ASX Small Caps Lunch Wrap: ASX down and miserable, because it’s just that kind of day

That's it from me, kids... be nice to each other, take care and good luck with everything. Pic: Getty Images

- Local markets sag after Wall Street hit by tech sell-down

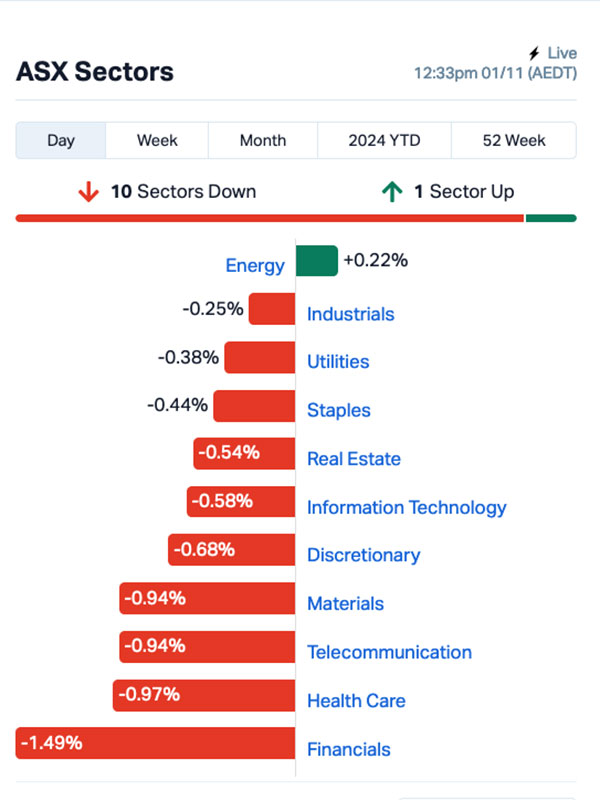

- The only sector performing better than basically terrible is Energy

- Oh, and one other thing – I’m going fishing

Local markets are down this morning, which is rather fitting, because so am I – as this is the last Lunch Wrap I’m ever going to write, because I am outta here.

I’ll keep this brief, but if you’ll allow me one last heaving bag of self-indulgence, I want to kick this off by saying thank you to the extraordinary people that I’ve had the joy of working alongside for the past few years.

They have, whether they like it or not, become like family to me and I am going to miss them all terribly.

A time like this needs music, I reckon… Tom, play me out, if you’d be so kind.

And with the sound of that gravelly-voiced bastard breaking our hearts ringing in our ears, it’s time to smile one of those gritted-teeth grimaces, pretend like I care about what the markets are doing today, and try my best to sound like I know what I’m talking about…

Thanks, everyone. Especially you.

TO MARKETS

The ASX 200 benchmark is slumped over in its chair this morning, with a set of knives bearing the names of the Big Four banks buried deep between its shoulder blades, and a growing line of sectors queued up for their turn to twist the blades.

The only sector performing better than basically terrible is Energy, and even that has barely managed to cling on to a positive frame of mind this morning.

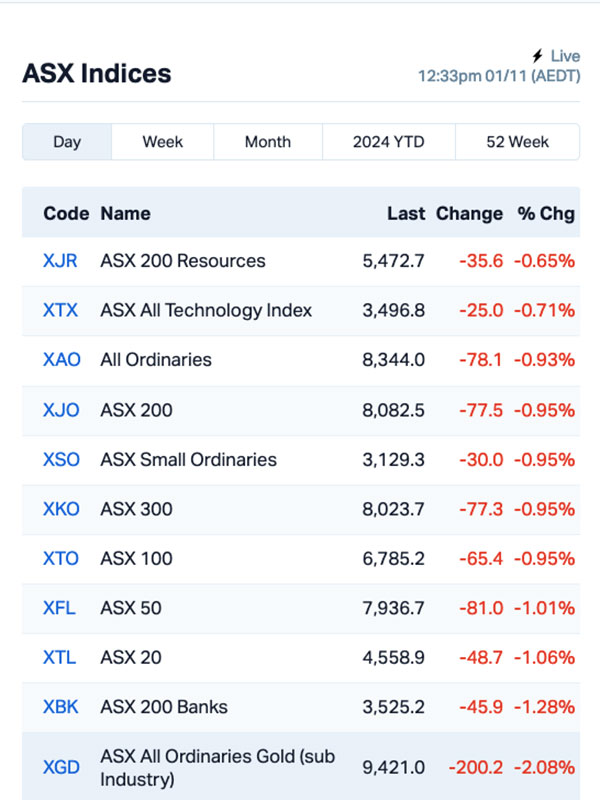

Here’s how the charts looked at lunchtime.

Energy is holding above zero for now, thanks mainly to Woodside and Ampol, as the rest of the Billion Dollar energy stocks are trading lower today.

Even the goldies – usually a safe bet during a sell-off – are copping it this morning, with the XGD All Ords gold index down about 2.5% the last time I looked… which will probably be the last time I ever look at it.

The headlines this morning are really, really dull, and don’t really add much to the conversation about why the market’s in the doldrums today.

In a nutshell, the ASX is suffering this morning because of a combination of things – a turd of a warm-up from Wall Street overnight (which I’ll get to in a few minutes), and a bunch of numbers that landed on Wednesday that were almost exactly in the sweet spot that helps absolutely nobody.

When the ABS delivered the CPI data a couple of days ago, there were a lot of people waiting to see which way that particular wind was blowing. What the market was crying out for was a clear indication, one way or the other, of how the RBA’s lever yanking was working out for interest rates.

What we got was a number that was right in the middle of the road – not good enough to spark renewed calls for rate cuts, and not bad enough to warrant an unruly mob storming the gates of the RBA castle with torches and pitchforks.

So… we got Goldilocks numbers instead, right in the zone where she’s the only one that’s happy, while the rest of us sit around and bitch about how the numbers were either too hot, or too cold, depending on your outlook.

And without a clear indication of what we’re supposed to be doing, the market is reacting the way it always does when we’re not sure what the plan is… people start hitting the ‘Sell’ button, and two days later, here we are.

The entire market is heading towards a big step backwards for the week – the benchmark is already 1.5% down since this time last Friday – and next week is going to be absolutely mental.

The US goes to the polls on Tuesday (their time) to decide on whether sanity or lunacy will be the predominant flavour for American politics for the next four years.

With that race for the White House so inexplicably close, whichever way the election goes is likely to mean chaos for Wall Street… which usually means chaos here, too.

I’m almost unhappy that I’ll be sitting on a beach somewhere with a fishing rod in my hands when it all starts to burn.

… almost.

NOT THE ASX

Overnight, the S&P 500 closed 1.86% lower, the blue-chips Dow Jones was down by 0.9%, and the tech-heavy Nasdaq crumbled by -2.76%.

The Volatility or Fear Gauge spiked, reaching a three-month high with the VIX up 14%.

The Nasdaq was brought down by a sell-off in major tech stocks following disappointing earnings reports from some of these names…

Microsoft, Nvidia, and Meta were down between 4-6%, dragging the NYSE Fang+ Index down by 3%.

Amazon, however, surged by 4.5% in extended trading after forecasting strong sales and profits this holiday season, beating analysts’ expectations. The company expects operating income between $US16 billion and $US20 billion for the upcoming quarter. Analysts had estimated around $US17.5 billion.

Amazon’s CEO Andy Jassy is banking big on generative AI, investing heavily in new data centres to keep up with demand, even as some investors worry about when the returns will start rolling in.

Apple slipped 2% despite exceeding expectations in its latest quarter on the back of solid early sales of the iPhone 16. Apple reported sales of $US94.93 billion, just ahead of Wall Street’s estimates. CEO Tim Cook said iPhone 16 sales are off to a better start compared to the previous model.

Intel fell 3.5% but surged by 8.5% in extended trading after it forecasted Q4 revenues slightly above analysts’ expectations, and said it was on track to reclaim some lost ground in the market.

In Japan, the Nikkei is down 1.94% this morning, after the Japanese Government announced a crackdown on those weird cartoons where everything has sex with everything else.

I’ve no idea what’s happening on the Chinese markets, and – if I’m being honest – I’ve pretty much checked out entirely at this point, so you can look them up for yourself.

So… for the final time, let’s go take a look at the Small Caps and see who’s weathering the storm on the ASX today.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 1 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MNC Merino and Co 0.45 69.8 59,006 $14,065,291 BDG Black Dragon Gold 0.07 59.1 4,291,279 $11,770,778 CLE Cyclone Metals 0.0015 50.0 60,654,169 $12,738,964 EDE Eden Inv 0.0015 50.0 2,189,718 $4,108,209 IBG Ironbark Zinc 0.003 50.0 16,525,774 $3,667,296 RTG RTG Mining 0.035 34.6 1,078,361 $28,208,505 BYH Bryah Resources 0.004 33.3 761,925 $1,509,861 ASQ Australian Silica 0.042 31.3 249,449 $9,019,532 VR1 Vection Technologies 0.0215 26.5 21,814,902 $22,552,012 WML Woomera Mining 0.0025 25.0 333,597 $4,333,180 DOU Douugh 0.0085 21.4 495,103 $7,574,482 THB Thunderbird Resource 0.018 20.0 1,548,064 $4,864,896 AHK Ark Mines 0.21 20.0 26,703 $9,703,122 MEL Metgasco 0.006 20.0 393,147 $7,287,934 KNI Kunikolimited 0.245 19.5 298,887 $17,787,700 HE8 Helios Energy 0.013 18.2 829,808 $28,644,544 NFL Norfolk Metals 0.135 17.4 44,329 $4,705,332 DGR DGR Global 0.014 16.7 357,143 $12,524,352 HHR Hartshead Resources 0.007 16.7 10,913,920 $16,852,093 RFA Rare Foods Australia 0.028 16.7 484,340 $6,527,598

Ironbark Zinc (ASX:IBG) was flying this morning, after revealing two major steps forward for the company – the appointment of highly experienced and accomplished gold industry leader Nikolai Zelenski as the Company’s new executive chair-Elect, and a tranche of firm commitments from institutional and sophisticated investors to raise $10 million in new equity funding.

Australian Silica Quartz (ASX:ASQ) was up on news that it has found gold at its 100% owned Koolyanobbing metals project, with assays from the company’s recent RC drilling campaign back from the lab. ASQ reports that it has discovered high-grade gold mineralisation at the Golden Wishbone prospect, with the best of the results coming from near surface, such as 2m at 14.2 g/t gold from 11m including 1m at 27.7g/t gold from 11m from hole ASQRC015, which is a significant upgrade to its previously reported results.

Vection Technologies (ASX:VR1) was climbing on news that it has been awarded a $1.6 million Artificial Intelligence (“AI”) software licences contract for the Brexia Med healthcare project. The contract is set to run for three years, with a further option for an additional two further years at $1 million. Brexia Med will deploy TDB’s Algho AI software as part of an innovative “Hub & Spoke” healthcare model, aiming to meet the increasing demand for localised private healthcare services, incorporating advanced AI technology for patient screening to streamline healthcare delivery.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for November 1 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CDE Codeifai 0.001 -33.3 27,853,461 $3,961,942 AKN Auking Mining 0.003 -25.0 525 $1,565,401 AMD Arrow Minerals 0.0015 -25.0 14,195,968 $26,447,256 BNL Blue Star Helium 0.003 -25.0 165,050 $10,779,541 BP8 BPH Global 0.003 -25.0 280,000 $1,586,566 ZMI Zinc of Ireland 0.009 -25.0 313,322 $6,068,831 GTI Gratifii 0.004 -20.0 5,756,229 $10,745,981 LPD Lepidico 0.002 -20.0 9,560 $21,472,812 TAS Tasman Resources 0.004 -20.0 909,600 $4,026,248 VML Vital Metals 0.002 -20.0 345,192 $14,737,667 FLC Fluence Corporation 0.065 -18.8 817,390 $86,477,313 IRX InhaleRX 0.024 -18.6 160,458 $6,229,859 AZI Altamin 0.023 -15.9 820,233 $11,995,061 SIX Sprintex 0.059 -15.7 458,030 $38,193,735 ADR Adherium 0.011 -15.4 1,588,916 $9,861,540 RMX Red Mount 0.011 -15.4 1,364,782 $5,035,651 SBR Sabre Resources 0.011 -15.4 1,529,736 $5,108,505 AMM Armada Metals 0.012 -14.3 68,884 $4,802,000 FIN FIN Resources 0.006 -14.3 14,949 $4,544,881 NSM North Stawell 0.012 -14.3 1,406,980 $3,817,471

ICYMI – AM EDITION

Dimerix (ASX:DXB) is teaming up with the University of Michigan’s Nephrotic Syndrome Study Network of Rare Kidney Diseases (Neptune) for biomarker profiling and prospectively identifying patients with focal segmental glomerulosclerosis (FSGS) for the company’s ACTION3 trial via the University’s proprietary Neptune Match network.

The ACTION3 Phase 3 clinical trial aims to recruit approximately 286 patients globally with FSGS, a rare disease categorised within nephrotic syndrome. Biomarker profiling among the Neptune Match participants will help identify those FSGS patients who meet the inclusion/exclusion criteria and may benefit from a treatment with a mechanism of action such as the company’s DMX-200 treatment.

“This is an extremely important collaboration for the ACTION3 trial as Neptune is the recognised global leader in rare kidney disease research,” DXB chief medical officer Dr David Fuller said.

“The Neptune Match program has a track record of successfully assisting recruitment into trials and should boost our recruitment rate for the ACTION3 trial in the USA while the biomarker work will provide further invaluable insights into the mechanism of action and response to DMX-200 in patients with FSGS.”

Interim analysis is currently planned after the first 144 patients reach 35-week treatment, expected around mid-2025.

At Stockhead, we tell it like it is. While Dimerix is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.