ASX Small Caps Lunch Wrap: ASX higher on Wall Street rise, Rio set to buy Arcadium for $10bn

Pic: Getty Images

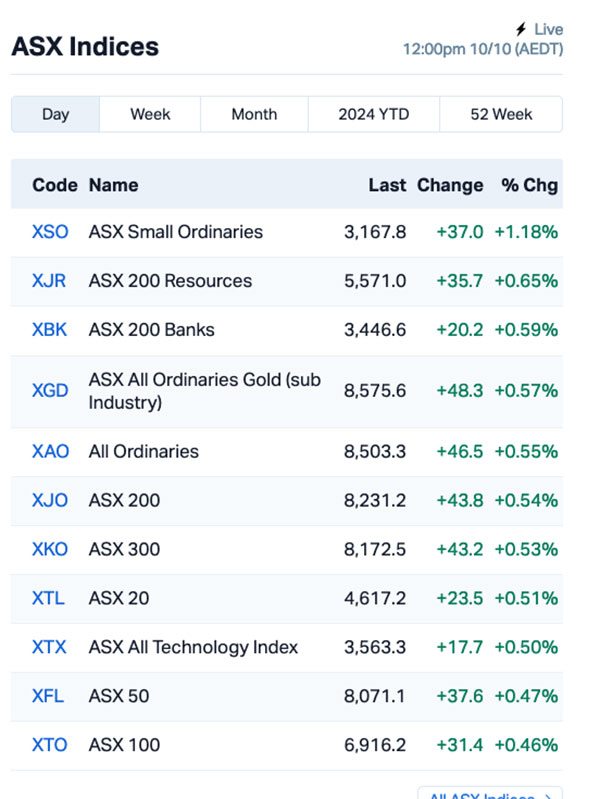

- ASX 200 up 0.54pc at midday, eyeing off fresh highs on a buoyant morning

- Arcadium Lithium set to be bought up by Rio Tinto for $10 billion in cash

- Small Caps lead the market higher, with Resources and Banks offering support

The ASX 200 was higher at lunchtime, after local markets took their lead from Wall Street to rise 0.54% this morning.

It’s the Small Caps leading the charge this morning, with a boost among Resources and the banks adding to the market buoyancy.

Crude and gold prices were steady overnight, and iron ore was up 0.8% mid-morning, adding some juice to the Materials sector today.

I’m just back from holidays, and I’ve been ignoring everything for an entire week – so let’s just get this out of the way and pretend like I know what’s been happening.

TO MARKETS

The benchmark shifted higher this morning, buoyed by a positive result on Wall Street overnight – a surprising result there considering the major weather event that is threatening to blow most of Florida into the Gulf of Mexico today.

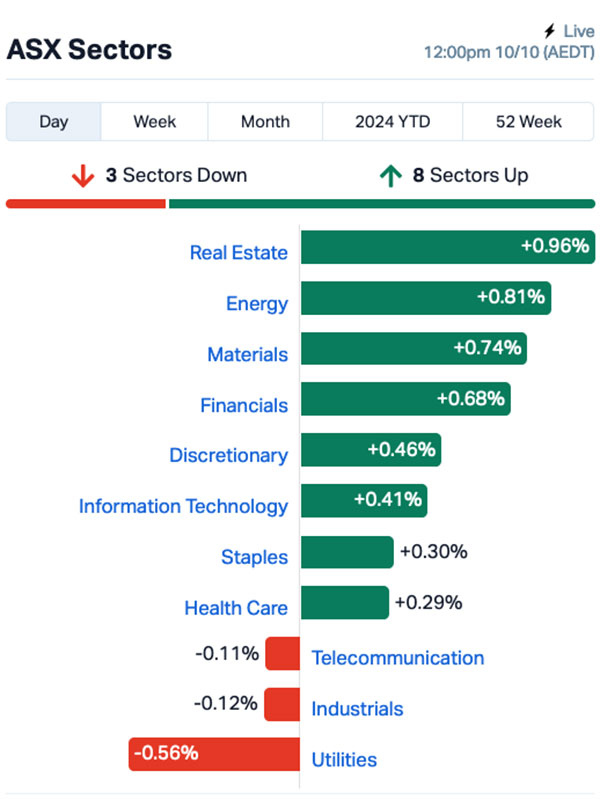

At lunchtime, the ASX sectors looked like this:

The big winners are among the Small Caps today, with that sub-index climbing 1.18% to be out in front of the rest of the market. Resources and Banks are also picking up some of the heavy lifting, and that’s left the ASX 200 up by 0.54% as we head into lunch.

Up the fat end of town, the headline news from this morning has been Rio Tinto’s call to buy Arcadium Lithium (ASX:LTM) – as in, the whole thing – for AUD $10 billion in cash. The purchase significantly boosts Rio’s exposure to lithium, making it the third-largest producer in the world.

“With spot lithium prices down more than 80% versus peak prices, this counter-cyclical acquisition comes at a time with substantial long-term market and portfolio upside, underpinned by an appealing market structure and established jurisdictions,” Rio said in a statement this morning.

Josh Chiat has covered this story in a lot more detail, so you should definitely have a read of his excellent deep dive into the transaction here.

Elsewhere, Mexican food giant Guzman y Gomez (ASX:GYG) has had an excellent quarter, reporting that sales between June and September have beaten expectations by climbing to $278.8 million, up from $230.9 million in the same period last year.

The company’s price has slipped a little this morning, though – it’s down 0.39%, but GYG still boasts an almost unbelievable market cap of $3.6 billion.

NOT THE ASX

Overnight, the S&P500 rose by 0.71% to a fresh record high, the blue chips Dow Jones climbed by 1%, and the tech-heavy Nasdaq lifted by 0.6%.

Cyclical stocks, those that tend to rise and fall with the economic cycle, led the way.

This came after the release of the Fed Reserve minutes for the September meeting, which revealed that a “substantial majority” of officials supported the 50 basis points cut to initiate looser monetary policy.

“The bottom line is that Powell might have the market’s back headed into the year end,” said David Russell at TradeStation.

US investors have indeed been feeling pretty confident lately.

The Fed has begun cutting interest rates, and the job market’s looking solid. Plus, inflation appears to be easing, with analysts predicting that the US CPI for September, set to drop in tomorrow morning AEST, will land at 2.3% – the lowest we’ve seen since early 2021.

Our neighbours across the ditch have also had some rate relief, after the RBNZ cut rates there by 0.5% to take the official rate to 4.75% – but it’s unlikely to have much of an impact on things here, as our own Reserve Bank remains doggedly on track to do nothing for a while yet.

In US stock news, Alphabet fell by 1.5% last night after the US Department of Justice said it was contemplating a potential breakup of Google, a move that would make it the biggest antitrust action seen in decades. In a filing yesterday, the DoJ said it might force Google to share the core data used for its search and AI tools.

Tesla Inc fell 1.4% ahead of the RoboTaxi Event later tonight at Warner Bros Discovery’s movie studio in Burbank, California.

The event, dubbed “We, Robot”, will be showcasing Tesla’s new robotaxi and is seen as crucial for the company’s future. RBC analyst Tom Narayan said the robotaxi business could generate US$153 billion in revenue for Tesla – provided none of the taxis go rogue, of course, which is not a given considering the ongoing issues that Tesla’s self-driving tech is widely reported to have.

Chips stocks mostly rose after Taiwan Semiconductor Manufacturing Co (TSMC) reported a stronger-than-expected 39% increase in quarterly revenue, easing worries that AI hardware spending may be slowing down.

Meanwhile, WW International shares rose by 38% after the company announced a new GLP-1 prescription weight-loss drug. In total, the stock has jumped more than 105% in the past five days.

In Asian market news, Taiwan’s exchange is closed for Double Tenth Day, proving once and for all that you really don’t need a real reason to have a day off every now and then.

Hong Kong and Shanghai markets aren’t open yet – thanks heaps, Daylight Savings – while Japan’s Nikkei is up 0.51% an hour into their trading day.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 10 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap 1TT Thrive Tribe Tech 0.002 100.0 300,000 $611,622 SOR Strategic Elements 0.051 41.7 8,818,017 $16,877,104 LTM Arcadium Lithium 8.205 38.8 26,584,819 $2,038,596,718 VKA Viking Mines 0.011 37.5 7,930,442 $8,500,734 ARC ARC Funds 0.12 36.4 27,873 $3,443,076 AAU Antilles Gold 0.004 33.3 892,116 $5,567,228 CCZ Castillo Copper 0.008 33.3 3,203,727 $7,797,032 ROG Red Sky Energy 0.0075 25.0 28,826,051 $32,533,363 STM Sunstone Metals 0.0075 25.0 18,668,657 $25,955,422 AIV Activex 0.005 25.0 80,000 $862,010 VML Vital Metals 0.0025 25.0 996,683 $11,790,134 TAT Tartana Minerals 0.037 23.3 35,918 $5,479,377 BCB Bowen Coal 0.0085 21.4 42,453,968 $20,513,428 VR1 Vection Technologies 0.0085 21.4 6,390,426 $9,286,123 ICE Icetana 0.023 21.1 50,000 $5,027,940 AMM Armada Metals 0.012 20.0 500,000 $2,080,000 OCC Orthocell 0.655 19.1 2,053,164 $115,267,250 KFM Kingfisher Mining 0.069 19.0 31,000 $3,115,470 BRN Brainchip 0.315 18.9 31,785,748 $520,054,014 AUR Auris Minerals Ltd 0.007 16.7 234,315 $2,859,756

Strategic Elements (ASX:SOR) announced the launch of the Energy Ink “Cell to Sheet Program”, which the company says is “aimed at creating larger-scale prototypes and demonstrators with significantly increased energy generated from moisture”.

Arcadium Lithium (ASX:LTM) was up on news that it is set to be acquired by Rio Tinto for $6.7 billion in cash, making Rio the third-largest lithium miner in the world. You can read more about this here, thanks to Josh Chiat.

Viking Mines (ASX:VKA) was up on news that the company has commenced with a strategic review of the gold potential and opportunities at the First Hit Project, “in light of current record gold prices & the substantial inherent value and exploration potential on Vikings tenure”.

Antilles Gold (ASX:AAU) was up after issuing a retraction of its 08 October announcement, parts of which fell foul of ASX listing rules 5.16, 5.17, and 5.19 by including forecast financial information derived from a production target. The current announcement also contains new test work results for the proposed La Demajagua gold-silver-antimony open-pit mine in Cuba, claiming “it is expected that the production of 3,982tpa of a precipitate with 48% Sb (containing 1,911tpa antimony) will be realised from the 50,025 tpa gold-arsenopyrite concentrate containing 4.9% antimony.”

Tartana Minerals (ASX:TAT) has entered into a non-binding agreement to acquire Queensland Strategic Metals, which holds ten EPMs and one ML covering copper, tin, tungsten, antimony and silver and gold prospects. The key projects include Laheys Creek, Comeno, De Wett, Lady Agnes and Tap’n’Toe, Fluorspar in the which polymetallic (Sn, Pb, Cu, Ag, Au, REE, Indium) prospects relate to Carboniferous-Permian granites.

Vection Technologies (ASX:VR1) climbed on news of the execution of a binding $3.6m XR software licences distribution agreement with Cometa SpA, a leader in the education sector serving over 2,500 high schools.The companies expect to deliver immersive classroom solutions to 500 high schools in Italy by FY25.

Kingfisher Mining (ASX:KFM) was up on news that it has picked up high grade rockchip samples at Ring Well, with copper values of 20.2% and 21.6% in an outcropping surface zone with 44m of strike exposed. Ring Well prospect has had no significant prior work and has not been drill tested or the subject of any surface Geophysics, and on-going investigations looking to increase strike extents of the Ring Well prospect and evaluation of other areas previously highlighted in recent field evaluation.

Earlier, Artemis Resources (ASX:ARV) announced recent rock chip sampling at the Titan prospect has yielded impressive high-grade gold and newly discovered silver, with results including 553,754 g/t Au and 1,305 g/t Ag from one sample. The area shows strong potential, covering over 63 hectares and remaining open for further exploration. The company said the results suggest that the mineralisation is linked to quartz-iron veining, reinforcing the potential for more exploration in the region.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 10 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap BCBR Bowen Coal 0.001 -75.0 948,150 $31,180,410 ATV Activeport Group 0.02 -59.2 13,231,936 $17,318,635 BNL Blue Star Helium 0.003 -25.0 320,000 $9,724,426 RNE Renu Energy 0.0015 -25.0 2,612,500 $1,690,490 PR1 Pure Resources 0.12 -20.0 120,354 $6,586,940 INP Incentiapay 0.004 -20.0 50,000 $6,326,200 SFG Seafarms Group 0.002 -20.0 200,000 $12,091,498 DAL Dalaroo Metals 0.021 -19.2 551,391 $6,457,750 RTG RTG Mining 0.035 -16.7 822,903 $45,567,585 NES Nelson Resources 0.0025 -16.7 1,583,333 $1,915,783 PUR Pursuit Minerals 0.0025 -16.7 1,676,666 $10,906,200 IBX Imagion Biosys 0.031 -16.2 504,080 $1,318,922 BCM Brazilian Critical 0.011 -15.4 1,438,977 $10,799,613 BMO Bastion Minerals 0.006 -14.3 50,000 $3,600,573 NIM Nimy Resources 0.06 -14.3 227,000 $12,145,953 PAB Patrys 0.003 -14.3 51,734 $7,201,066 WMG Western Mines 0.22 -13.7 109,904 $21,713,525 AW1 American West Metals 0.095 -13.6 8,970,085 $57,000,567 HE8 Helios Energy 0.013 -13.3 1,000,000 $39,060,742 NOX Noxopharm 0.1 -13.0 436,699 $33,607,364

ICYMI – AM EDITION

Firetail Resources (ASX:FTL) has started its maiden 5000m drill program at its Skyline (formerly York Harbour) project in Newfoundland, Canada, to infill and extend high-grade copper mineralisation intersected by historical drilling.

Previous holes had returned results such as 29m at 5.25% copper and 9g/t gold from 147m, 24.3m at 2.77% copper, 9.3% zinc and 18g/t silver from 93m, and 22.56m at 4.34% copper from 68.88m.

The company is also carrying out a project wide heli-borne electromagnetic survey to define further potential VMS targets as previous geophysical surveys had only evaluated a small portion of tenure.

EM conductor targets to be assessed and if warranted rapidly drill tested.

At Stockhead, we tell it like it is. While Firetail Resources is a Stockhead advertiser, it did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.