G50 G50Corp Ltd 0.16 33% 116,748 $13,114,800 CCO The Calmer Co Int 0.009 29% 7,429,416 $9,669,130 RAU Resouro Strategic 0.64 28% 616,699 IPO today 88E 88 Energy Ltd 0.0025 25% 6,934,542 $57,785,344 AEV Avenira Limited 0.005 25% 100,008 $9,396,136 TMR Tempus Resources Ltd 0.005 25% 6,549,822 $2,923,995 TX3 Trinex Minerals Ltd 0.0025 25% 1,700,000 $3,657,305 PLG Pearl Gull Iron 0.023 21% 5,474,874 $3,886,294 AMD Arrow Minerals 0.003 20% 8,143,888 $26,348,413 EVR EV Resources Ltd 0.006 20% 1,649,579 $6,606,357 POS Poseidon Nick Ltd 0.006 20% 1,850,434 $18,567,674 NUC Nuchev Limited 0.13 18% 7,500 $9,902,963 AQX Alice Queen Ltd 0.007 17% 1,163,197 $4,145,940 CE1 Calima Energy 0.007 17% 17,858,106 $3,798,485 DOU Douugh Limited 0.0035 17% 240,280 $3,246,207 HLX Helix Resources 0.0035 17% 62,950 $9,792,581 BEO Beonic Ltd 0.029 16% 388,000 $10,612,374 EMU EMU NL 0.03 15% 202,352 $2,014,817 TYX Tyranna Res Ltd 0.008 14% 744,317 $23,015,477 ACE Acusensus Limited 0.645 14% 287,778 $71,422,270

Enterprise Metals (ASX:ENT) was up on Friday morning, with the company in the middle of an entitlement offer to raise approximately $1.42 million (before costs), at a price of $0.004 per new share, and a $0.006 per share option expiring in two years, for eligible shareholders. Any remainders will form part of a top-up offer.

Market newbie Resouro (ASX:RAU) went live this morning, and sailed to a +28% gain. Christian Edwards has done the hard yards on this one, and you can read his wonderful piece of journalistic endeavour right here.

Tempus Resources (ASX:TMR) climbed through the morning on news that it has completed its acquisition of the highly prospective Prescott copper and base metals project, which is located “only 100km from American West Metals (ASX:AW1) Storm Project which currently hosts an Indicated & Inferred resource of 17.5 Mt @ 1.2% Cu and 3.4g/t Ag”.

Pearl Gull Iron (ASX:PLG) – who I haven’t heard from in ages – was up this morning, on news that the company has has entered into a binding agreement to acquire Huemul Holdings, which is currently finalising negotiations of a further agreement to have the right to earn up to an 80% interest in NeoRe SpA, a Chilean company that holds tenements and tenement applications in Chile that are highly prospective for Ionic Adsorption Clay (IAC) Rare Earth Elements (REEs).

And finally Calima Energy (ASX:CE1) , which suffered an *ahem* calamitous crash yesterday, has bounced back (sort of) after the previously $80 million market cap company returned about $80 million to its shareholders, and sent its share price plummeting about 97% before the brakes were pulled on.

For what it’s worth, Calima says that it’s just the “market finding equilibrium” and that it was open about both the capital return, and the fact that it plans to continue operating its Paradise Field activities, with about $5-6 million in cash on hand.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 14 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 3,888,890 $11,649,361 AUK Aumake Limited 0.002 -33% 133,019 $5,743,220 HCT Holista CollTech Ltd 0.004 -33% 51,099 $1,672,800 WBE Whitebark Energy 0.01 -29% 889,144 $2,688,005 AVE Avecho Biotech Ltd 0.003 -25% 145,000 $12,677,188 LNU Linius Tech Limited 0.0015 -25% 200,000 $11,093,481 MRQ MRG Metals Limited 0.003 -25% 40,787,396 $10,100,475 VML Vital Metals Limited 0.003 -25% 764,902 $23,580,268 VPR Volt Group 0.0015 -25% 198,199 $21,432,416 MSI Multistack International 0.007 -22% 2,200 $1,226,735 CRR Critical Resources 0.008 -20% 819,682 $17,803,503 SIH Sihayo Gold Limited 0.002 -20% 6,666 $30,510,640 OPT Opthea Limited 0.37 -17% 3,223,134 $296,098,821 HHR Hartshead Resources 0.0075 -17% 4,870,000 $25,278,139 1MC Morella Corporation 0.0025 -17% 2,101,643 $18,536,398 BXN Bioxyne Ltd 0.005 -17% 693,300 $12,279,872 TTI Traffic Technologies 0.005 -17% 129,400 $5,837,311 BCC Beam Communications 0.13 -16% 22,743 $13,395,398 APL Associate Global 0.105 -16% 142,168 $7,061,553 JLL Jindalee Lithium Ltd 0.325 -16% 82,693 $23,288,695 CC9 Chariot Corporation 0.19 -16% 212,715 $18,627,561 MTM MTM Critical Metals 0.033 -15% 1,351,771 $10,963,167 DAF Discovery Alaska Ltd 0.012 -14% 80,000 $3,279,286 GTI Gratifii 0.006 -14% 1,352,422 $12,292,334 ION Iondrive Limited 0.012 -14% 18,917 $8,467,992

ICYMI – AM EDITION

LTR Pharma (ASX:LTP) and Alpine Capital have won IPO of the year at the Australian Stockbrokers Foundation awards after the company burst onto the scene in December with its innovative SPONTAN nasal spray treatment for erectile dysfunction.

Just last week the company announced strong initial bioequivalence trial results which showed the product achieves rapid absorption and faster onset of action (between 9-12 minutes) compared to existing gold-standard oral therapies which can take over an hour to take effect.

LTR is currently trading around +300% on its listing price.

Corazon Mining (ASX:CZN) has announced plans to acquire three high grade zinc-copper-gold deposits near its flagship Lynn Lake nickel-copper-cobalt project in Canada.

Impact Minerals (ASX:IPT) has nabbed a $354,000 research and development rebate for the financial year ending June 2023.

The funds add to the $3.725m raised from a recent placement and exercise of options – and means the company is fully funded as it looks to complete the pre-feasibility study for its Lake Hope high purity alumina project.

Impact’s managing director Dr Mike Jones said the unique mineralogy and patented and proprietary processing techniques for the project have allowed the company to claim back a significant proportion of expenditures through the Research and Development Tax Incentive program.

“Although this rebate covers all of our projects, we had only had the Lake Hope project for three months of the 2023 financial year,” he said.

“We anticipate being able to claim an increasing amount of our expenditures on Lake Hope as we continue to develop this exciting project”.

And Meteoric Resources (ASX:MEI) has vastly increased the certainty of its Caldeira project in Brazil after defining a significant measured and indicated resource of 85Mt at 3,034ppm TREO for the Capão do Mel deposit.

At Stockhead, we tell it like it is. While Corazon Mining, Meteoric Resources, Impact Minerals and LTR Pharma are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.