ASX Small Caps Lunch Wrap: ASX 200 gut-punched over global slowdown fears

Pic via Getty Images.

- Global economic slowdown fears have sent markets tumbling everywhere

- ASX 200 fell 178 points in 15 minutes, and the bourse is a sea of red

- A couple of Small Caps are beating the odds, though, which is nice

Well… things are far from excellent on the bourse this morning, after the benchmark plummeted 178 points in the opening 15 minutes of trade, erasing a lot of the excellent gains made during the week and causing intestinal distress among local investors.

At around 11am, there were just eight of the 200 companies that make up the benchmark index showing any gains, and most of the gains were pitifully small.

That weird, nasally voice you can hear is the late great Tom Petty, twanging out his highest-charting hit – a toe-tapping love letter to Los Angeles, which sounds like it was written in about 20 minutes, because it was.

So, with Petty’s Free Fallin ringing in your ears as a suitable soundtrack to the mess we’re in, here’s what’s been happening so far today in the boiling sea of red that our market has become.

TO MARKETS

If you can remember back to March 10 last year, you’ll remember what days like today are like – because that was the last time the ASX was hit so hard, and so early, like it has been today.

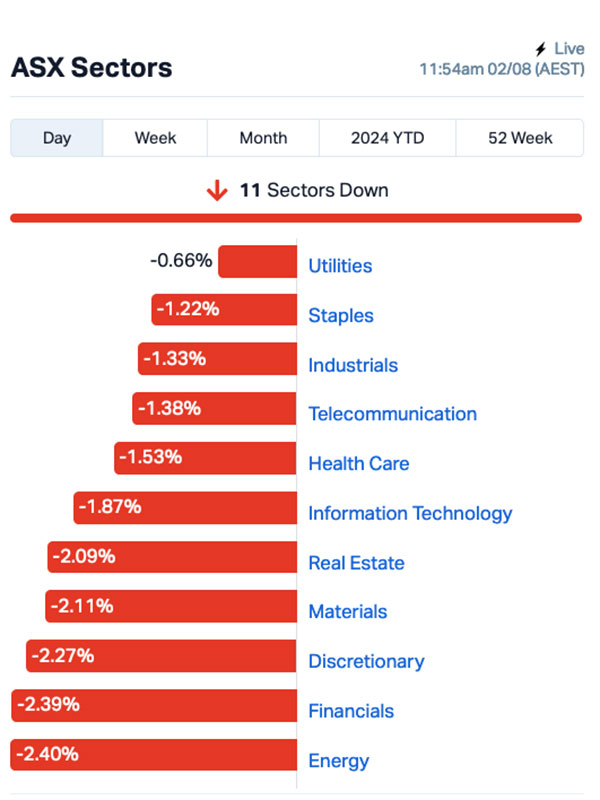

It makes for unpleasant viewing, but here’s what the sectors were doing this morning:

You can see for yourself what’s happening, and there’s really not all that much to explain… everything’s down because investors are bailing as hard and as fast as they can.

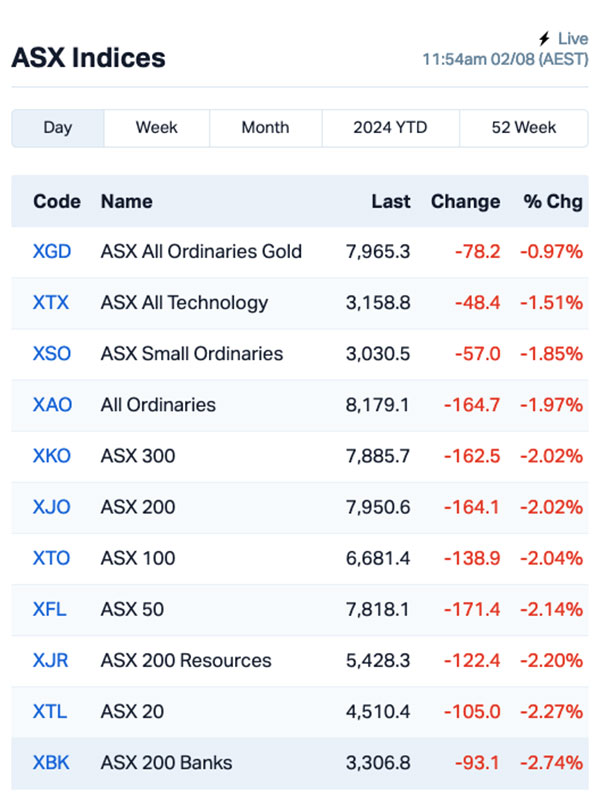

A look at the ASX indices just confirms what’s happening – and you can tell it’s a super-rough day when the usual ‘safe haven’ that lurks among the ASX goldies is (as expected) the best performer, but even that index is down nearly 1.0% at lunch.

There’s a single bright spot among the companies that make up the ASX 200 index, though – and that’s US-based payment company Block Inc (ASX:SQ2) , which last time I checked was up by more than 7.0%.

That’s because Block has presented the market with some positive news around its profit forecast, which the company says is likely to be higher than its initial expectations, with its annual adjusted core earnings rising to at least $2.90 billion, which is a bigger number than the previous forecast of $2.76 billion.

Some housekeeping from stories that emerged during the week, and – as feared – a number of Rex (ASX:REX) employees have started receiving their “sorry but you don’t work here no more” letters.

There are formal notices of termination reportedly arriving for workers that were involved with Rex’s major city operations – in a nutshell, that’s everyone whose “office” was a 737 jet rather than a turbo-prop aircraft.

There’s a smattering of Small Caps making some headway today as well, which I’ll get to in a minute, but that’s pretty much all the headline news from the market today.

NOT THE ASX

Overnight, Wall Street fell hard, leaving the S&P 500 down by 1.37%, while the blue chips Dow Jones index tumbled by 1.21%, and the tech heavy Nasdaq crashed 2.30%.

There were a couple of big names in some strife overnight in New York, specifically Amazon which slid more than 5.3% after reporting weaker-than-expected revenue for Q2 and a disappointing forecast, with its cloud business performing well but its advertising unit falling short.

There’s trouble brewing at chipmaker Intel as well, with that company announcing a slew of layoffs in an attempt to streamline things before 2025.

The chipmaker is set to slash its headcount by over 15% as part of a new US$10 billion cost savings plan – which equates to some 15,000 workers who will suddenly find themselves with a lot more spare time on the way into Christmas.

Apple bucked the trend, offering a tantalising glimpse of what it looks like when tech companies are able to pivot around issues that are holding them back – in Apple’s case, that’s a downturn in revenue from the Chinese market – by getting everyone excited about the fact that they’ve been able to shoehorn the latest tech buzzword into the next iteration of their already market-dominant product.

Apple’s new iPhone 16 is due to hit stores in a matter of weeks, and its new iOS has some kind of AI whizzbangery in it that doesn’t need to phone home to function – the AI ‘thinking’ takes place on the device itself, and it will automate things to make users’ lives simpler… says Apple.

The example I keep seeing is that the AI – if you allow it to – will ferret through your messages and emails, and try to pre-empt questions you might want answered.

So, if you get a text message from a loved one telling you what time they will be arriving by plane from somewhere exotic, the AI will already have looked up the flight info, popped a reminder in your calendar that you are meant to be at the airport to pick them up.

If someone could pass me my sunglasses, that’d be great – because that sounds like a future that’s too bright to stare at directly, lest we be blinded by the glory that is a device to help us stop having to think too hard.

Meanwhile, the price of gold traded flattish at US$2,446.02 an ounce overnight, oil prices were down by around 1% with Brent crude now trading at US$79.96 a barrel, and iron ore price climbed by 1.3% to US$102.25 a tonne.

In Asian markets today, the rout we’re seeing on the ASX is being repeated to varying degrees by our regional compatriots.

The Hang Seng is off by 1.49%, Shanghai’s markets are being suspiciously durable by falling just 0.08%, but the damage is really showing in Japan, where the Nikkei is down by 4.1% so far today.

And I reckon everyone involved with the Rwanda Stock Exchange is thankful that they’re enjoying a market holiday today, and all 10 companies listed on that exchange are being spared exposure to today’s global sell-down.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CNJ Conico Ltd 0.002 100.0 4,645,929 $2,201,528 AME Alto Metals Limited 0.0565 71.2 28,355,166 $23,810,265 HCT Holista CollTech Ltd 0.01 42.9 913,104 $1,951,600 ADG Adelong Gold Limited 0.004 33.3 271,200 $3,353,967 MSG Mcs Services Limited 0.005 25.0 1,000 $792,399 RML Resolution Minerals 0.0025 25.0 820,000 $3,220,044 VRS Veris Ltd 0.052 23.8 1,298,103 $21,397,222 GLH Global Health Ltd 0.14 21.7 48,571 $6,675,697 CRR Critical Resources 0.006 20.0 2,251,304 $8,901,751 PRM Prominence Energy 0.006 20.0 1,326,692 $1,556,882 AUK Aumake Limited 0.007 16.7 6,032,646 $11,486,441 EPM Eclipse Metals 0.007 16.7 328,741 $13,505,133 MME Moneyme Limited 0.097 15.5 3,157,184 $67,206,592 BMG BMG Resources Ltd 0.008 14.3 1,529,330 $4,786,580 BTR Brightstar Resources 0.017 13.3 44,071,114 $70,833,354 EMH European Metals Hldg 0.26 13.0 33,017 $47,712,282 LV1 Live Verdure Ltd 0.445 12.7 194,752 $49,353,392 RDS Redstone Resources 0.0045 12.5 459,625 $3,701,514 CBH Coolabah Metals Limi 0.07 11.1 59,608 $8,451,845 OJC The Original Juice 0.15 11.1 184,278 $39,994,757

Alto Metals (ASX:AME) was higher by lunchtime today, largely because the company is in the middle of being acquired by Brightstar Resources (ASX:BTR), with the company now able to come out of a trading halt because a certain condition has been met – to whit, the results of Brightstar’s bookbuild in connection with a $24,000,000 capital raise ahead of the Alto purchase.

The deal would see Alto shareholders pocket 4 Brightstar shares per Alto share, and Brightstar gets its hands on Alto’s 100% owned Sandstone Gold Project, comprising a significant land position in the East Murchison and current Mineral Resource of 1.05Moz Au at 1.5g/t.

Brightstar was also up – see above for why.

Veris (ASX:VRS) was also up at lunchtime, largely due to a healthy trading update the company released a couple of days ago, which has been interpreted as “good” by investors, and sent the company climbing a smidgen over 14% today.

Earlier in the day, the leaders included Estrella Resources (ASX:ESR), after the company delivered an investor webinar on the heels of news that it has an update to exploration activities in the Lautém Municipality of Timor-Leste and the discovery of the a supergene manganese Sica Prospect, the latter of which is quite visually exciting as areas of manganese mineralisation lie exposed on the surface, with pXRF determinations in the field range between 59% – 26% Mn.

And Bastion Minerals (ASX:BMO) was up this morning on news that it has successfully completed a placement to raise $500,000 before costs through a one-tranche placement, with a 1 for 3 free attaching option along with an entitlement issue to raise up to A$1,500,000 before costs.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 88E 88 Energy Ltd 0.002 -33.3 2,530,322 $86,801,436 AUH Austchina Holdings 0.002 -33.3 2,000 $6,301,151 EXL Elixinol Wellness 0.003 -25.0 206,292 $5,284,729 JAV Javelin Minerals Ltd 0.0015 -25.0 333,000 $8,553,692 ME1 Melodiol Glb Health 0.0015 -25.0 18,556,500 $1,215,473 OLI Oliver'S Real Food 0.012 -25.0 82,666 $7,051,711 SBW Shekel Brainweigh 0.043 -21.8 42,717 $11,593,216 ZMM Zimi Ltd 0.015 -21.1 28,593 $2,406,630 EFE Eastern Resources 0.004 -20.0 86,400 $6,209,732 MOM Moab Minerals Ltd 0.004 -20.0 2,766,830 $3,969,071 NAE New Age Exploration 0.004 -20.0 1,203,312 $8,969,495 CCO The Calmer Co Int 0.007 -17.6 12,829,663 $18,303,218 DYL Deep Yellow Limited 1.0825 -16.7 10,413,269 $1,260,142,004 MDI Middle Island Res 0.015 -16.7 58,000 $3,931,212 AVE Avecho Biotech Ltd 0.0025 -16.7 818,465 $9,507,891 GTI Gratifii 0.005 -16.7 3,000,000 $10,536,286 XST Xstate Resources 0.01 -16.7 527,521 $3,858,230 AI1 Adisyn Ltd 0.028 -15.2 724,792 $6,109,356 BMN Bannerman Energy Ltd 2.56 -14.4 795,762 $525,563,501 MBK Metal Bank Ltd 0.018 -14.3 6,000 $8,199,645

IN CASE YOU MISSED IT – AM EDITION

MONEYME (ASX:MME) grew Q4 loan originations by 25% over the previous quarter to $165m while increasing its loan book by 6% to $1.22bn. Net credit losses dropped from 4.8% in Q3 to 4.5% while gross revenue climbed 1% to $54m. Shares in the company were up >30% this morning, making it one of the top gainers today.

Peregrine Gold (ASX:PGD) has completed the second phase of reverse circulation drilling at its Tin Can prospect with an assessment underway to provide a sub-surface image of potentially larger mineralised zones that contain pyrite.

Prospect Resources (ASX:PSC) has received firm commitments from new and existing Australian and international institutional and sophisticated investors to subscribe for ~80 million new shares priced at 10c to raise ~$8m.

This includes $1.57m worth of shares to be issued to long-term substantial shareholder Eagle Eye. Proceeds will be used to advance exploration and development activities at the company’s Mumbezhi copper project, and the company will also look to raise up to $2m through a share purchase plan.

At Stockhead, we tell it like it is. While MONEYME, Peregrine Gold and Prospect Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.