ASX Small Caps Lunch Wrap: A peak then a punch on the first day of March

Winner. Via Getty

Australian markets bumped straight back off a new record high on Friday morning after similar nonsense on Wall Street overnight.

At midday on Friday March, the ASX200 was down about 2 points, or 0.03% higher at 7,701.

We’re flat and we hit a new record high. Sigh. Fickle Friday’s eh.

Money on the major miners, the Resources stocks and local IT sector lifted the benchmark into new untrodden territory on Friday morning.

That’s unsurprising in itself – US stocks banged into more all-time highs last night as Wall Street traders pumped hard to make February a winner.

The S&P 500 rose 0.5% to top its record set last week. Next door, the Dow Jones ended a smidge off the record it set last week , up 0.1%, while the tech-y Nasdaq composite jumped 1% and smacked its 2021 all-time on the butt as it passed.

EU markets closed mixed. London’s FTSE added 0.07%, Frankfurt gained 0.45%, and the mugs in Paris closed 0.34% lower.

Around the hood, Tokyo’s Nikkei fell 0.1%.

Hong Kong’s Hang Seng lost 0.15% and the mainland’s Shanghai Composite surged 2%.

As the poet said, there was indeed movement at the station for the word had passed around that the colt from Old Regret had got away, which he did this morning at the open as local markets surged… before remembering who and where they were and promptly fell in a heap.

Tech, (up 1.2%) was the best in show on Friday morning. But the initial burst largely came out of the Materials space where iron ore, gold and lithium stocks got instantly chipper, then cheaper…

Major goldies, Newmont Corporation (ASX:NEM) , Northern star and Evolution Mining (ASX:EVN) were in the money.

Lithium biggies IGO (ASX:IGO) and Pilbara Minerals were again among thgains.

And welcome back to the money side, Core Lithium (ASX:CXO) !

Iron ore heavyweights Fortescue (ASX:FMG) and BHP (ASX:BHP) helped offset serious Healthcare weakness – Cochlear and Sonic Healthcare down 3% a peice.

IT stocks were led by WiseTech Global (ASX:WTC) and consumer staples stocks got a boost from Coles Group (ASX:COL) andWoolworths (ASX:WOW) both up aropun d 1%.

Ampol (ASX:ALD) was the worst, but only because it went ex-div on Friday.

And we’ve got a stack more going Ex-Div on Friday, too…

(franking % in brackets below))

Ampol Limited (ASX:ALD) is paying $1.20 (100)

Argo Global Ltd (ASX:ALI) is paying $0.04 (100)

AMP Limited (ASX:AMP) is paying $02.20

ASX Limited (ASX:ASX) is paying $01.10 (100)

Centrepoint Alliance (ASX:CAF) is paying $0.10 (100)

Cleanaway Waste Ltd (ASX:CWY) is paying $0.245 (0)

Eumundi Group Ltd (ASX:EBG) is paying $035 (100)

Johns Lyng Group (ASX:JLG) is paying $0.47 (100)

Mineral Resources. (ASX:MIN) is paying $0.20 (100)

NB Global Corporate Income Trust (ASX:NBI) $0.012 (0)

Prestal Holdings Ltd (ASX:PTL) is paying$0.06 (100)

Redox Limited (ASX:RDX) is paying $0.06 (100)

Sonic Healthcare (ASX:SHL) is paying $0.43 (0)

Silk Logistics (ASX:SLH) is paying $0.028 (100)

Stanmore Resources (ASX:SMR) is paying $0.012 (100)

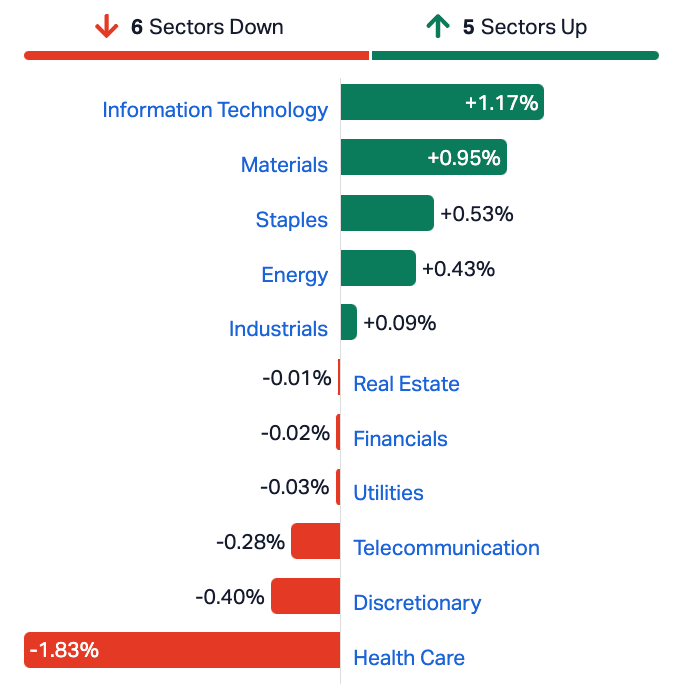

ASX Sectors on Friday at Lunch

Not the ASX…

The Nasdaq Composite advanced Thursday, rising to its first closing record since November 2021.

The tech-heavy Nasdaq jumped 0.9 per cent to close at an all-time high at 16,091.92, as tech stocks and chips rallied into the close. The S&P 500 also popped to a record close, rising 0.52 per cent at 5,096.27. The Dow Jones Industrial Average ticked higher by 0.12 per cent at 38.996.39.

Thursday’s session points to a positive finish for the month for Wall Street, despite a string of declines raising questions around the sustainability of the AI-driven rally. The Nasdaq is leading the pack with a 5.2 per cent gain. The S&P 500 has jumped 4.6 per cent, while the Dow has added 1.8 per cent. This would mark the Dow’s first four-month winning streak since May 2021.

Data showed the Federal Reserve’s preferred measure of inflation was stubbornly above the central bank’s target in January, but at least didn’t exceed Wall Street forecasts.

The core personal consumption expenditures price index increased by 0.4 per cent for the month and 2.8 per cent from a year ago. That matches Dow Jones estimates. Headline PCE, which includes food and energy categories, increased 0.3 per cent monthly and 2.4 per cent on a 12-month basis, compared to respective estimates for 0.3 per cent and 2.4 per cent.

Personal income rose 1 per cent month-over-month in January, well above the forecast for 0.3 per cent.

In other economic data today, pending home sales posted a surprise drop in January amid swings in mortgage rates. Pending sales declined 4.9 per cent for the month, much worse than the 2 per cent projected increase from the Dow Jones consensus.

Snowflake shed 18.4 per cent after announcing the retirement of its CEO and sharing disappointing product revenue guidance. Meanwhile, Okta popped nearly 23 per cent on strong results.

Weight loss drugmaker Viking Therapeutics announced its intention to raise cash in a US$550 million offering. The Company is hoping to take advantage of the intense interest that has followed the release of phase 2 clinical trial results on Tuesday.

Viking is working on its own GLP-1/GIP receptor and it’s getting some strong early results vs obesity.

Viking Therapeutics was down 15% in trading Thursday. That’s about 20% off this week’s high, but the stock’s price is still twice what it was on Monday.

Across the US sectors, all closed higher overnight except for Health and Consumer Staples. Tech was the best performer.

US Futures are thusly on Friday in Sydney:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 28 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVW Avira Resources Ltd 0.0015 50% 1,400,491 $2,133,790 AHN Athena Resources 0.004 33% 4,221,068 $3,211,403 H2G Greenhy2 Limited 0.008 33% 573,658 $2,512,535 360 Life360 Inc. 10.69 31% 3,172,786 $1,668,454,718 WWG Wisewaygroupltd 0.06 28% 58,813 $7,862,812 ICL Iceni Gold 0.024 26% 535,290 $4,684,660 WHK Whitehawk Limited 0.039 26% 10,427,167 $10,480,192 HXG Hexagon Energy 0.015 25% 327,220 $6,154,991 SCN Scorpion Minerals 0.022 22% 1,125,463 $7,370,211 OXT Orexploretechnologie 0.029 21% 869,238 $4,689,976 AON Apollo Minerals Ltd 0.025 19% 140,000 $14,623,201 IR1 Irismetals 0.575 19% 414,479 $62,824,466 VMS Venture Minerals 0.02 18% 17,980,049 $37,683,555 RIL Redivium Limited 0.0035 17% 124,255 $8,192,564 NZO New Zealand Oil&Gas 0.465 16% 17,850 $89,580,335 ANR Anatara Ls Ltd 0.029 16% 1,261,591 $4,197,343 NVX Novonix Limited 0.95 16% 4,840,716 $400,869,949 AXN Alliance Nickel Ltd 0.037 16% 54,865 $23,226,868 HXL Hexima 0.015 15% 70,000 $2,171,515 ADX ADX Energy Ltd 0.115 15% 966,607 $42,848,309 EG1 Evergreenlithium 0.115 15% 32,085 $5,623,000 SRX Sierra Rutile 0.096 14% 2,183,183 $35,635,862 MLX Metals X Limited 0.33 14% 4,806,250 $263,107,159 BPH BPH Energy Ltd 0.025 14% 3,684,247 $24,146,060 WSI Weststar Industrial 0.13 13% 491,116 $12,738,002

Family safety app Life360 (ASX:360) has announced its quarter and CY23 results including revenue of $305 million, a YoY increase of 33%, in line with guidance of $300mn -$310mn and core Life360 subscription revenue of $200 million, up 52% YoY. Net loss of $28.2mn was a $63.5mn improvement from CY22.

A pumped Life360 CEO Chris Hulls was particularly chuffed with the app’s 61 million monthly active users (MAU) globally.

“In CY23 we made significant strides in our member experience, showing our users what their family members are up to, whether they’re driving, walking or biking. We put pets and other valuables on the map with Tile, all in the service of our mission to keep people close to the ones they love.

“At the same time we made meaningful progress on our path to profitability as we significantly reduced our net loss, and achieved a major milestone by delivering our first full year of positive Adjusted EBITDA1 and Operating Cash Flow.”

“In 2023, we delivered on our commitment to balance fiscal responsibility and prudent investment to position the business for long-term success. We delivered YoY revenue growth of 33% while GAAP operating expenses increased only 4% YoY. We met or exceeded all of the guidance metrics we provided to the market for CY23.”

Perhaps the jewel in the 360 crown here is Hulls’ announcement of a new advertising revenue stream…

“…that offers partners unparalleled reach to Life360’s enormous free user base, and more than 20 million daily active users (DAU) connecting with their families and friends.”

Aussie integrated freight and logistics operator Wiseway Group (ASX:WWG) continued its turnaround trajectory over the last 6 months, clocking $4.3mn in EBITDA and $562,000 in Net Profit Before Tax.

Overall, in the last 12 months the Group’s achieved a 35% boost in EBITDA (of $7.5mn)

As well as $1.1 million in NPAT.

The company says the results reflect “the flow through benefits from effective cost management, operational improvements, and focused strategic initiatives” to increase profitability.

CEO Roger Tong, Wiseway says WWG’s focus on expanding imports has particularly paid off, with Wiseway capturing market share in the inbound eCommerce market from China.

European Lithium (ASX:EUR) has announced publicly traded special purpose acquisition company Sizzle Corp (NASDAQ:SZZL) and EUR’s Wolfsberg lithium project in Austria have officially merged to form Critical Minerals Corp.

Critical Metals started trading on the NASADAQ on February 28 under the ticker CRML with the Wolfsberg lithium project in Austria becoming its initial flagship asset with the mine’s future construction and commissioning a key focus.

Focused on project development of low-emission fuels and energy materials Hexagon Energy Materials (ASX:HXG) says it progressed confidential commercial discussions with potential strategic partners regarding its WAH2 project and received indicative pricing for several key aspects of the project during the December quarter.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 1 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap WEC White Energy Company 0.035 -26% 50 5,322,061 HCD Hydrocarbon Dynamic 0.003 -25% 106,225 3,234,329 IS3 I Synergy Group Ltd 0.006 -25% 10,000 2,432,643 NGS NGS Ltd 0.01 -23% 557,929 3,265,956 ATH Alterity Therap Ltd 0.004 -20% 10,100,000 21,913,774 IVX Invion Ltd 0.004 -20% 102,272 32,122,661 LNR Lanthanein Resources 0.004 -20% 756,000 6,449,060 MGU Magnum Mining & Exp 0.016 -20% 3,920,435 16,187,228 NAE New Age Exploration 0.004 -20% 1,848,021 8,969,495 PUR Pursuit Minerals 0.004 -20% 138,015 14,719,857 PTL Prestal Holdings Ltd 0.36 -18% 28,111 75,002,180 SOP Synertec Corporation 0.1 -17% 100,000 51,779,512 M4M Macro Metals Limited 0.0025 -17% 469,999 8,436,233 MOH Moho Resources 0.005 -17% 300,000 3,235,069 OAU Ora Gold Limited 0.005 -17% 446,600 34,440,005 HT8 Harris Technology Gl 0.011 -15% 425,529 3,888,761 POS Poseidon Nick Ltd 0.006 -14% 1,012,546 25,994,743 SEN Senetas Corporation 0.012 -14% 1,429,835 21,997,967 8CO 8Common Limited 0.046 -13% 320,381 11,877,030 1MC Morella Corporation 0.0035 -13% 536,114 24,715,198 ALY Alchemy Resource Ltd 0.007 -13% 1,679,547 9,424,610 OPN Oppenneg 0.007 -13% 423,956 9,033,437 ZEU Zeus Resources Ltd 0.007 -13% 125,000 3,674,248 OEC Orbital Corp Limited 0.105 -13% 162,896 17,496,808 CPV Clearvue Technologie 0.49 -13% 1,034,438 128,808,200

ICYMI at Midday

Ora Banda Mining (ASX:OBM) has received firm commitments for a single tranche placement raising $30 million at 22c/share to rapidly advance its Sand King project towards FID.

Earlier this week the reborn gold producer confirmed Sand King was shaping as the company’s second underground mine at its Davyhurst operations in the WA Goldfields on the back of some “game-changing” drill intersections.

“We are at an exciting inflection point as the company pivots away from our current low-grade open pit mill feed to high-grade underground mill feed as its primary source of ore,” OBM managing director Luke Creagh said today.

Latin Resources (ASX:LRS) has appointed seasoned lithium mining guru Aaron Maurer as its new chief operating officer where he is set to play a key role in the ongoing development of the company’s flagship Salinas lithium project in Brazil.

Maurer was executive general manager of operations at the Mt Marion lithium mine for over five years and most recently was head of operations for Ghana-focused lithium developer Atlantic Lithium (ASX:A11).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.