ASX Small Caps Lunch Wrap: Benchmark and goldies in good form out the gate

Pic: Getty Images

- Local benchmark ticks up after solid showing on Wall Street late Friday

- Big guns MinRes and Westpac struggling but Telix jumps on positive news

- All eyes on the US election and the Federal Reserve this week

The ASX started the week on a positive note, up 0.33% following a strong lead from Wall Street.

With the US election and the Fed Reserve’s rates announcement coming up this week, investors are keeping a close eye on the market.

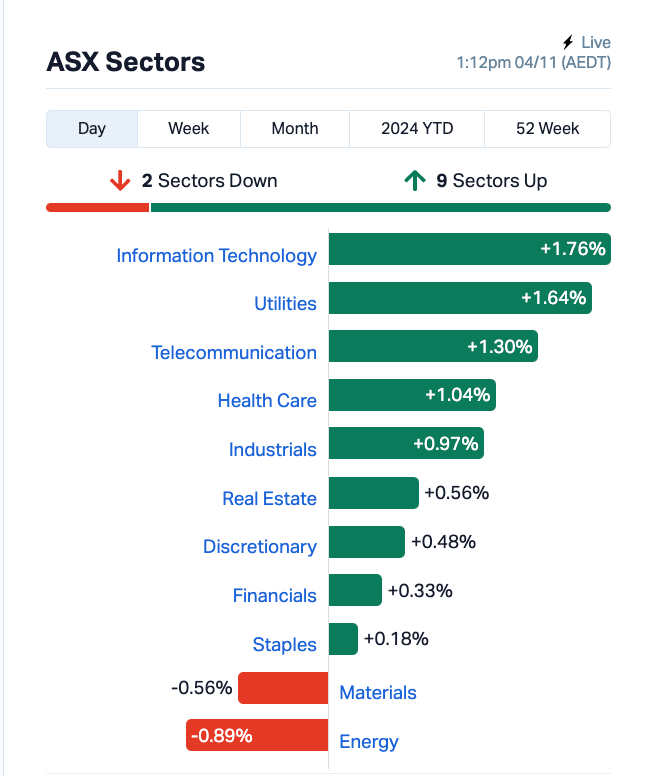

Tech and utilities sectors led the gains today, while commodity and energy-related stocks lagged.

Mineral Resources (ASX:MIN) dropped 9% after the company announced that founder and CEO, Chris Ellison, will resign within 18 months due to misconduct involving personal use of company resources.

Westpac (ASX:WBC) also struggled, falling 0.5% after reporting a 3% decline in net profit to $7 billion for FY24. The bank is set to pay a final dividend of 76¢, fully franked, which is a 6% increase from last year.

Crude prices surged over 1% this morning after OPEC+ announced a delay in its production increases, but energy stocks didn’t reflect the news, with Woodside Energy Group (ASX:WDS) and Ampol (ASX:ALD) dipping slightly.

Still in large caps and Telix Pharmaceuticals (ASX:TLX) jumped 2% as it celebrated a decision from the US Centers for Medicare & Medicaid Services (CMS) to start separate payments for specialised diagnostic radiopharmaceuticals.

This will make make it easier for patients to access advanced imaging tools like the ones Telix owns.

Read more on the Telix news in Tim Boreham’s morning biotech/healthcare wrap, Health Check.

NOT THE ASX

Wall Street closed higher on Friday, with the S&P 500 up 0.51%, the Dow Jones climbing 0.69%, and the Nasdaq rising 0.8%.

The rally came despite a disappointing US jobs report showing only 12,000 jobs added in October, which could impact the Federal Reserve’s upcoming policy decision on Thursday (US time).

Amazon shares surged over 6% after a strong earnings report, while Intel jumped nearly 8% on positive quarterly results and guidance.

Trump Media & Technology fell over 13%, reflecting uncertainty ahead of the election; and Super Micro Computer continued to drop, down another 10.5% due to accounting issues that have raised concerns among investors.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 4 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.002 | 100% | 2,367,645 | $1,163,016 |

| ORD | Ordell Minerals Ltd | 0.35 | 59% | 4,256,373 | $7,880,987 |

| AMD | Arrow Minerals | 0.002 | 33% | 1,809,117 | $19,835,442 |

| BNL | Blue Star Helium Ltd | 0.004 | 33% | 1,023,205 | $8,084,656 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 325,000 | $1,189,924 |

| RBR | RBR Group Ltd | 0.002 | 33% | 4,800,000 | $2,451,607 |

| WGR | Western Gold Resources | 0.034 | 31% | 645,317 | $4,429,231 |

| PUA | Peak Minerals Ltd | 0.0065 | 30% | 32,209,165 | $12,485,551 |

| BDG | Black Dragon Gold | 0.085 | 27% | 6,407,335 | $17,923,684 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 500,000 | $2,013,147 |

| ERA | Energy Resources | 0.0025 | 25% | 3,776,296 | $44,296,598 |

| CUL | Cullen Resources | 0.006 | 20% | 1,140,191 | $3,467,009 |

| ATC | Altech Batt Ltd | 0.054 | 17% | 6,705,862 | $89,050,009 |

| HTG | Harvest Tech Grp Ltd | 0.014 | 17% | 722,155 | $10,405,243 |

| YRL | Yandal Resources | 0.36 | 16% | 909,770 | $83,020,360 |

| FBM | Future Battery | 0.022 | 16% | 1,824,625 | $12,641,763 |

| BMT | Beamtree Holdings | 0.26 | 16% | 177,862 | $65,192,775 |

| VSR | Voltaic Strategic | 0.015 | 15% | 3,427,518 | $7,378,153 |

| MNC | Merino and Co | 0.535 | 15% | 204,046 | $24,680,605 |

| MRQ | Mrg Metals Limited | 0.004 | 14% | 629,102 | $9,542,815 |

| STM | Sunstone Metals Ltd | 0.008 | 14% | 6,465,831 | $36,042,325 |

| RHK | Red Hawk Mining Ltd | 0.795 | 14% | 27,322 | $139,868,035 |

| LKY | Locksleyresources | 0.027 | 13% | 2,170,028 | $3,520,000 |

| ATS | Australis Oil & Gas | 0.009 | 13% | 322,738 | $10,312,078 |

| CCO | The Calmer Co Int | 0.009 | 13% | 986,119 | $17,611,091 |

Blue Star Helium (ASX:BNL) has been rising today after having advised it’s successfully completed its agreement to farm out a 50% interest in its Galactica/Pegasus project in Colorado, USA, to Helium One Global.

This is in exchange for the latter paying a US$1.5 million cash consideration and to fund the drilling of six development wells via a US$2.7m free carry. Blue Star will remain the operator of the gas project.

Ordell Minerals (ASX:ORD) was well up this morning after announcing “significant drill results” from recent, shallow, wide-spaced reverse circulation drilling at its Barimaia Gold Project, located near Mount Magnet in the Murchison region of Western Australia.

Drilling completed on section 585,640E returned high-grade gold mineralisation in 24BARC083 (29m at 2.52g/t Au from 81m) to the end of the hole at 110m. Meanwhile, visible gold was panned in the interval from 107m to 108m, which returned an intercept of 1m at 47.5g/t Au.

Another junior goldie, Western Gold Resources (ASX:WGR), was also a standout performer early doors. The company advised its Mining Proposal and Mine Closure Plan has been approved by the WA Department of Energy, Mines, Industry, Regulation and Safety for open pit mining operations at the Gold Duke project, west of Wiluna in Western Australia’s Mid West.

And Future Battery Minerals (ASX:FBM) has been having a good Monday, too, having announced it’s selling its 80% interest in the Nevada lithium project to Austroid Corporation for $4m in cash to focus on its lithium assets in WA’s Goldfields region.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for November 4 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.001 | -50% | 7,825,802 | $11,730,481 |

| AVE | Avecho Biotech Ltd | 0.002 | -33% | 3,007,934 | $9,507,891 |

| TMK | TMK Energy Limited | 0.002 | -33% | 194,174,178 | $25,177,217 |

| AUQ | Alara Resources Ltd | 0.036 | -27% | 1,414,583 | $35,186,290 |

| GAS | State GAS Limited | 0.033 | -21% | 2,566,090 | $15,934,525 |

| AD1 | AD1 Holdings Limited | 0.004 | -20% | 391,766 | $5,486,742 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 200,000 | $6,620,957 |

| CT1 | Constellation Tech | 0.002 | -20% | 337,907 | $3,686,834 |

| TTI | Traffic Technologies | 0.004 | -20% | 40,000 | $5,594,090 |

| VFX | Visionflex Group Ltd | 0.004 | -20% | 82,918 | $14,589,123 |

| MTC | Metalstech Ltd | 0.145 | -19% | 91,024 | $35,461,509 |

| KNG | Kingsland Minerals | 0.19 | -17% | 60,598 | $14,133,454 |

| HIQ | Hitiq Limited | 0.025 | -17% | 604,739 | $10,555,349 |

| EPM | Eclipse Metals | 0.005 | -17% | 600,000 | $13,517,133 |

| QXR | Qx Resources Limited | 0.005 | -17% | 277,994 | $6,660,467 |

| SFG | Seafarms Group Ltd | 0.0025 | -17% | 3,120,541 | $14,509,798 |

| MEK | Meeka Metals Limited | 0.074 | -15% | 27,406,439 | $168,319,676 |

| GGE | Grand Gulf Energy | 0.003 | -14% | 30,000 | $8,576,355 |

| NVA | Nova Minerals Ltd | 0.2425 | -13% | 508,869 | $76,142,327 |

| HPC | The Hydration Company | 0.013 | -13% | 486,428 | $4,573,696 |

| MGL | Magontec Limited | 0.165 | -13% | 9,000 | $15,132,316 |

| BLU | Blue Energy Limited | 0.007 | -13% | 188,184 | $14,807,789 |

| GCM | Green Critical Min | 0.007 | -13% | 27,776,952 | $12,208,341 |

| KGD | Kula Gold Limited | 0.007 | -13% | 32,574 | $5,145,695 |

| ODE | Odessa Minerals Ltd | 0.007 | -13% | 3,863,947 | $10,146,260 |

IN CASE YOU MISSED IT – AM EDITION

Intra Energy Corporation (ASX:IEC) has received commitment from sophisticated investors to raise $850,000 via a two-tranche non-brokered placement.

Tranche 1 will settle this week utilising the company’s existing placement capacity under Listing Rule 7.1 by the issue of 218m shares, raising $109,000.

Tranche 2 is subject to shareholder approval at the IEC’s upcoming annual general meeting (AGM) and will raise $612,000 by the issue of 1.22b shares.

Funds raised will be used to further exploration at the Maggie Hays Hill gold and lithium project in WA, the assessment of further value accretive opportunities, and general working capital.

Star Minerals (ASX:SMS) is undertaking a two for three renounceable rights issue of shares at 4cents per share raise up to $2.5m, representing a discount of 27% to the company’s last close of $0.055.

Funds raised will be spent towards exploration activity at the Cobra project in Namibia, assuming shareholders approve the issue of Consideration Shares and Performance Shares to Madison at a forthcoming general meeting of shareholders.

All new shares issued will rank equally with existing shares on issue and the company will apply for quotation of the new shares.

Directors of SMS intend to participate in the rights issue in the manner set out in the offer document.

CuFe (ASX:CUF) has completed the sale of the company’s mining rights at the JWD iron ore mine in WA to Newcam Minerals.

The company met all conditions precedent by 31 October with settlement of the transaction completed by November 1.

“We are pleased to complete this agreement with Newcam and thank them for their assistance in achieving this,” CUF executive director Mark Hancock said.

“We would also like to thank all those who have assisted us over our time at JWD.”

Aura Energy (ASX:AEE) has appointed Mohamed El Moctar Mohamed El Hacene to the newly established role of country manager for Mauritania.

Hacene is a highly qualified Mauritian national with extensive experience in mining and international affairs and previously served as Mauritania’s Minister of Petroleum and Mines from 2007 to 2008.

He started work with AEE on 1 November after ten years with the United Nations as director, economic development and integration division, economic and social commission for Western Asia based in Lebanon.

“We are very pleased to welcome Moctar to the Aura Energy team, his experience is outstanding and his passion for the Tiris uranium project and developing the mining industry in Mauritania is formidable,” AEE managing director and CEO Andrew Grove said.

At Stockhead we tell it like it is. While Intra Energy Corporation, Star Minerals, CuFe, Aura Energy and Future Battery Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.