ASX Small Caps Lunch Wrap: Coles and Woolies weigh after ACCC cries foul on ‘bargains’

Pic via Getty Images

Local markets opened lower today, after Wall Street cooled dramatically on Friday in the wake of its post-rate cut surge and knocked a lot of the wind out of the ASX’s sails well before things got underway this morning.

Added to that, the ACCC has launched legal action against both Coles and Woolworths, alleging serious deceptive behaviour from the supermarket duopoly, and Jim Chalmers’ plans to revamp the RBA have been scuttled by an extraordinary demand from The Greens.

It’s all combined to depress the benchmark, which has been battling for traction around -0.7% all morning. Time to dive in and see what’s what.

TO MARKETS

The benchmark was set to open lower this morning, with the ASX Futures Index pointing at -0.8% around 8:00am today – mostly thanks to Wall Street’s cooldown on Friday when profit taking and risk-assessment adjustments slowed the expected post-rate cut surge.

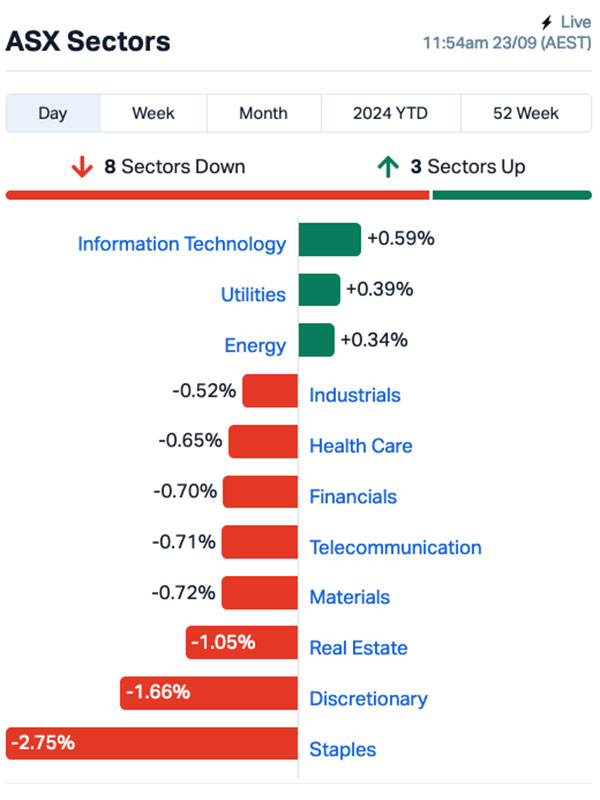

Here’s how the sectors looked at lunchtime:

As you can see, Consumer Staples has been lagging badly, largely because of some market-shaking news from the ACCC, which announced this morning that it has launched legal action against the two largest supermarket operators in the country – Coles Group (ASX:COL) and Woolworths (ASX:WOW) – for “allegedly breaching the Australian Consumer Law by misleading consumers through discount pricing claims on hundreds of common supermarket products”.

Specifically, the ACCC says that both of the big supermarkets had been misleading consumers, claiming that a large number of products had been “subject to price rises of at least 15 per cent for brief periods, before being placed in Woolworths’ ‘Prices Dropped’ promotion and Coles’ ‘Down Down’ promotion, at prices lower than during the price spike but higher than, or the same as, the regular price that applied before the price spike”.

The ACCC alleges the conduct involved 266 products for Woolworths at different times across 20 months, and 245 products for Coles at different times across 15 months – and, while the two legal actions are separate for each company, the penalties they are facing are severe.

Both Coles and Woolworths are potentially on the hook for the greater of three penalties:

- $50,000,000, or

- Three times (3x) the value of the ‘reasonably attributable’ benefit obtained, or

- if the Court cannot determine the value of the ‘reasonably attributable’ benefit, 30 per cent of the corporation’s adjusted turnover during the breach turnover period for the contravention.

Unsurprisingly, the two biggest players in the Consumer Staples sector have taken hits – which means that investors can grab themselves a bargain, with Coles selling for 3.3% off, and Woolies an absolute steal at 3.2% off.

Elsewhere, the big miners are down on waning iron ore prices. Yes… again. Last time I looked, the Sinagpore TSI Iron Ore price was at $90.30, down 1.49% from the previous figure – and BHP (ASX:BHP) was down 1.3%.

The Big Banks have also made heavy going of the morning session, down between 0.25% and 1.2%, with Commonwealth Bank (ASX:CBA) taking the heaviest losses.

Meanwhile in Canberra, it looks like efforts by Federal Treasurer Jim “Supernintendo” Chalmers to reupholster the Reserve Bank are now dead in the water, after The Greens made a startling demand in order to gain their support for the bill.

Greens economic justice spokesman Nick McKim said Chalmers should step in and use his legislative power to order rate cuts from the RBA on Tuesday, when the board is due to meet and almost certainly keep interest rates on hold.

With the coalition already signalling that it’s not going to play ball on the bill, Chalmers was waiting on a detailed response from the Greens, and what he got was either – depending on your outlook – a cynical, populist demand specifically designed to be so unpalatable that Chalmers had no chance but to scuttle his plans, or a very loud example of why minor parties should never be allowed anywhere near the reins of the economy.

Either way, the party’s almost definitely over for this round of planned reforms to the RBA, and Chalmers is going to have to go back to the drawing board for an easier passage for his desired changes to the way the central bank operates.

In the world of gold, the precious metal’s spot price soared above US$2,600/ounce for the first time on Friday, driven by expectations of more US interest rate cuts and escalating tensions in the Middle East.

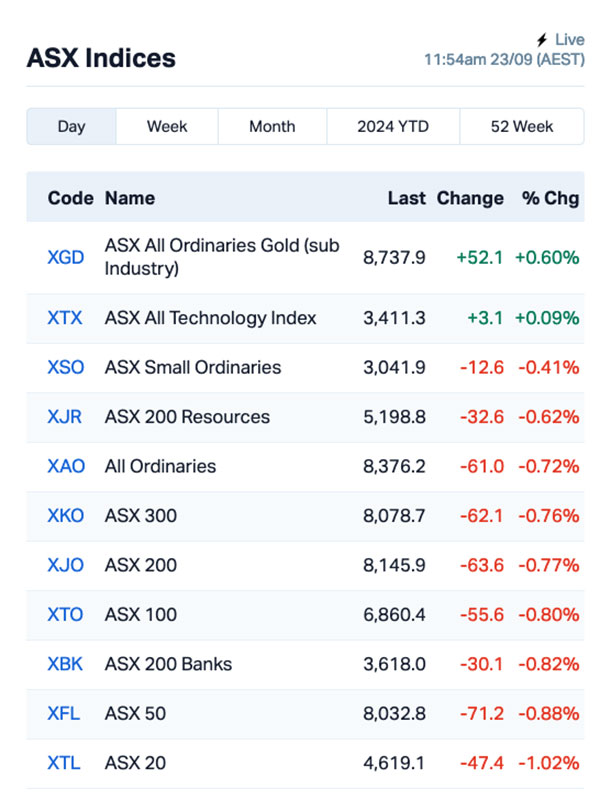

That has helped local goldies to take the lead on an otherwise pretty ordinary battlefield today – they’re up 0.62%, and the only sub-index with a gain worth talking about.

The rest of this week is a big one for the data lovers among us, with the RBA’s expected “deer in the headlights” rates act expected to continue when it meets for lunch tomorrow to decide to do nothing.

Later in the week, we’ve got the CPI indicator for August coming on Wednesday, followed by the RBA stability review and ABS Job vacancies for August, followed by ANZ’s Consumer Confidence numbers on Friday.

Strap in – it could be a busy one.

NOT THE ASX

On Friday, US shares soared to record levels, but that momentum faded away on Friday, with the S&P 500 ending the day down by 0.2%.

Meanwhile, the Dow Jones managed a slight gain of 0.1%, reaching a new closing high, while Nasdaq was 0.36% lower.

In US stock news, Intel Corp jumped 3% following a report from The Wall Street Journal that semiconductor giant Qualcomm recently reached out to Intel regarding a potential takeover. Qualcomm’s stock dropped nearly 3%.

FedEx Corp plunged 15% after cutting its full-year guidance and announcing Q1 earnings that fell far short of Wall Street expectations.

Mercedes-Benz fell 7% in Frankfurt after lowering its full-year profit outlook for the second time in less than two months due to ongoing drops in sales in China, the world’s biggest car market.

And, Baltimore-based Constellation Energy surged 22% and hit all-time highs after the company revealed plans to restart a nuclear reactor at Three Mile Island in Pennsylvania and sell the power to Microsoft for its data centres.

Wall Street had been expecting Constellation to land a deal with a major tech player this year, as companies look for more energy to support their tech needs amid the AI boom.

In Asian markets today, there’s no news from Japan as the markets there are closed for the Autumn Equinox celebrations.

Elsewhere, it’s business as usual and the Hang Seng is up 0.33% and Shanghai markets are higher by 0.28%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 23 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap JPR Jupiter Energy 0.025 56.3 2,223 $20,391,768 AMD Arrow Minerals 0.003 50.0 89,239 $25,378,730 ODE Odessa Minerals 0.003 50.0 180,079 $2,086,565 MXO Motio 0.026 44.4 2,985,037 $4,827,570 NOV Novatti Group 0.087 40.3 1,294,175 $22,056,528 AL8 Alderan Resource 0.004 33.3 11,918,251 $3,818,584 MTH Mithril Silver Gold 0.47 27.0 7,530,340 $38,138,202 88E 88 Energy 0.0025 25.0 12,271,449 $57,867,624 AVE Avecho Biotech 0.0025 25.0 500,000 $6,338,594 CAV Carnavale Resources 0.005 25.0 110,000 $16,360,874 ECT Env Clean Tech 0.0025 25.0 150,465 $6,343,621 EMP Emperor Energy 0.01 17.6 8,938,932 $3,312,575 ERW Errawarra Resources 0.09 25.0 387,018 $6,906,288 GTI Gratifii 0.005 25.0 10,000 $8,596,785 NAE New Age Exploration 0.005 25.0 7,227,064 $7,175,596 PVW PVW Resources 0.026 23.8 511,115 $2,654,500 PNT Panther Metals 0.023 21.1 1,058,983 $1,656,157 PGO Pacgold 0.145 20.8 146,753 $10,097,453 ADD Adavale Resource 0.003 20.0 110,000 $3,059,413 LAM Laramide Resources 0.5625 17.2 10,000 $9,820,432

Audience Experience & Digital Place Based media company Motio (ASX:MXO) was up on Monday morning, after delivering an investor update to the market, drawing attention to the company’s performance in FY24. Motio says that it has managed to bring in a 27% rise in revenue to $8.367 million on a gross margin of 72%, with the company guidance for FY25 coming in at a 10%-15% increase on pcp, targeting between $9.2 million to $9.6 million.

Novatti (ASX:NOV) is showing as a winner this morning, but the announcement it delivered this morning was simply a notice of its AGM.

Mithril Silver and Gold (ASX:MTH) was rising early on Monday morning, most likely on the back of Friday’s report that the company has hit a fantastic intercept at its Copalquin project in Mexico. The company says the drill result has come back at a breathtaking 7m grading 144g/t gold and 1162g/t silver, with that intercept from a down-hole depth of just 18m forming part of a broader 33m intersection at 31.8g/t gold and 274g/t silver from surface.

Avecho (ASX:AVE) was rising after delivering a not-exactly-stellar half-year financial report this morning, showing that the company has experienced a revenue drop of 30% for the period to $312,187, which the company says is “mainly attributable to a decrease in Vital ET sales made to Ashland during the period”. However, Research and development tax incentive and other income increased by 80% to $725,182 – and the company currently has net assets of $4,216,535, including cash and cash equivalents of $4,838,410.

Emperor Energy (ASX:EMP) was up on news that it has received firm commitments to raise $1.25 million in an institutional placement, at an issue price of A$0.007 per share with Nero Resources Fund, Perennial Value Management and Regal Funds Management set to become substantial shareholders. The company has also appointed Argonaut as a strategic financial advisor to assist with progressing the Judith Gas Field Project.

New Age Exploration (ASX:NAE) was also rising on Monday morning, on news that the company has begun exploration drilling at the Wagyu Gold Project in the Pilbara, WA. The company plans to drill approximately 4,300 metres in Phase 2, continuing to test “high-priority targets, including potential ‘Hemi-Style’ intrusive systems”, as it is just 9km along strike from De Grey’s ~10.5Moz Hemi gold deposit.

Pacgold (ASX:PGO) was climbing on news of an AGM around the corner – so today’s rise is more likely to do with last week’s reports of a 6,000m aircore bedrock geochemical programme scheduled to commence in the first week of October at the company’s 100% owned Alice River gold project, 300km northwest of Cairns, North Queensland.

Laramide Resources (ASX:LAM) was also rising, but today’s news of a change of Director’s interest most likely wasn’t the cause. Last week, the company revealed first assays from its Long Pocket infill drilling progrem, which returned strong uranium mineralisation at shallow depths. Significant intersections included 10m @ 606ppm U3O8 from 6m depth, including 2m @ 1,726ppm U3O8 from 11m, and 8m @ 1,770ppm U3O8 from 16m depth, including 4m @ 3,128ppm U3O8 from 17m.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 23 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap QEM QEM 0.097 -25.4 381,886 $19,680,923 BNL Blue Star Helium 0.003 -25.0 7,697,746 $9,724,426 ENT Enterprise Metals 0.003 -25.0 329,096 $4,413,269 PRX Prodigy Gold 0.0015 -25.0 1,228,749 $4,235,549 RNE Renu Energy 0.0015 -25.0 14,503,500 $1,528,268 VPR Volt Group 0.0015 -25.0 504,907 $21,432,416 BUR Burley Minerals 0.05 -24.2 617,989 $9,924,482 CTO Citigold Corp 0.004 -20.0 1,536,910 $15,000,000 EXL Elixinol Wellness 0.004 -20.0 403,373 $6,605,912 PRS Prospech 0.031 -18.4 1,057,732 $11,499,855 AIV ActiveX 0.005 -16.7 508,010 $1,293,015 CUL Cullen Resources 0.005 -16.7 2,015,400 $4,160,411 LML Lincoln Minerals 0.005 -16.7 2,411,087 $12,337,557 LPD Lepidico 0.0025 -16.7 450,956 $25,767,375 SHV Select Harvests 3.7 -16.5 1,022,950 $536,429,099 COD Coda Minerals 0.082 -16.3 815,281 $17,178,670 LRL Labyrinth Resources 0.016 -15.8 6,458,171 $25,144,164 SRN Surefire Resources 0.006 -14.3 477,000 $13,904,155 TRP Tissue Repair 0.395 -14.1 677,150 $27,813,828 ZNC Zenith Minerals 0.037 -14.0 8,000 $15,152,378

ICYMI – AM EDITION

The company has acquired a new strategic tenement at the Equador niobium and tantalum project that directly adjoins its existing Equador North mining lease. Rock chips collected as part of due diligence analysis indicated exceptional grades similar to the existing Equador project results, including 42.93% Nb2O5, 11.39% Ta2O5 and 33,310 ppm PREO and 21.21% Nb2O5, 79.49% Ta2O5 and 199,150 ppm PREO.

“This is another exceptional acquisition for the company to add areas of geological significance which has proven results,” managing director Gower He said. “This project just continues to amaze us on its potential and areas of growth. The team has done a wonderful job to make this happen.”

Anson has been granted an additional 21 strategic SITLA blocks that abut its Green River lithium project claims in Utah, USA, which cover a total area of 6,685 acres (27.05 km2) of highly prospective for lithium-rich brines that are the target of planned exploration programs.

The blocks have been granted as 1 large Other Business Administration (OBA) which allows for special consideration to bring significant projects into production.

The company says this approval demonstrates the Government of Utah’s support for the development of the Green River project. This OBA lease also increases the Green River land package abutting the company’s privately owned land parcel and the proposed processing plant location.

The company has commenced Phase 2 drilling at its Wagyu gold project in WA with the aim of testing additional gold targets identified from geophysics surveys and to follow up on Phase 1 geological observations (assays pending).

NAE plans to drill around 4,300m, continuing to test high priority targets, including potential ‘Hemi-Style’ intrusive systems like De Grey Mining’s (ASX:DEG) adjoining 10.5Moz Hemi gold deposit.

QEM is undertaking a 1 for 3.5 renounceable rights issue at $0.07 per share to raise up to ~$3m to complete current test work program to optimize and lock-down flow sheets for entry into the pre-feasibility study for its Julia Creek vanadium and oil shale project in QLD.

The funds will also be used to continue environmental studies, EIS Term of Reference, approvals documentation, and for general working capital.

“This fundraising follows delivery of a positive Scoping Study for QEM’s Julia Creek Project demonstrating a distinctive and commercially attractive project for onsite critical minerals refining in Queensland,” QEM’s Chair Tim Wall said.

At Stockhead, we tell it like it is. While Summit Minerals, Anson Resources, New Age Exploration and QEM are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.