ASX Small Caps Lunch Wrap: ASX is lookin’ peachy at lunch, but CBA’s out on a limb

Pic via Getty Images

Local markets are having a pretty good Wednesday, having opened sharply higher on the back of a data-driven rally on Wall Street overnight.

US investors got some good news ahead of tonight’s US CPI call, which is a hugely important data drop for New York – we all saw what happened when there was even a sniff of recession in the air last week, so there’s some anxious-looking investors with fingers poised over the Sell button, waiting for that to drop.

But in the meantime, it’s all systems Green for the ASX this morning, after a 57-point jump at the start of the session and a decent amount of market-wide momentum keeping all the graphs looking verdant and happy today.

Let’s dive in.

TO MARKETS

From the get-go this morning, the ASX has had a sheen of positivity, jumping 0.7% at open and then working like a lumberjack to keep that momentum going forward.

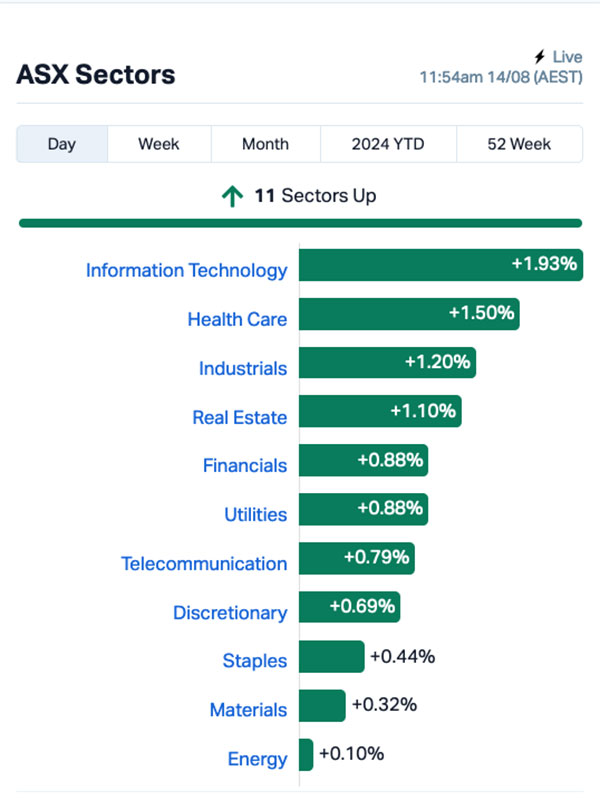

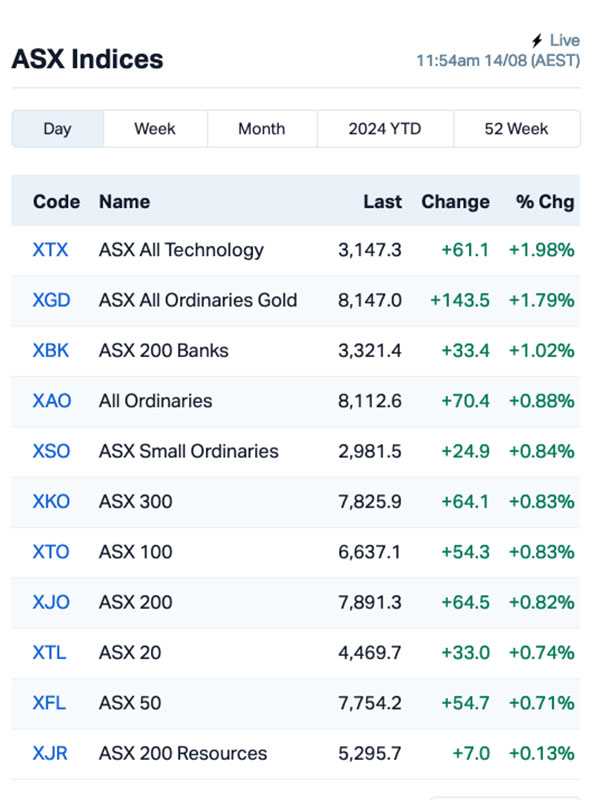

By lunchtime, despite a bit of a post-opening dip, the benchmark ASX 200 had climbed 0.9% by midday, with InfoTech most definitely the star of the show, dominating both the sector charts and the ASX indices as well.

Here’s how the sectors were looking at midday:

The InfoTech charge was led by the Top Three in Tech this morning, with WiseTech Global (ASX:WTC) up 1.94%, Xero (ASX:XRO) up 2.09% and NextDC (ASX:NXT) adding 2.57%. Investors are piling back into tech stocks again today after Wall Street’s Nasdaq went booming overnight.

The Small Caps leader was also a techy this morning, with LiveHire (ASX:LVH) up an enormous 94.7% at lunchtime – I’ll explain why in a few minutes.

A look at the ASX indices has the techies out in front there as well, with the goldies firming in second place and the banks adding their own gains to the list.

However, the banks saw a sharp turnaround at midday, with the Commonwealth Bank (ASX:CBA) in particular showing uncharacteristic volatility this morning, opening higher before diving around 1.3% after the bank reported that its statutory full-year profit has dropped 6.0% to just $9.5 billion.

Oh no… whatever shall we do? etc.

CBA has blamed inflationary pressures on operating expenses for the dip, and has since issued a warning that there’s a growing trend of people not being able to make their mortgage payments.

CBA – which holds roughly a quarter of the county’s mortgages on its books – says that stubborn inflation and high interest rates are to blame for the unhappy news that as of the end of June this year, 0.65% of its mortgages were at or beyond 90 days overdue.

If only there was something the bank could do to help, with that $9.5 billion it made this year… but I guess we’ll never know, because the bank has also announced today that its planned buyback of 1,673,580,358 shares is set to continue until 13 August, 2025 – and declared a final dividend of $2.50 per share, compared with $2.40 a year ago.

CBA did have some positive information for people other than its shareholders this morning, though, with Commonwealth Bank chief executive Matt Comyn sticking to his guns on the prediction that we’re going to see a rate cut in November – despite RBA chief Michele Bullock quite clearly stating precisely the opposite last week.

Elsewhere, there were more earnings reports from the market’s big guns – some good, some not as good.

AGL Energy (ASX:AGL) has reported a statutory profit after tax of $711 million, citing a sharp increase in its core retail customer base for the jump. It’s a huge about-turn for AGL, which famously reported a shocking $1.26 billion loss this time last year.

And Seven West Media (ASX:SWM) has tallied up its books for the year and announced a 69% fall in profits, banking a statutory net profit after tax of $45 million for FY24. It’s been a very rough year in and out of the boardroom at Seven, and the company is blaming a weak advertising market for the decline.

NOT THE ASX

Overnight, the S&P 500 surged by 1.68%, the blue chips Dow Jones was up by 1.04%, while the tech-heavy Nasdaq rose by 2.43%.

The jump was due to some happy data landing last night, in the form of the US producer prices (PPI), which rose less than anticipated in July.

Investors have taken that as a sign that inflation is still easing in the US, which is ringing true when this data is viewed alongside news that US service costs dropped the most in nearly 18 months, evidence of waning inflation pressures.

But all eyes will be on the Big One tonight, when the US CPI figures for July land – and while the PPI figures are a good indicator, they’re not an infallible lead as to what’s going to be in the headlines about US inflation in the morning.

That said, things seem to be settling a bit on Wall Street, with the Street’s favoured volatility index, the VIX, dropping to about 18, signalling ‘moderate volatility’ ahead.

In US stock news, Starbucks surged 24% after the surprising news that it was replacing its CEO with Chipotle’s Brian Niccol, while Chipotle shares fell over 7%.

Nvidia rose about 7%, adding to Monday’s 4% increase, after Bank of America analysts named it a top “rebound” stock.

Home Depot was the major earnings highlight last night. The home-improvement retailer’s stock rose 1% despite lowering its forecast for comparable same-store sales for the remainder of the year.

General Motors shares also rose about 1% after the company began laying off staff in China; while Paramount Global informed staff in a memo that it will be closing its renowned TV studio by the end of the week.

And Avon Products Inc, the unlisted company famous for its door-to-door sales of beauty products, filed for bankruptcy after being hit with numerous lawsuits claiming that the talc in its products caused cancer.

In Asian markets this morning, the positivity we’ve enjoyed this morning has not been infectious – Japan’s Nikkei is down 0.10%, the Hang Seng is down 0.37% and Shanghai markets are trading 0.46% lower at midday, our time.

And if you’re waiting on important market news from Morocco or Pakistan, you’ll need to wait until tomorrow, because those markets are closed for holidays today.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 14 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap LVH Livehire Limited 0.0465 93.8 30,334,561 $8,870,350 ADD Adavale Resource Ltd 0.003 50.0 1,594,636 $2,422,864 MTB Mount Burgess Mining 0.0015 50.0 750,000 $1,298,147 SFG Seafarms Group Ltd 0.003 50.0 156,281 $9,673,198 NOX Noxopharm Limited 0.115 36.9 3,728,150 $24,547,988 NRZ Neurizer Ltd 0.004 33.3 875,000 $6,511,797 PV1 Provaris Energy Ltd 0.022 29.4 297,815 $10,691,492 AVE Avecho Biotech Ltd 0.0025 25.0 16,000 $6,338,594 CRB Carbine Resources 0.005 25.0 1,208,000 $2,206,951 ION Iondrive Limited 0.01 25.0 10,182,245 $5,668,060 KPO Kalina Power Limited 0.005 25.0 30,632 $9,945,576 STM Sunstone Metals Ltd 0.01 25.0 3,097,382 $30,815,229 MI6 Minerals260Limited 0.13 23.8 116,748 $24,570,000 JGH Jade Gas Holdings 0.047 23.7 491,820 $59,919,698 AQC Auspaccoal Ltd 0.145 20.8 3,454,220 $64,056,111 ECG Ecargo Hldg 0.006 20.0 164,624 $3,076,250 ESR Estrella Res Ltd 0.006 20.0 2,518,083 $8,796,859 LML Lincoln Minerals 0.006 20.0 16,166 $10,281,298 CAZ Cazaly Resources 0.019 18.8 1,224,876 $7,380,848 GMN Gold Mountain Ltd 0.0035 16.7 125,000 $9,533,230

LiveHire (ASX:LVH) was leading the way on Monday after news broke that MA Moelis Australia, on behalf of Humanforce Holdings, has launched an on-market takeover of Livehire, offering $0.045 per share – a substantial premium to the stock’s overnight close of $0.024 per share. The offer to purchase shares at that price will remain open until September 30.

Noxopharm (ASX:NOX) jumped more than 40% on Monday morning after releasing promising new data about its CRO-67 drug, which targets pancreatic cancer. The drug is designed to overcome the challenge posed by the dense barrier of cells surrounding pancreatic tumours, which typically protects the tumours from both anti-cancer drugs and the body’s immune system. CRO-67 works by targeting and destroying both the cancerous cells and these protective barrier cells.

Estrella Resources (ASX:ESR) was rising on news that the company has applied for four additional highly prospective Exploration and Evaluation Licences in Baucau Municipality, Timor-Leste, covering 194.4km2 and valid for four years. Estrella says that manganese mineralisation has already been spotted from surface within the application area.

Gold Mountain (ASX:GMN) was up on news of high-grade results from channel samples from the Irajuba tenements in its Down Under Project area, with peak values of 1045 ppm TREO apparent in a strongly weathered profile, alongside magnet REE of up to 33.6% of TREO, and heavy REE of up to 19.1% of TREO. The company says that augur drilling is next on the list of activities at the site, to drill below the strongly leached zone into saprolite to test the boundaries of the find.

Forbidden Foods (ASX:FFF) was also climbing on news of an acquisition, this time via a share purchase agreement (SPA) that has been executed to purchase leading plant-based non-dairy business Oat Milk Goodness, under which Forbidden Foods will acquire 100% of the shares in OMG for a consideration of $3.42m via the issue of 285m ordinary shares priced at 1.2c per share, subject to conditions precedent and shareholder approval.

Evion Group (ASX:EVG) was up on news that the Madagascan government has confirmed a new Mining Code which includes granting of development and production licences for compliant graphite projects, and has set out a programme for the issuing of new mining permits.

Titomic (ASX:TTT) was up on news that it has received further purchase orders from a global U.S. aerospace and defence prime totalling $577,000, and says that the orders represent “a significant milestone in the Company’s relationship with this global US aerospace and defence prime reflecting a qualification period spanning several years with this order taking cumulative orders on this project to over A$1.0 million”.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 14 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LSR Lodestar Minerals 0.001 -50.0 82,714 $5,201,560 PUR Pursuit Minerals 0.002 -33.3 1,356,308 $10,906,200 RIL Redivium Limited 0.002 -33.3 36,319 $8,192,564 RMX Red Mount Min Ltd 0.001 -33.3 1,000,000 $5,135,366 OAR OAR Resources Ltd 0.0015 -25.0 1,500,000 $6,444,200 SHO Sportshero Ltd 0.003 -25.0 10,125 $2,471,331 SI6 SI6 Metals Limited 0.0015 -25.0 305,000 $4,737,719 MOZG Cbnd 8% 09-24 3M Qet 0.3 -25.0 3,131 $5,821,994 TM1 Terra Metals Limited 0.043 -23.2 3,872,604 $20,405,207 AUK Aumake Limited 0.007 -22.2 24,095,636 $17,229,661 TTI Traffic Technologies 0.004 -20.0 25,697 $4,864,426 AI1 Adisyn Ltd 0.025 -16.7 50,000 $6,933,960 FGL Frugl Group Limited 0.03 -16.7 200,135 $3,776,710 BP8 Bph Global Ltd 0.0025 -16.7 3,759 $1,189,924 H2G Greenhy2 Limited 0.005 -16.7 486,168 $3,589,105 SOC Soco Corporation 0.11 -15.4 4,754 $17,997,156 CRR Critical Resources 0.006 -14.3 912,723 $12,462,452 GES Genesis Resources 0.006 -14.3 100,000 $5,479,889 RNE Renu Energy Ltd 0.003 -14.3 13,665,121 $2,541,469 IXU Ixup Limited 0.025 -13.8 76,705 $44,884,825

ICYMI – AM EDITION

Argent Minerals (ASX:ARD) is set to kick off a 3,300m 51-hole reverse circulation drilling program at the Kempfield project in September. The program has been designed to confirm the newly discovered Kempfield NW and Sugarloaf Hills prospects as well as delineate mineralised extensions outside the current resource area.

LTR Pharma (ASX:LTP) has entered a co-development agreement with Aptar Pharma to commercialise nasal spray ED treatment Spontan in the USA as well as other key markets around the world with a long-term alliance for ongoing innovation for healthcare solutions. The agreement will encompass joint development and expertise, combining LTR Pharma’s pharmaceutical development capabilities with Aptar Pharma’s expertise in nasal spray technology – including Aptar’s VP7 model nasal spray components.

At Stockhead we tell it like it is. While Argent Minerals and LTR Pharma are Stockhead advertisers, they did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.