ASX Small Caps Lunch Wrap: Fruit and veggies scuttle any hope of interest rate cuts

Enjoy your watermelon, small child... it will be your last. Pic via Getty Images

- ASX 200 benchmark is moping like a moody teenager refusing to get out bed

- August headline CPI falls to 2.7%, but trimmed inflation figures are still too high

- Who won the Small Caps race this morning? Read on to find out

Local markets opened flattish this morning, after finishing flattish yesterday in the wake of the RBA picking the most boring option – “do nothing” – on what has to be in the running for “Most Boring Inane Chit-Chat” topic for 2024.

It’s in imminent danger of edging out perennial champion “Housing Crisis” and relative newcomer “Cost of Living”, and honestly I am struggling to be even remotely enthused about mentioning it.

Pouring whatever the opposite of fuel is on the fire, the ABS delivered its August CPI figures this morning. Headline inflation is down to 2.7% for the 12 months to August, which is nice – but trimmed inflation is still at 3.4% and outside the RBA’s desired range.

But inflation is falling in a manner that some describe as “slow and steady”, but I can’t help but think of as “lengthy and tedious”.

I need a holiday. Urgently.

Here, in more detail, is what’s been happening on the markets this morning.

TO MARKETS

As the morning turned into lunchtime, the Australian Bureau of Counting Things delivered its August CPI data – and the numbers are right down the middle of Main Street, falling from 3.5% in July to 2.7% in August, and on track for the 2.0-3.0% window the RBA is aiming for.

Before everyone gets too excited about it and the interminable moaning about the RBA being big meanies about interest rates starts up again in earnest, the sharp decline for the August figure is almost entirely down to government energy rebates – which is why it’s unlikely to be the number the RBA cares about.

Its preferred yardstick tells a similar story, albeit one that is nowhere near as dramatic.

Trimmed mean inflation – which ignores government largesse in favour of unsullied numbers – fell from 3.8% in July to 3.4% in August… which, just so we’re clear, is not between 2.0% and 3.0%.

The largest driver of inflation over the period was “fruit and vegetables”, which soared +9.6%, so the options moving forward are now clear.

An interest rate cut – and more affordable mortgages – are within reach, but the cost of that will be everyone getting scurvy.

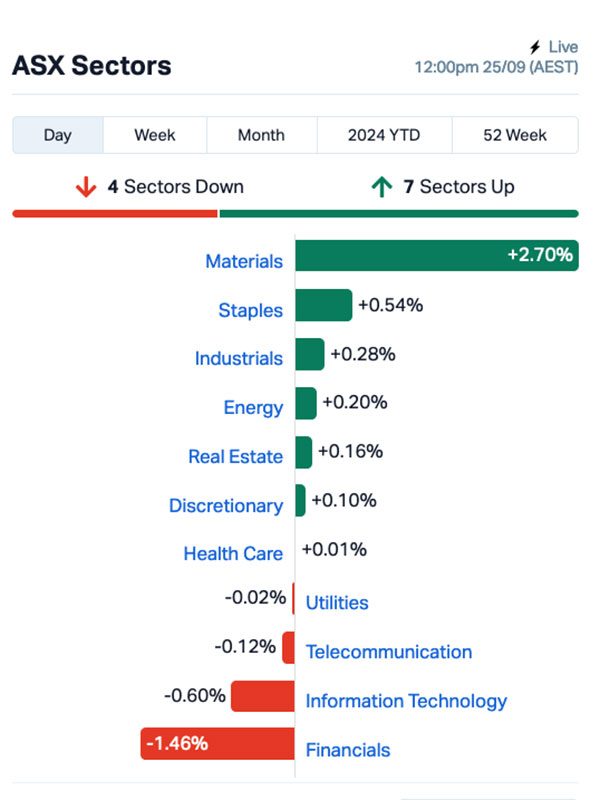

The effect of that news on the market has been minimal – after a flattish start to the day, the CPI data provided a small, short-lived boost that was gone 20 minutes later, leaving the sector chart looking like this:

In a nutshell: Materials (resources) are enjoying a morning in the sun, off the back of yesterday’s relatively surprising word out of China that Beijing finally appears to have landed on a course of stimulus action to save its economy from complete annihilation.

That’s given Aussie resources stocks a much-needed boost through rising commodity prices overnight – especially iron ore, which has seen a 3.0% boost to US$97.55/tonne, adding some hope that China isn’t going to drag our economy down into the mire as collateral damage.

Copper, lithium and silver prices jumped by over 4% overnight, while crude prices lifted by 1% on the news.

This morning, BHP (ASX:BHP) was up 2.75%, Fortescue (ASX:FMG) was up 3.44%, South32 (ASX:S32) was up 4.81% – you get the idea. It’s been a great morning for our big diggers.

The flipside is the grossly overweight Financials sector, which has taken a 1.5% knee this morning, led by the Big Four dropping their collective bundle since the ASX opened.

Commonwealth Bank (ASX:CBA) is down 2.3%, National Australia Bank (ASX:NAB) is down 2.9%, Westpac (ASX:WBC) was down 1.1% – and, again, you get the idea.

Interesting note – Macquarie Group (ASX:MQG) is down 1.72% this morning, a combination of yesterday’s lack of action from the RBA on interest rates, and news that the big finance group has been fined a record $4.9 million, after the Markets Disciplinary Panel (MDP) found that it had failed to stop “suspicious orders” being placed on the electricity futures market.

An ASIC investigation uncovered 50 occasions between January to September 2022 where Macquarie ran roughshod over market rules, allowing three clients to put in orders that should have been flagged and stopped.

NOT THE ASX

Overnight, the S&P 500 finished higher by 0.25%, the Dow Jones was up by 0.20%, and the tech heavy Nasdaq climbed by 0.56%.

It’s worth noting that the VIX Index, which measures market volatility and is also called the market’s “fear index” dropped by 3%, suggesting the market expects steadier days ahead.

In US stock news, Nvidia was up 4% after news that CEO Jensen Huang finished selling his shares after reaching the limit of 6 million shares allowed under a trading plan. He still owns over 75 million shares of Nvidia directly and another 785 million through trusts.

Visa Inc. dropped 5.5% following reports that the US Justice Department is set to file a lawsuit claiming it has a monopoly on debit cards.

Estee Lauder popped 6% on China’s stimulus package news as the beauty brand gets nearly a third of its sales from the Asia region.

Markets in Botswana are closed for a holiday… the lucky sods.

Meanwhile, across Asian markets this morning the Nikkei is up 0.22%, Hong Kong’s Hang Seng is up 1.82% and Beijing’s stimmy cash-splash has propelled Shanghai markets to a 2.14% jump at lunchtime.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 25 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap RNE Renu Energy 0.002 100.0 4,377,337 $804,134 CTN Catalina Resources 0.003 20.0 1,221,000 $3,096,217 LSR Lodestar Minerals 0.002 50.0 2,449,999 $3,372,329 SI6 SI6 Metals 0.002 50.0 1,808,315 $2,368,859 EV1 Evolution Energy 0.04 42.9 72,333 $10,095,880 LNU Linius Tech 0.002 33.3 250,000 $8,797,861 NRZ Neurizer 0.004 33.3 1,217,447 $6,543,358 YAR Yari Minerals 0.004 33.3 570,000 $1,447,073 LRL Labyrinth Resources 0.017 30.8 14,955,499 $50,007,235 WGR Western Gold 0.037 27.6 23,000,273 $4,940,297 CCZ Castillo Copper 0.005 25.0 224,241 $5,198,021 ECT Env Clean Tech 0.003 25.0 22,963 $6,343,621 EOF Ecofibre 0.04 25.0 1,273,850 $12,123,965 1AE Aurora Energy Metals 0.047 23.7 293,487 $6,804,422 BNZ Benz Mining 0.2 21.2 319,848 $17,629,578 BUR Burley Minerals 0.053 20.5 1,047,023 $6,616,322 ADD Adavale Resources 0.003 20.0 8,200 $3,059,413 NAE New Age Exploration 0.006 20.0 1,215,508 $8,969,495 SFG Seafarms Group 0.003 20.0 424,909 $12,091,498 MGT Magnetite Mines 0.22 18.9 484,786 $18,930,930

ReNu Energy (ASX:RNE) doubled up (from $0.001 to $0.002) on news that it has entered into a binding Grant Deed with the Tasmanian Government for the award of up to $8 million of funding for its Tasmanian green hydrogen project, to be paid on delivery of green hydrogen to customers.

Western Gold Resources (ASX:WGR) was up after the company published a positive Scoping Study for its Gold Duke project in Western Australia, noting that the study has only assessed the economics based on mining 51% of the current published 2.9Mt at 2.07g/t for 234,000oz gold mineral resource of Gold Duke.

Lodestar Minerals (ASX:LSR) was up on news that test drilling at its Ned’s Creek site has been completed, and data from two drillholes at the Ned’s Creek project in Western Australia is due from the lab imminently. Lodestar recently completed placing of the Rights Issue shortfall, with exploration at Ned’s and inaugural Aircore drill testing on gold anomalies at Coolgardie West set to kick off shortly.

Ecofibre (ASX:EOF) was up on news that it has completed an agreement with Under Armour for the supply of NEOLAST yarns to Under Armour’s nominated knitting mills, including the purchase of associated manufacturing equipment. The initial term of the supply agreement is three years, with an expected annual revenue at full production of US$6.0 million.

Si6 Metals (ASX:SI6) announced plans to undertake a non-renounceable rights issue of one (1) fully paid ordinary share in the capital of the company for every two (2) shares held by eligible shareholders at an issue price of $0.001 per share (pre-consolidation) or $0.02, with funds raised to go towards exploration programs at the Lithium Valley (lithium), Pimento (rare earth elements) and Monument (gold) projects and for general working capital purposes.

Earlier, Great Boulder Resources (ASX:GBR) revealed that infill and extensional RC drilling at its Mulga Bill project has intersected more extremely high gold grades, extending the resource and adding thickness and grade to existing lodes. Highlights include 5m @ 43.13/t Au from 185m, including 2m @ 102.80/t Au from 186m, and 5m @ 40.61g/t Au from 256m, including 1m @ 194.50g/t Au from 258m.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 25 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap BCT Bluechiip 0.002 -50.0 1,920,983 $4,737,249 88E 88 Energy 0.002 -33.3 37,173,002 $86,801,436 ALR Altair Minerals 0.003 -25.0 8,727,260 $17,186,310 SIS Simble Solutions 0.003 -25.0 475,000 $3,013,803 SMM Somerset Minerals 0.003 -25.0 1,000,666 $4,123,995 AIV ActiveX 0.004 -20.0 1,990 $1,077,513 EXL Elixinol Wellness 0.004 -20.0 338,087 $6,605,912 WML Woomera Mining 0.002 -20.0 3,834 $3,795,347 NPM Newpeak Metals 0.014 -17.6 262,152 $5,191,886 AOA Ausmon Resorces 0.003 -16.7 267,833 $3,176,998 ERA Energy Resources 0.005 -16.7 13,456,820 $132,889,795 NVA Nova Minerals 0.14 -15.2 1,966,500 $40,186,885 C7A Clara Resources 0.009 -15.1 102,667 $2,651,374 HOR Horseshoe Metals 0.006 -14.3 84,040 $4,642,972 MCT Metalicity 0.03 -14.3 1,121,720 $17,450,458 NOR Norwood Systems 0.03 -14.3 77,417 $16,632,925 SPQ Superior Resources 0.006 -14.3 1,330,919 $15,189,047 BIT Biotron 0.019 -13.6 391,558 $19,850,803 PGM Platina Resources 0.019 -13.6 304,772 $13,709,967 NVU Nanoveu 0.02 -13.0 65,000 $11,613,222

ICYMI – AM EDITION

Finder has raised an additional $2 million through a shortfall placement, bringing the total amount raised in the entitlement offer to $6 million. The company placed just over 41.5 million shares at 4.8 cents each, with interest from new institutional investors.

Directors joined in the raise, applying for more than 2 million shares valued at about $105,000.

At Stockhead, we tell it like it is. While Finder Energy is a Stockhead advertiser, it did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.