ASX Small Caps Lunch Wrap: Guess who’s got a stomach-churning spider story for you all today?

Derek didn't care what anyone was saying about him behind his back - his new Nike sponsorship deal was making him feel totally fabulous. Pic via Getty Images.

Local markets have put in a solid morning’s work, leading the ASX benchmark to a +0.45% gain by lunchtime, despite headwinds in the form of falling gold prices, rising oil prices and RBA chief Michele Bullock bank-splaining why we need to look after our folding cash money better.

I’ll get to all that in a minute, but first… boy-oh-boy, have I got a treat for you.

It’s a tale of horrifying woe for one British man, whose 35th wedding anniversary cruise off the coast of France took a turn for the deeply, deeply weird.

Colin Blake and his wife were spending the evening ashore in Marseille, when Blake noticed that one of his toes was getting a bit sore – and also, turning kinda purple.

After a cursory examination by his wife, she declared it to the result of Blake’s new sandals, suggesting that “they were rubbing on my big toe and that was causing it to be red”.

The following day, with the ship once again out to sea, Blake’s toe was still inflamed and quite painful, so he hobbled off to visit the ship’s doctor for a second opinion.

The doctor, it turns out, knew quite a bit more than Mrs Blake about injured toes, and offered up an alternate theory concerning the pain and swelling, informing Blake that he had been bitten by a Peruvian wolf spider.

The good news is that a bite from a Peruvian wolf spider is about as bad for an adult human as been stung by a bee, or some unwarranted criticism from a trusted friend or colleague.

The bad news for Mr Blake, however, was that the Peruvian spider that had bitten his toe had also decided to make use of his digit as an incubator for its eggs.

And so, like a demented magician hell-bent on turning the victim’s entire life into a waking nightmare, the doctor made a small incision in the area around the bite – and out poured the spider’s eggs.

… yeah, I know. You’re probably trying to eat your lunch, and now that you’re thinking of some random English dude’s elderly toe, sliced open and with a river of spider eggs and gross old-man toe juice flowing forth, you’ve lost your appetite.

To which I say: “You haven’t even heard the best bit yet”.

With the wound proving stubbornly resistant to healing, Blake went back to the doctor for further medical advice – only to be told that they hadn’t quite managed to get all the eggs out first time around.

And that one of the eggs had hatched.

And that the pain Blake was feeling was because that baby spider, born underneath the skin of Blake’s toe, was trying desperately to eat its way out, to freedom.

You’re very, very welcome – I trust you will enjoy the rest of your lunch.

TO MARKETS

It’s not been a bad day on the local markets, all things considered, after the bourse struggled all day yesterday but barely managed to move the needle before the end of the session.

That no doubt left local stock enthusiasts with a bit of pent-up investus interuptus, so – with a decent enough lead in from Wall Street overnight – the benchmark has been making steady upward progress throughout the morning, reaching +0.41% at lunch.

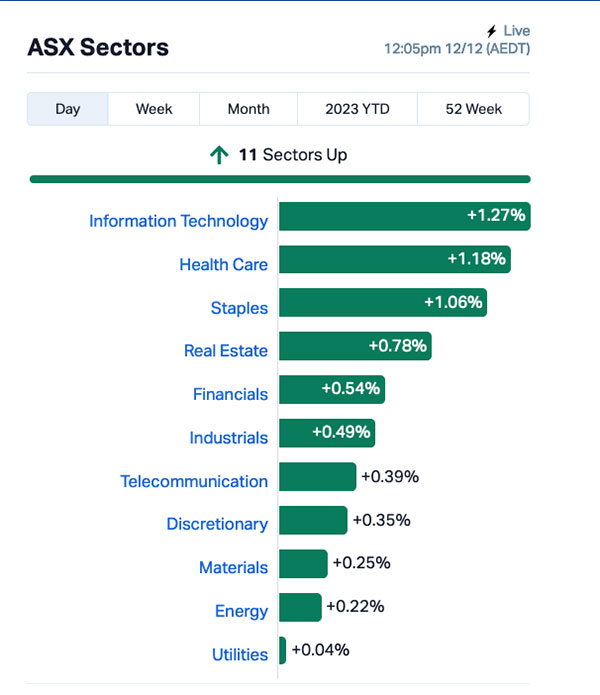

It was heartening to check how each sector is travelling today, and seeing everything in the green, with varying degrees of success, over the course of the morning. InfoTech is leading the way for the local players, out in front to the tune of +1.36%.

Languishing down the bottom of the ladder – and dipping below zero, despite everyone’s best efforts – is the beleaguered Energy sector, which is once again taking a hammering for all the same reasons as it has been over the past couple of weeks.

Sluggish demand from China, oil prices behaving weirdly, uranium prices spiking apparently at random – aka, Business As Usual for that sector of the market.

The result for the Energy sector is this ugly, brutal mess.

It’s also worth noting that spot gold prices have tumbled back below US$2,000/oz, which was putting the goldies under some moderately serious pressure this morning, leaving the XGD All Ords Gold Index in the red for a few hours.

It’s since come right, however, but only just – at the time of writing, it’s sitting on +0.04%, and spot gold is at US$1,984.47/oz.

NOT THE ASX

Looking overseas, and the US market had a moderate, if slightly lacklustre session overnight, which left the S&P 500 up by +0.32%, the blue chips Dow Jones index higher by +0.32% and the tech-heavy Nasdaq needle moving +0.12%.

Like I said – nothing special, but not a total pile of sh*t either.

Earlybird Eddy reports that Wall Street’s traders began the US week on a cautious note ahead of the US CPI release tomorrow, and the Fed’s last scheduled rates decision of 2023 on Wednesday (US time).

The market expects the Fed to pause this week, but commence cutting rates by mid next year.

“The biggest risk to ‘risk-on’ is the fact that the Fed does not do what the market is telling it that it is going to do, which is slash interest rates over the course of 2024,” David Neuhauser, chief investment officer of Livermore Partners, told CNBC.

To individual stock news, Nike rose 2.3% after analysts at Citigroup say “buy”.

Department store Macy’s surged almost 20% as exisiting shareholders, Arkhouse Management and Brigade Capital, combined to lob a US $5.8bn takeover offer that could take the iconic retail brand from the stock market.

Eddy also noted that crypto stocks took a proper kicking overnight, after Bitcoin lost control of its bowels and soiled the linen by -7%, falling below US$40,600 – and here I was, yesterday, thinking to myself that BTC was actually starting to behave itself.

Most crypto related stocks like Coinbase and Riot Platforms fell, Eddy reports, adding that Cathy Wood’s ARK fund has been consistently selling Coinbase shares over the past couple of weeks.

In Japan, the Nikkei is doin’ orright, up 0.62%, Hong Kong’s Hang Seng is up 0.35%, while Shanghai markets are flatter than a week old can of Coke.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 12 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DOC Doctor Care Anywhere 0.061 36% 422,383 $16,498,901 CYQ Cycliq Group Ltd 0.004 33% 216 $1,072,550 IEC Intra Energy Corp 0.004 33% 267,111 $4,982,345 RMX Red Mount Min Ltd 0.004 33% 125,081 $8,020,728 FCG Freedom Care Group 0.2 29% 57,397 $3,702,006 ESR Estrella Res Ltd 0.005 25% 1,332,745 $7,037,487 T3DDB 333D Limited 0.005 25% 80,607 $425,242 CMP Compumedics Limited 0.29 21% 113,747 $42,519,108 HAR Haranga Resources 0.205 21% 303,296 $13,637,929 1MC Morella Corporation 0.006 20% 635,000 $30,893,997 TTT Titomic Limited 0.039 18% 6,121,903 $29,443,976 HIQ Hitiq Limited 0.021 17% 537,233 $5,876,238 SIS Simble Solutions 0.0035 17% 420,000 $1,808,852 VRC Volt Resources Ltd 0.007 17% 32,438,571 $24,780,640 BUR Burley Minerals 0.18 16% 94,508 $15,700,997 NFL Norfolk Metals 0.22 16% 592,815 $6,711,749 PLT Plenti Group Limited 0.79 14% 369,085 $118,790,512 PNX PNX Metals Limited 0.004 14% 1,500,000 $18,832,187 DKM Duketon Mining 0.2 14% 65,014 $21,390,209 S3N Sensore Ltd 0.12 14% 24,000 $3,821,290 BLY Boart Longyear 1.515 13% 4,061 $396,533,355 ASQ Australian Silica 0.063 13% 389,580 $15,784,181 EPM Eclipse Metals 0.009 13% 260,000 $16,500,434 HFY Hubify Ltd 0.018 13% 75,722 $7,938,181 WIN Widgie Nickel 0.092 12% 1,496,896 $24,431,494

Leading the Small Caps winners this morning is UK-based telehealth company Doctor Care Anywhere Group PLC (ASX:DOC) , which is making some decent (and rapid) gains this morning after news broke that the company is set to repay its December 2022 senior loan facility with AXA PPP Healthcare Group.

From what I’ve been able to glean quickly this morning, DOC is looking to raise some to raise £10.6 million under an offer of convertible notes, subject to shareholder approval.

The company says the notes would be due 31 December 2027, with no repayment of principal required until maturity, at a conversion price of Conversion price of $0.0875 per share, which is a whopping 94% premium on the DOC closing price yesterday.

Also performing well this morning was Cycliq (ASX:CYQ), climbing well on the news that the bicycle safety gear company had successfully made it to the end of the annual Black Friday sales event.

The company says that it raked in an unaudited $1.2 million in gross revenue for the month of November, after the company saw its total order count increase by 29% over that same period.

And the final small cap to mention from this morning (because it had news, and isn’t moving completely at the whim of the market), is Compumedics (ASX:CMP), which came out of a trading halt with news that it has received two new orders for its Magnetoencephalography (MEG) tech – from Tsinghua and Tianjin Universities – worth around $9.3 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 12 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SHN Sunshine Metals Ltd 0.0175 -42% 59,460,101 $36,720,253 TG6 TG Metals 0.43 -41% 8,092,394 $39,482,902 APL Associate Global 0.13 -26% 40,000 $9,886,175 AVW Avira Resources Ltd 0.0015 -25% 169,333 $4,267,580 BMG BMG Resources Ltd 0.009 -25% 681,200 $7,605,566 VBC Verbrec Limited 0.065 -24% 86,674 $21,530,471 AYT Austin Metals Ltd 0.007 -22% 1,499,999 $9,142,872 AU1 The Agency Group Australia 0.033 -21% 368,501 $18,000,217 YOJ Yojee Limited 0.004 -20% 126,251 $6,529,926 MHI Merchant House 0.041 -20% 1,000 $4,807,591 BCT Bluechiip Limited 0.0155 -18% 2,619,917 $14,954,673 PRS Prospech Limited 0.032 -18% 955,200 $8,746,832 NPM Newpeak Metals 0.015 -17% 531,351 $1,799,131 DAL Dalaroo Metals 0.02 -17% 451,174 $1,986,000 ZNO Zoono Group Ltd 0.045 -15% 393,500 $10,066,167 NHE Noble Helium 0.145 -15% 4,148,983 $43,924,506 S2R S2 Resources 0.175 -15% 1,486,520 $84,189,712 G88 Golden Mile Res Ltd 0.018 -14% 441,661 $6,917,180 ATH Alterity Therapeutics 0.006 -14% 3,357,908 $19,616,523 CCZ Castillo Copper Ltd 0.006 -14% 50,000 $9,096,537 M2R Miramar 0.024 -14% 165,000 $4,168,347 NAE New Age Exploration 0.006 -14% 500,000 $12,557,292 NGL Nightingale Intel 0.039 -13% 81,904 $4,834,522 CNQ Clean Teq Water 0.3 -13% 21,583 $22,443,841 PBL Parabellum Resources 0.3 -13% 20 $21,493,500

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.