ASX Small Caps Lunch Wrap: CPI data put a rocket up the ASX, but REX is circling the drain

Pic via Getty Images.

- Benchmark up as much as 1.3pc today after CPI data did what we all expected

- REX is on the brink of total collapse, and no one’s quite sure what to do about it

- Small Caps winners are banking gains on some cracking quarterlies

Local markets opened higher this morning, after Aussie investors thumbed their noses at a weak lead-in from Wall Street which saw another rough round of sell-offs in tech.

As I’m writing this, we’re waiting on the ABS to drop its CPI data, which could potentially knock the wind out of the benchmark’s sails – but prior to that data landing, things were chugging along pretty well.

(Update – the CPI data dropped… and it’s good news. I’ll explain more in a moment.)

Earlier in the session, the ASX 200 was up 0.63%, 10 out of 11 sectors were in positive territory – including our local techies, which have defied a punishing night for the US Nasdaq to climb 1.1%.

But, there’s bad news… Rex is in trouble. Big trouble.

TO MARKETS

Before we get to that, there’s the small matter of the national CPI data for the 12 months to June, which the Australian Bureau of Spreadsheets has delivered to an eagerly awaiting market this morning.

Our annual rate of inflation has risen to 3.8%, which is up from 3.6% at the start of 2024 – but we all knew it was coming, with most economists due to spend the next couple of hours nodding sagely and saying stuff like “Picked it!” and “told ya so!” to each other.

For what it all means, I shall defer to IG Analyst Tony Sycamore, who is not just named after one of my favourite trees, but is also a bit of a whizz with this kind of stuff.

“Headline inflation rose by 1.0% over the quarter (the consensus was +1.0%), bringing the annual rate to 3.8% from 3.6% prior, the first increase in annual CPI since December,” Tony said.

“The RBA will likely look through this number with subsidies announced in the federal budget expected to drag it lower again.

“The trimmed mean rose by 0.8% in the June quarter (consensus was +1.0%), allowing the annual rate to fall to 3.9% from 4.0% prior – for a sixth quarter of lower annual trimmed mean inflation.”

That’s important, because with six straight quarters of lower trimmed annual mean inflation in its pocket, the RBA has a reason to believe that its furious yanking on the Interest Rate Lever has worked, and that inflation is returning to target.

And that, dear reader, will vastly lessen the likelihood that we’re going to get slapped with another rate rise in the near future.

But of course, you guys knew that already – as evidenced by the fact that the ASX 200 benchmark jumped like it just had its bottom pinched when the ABS announced the number, surging 58 points in a few minutes to take the benchmark’s gain to around 1.2% in very short order.

Around 1pm today, the benchmark was powering along at 8,065.4 points, putting it within reach of its recent all-time high of 8083.7 points.

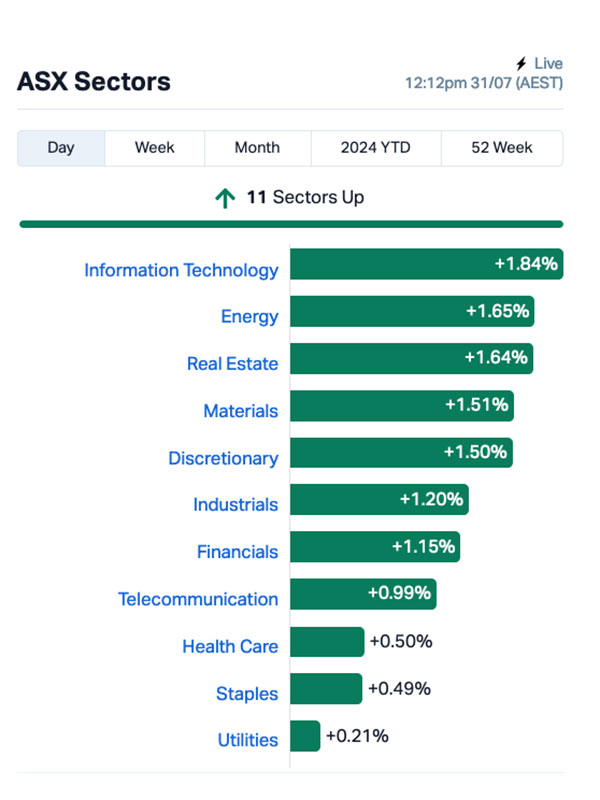

That surge of happy feelings has pushed every sector into positive territory, so the sector charts look all lovely and green, like this:

The other remarkable part of that chart is that our local tech stocks have ignored the battering that US tech stocks took overnight, which is not often the case – and it’s a rare day indeed that the ASX InfoTech stocks not only ignore the lead-in from Wall Street, but end up topping the charts.

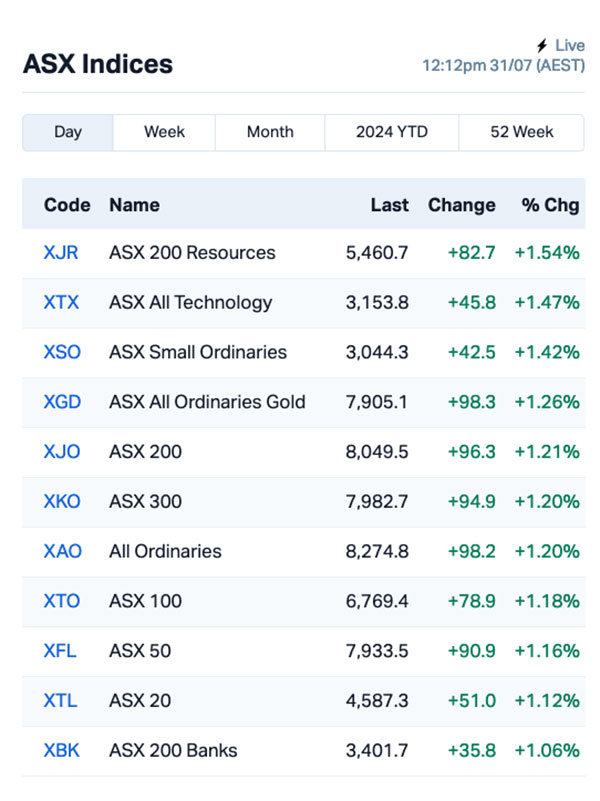

A look at the ASX indices shows a better picture of what the market’s thinking today – and it’s solid news for Resources, tech stocks, the goldies and… Small Caps!

The ASX Small Ordinaries index is outpacing the goldies so far today, which is broadly in line with a shift that’s happening in the US, as investors there cycle out of the ‘safe’ mega-stocks and back towards smaller stocks with larger risk surfaces.

The rest of the day’s headlines are being hogged by news that Regional Express (ASX:REX) has had its securities suspended today, after the airline went into voluntary administration and announced that about 610 people are about to lose their jobs.

As is often the case when it comes to any discussions about Australian airlines, literally everyone has some very strong opinions about it, mostly around whether the federal government needs to step in with a bailout, or actually purchase a chunk of the airline, to keep it in the air.

But the collapse of Rex comes about two months after low-cost airline Bonza hit the skids as well, and it means that in the short term, the concentration of survive providers for domestic air travel in Australia is continuing.

Virgin Australia and Link are still doing their thing on a small number of regional routes, but if Rex does go the way of the dodo, there’s going to be a lot of people left struggling to get from one far-flung part of the country to another.

As is often the case whenever the topic of airlines comes up in this country, absolutely every single person ever has an opinion about what to do next, and if X (formerly known as a reliable source of information, and also Twitter) is any indication, they are falling over themselves to tell the world what those opinions are.

Among my favourite takes on the Rex debacle is the suggestion that the federal government “just buys a chunk of Rex to keep it going” – which is on-brand for a furious lefty like our Prime Minister.

I know this because I have personally sat through hours of listening to Anthony Albanese during his formative years, arguing ad nauseum at our local ALP branch meetings that essential services should all be nationalised.

Well… here’s your shot, Albo. When REX shares were suspended this morning, they were at $0.565 a pop, giving it a market cap of a paltry $65 million or so – which is a tiny fraction of the $10 billion the government said it was going to be saving us thanks to its much-vaunted ‘rorts and waste’ audit from 2022.

Albo Air has a certain ring to it, no?

NOT THE ASX

I’ll keep this brief – if you want the details, head on over to Eddy Sunarto’s wrap of the US markets from this morning – but the headlines from there are as follows.

Microsoft had a bad session, after its Azure cloud service showed slower quarterly growth, disappointing investors who had been eager to see returns from the company’s substantial investments in AI products.

That sparked a downturn for the tech heavy Nasdaq, which sank 1.28%. The S&P 500 closed the day down by 0.5%, while the blue chips Dow Jones index lifted by 0.50%.

Overnight, gold fell by 1% to US$2,409.35 an ounce, oil prices were down by a further 0.8%, with Brent crude now trading at US$79.11 a barrel and the Aussie dollar slipped by 0.15% to US$0.654.

In Asian markets this morning, Japan’s Nikkei is lower by 0.41%, but the Hang Seng is up 1.44% and Shanghai’s having a banger, up 1.15%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 31 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap TD1 Tali Digital Limited 0.0015 50.0 2,700,000 $3,295,156 TX3 Trinex Minerals Ltd 0.003 50.0 62,000 $3,657,305 VPR Voltgroupltd 0.0015 50.0 2,003,975 $10,716,208 MMM Marley Spoon Se 0.029 38.1 362,803 $2,472,212 T3D 333D Limited 0.011 37.5 482,194 $955,559 KPO Kalina Power Limited 0.004 33.3 3,705,911 $7,459,182 1AI Algorae Pharma 0.012 33.3 27,690,719 $15,186,553 AD1 AD1 Holdings Limited 0.009 28.6 597,910 $6,290,539 BUY Bounty Oil & Gas NL 0.005 25.0 850,440 $5,994,004 EFE Eastern Resources 0.005 25.0 150,000 $4,967,786 ME1 Melodiol Glb Health 0.0025 25.0 5,673,183 $1,215,473 PNX PNX Metals Limited 0.005 25.0 20,000 $23,880,859 SPA Spacetalk Ltd 0.021 23.5 2,518,232 $8,007,364 GTE Great Western Exp. 0.032 23.1 64,034 $9,048,276 FRB Firebird Metals 0.135 22.7 84,964 $15,659,754 JAY Jayride Group 0.011 22.2 2,612,618 $2,126,782 IXU Ixup Limited 0.023 21.1 1,675,250 $29,407,299 APX Appen Limited 0.805 20.1 24,249,752 $149,411,101 AHN Athena Resources 0.006 20.0 1,616,765 $5,352,338 TMS Tennant Minerals Ltd 0.021 16.7 133,865 $17,206,027

Volt Power Group (ASX:VPR) was leading the charge Wednesday morning on a solid quarterly, which outlined that the company has achieved record Q2 Ordinary Revenue receipts of $2.0 million., YTD ordinary revenue receipts were up ~ 75% to $3.0 million vs YTD FY23 comparison $1.7 million. Additionally, the company achieved record YTD Net Cash from Operating Activities totalling $1.3 million (YTD FY23 comparison $0.4 million) – which is up ~200%, and leaves Volt with $2.4 million in the bank.

Kalina Power (ASX:KPO) delivered its quarterly today, outlining tbhe company’s continued process to secure funding to complete the project development of its projects. This includes KDP’s ~200MW projects deploying natural gas-fired Combined Cycle Power Plants integrated with Carbon Capture and Sequestration (‘CC-CCS’) as well as potential investment at KDP’s Saddle Hills project.

Algorae Pharmaceuticals -1AI (ASX:) was up on complicated news around some fresh, positive Pre-Clinical Results that showed its drug AI-116 “significantly reduces glutamate-induced toxicity in vitro, exceeding that of existing FDA registered drug for dementia, Donepezil”.

Alterity Therapeutics (ASX:ATH) was up because its quarterly says that the company saw positive interim data reported from ATH434-202 Phase 2 clinical trial showing improvement on the UMSARS Activities of Daily Living Scale and stable or improved neurological symptoms in some patients. The quarterly also says the company has “Cash balance on 30 June 2024 of A$12.6” – which I’m assuming is meant to have the word “million” on the end, because otherwise it’d be your shout for lunch.

New Age Exploration (ASX:NAE) is up because… it also released a quarterly, outlining how things are going at its Wagyu Gold Project, which is located in the well-endowed gold region of the Central Pilbara next door to De Grey’s Hemi (things are going well) and how the sale of the company’s Lochinvar metallurgical coal project is going (it has been sold).

333D (ASX:T3D) – which is a 3D printing company – has announced a new services agreement with each of Next Healthcare and Cloud Strike (t/a Align Radiology) to provide ongoing digital asset management and 3D printing services to those entities. It’s all very complicated but the main thrust is that its most likely going to be steady, ongoing work for 333D as it develops software and processes to meet the needs of both entities.

Spacetalk (ASX:SPA) was up on Wednesday, because it also delivered quarterly with some good news in it – namely, that the company achieved positive cash flow from operating activities of $0.85 million in Q4FY24, up from -$1.5 million in Q4 FY23, and positive free cashflow of $0.37 million, up from Q4 FY23’s -$2.24 million. That’s due to turnaround measures put in place by the company, and a 58% increase vs PCP for customer receipts.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 31 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 88E 88 Energy Ltd 0.002 -33.3 1,403,583 $86,678,016 LPD Lepidico Ltd 0.002 -33.3 6,094,058 $25,767,375 MCT Metalicity Limited 0.002 -33.3 35,442,713 $13,457,558 RML Resolution Minerals 0.002 -33.3 1,000,000 $4,830,065 CMO Cosmometalslimited 0.036 -32.1 700,894 $6,792,294 NWC New World Resources 0.017 -32.0 38,295,331 $70,890,376 MEL Metgasco Ltd 0.0035 -30.0 12,346,784 $7,237,934 ADD Adavale Resource Ltd 0.003 -25.0 8,948,228 $4,261,061 MKL Mighty Kingdom Ltd 0.003 -25.0 127,688,557 $12,863,772 OVT Ovanti Limited 0.003 -25.0 34,400 $4,960,422 SI6 SI6 Metals Limited 0.0015 -25.0 33,542,818 $4,737,719 ARV Artemis Resources 0.008 -20.0 1,041,419 $19,168,824 CAV Carnavale Resources 0.004 -20.0 92,000 $17,117,759 CCZ Castillo Copper Ltd 0.004 -20.0 701,796 $6,497,527 CTO Citigold Corp Ltd 0.004 -20.0 600,000 $15,000,000 NRZ Neurizer Ltd 0.004 -20.0 446,399 $9,512,153 RNE Renu Energy Ltd 0.004 -20.0 18,359 $3,630,670 SHO Sportshero Ltd 0.004 -20.0 135,319 $3,089,164 WNR Wingara Ag Ltd 0.008 -20.0 200,017 $1,755,425 FLC Fluence Corporation 0.105 -19.2 2,072,615 $140,525,634

IN CASE YOU MISSED IT

AirTasker (ASX:ART) has delivered a massive FY24, with a more than 115% improvement in positive free cash flow in a breakout 12 months. Group revenues were up 5.6% to $46.6m while admin and corporate costs were slashed by 31.9% to $3.3m.

At Stockhead, we tell it like it is. While AirTasker is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.