ASX Small Caps Lunch Wrap: ASX up, and things are pretty quiet for a Wednesday

Pic: Getty Images

- ASX up slightly by lunchtime on a quietish news day (so far)

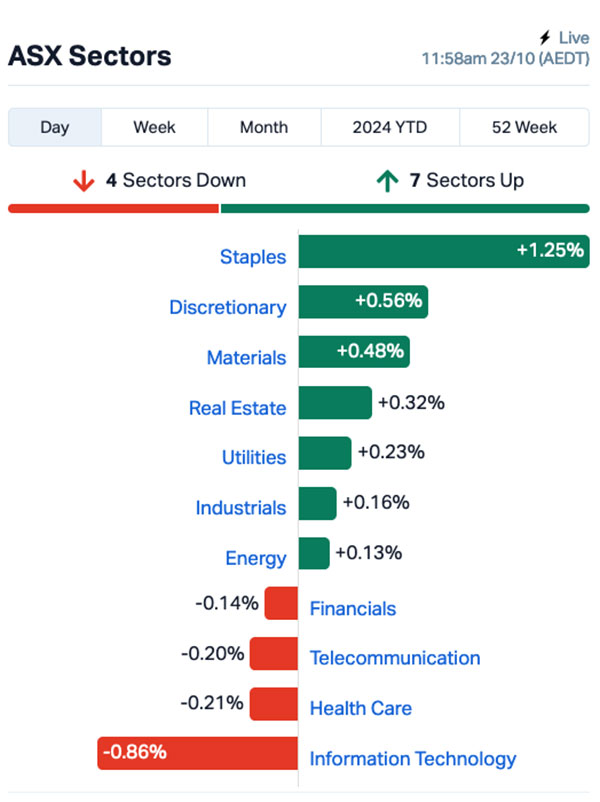

- Supermarkets up, InfoTech down as Codan sheds value

- Small Cap winners include Eastern Metals and Arrow Minerals

Local markets have opened broadly higher this morning, with the ASX 200 benchmark up about 0.3% early in the session, bouncing nicely after yesterday’s sell-down.

There’s not a whole heap of major news kicking about – it’s almost a little bit too quiet today – but let’s jump in to what we’ve got…

TO MARKETS

The ASX opened higher this morning, in the wake of modest gains on Wall Street, with the benchmark jumping 0.15% at open.

As we rumbled toward lunchtime, the ASX 200 was holding reasonably firm around 0.25% higher, with most sectors enjoying a morning of sunshine, puppies and rainbows.

(Update: the benchmark’s bottle cap has been misplaced and consequently the ASX 200 has lost a fair amount of fizz, sitting at a meek 0.099% gain at the time of tapping in this sentence.)

InfoTech is once again in the doldrums – but this morning, it’s not WiseTech Global’s (ASX:WTC) ongoing pants-related mega-drama that’s to blame.

The big loser in that sector this morning is Codan (ASX:CDA), the “rugged electronics solutions” company that recently bought military radio manufacturer Kägwerks, which has taken a hit this morning following the release of the CEO’s address to the AGM.

There’s nothing spectacular in the address – the overall news for Codan looks pretty bright, actually – and the only thing I can spot that might have upset shareholders is a move towards performance bonuses for senior execs, dependent on the company’s fortunes spread over three years.

Codan was down more than 6% last time I looked prior to lunch.

The clear winner at midday was Consumer Staples, which has risen sharply on the back of lifts by major supermarkets Coles Group (ASX:COL) and Woolworths (ASX:WOW).

Elsewhere, Resources stocks have been performing well, with the goldies up 0.35% at lunchtime as the precious metal continued to climb beyond US$2,720/oz overnight.

Elsewhere, Jewellery retailer Michael Hill (ASX:MHJ) has managed a rise in revenue, with shareholders being told at the AGM that retail operations for all stores was 4.3% better than last year, and 4.0% higher on a same-store basis.

QBE Insurance (ASX:QBE) was lower on news that it’s been hit with a lawsuit by ASIC, for being inconsistent with its discounting to customers. This isn’t a new story, as it’s been rattling around for a couple of years now and there’s not much in the way of fresh info, other than paperwork being filed in court.

NOT THE ASX

In the US, the S&P 500 and Dow Jones remained mostly unchanged, while the Nasdaq 100 saw a slight increase of 0.2%.

Stocks struggled toward the US close following disappointing news from several majors, as traders also contemplated the likelihood of a slower pace of Fed Reserve rate cuts.

Starbucks Corp fell 3.5% after withdrawing its guidance for 2025 following a third straight quarter of declining sales.

Texas Instruments Inc provided a cautious outlook for the current period, despite exceeding estimates.

McDonald’s Corp slumped 7% after its Quarter Pounders were linked to an E. Coli outbreak in the western United States.

Among major stocks, Apple and Tesla each fell by around 0.5% each, but Microsoft gained 2%.

General Motors stood out, surging by 9% after reporting stronger-than-expected Q3 profits and revenue.

Elsewhere, gold prices touched fresh highs again after rising by 1%, marking a 31% increase for the year. Marcus Today analyst Henry Jennings described the situation in the bullion market as “extraordinary” and “very bullish”.

In Asian markets this morning, Japan’s Nikkei was down 0.17% in early trade, and at the time of writing, the other majors in the region hadn’t kicked off yet.

On a macro-economic scale, China is being unusually quiet about when it’s going to hold its week-long People’s Congress, where it’s expected the details of a major economic support package will be announced.

Normally, we get a week’s notice before the big event, and the current best guess is that it won’t be happening until November, possibly, as China – along with the rest of the world – waits to see if the US is going to dodge a bullet, or vote its way into four more years of kleptocratic insanity on November 5.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 23 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MHC Manhattan Corp 0.002 100.0 6,477,361 $4,497,970 MTB Mount Burgess Mining 0.0015 50.0 500,000 $1,298,147 PRX Prodigy Gold 0.003 50.0 93,108,987 $4,664,912 ALR Altair Minerals 0.004 33.3 45,750 $12,889,733 AOK Australian Oil 0.004 33.3 350,000 $2,833,920 ENT Enterprise Metals 0.004 33.3 815,874 $3,534,952 NVU Nanoveu 0.064 33.3 49,693,882 $24,236,289 SIS Simble Solutions 0.004 33.3 450,000 $2,260,352 TX3 Trinex Minerals 0.002 33.3 250,000 $2,742,978 TMK TMK Energy 0.0025 25.0 858,699 $15,183,224 NOU Noumi 0.295 22.9 581,427 $66,506,237 MME Moneyme 0.135 22.7 1,872,659 $88,008,632 SNG Siren Gold 0.135 22.7 3,338,704 $22,789,128 TZN Terramin Australia 0.099 22.2 2,024,035 $171,441,580 IBX Imagion Biosys 0.055 22.2 240,334 $1,604,095 FHS Freehill Mining 0.006 20.0 1,000,000 $15,392,639 GTI Gratifii 0.006 20.0 3,251,643 $10,745,981 PLT Plenti Group 0.765 17.7 157,977 $113,958,885 BDG Black Dragon Gold 0.027 17.4 775,103 $6,152,907 MRQ MRG Metals 0.0035 16.7 1,251,714 $8,134,556

Eastern Metals (ASX:EMS) was up early on news that reconnaissance drilling completed at two new targets, Kelpie Hill and Windmill Dam, and at the advanced Evergreen prospect within the 100%-owned Cobar Project in NSW. Initial assays have come back with results such as 7m @ 4.3g/t Au, 2.7g/t Ag, 0.3% Pb from 50m and 1m @ 4.17g/t Au, 2.7g/t Ag from 82m, with the second and third holes returning 3.05m @ 3.9% Zn, 2% Pb, 29.5g/t Ag from 298.5 and 0.5m @ 7.2% Zn, 2.4% Pb from 299m.

Energy Resources of Australia (ASX:ERA) was up this morning after letters went out to shareholders about the previously announced, Rio-backed pro-rata renounceable entitlement offer of new ERA ordinary shares to raise up to approximately $880 million.

Venus Metals (ASX:VMC) was up, but its announcement this morning was just an AGM announcement, which isn’t terribly exciting.

Arrow Minerals (ASX:AMD) was up on news that the company has inked an MoU with Baosteel for potential mine gate sales of its iron ore, enabling access to the Simandou port and rail, the world’s largest and newest bulk infrastructure development. Arrow has also begun the next phase metallurgical testwork on the Simandou Formation Oxide BIF identified at its Simandou North Iron Project.

Adisyn (ASX:AI1) was up this morning on news that it has entered into formal negotiations to acquire 100% of semiconductor IP business 2D Generation, with the goal of leveraging 2D Generation’s “innovative semiconductor solution” to generate opportunities in AI1’s target markets including defence applications, data centres and cybersecurity.

Resource Base (ASX:RBX) was up on the heels of a quarterly this morning, which outlined the company’s recent work in Canada’s James Bay, where completion of the 2024 summer field program following up anomalous targets at the Wali Project resulted in multiple lithium and gold anomalies, with a peak lithium value of 20ppm and peak gold value of 436ppb with associated pathfinder elements.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 23 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ADA Adacel Technologies 0.31 -34.0 575,954 $35,872,745 MTB Mount Burgess Mining 0.001 -33.3 498 $1,947,220 TIG Tigers Realm Coal 0.002 -33.3 26,666 $39,200,107 WML Woomera Mining 0.002 -33.3 4 $6,165,223 KKO Kinetiko Energy 0.069 -29.6 981,992 $140,388,440 PLY Playside Studios 0.52 -27.3 6,358,741 $292,593,827 LM1 Leeuwin Metals 0.067 -22.1 22,125 $4,029,244 HMD Heramed 0.02 -20.0 381,700 $15,831,245 LPD Lepidico 0.002 -20.0 100,499 $21,472,812 CR9 Corella Resources 0.009 -18.2 379,493 $5,116,017 29M 29 Metals 0.4625 -18.1 3,783,925 $396,671,824 BRU Buru Energy 0.05 -18.0 5,501,999 $47,234,067 HTG Harvest Tech 0.014 -17.6 71,927 $13,884,625 IRX InhaleRX 0.028 -17.6 662,667 $6,569,201 DTR Dateline Resources 0.005 -16.7 11,223,521 $15,097,563 PUA Peak Minerals 0.006 -14.3 4,787,366 $17,479,772 A11 Atlantic Lithium 0.275 -14.1 256,941 $207,894,097 AZI Altamin 0.031 -13.9 196,617 $15,798,565 SFX Sheffield Resources 0.225 -13.5 122,457 $102,649,287 KGD Kula Gold 0.007 -12.5 431,250 $5,145,695

ICYMI – AM EDITION

Brazilian Critical Minerals (ASX:BCM) has announced key logistics milestones for its Ema Rare Earths Project in Brazil. The company reports that “substantial progress” has been made in its efforts to deliver the final product of Mixed Rare Earth Carbonate to ports in Brazil.

BCM notes that inspections and discussions have confirmed the suitability of the Port of Prainha, 130kms by road from the Ema Project, then barging to the Port of Chibatão, with capacity to handle Panamax sized vessels. Alternative routes to port have also been identified. A Scoping Study is meanwhile on course for final report in mid-December.

Astral Resources (ASX:AAR) has reported a significant gold intercept at Kamperman, revealing 3 metres at 177g/t Au from drill hole FRC378. The first 20 holes of a 31-hole drilling program have shown promising results, including 12 metres at 7.26g/t Au and 25 metres at 24.3g/t Au.

Encouraging findings have prompted plans for diamond drilling to further explore the high-grade zone. Meanwhile, drilling at Mandilla is assessing dewatering needs for the Pre-Feasibility Study, with infill drilling ongoing at the Iris and Eos Deposits and an updated Mineral Resources Estimate expected in March 2025.

Prodigy Gold (ASX:PRX) has received firm bids for the remaining shortfall from its recent Entitlement Offer to raise a further ~$1,677,532 (before expenses) at the issue price of $0.002 per share.

This will bring the total capital raised under the Rights Issue to about $2,106,894 (again, before expenses). This comes on the back of the goldie junior delivering some exceptional gold results from drilling at its Hyperion deposit, part of the Tanami North project in the NT. A headline strike of 10m @ 15.9g/t gold ought to build excitement ahead of a planned resource upgrade.

Suvo Strategic Minerals (ASX:SUV), an Australian hydrous kaolin producer and exploration company, has received firm commitments for $2 million (before costs) under an oversubscribed placement at $0.048 per share.

Cornerstone investment (15% of total placement) comes from shareholders of PERMAcast, which is Western Australia’s leading supplier of precast and prestressed concrete products. SUV notes that funds will support the development and commercialisation of the company’s low carbon cement (green cement) intellectual property.

White Cliff Minerals (ASX:WCN) says it has acquired additional licence area on the northern, adjacent boundary of its Rae Copper-Silver Project in Nunavut, Northern Canada, where the company says preliminary geophysical results have confirmed prospectivity for district scale sediment-hosted copper potential.

The acquisition grows White Cliff’s licence area by 20% to 1,198 km2, with the licence now covering more than 72km strike length of the prospective Rae Group Sediments, and with recent fundraising completed, the company is now fully funded for Q1 2025 drilling at Rae after it receives results from its recent airborne MobileMT geophysics campaign.

Medical data and technology company HeraMED (ASX:HMD) has announced it has received firm commitments for a two-tranche private placement of $3.1m to sophisticated and professional investors.

HMD, which is focused on digital transformation of maternity care, said placement proceeds would support commercial deployments, pilots and integration of HeraCARE into large health systems, private clinics and various platforms in the US, Australia, and Europe.

AdAlta (ASX:1AD) has appointed Kevin Lynch as the consultant chief medical officer (CMO) for AdCella while a yet unnamed consultant CMO with more than 30 years’ experience in respiratory and orphan drug development has been appointed to AdSolis.

Earlier this month, the company formed a clinical advisory board and appointed an additional adviser to advance its lead asset AD-214, which is domiciled under AdSolis.

1AD said the collective expertise and global reach of the healthcare professionals on the CAB would be crucial in guiding AD-214’s Phase 2 clinical trial preparations and ensuring its success.

At Stockhead we tell it like it is. While Brazilian Critical Minerals, Astral Resources, Prodigy Gold, Suvo Strategic Minerals, White Cliff Minerals, HeraMED and Adalta are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.