ASX Small Caps Lunch Wrap: ASX up slightly as Myer goes on a shopping spree

Pic: Getty Images

- The ASX was up around 0.4% at lunchtime, holding steady since open

- The big news is a brand deal for Myer and oil prices tanking overnight

- Small Cap winners include Li-S, Lanthanien and PainChek

The highlights are in the bullet points above this text. The important stuff is below this text. I think we can all agree that this text, therefore, is basically useless.

Let’s just pretend it was sharp, insightful and witty… and then get on with our day.

TO MARKETS

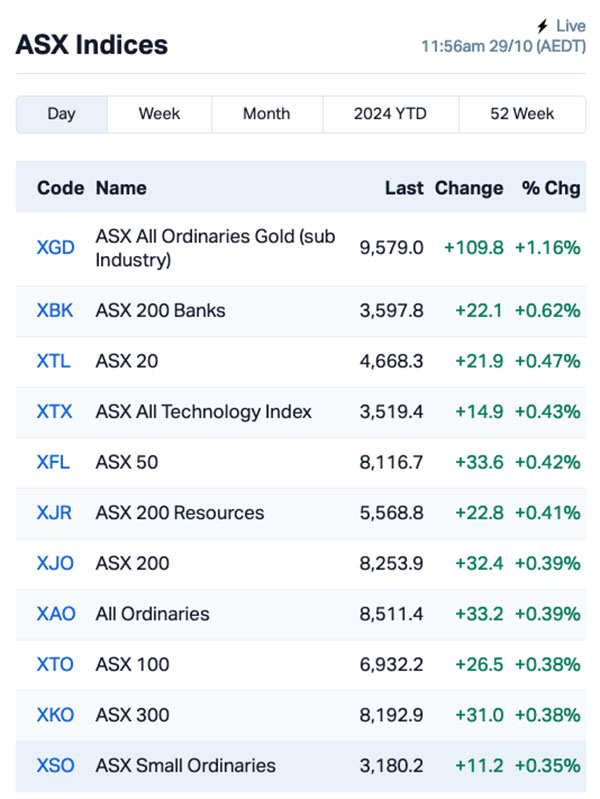

Overall, it’s been a relatively quiet morning, with the goldies, banks and Real Estate leading the gains and driving the ASX up 0.4% or thereabouts.

Here’s how the sectors looked at midday.

And for proof that the goldies are shining, here’s how the sub-indices looked around that time as well.

Up the big end of town, Myer (ASX:MYR) has bought a bunch of major clothing brands, including Portmans, Just Jeans, Jay Jay’s and Dotti from Premier Investments (ASX:PMV).

Premier will receive a bunch of Myer shares, and focus on its two remaining major brands – namely, Peter Alexander and Smiggle, in a bid to corner the satin pyjamas that turn into a pencil case market once and for all.

Meanwhile, we can expect the next Myer catalogue to be called something like “Double Down on Double Denim”, and everybody to be dressed like Jay Leno for the next four years.

Jokes aside, the market appears to be on board with the move, as both Myer and Premium were up in the wake of the news – Myer by 5%, before giving those gains back within the hour, and Premier jumped more than 12%, before it too eased on the way towards lunch.

Elsewhere, the price of oil is once again the talk of the town – after a horror slump yesterday, the slide continued when oil prices plunged over 5% overnight as Wall Street traders returned from the weekend.

The slump for oil appears to be related to Israel’s choice of targets when it struck Iran, hitting “only military sites” and not oil refineries or – god help us – nuclear facilities.

Also, there’s massive oversupply issues looming, and a rapidly falling global demand for oil that is partly seasonal, and partly because China’s economy is in desperate trouble.

Not a single part of any of that is good news… but petrol is going to be cheaper in a few days, so “hooray”, I guess?

Time to take a look at what else has happened overseas before I realise how depressing that really is.

NOT THE ASX

Overnight, the Dow Jones climbed by 0.65%, while both the S&P 500 and Nasdaq nudged up by 0.3% each.

There are a heap of companies (about 170 in the S&P 500 index) set to report their earnings this week, including big names like Alphabet, Meta, and Apple. The main question for investors is whether Big Tech’s investments in AI are translating into profits.

US investors are also getting ready for a wave of economic data this week that might challenge hopes for a “soft landing”. These include the latest CPI numbers that the Federal Reserve watches closely, and the October jobs report.

To stocks, investors seem to be pricing in a Trump election win on November 5 as Trump Media & Technology Group surged by 22%.

Ford shares fell 5% in after-hours trading after the automaker revised its guidance downward. The company now anticipates a full-year adjusted EBIT of US$10 billion, a drop from its previous forecast of US$10 to $12 billion.

Oklo, the nuclear power company backed and chaired by OpenAI’s Sam Altman, jumped nearly 30%, hitting almost three times its price just a month ago. The stock’s rise reflects growing investor interest in nuclear energy as a promising opportunity in the AI sector.

Meanwhile, Tesla‘s 25% stock surge after its earnings report has resulted in significant losses for short sellers. In the two days after the EV maker announced its third-quarter earnings last Wednesday, short sellers incurred losses of US$4.2 billion, according to data from S3 Partners.

In Asia this morning, Japan’s Nikkei has started the day slightly lower, and Chinese markets are still waking up.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 29 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap LIS Li-S Energy 0.34 83.8 4,540,788 $118,437,043 LNR Lanthanein Resources 0.004 33.3 232,000 $7,330,908 MHC Manhattan Corp 0.002 33.3 142,791 $6,746,955 PAB Patrys 0.004 33.3 1,000,000 $6,172,342 PPK PPK Group 0.615 30.9 349,464 $42,681,874 DOU Douugh 0.009 28.6 231,402 $7,574,482 SPD Southern Palladium 0.83 27.7 257,340 $58,337,500 SKO Serko 3.1 26.0 8,568 $301,405,178 PCK Painchek 0.035 25.0 2,902,501 $45,843,312 SCN Scorpion Minerals 0.015 25.0 10,002 $4,913,474 EWC Energy World Corp 0.025 25.0 572,102 $61,578,425 ERA Energy Resources 0.0025 25.0 3,343,530 $44,296,598 SLZ Sultan Resources 0.01 25.0 2,278,670 $1,580,692 IBX Imagion Biosys 0.076 24.6 427,846 $2,500,580 VKA Viking Mines 0.011 22.2 845,536 $9,563,326 AGY Argosy Minerals 0.046 21.1 21,540,731 $55,324,995 PUA Peak Minerals 0.006 20.0 1,996,674 $12,485,551 PUR Pursuit Minerals 0.003 20.0 497,334 $9,088,500 EEL Enrg Elements 0.002 20.0 1,120,000 $1,741,833 MPR Mpower Group 0.013 18.2 46,700 $3,780,736

Lanthanein Resources (ASX:LNR) released its quarterly report this morning, outlining where things are at for the junior explorer, which recently got cleared to drill an exciting target at its Lady Grey project, chasing a gold anomaly prospect adjacent to a 1.3Moz gold mine and one of Australia’s largest and highest-grade lithium operations.

Tech company Serko (ASX:SKO) was up on news that it is set to acquire Sabre’s business travel management solution GetThere for $US12 million, a move that increases Serko’s North American presence to become the #2 online booking tool provider. The two companies will now work together to co-develop and co-invest to bring new capabilities to the industry, while the deal “incentivises Sabre co-selling Serko solutions with revenue share”, with up to US$12.75 million.

PainChek (ASX:PCK) has announced preliminary results from a recent US clinical validation study and statistical analysis – including positive performance results in a paired study with the Abbey Pain Scale, which the company says will help pave the way forward for FDA approval for its product.

Energy World Corporation (ASX:EWC) is showing on the winner’s list today, but there’s no clear reason why. The company did respond to an ASX speeding ticket yesterday with a pro forma “we don’t know, either” – and it has announced that there’s an AGM coming up on November 28.

Argosy Minerals (ASX:AGY) was up after delivering a quarterly this morning, reiterating the company’s recent announcement about its progression toward completing the 12,000tpa project development engineering and DFS works to a construction-ready stage and commercialise the Rincon lithium project.

Viking Mines (ASX:VKA) was up after delivering an investor presentation this morning, and ENRG Elements (ASX:EEL) is showing on the list because the entitlements to its renounceable entitlement offer announced on October 25, 2024 have commenced trading today under the ASX code EELR.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for October 29 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap RNE Renu Energy 0.001 -50.0 1,336,010 $1,777,157 SER Strategic Energy 0.009 -47.1 15,462,629 $11,407,567 CDT Castle Minerals 0.002 -33.3 7,552,768 $4,118,442 GDA Good Drinks Aus 0.235 -27.7 873,584 $42,942,796 REC Recharge Metals 0.032 -25.6 1,594,086 $6,006,669 BNL Blue Star Helium 0.003 -25.0 738,583 $9,724,426 RIL Redivium 0.003 -25.0 325,000 $10,987,419 TOU Tlou Energy 0.017 -19.0 1,452,900 $27,270,271 SNG Siren Gold 0.094 -18.3 3,826,209 $23,824,998 WCN White Cliff Min 0.018 -18.2 19,955,423 $41,590,356 EPM Eclipse Metals 0.005 -16.7 300,000 $13,505,133 MEL Metgasco 0.005 -16.7 44,374 $8,745,520 ALM Alma Metals 0.006 -14.3 239,222 $10,798,617 ARV Artemis Resources 0.012 -14.3 283,000 $26,836,354 HE8 Helios Energy 0.012 -14.3 1,003,568 $36,456,692 M2R Miramar 0.006 -14.3 10,360 $2,777,763 MOH Moho Resources 0.006 -14.3 250,000 $3,774,247 RGL Riversgold 0.003 -14.3 556,750 $5,696,119 ADN Andromeda Metals 0.007 -12.5 372,573 $27,429,755 ADR Adherium 0.014 -12.5 371 $12,137,279

ICYMI – AM EDITION

Peregrine Gold (ASX:PGD) has announced a 1 for 4 non-renounceable entitlement issue to raise $2.5m at $0.15 per new share to fund exploration activities at its portfolio of Pilbara projects – including the Newman and Mallina gold projects – as well as for working capital.

The share price represents a 15.25% discount to the 10-day VWAP on October 28.

The one free attaching new option for every one new share applied for and issued, is exercisable at $0.25 on or before December 16, 2027.

EZZ Life Science Holdings (ASX:EZZ) has announced a $0.02 per share fully franked dividend to shareholders for the 12-month period ended June 30, 2024, with a payment date of December 9, 2024.

The company is focused on R&D in gene technology to address four key human health challenges: genetic longevity, human papillomavirus (HPV), children’s health, and weight management.

It also develops and distribute a range of health and wellness products worldwide, with a focus on Australia, New Zealand and China.

And Indiana Resources (ASX:IDA) has received the second instalment of US$25m of its US$90m settlement agreement with Tanzania for its unlawful expropriation of the Ntaka Hill nickel sulphide project.

The final instalment of US$30 million is due to be paid on or before March 30, 2025.

The board is currently planning for a dividend payment to shareholders in December 2024 with further details to be provided in due course.

At Stockhead, we tell it like it is. While Peregrine Gold, EZZ Life Science Holdings and Indiana Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.