ASX Small Caps Lunch Wrap: Goldies and Health shine, Wisetech woes still weigh

The threat was clear: feel better, or Randall would be vaporised on the spot. Pic: Getty Images

- ASX broadly up, goldies and Health Care sector lead the way

- Wisetech, MinRes and BHP in the headlines this morning

- Small Caps winners include Yandal Resources and Vection Tech

Local markets are up at lunchtime today, but there’s no escaping the fact it’d be a much better result, except the unfolding tawdry drama at Wisetech Global has cast a pall over the rest of the results.

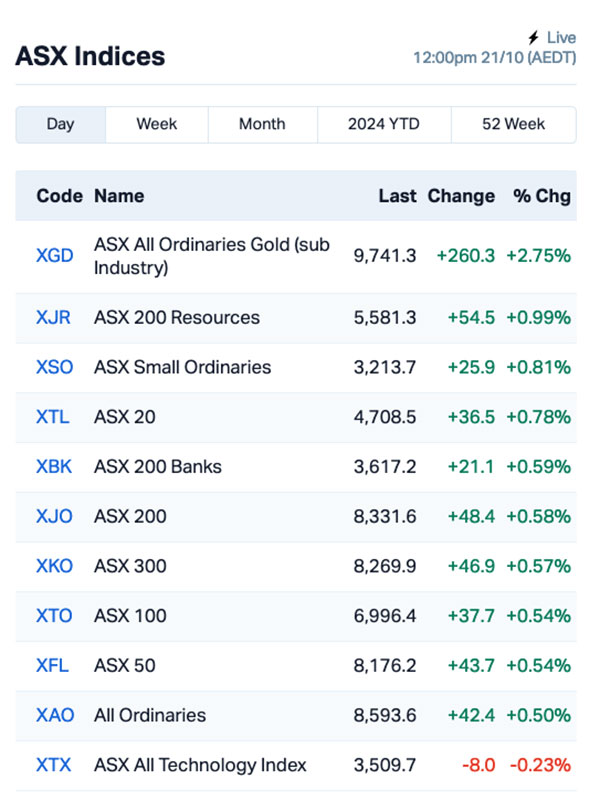

Overall, things look great, though. The goldies are firing on all cylinders again, with that sub-sector flying to a 2.7% gain since the market opened, Resources overall are plodding along nicely around +1.0% and everything else is moving nicely.

Except for InfoTech, and that’s in the murk by 2.5%, almost entirely because market heavyweight WiseTech Global (ASX:WTC) is being sold off heavily – yes, again – in the wake of its founder’s private life hassles.

TO MARKETS

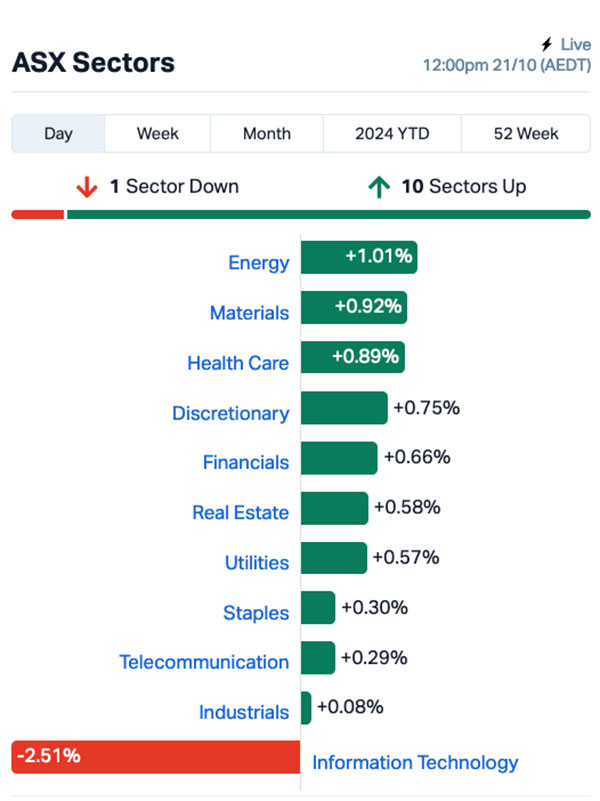

In more detail, here’s what’s happening on the ASX today – 10 of 11 sectors were in the green paint at lunchtime to varying degrees, with Materials, Health Care and Energy all close enough to +1.0% each.

Lagging a little were the Telcos, and Industrials – and a very clear last place belongs to InfoTech, which is Wisetech’s fault.

At midday, here’s how the sectors looked:

And here’s how the sub-indices looked:

The goldies in particular are having another bumper day, up nicely while the price of gold holds steady at a new all time high, around US$2,723/oz.

The major losses from this morning, however, can be attributed to separate stories in the headlines today, concerning three of the country’s biggest players in their respective fields – namely, Wisetech Global, BHP (ASX:BHP) and Mineral Resources (ASX:MIN).

I’ll start with MinRes, with founder and Managing Director Chris Ellison’s personal tax situation coming under scrutiny over allegations raised in the media that he has been avoiding his tax obligations.

For what it’s worth, the board at MinRes has told the ASX that it has full confidence in Ellison’s leadership, but that did come with something of a caveat.

“Since its IPO in 2006, payments made by MinRes to offshore entities connected with Mr Ellison related to pre-IPO sales contracts that were recognised as liabilities in the company’s financial statements at the time,” the board said in an announcement to the ASX.

“As to his private tax matters, Mr Ellison self-reported to the Australian Taxation Office, repaid amounts owed and disclosed these matters to the board.

“While this does not diminish what happened, Mr Ellison profoundly regrets his errors of judgment.”

Mineral Resources was sold off heavily this morning, down 10.7% at lunchtime.

Meanwhile the Wisetech Global scandal, which I wrote about last week, is deepening.

The company was sold off heavily again this morning after it was revealed that embattled founder and CEO Richard White disposed of 351,058 shares at $131.22 between 11-17 October, pocketing roughly $46 million in folding money.

I don’t have the time nor the energy to re-tell the whole story here – but Wisetech chairman Richard Dammery is reportedly engaged in a series of meetings with the company’s major investors in a bid to hose down the controversy.

Wisetech was down more than 16% early in the session today.

And the third major headline is from BHP, which is reportedly set to sign off on an eye-wateringly massive $US30 billion ($47.2 billion) settlement for the 2015 Mariana dam collapse.

By the looks of things, that settlement has been looming for quite some time, and investors have climbed back on board with BHP this morning, boosting its price around 1.4% since the market opened this morning.

NOT THE ASX

On Friday, the S&P 500 climbed 0.4%, reaching a new all-time high and marking its sixth consecutive week of gains – the longest streak of 2024.

The tech-heavy Nasdaq led the way with a 0.63% gain, while the blue chips-focused Dow Jones added 0.09%.

In US stock news, Netflix’s post-market results on Thursday eased concerns about Big Tech facing challenges in the third quarter. The streaming giant’s profit shot up, smashing Wall Street estimates, and both revenue and subscriber growth came in stronger than analysts expected. Shares were up 11%.

Tesla shares dropped 0.1% after the US National Highway Traffic Safety Administration (NHTSA) announced an investigation into the company’s full self-driving (FSD) technology. The NHTSA is looking into reports of four crashes that occurred while the FSD software was being used in situations with poor visibility, like when there’s sun glare, fog, or dust in the air. The investigation will involve about 2.4 million Tesla vehicles in the US – essentially every Tesla that has the FSD capability.

Wedbush analyst Dan Ives reported that iPhone sales in China have jumped 20% since September 20, when Apple launched the iPhone 16 and Huawei released a new model. Although Apple has lagged behind Huawei in China this year, this data has calmed concerns about weak initial iPhone 16 sales. Apple shares were up 1.23%.

American Express jumped nearly 3% after stronger-than-expected profit for Q3 and an upgrade to its full-year outlook, driven by solid consumer spending.

Coinbase saw its shares jump nearly 8%, riding the wave of Bitcoin’s recent surge. Bitcoin climbed nearly 10% last week and is getting close to the US$70,000 mark.

In Asian market news, China’s central bank lowered interest rates this morning. It’s literally happened as I was writing this, so I’m gonna leave it to someone who knows a lot more about this to write it up later in the day.

Japan’s Nikkei was up slightly in early trading, and the rest of the major Asian markets are still waking up, so no big news from there.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 21 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap PUA Peak Minerals 0.0045 125.0 58,261,777 $4,994,221 YRL Yandal Resources 0.195 95.0 2,995,274 $26,780,761 VR1 Vection Technologies 0.015 50.0 59,048,144 $13,265,890 CAV Carnavale Resources 0.004 33.3 12,747,115 $12,270,655 EXL Elixinol Wellness 0.004 33.3 3,013,925 $4,680,214 GCR Golden Cross 0.004 33.3 1,275,332 $3,291,768 DOU Douugh 0.012 33.3 31,958,096 $9,738,620 GRL Godolphin Resources 0.018 28.6 2,903,303 $4,426,957 88E 88 Energy 0.0025 25.0 3,727,876 $57,867,624 EVR EV Resources 0.005 25.0 20,400 $5,585,086 RIL Redivium 0.005 25.0 28,008 $10,987,419 VML Vital Metals 0.0025 25.0 254,841 $11,790,134 BML Boab Metals 0.16 23.1 4,154,412 $30,341,364 TZL TZ Limited 0.06 22.4 631,641 $12,572,573 QFE Quickfee 0.12 21.2 194,215 $33,334,959 KAU Kaiser Reef 0.21 20.0 4,622,490 $35,777,681 PR2 Piche Resources 0.12 20.0 93,758 $8,029,054 ERL Empire Resources 0.003 20.0 805,599 $3,709,783 OVT Ovanti 0.031 19.2 202,533,914 $40,465,057 AUZ Australian Mines 0.014 16.7 22,870,678 $16,782,145

Yandal Resources (ASX:YRL) was rising quickly on news that the first assay results from the twelve hole, 2,400m RC program completed across New England Granite structural targets in early October have been received. The results showed 78m @ 1.2 g/t Au from 96m to end-of-hole in 24IWBRC0039, including 5m @ 3.2g/t Au from 102m, and 5m @ 2.8g/t Au from 139m. The remaining results from this drill program are expected over the next 2-4 weeks.

Vection Technologies (ASX:VR1) was rising on news that it has partnered with IT giant Dell to launch its AI-based ‘Algho’ platform, securing its first sale of $500,000. The company says the launch is “testament to the value and potential of Vection’s acquisition of TDB” – the acquisition TDB, which supplied the generative AI layer which powers Vection’s ‘Algho’ platform, goes before shareholders for approval on Monday 28 October.

Carnavale Resources (ASX:CAV) was up on news that it has commenced an extensional drilling program at the high-grade Swiftsure deposit within the Kookynie Gold Project is underway, testing extensions to the Swiftsure bonanza gold grade shoots that contain zones of +30g/t within the resource. The company says it will monitor the drilling carefully and modify the program to chase the best mineralisation as it is encountered.

Elixinol Wellness (ASX:EXL) was up on news that it will be consolidating its securities, from 1.56 billion to a somewhat more manageable 195 million, with the process to be voted on as part of the company’s AGM later this month.

TZ (ASX:TZL) was up on news that it’s entered into a Heads of Agreement to acquire Proptech company, Keyvision Holdings – a “high margin, recurring revenue proptech company that provides Tenant Experience Apps for the property sector: Residential; Commercial; Retail; Aged Care and Community Groups”, according to the announcement.

Quickfee (ASX:QFE) was up after releasing a quarterly business update this morning, revealing quarterly revenue of $5.6 million, up 33% on pcp. The increase was driven by “strong growth in the core Finance product in both Australia and the US”, and has the company set for an expected FY25 EBTDA in the range of $1.5 -$2.5 million, with a stronger second half-year.

Kaiser Reef (ASX:KAU) climbed this morning on news that it has received firm commitments for a Placement of Kaiser shares at $0.15 per share to raise $8 million (before costs) to complete the last stage of the A1 Mine production plan. The funds have been earmarked for completion of the A1 Mine ramp up and expansion for high-grade gold production, and the resumption of drilling at the A1 Mine.

Vital Metals’ (ASX:VML) news was an AGM announcement, and Peak Minerals’ (ASX:PUA) news was a response to an ASX speeding ticket on price and volume.

Earlier, Environmental Clean Technologies (ASX:ECT) is up on news of the signing of a Joint Venture Agreement with ESG Agriculture, advancing from the Heads of Agreement signed in July 2024. The company says it marks a significant milestone in the progression of the COLDry Lignite-Nitrogen Fertiliser Project.

TMK Energy (ASX:TMK) was up on news that the first of the three additional pilot production wells at the Gurvantes XXXV Coal Seam Gas (CSG) Project, being drilled as part of the 2024 drilling program, has been successfully drilled to a total depth of 480m and has intersected approximately 60m of net coal, which is “as per prognosis and consistent with the existing three surrounding pilot production wells”.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 21 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SI6 SI6 Metals 0.001 -50.0 1,916,063 $4,737,719 NSM North Stawell 0.019 -45.7 2,205,130 $5,627,152 KLI Killi Resources 0.092 -36.6 9,343,057 $20,332,443 PRX Prodigy Gold 0.002 -33.3 55,800 $6,997,367 AAU Antilles Gold 0.003 -25.0 1,482,628 $7,422,971 EFE Eastern Resources 0.003 -25.0 375,000 $4,967,786 IBG Ironbark Zinc 0.003 -25.0 1,050,000 $7,334,591 SFG Seafarms Group 0.003 -25.0 64,214 $19,346,397 CC9 Chariot Corporation 0.21 -25.0 300,731 $25,095,801 BPP Babylon Pump & Power 0.005 -16.7 75,000 $14,997,294 BUY Bounty Oil & Gas 0.005 -16.7 5,351,166 $8,991,006 CMD Cassius Mining 0.005 -16.7 42,430 $3,252,027 LPD Lepidico 0.0025 -16.7 1,335,339 $25,767,375 POS Poseidon Nickel 0.005 -16.7 531,217 $25,223,253 PRM Prominence Energy 0.005 -16.7 820 $2,335,058 CMO Cosmo Metals 0.023 -14.8 120,000 $3,536,808 CDD Cardno 0.27 -14.3 421,114 $12,304,109 1AI Algorae Pharma 0.006 -14.3 5,583,202 $11,811,763 GLA Gladiator Resources 0.012 -14.3 200,000 $10,616,156 RBX Resource B 0.03 -14.3 34,807 $2,893,957

ICYMI – AM EDITION

Maiden drilling at Javelin Minerals’ (ASX:JAV) brownfields Coogee gold-copper asset, 55km southeast of Kalgoorlie, has been increased by 30% to 3,000m after priority targets were identified in earlier drilling.

The first phase of drilling will begin in mid-late November, testing several strong gold-copper targets close to the mined Coogee Deposit and over the surrounding areas.

Despite hosting a resource 126,685oz of gold and being located next to the world-class St Ives goldfield, Coogee has not had a systematic exploration drilling campaign undertaken around the Coogee pit since Ramelius (ASX:RMS) completed mining operations in 2014.

A Program of Work (PoW) has been approved and a drilling-for-equity agreement has been signed with highly regarded contractor Topdrill.

Titanium Sands (ASX:TSL) has completed its presentation to the Central Environment Authority (CEA) and 34 key stakeholders from various governmental departments at a formal meeting held recently at the CEA head office in Colombo, Sri Lanka.

The objectives of this meeting were to hear from all stakeholders and for TSL to have the opportunity to present its scoping plan and next steps for the Mannar heavy mineral sands project.

A combined site visit by all the interested stakeholders is set to take place next, followed by the terms of reference (TOR) being issued to the company.

“The key stakeholder presentation was a significant step in the evolving environmental process and as outlined by the Director General himself, now allows for the planning of the next steps leading to the finalisation of the process and then the issue of the IML for Mannar,” TSL managing director Dr James Searle said.

Chariot Corporation (ASX:CC9) has raised $1.61m following a placement of 8.09m shares at an issue price of 20c per share, which was strongly supported by a group of institutional, sophisticated and professional investors.

The existing cash reserves combined with the proceeds of the placement will fund phase 2 drilling at the Black Mountain lithium project, the fourth purchase price payment to Black Mountain Lithium Corp, execution of the pilot mine strategy and metallurgical test work in Perth.

“With this funding, we are now well positioned to pursue our medium-term plans,” CC9 managing director Shanthar Pathmanathan said.

“Additionally, with two series of options set to expire this year and further funds anticipated from the sale of listed shares from past divestments, this capital raise serves as a strong bridge to meet our future liquidity requirements.”

Zeotech (ASX:ZEO) has received a $905,000 R&D tax incentive relating to the Australian Government’s R&D Tax Incentive Program, which provides a cash refund on eligible research and development activities performed by Australian companies.

The refund relates to the company’s expenditure on development of its proprietary mineral processing technology for the sustainable production of manufactured zeolites.

It also reflects its spending on advancing its dual stream agri-soil product development, methane emissions control technology and high reactivity metakaolin research for low-carbon cement and concrete from his high-purity Toondoon kaolin project.ZEO has used $589,248.19 to repay the secured research & development loan with R&DIUM Capital and has banked the remaining $316,636.28.

Mt Malcolm Mines (ASX:M2M) has produced an inaugural gold doré bar from the bulk sampling program at the Golden Crown prospect.

With a combined weight of 13.85 ounces (431g), the company said the two gold doré bars mark a significant milestone.

Visible gold was observed in the rock chip samples collected from the zones of mineralisation, with 11 of the 30 samples returning assays of over 5g/t gold as well as a top result of 458.39g/t gold.

“The inaugural gold doré bar represents a significant achievement in the gravity processing at Golden Crown, and we are thrilled to have reached this key milestone,” M2M managing director Trevor Dixon said.

“These promising results strengthen our confidence in the prospect’s economic potential, and we are excited to proceed with further work to unlock its full value.”

At Stockhead we tell it like it is. While Javelin Minerals, Titanium Sands, Chariot Corporation, Zeotech and Mt Malcolm Mines are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.