ASX Small Caps Lunch Wrap: A morning of very few surprises as the market waits on RBA call

Pic via Getty Images

- ASX 200 dips 0.35pc as the Coles and Woolies selldown continues at pace

- Commodities got a shot in the arm from economic stimulus plans out of China

- Exploration, a juicy defence contract and a move to de-list have moved Small Caps

The ASX opened ever so slightly higher this morning, before slapping the snooze button and heading back to bed in the opening 30 minutes of the session, leading to a dull 30 minute stretch that had the benchmark plodding morosely along at pretty much break-even.

By lunchtime, the market had slumped to a 0.35% loss, when a surprise Chinese announcement goosed commodities unexpectedly, but not hard enough to offset the market’s obvious displeasure at the prospect of Coles (ASX:COL) and Woolworths (ASX:WOW) being banished to the nether realms by an angry ACCC.

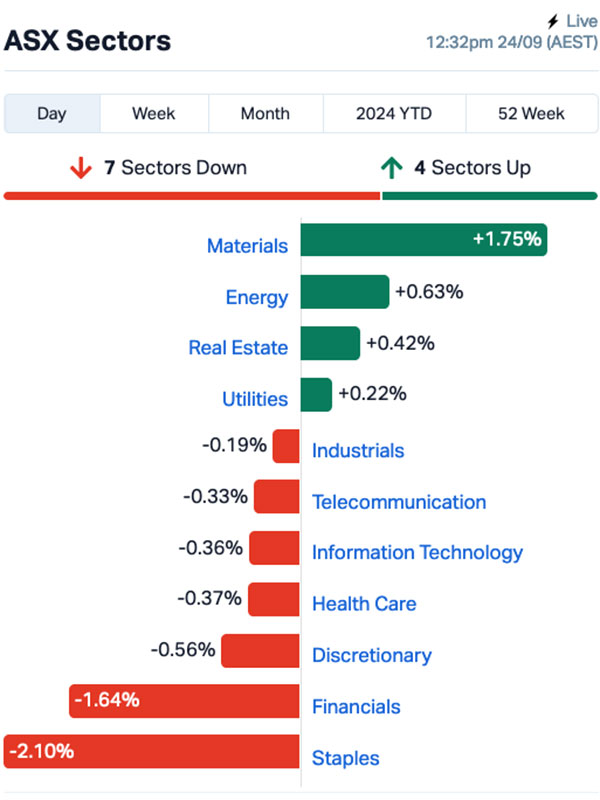

A look at the charts holds very few surprises – most sectors were barely moving the needle, except for Consumer Staples, which was down 1.7% early in the day as investors delivered another round of kickings to the collective kidneys of the supermarkets.

A refresher in case you missed all the fun yesterday: The ACCC has launched separate but similar legal action against the two big supermarket players, accusing them of jacking up prices for short periods before “discounting” them back down, but oftentimes ending up with consumers paying a higher price than before.

The allegations could be a serious breach by both companies and, if proven in court, could result in at least $50,000,000 in fines for both companies, and possibly much more if the court is able to figure out how much the companies profited from the practice.

If that happens, the fine could run to triple whatever profits the court identifies – and the law calls for the greater of the financial punishments to be levied on a guilty finding.

But on the positive side of the ledger, yesterday’s surge in interest from investors buying up uranium-diggers has continued this morning, with the likes of Paladin Energy (ASX:PDN), Boss Energy (ASX:BOE) and Deep Yellow (ASX:DYL) adding a further 4.0% to 5.9% per cent in early trade to yesterday’s 5.1% to 8.2% gains.

A quick look at commodities because there’s bugger all else happening this morning – oil prices closed 0.5% lower overnight despite Israel launching a deadly attack on Lebanon that reportedly claimed 492 lives.

Oil prices have moved higher throughout the morning, though, with WTI crude up 0.7% and closing in on US$71 per barrel, while Brent crude was up 0.6% to US$74.35 a barrel the last time I looked.

Overnight, gold rose by 0.2% to US$2,627.75 an ounce after earlier touching an all-time high of US$2,635.05.

And Singapore TSI Iron Ore futures fell 2% to US$89.75 a tonne, a one-year low, but were pointing 1.95% higher this morning at $91.30/tonne by 11:30am.

The sudden surge this morning among major commodities is being blamed – not the right word, but I am too tired to figure out how to say it properly – on an unexpected announcement(s) out of Beijing this morning, after the PBoC went public with a “surprisingly broad” array of monetary policy stimulus measures.

The always exciting Aussie dollar is changing hands for US$0.6845 at the time of writing, and the jury is out on whether the expected ‘nothing to see here’ from the RBA this afternoon is going to give the dollar an upward nudge, or whether the continued inaction from the Board has already been priced in.

The market’s obviously not expecting any fireworks – and the big banks are down in anticipation of nothing happening, so all we can do now is wait…

I can barely contain myself.

NOT THE ASX

Overnight, the S&P 500 finished higher by 0.28%, the Dow Jones was up by 0.15%, and the tech heavy Nasdaq climbed by 0.14%, as US traders got all excited about Fed officials pointing to the possibility of more rate cuts ahead.

Chicago Fed President Austan Goolsbee said that as inflation nears the central bank’s target, the focus should shift to the labour market, adding “that likely means many more rate cuts over the next year.”

Neel Kashkari from the Minneapolis Fed also pointed to weakness in the job market and supports another 50bp rate cut by year’s end, Eddy Sunarto reported this morning.

Meanwhile, Raphael Bostic at the Atlanta Fed took a more moderate view, warning against making a habit of large rate cuts in the future.

In US stock news, Intel jumped another 3% after private equity powerhouse Apollo Asset Management committed to a US$5 billion investment in the ailing Silicon Valley icon, presumably to thwart any potential moves by Qualcomm.

Earlier, Qualcomm reportedly made informal overtures to Intel about a potential takeover, which could become the largest tech merger in history.

Tesla popped 5% ahead of the company’s Robotaxi day on October 10th where it will be showcasing its Full Self-Driving technology.

Bank of America said in a note that if the event goes well, it could really boost Tesla, as Tesla’s flair at these events often gives the stock a nice lift.

Boeing Co rose 2% after proposing a 30% wage increase to its biggest union in an effort to resolve a deadlock that has halted aircraft production.

Microsoft, meanwhile, received a rare downgrade from Wall Street as some analysts are worried the tech giant relies too much on Nvidia for its AI tech and that its competitors have closed the gap.

Analysts at D.A. Davidson lowered Microsoft’s rating from Buy to Neutral, but kept the price target at US$475, versus current price of US$433.50. Microsoft was down 0.4%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 24 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CT1 Constellation Tech 0.002 100.0 473,254 $1,474,734 E25 Element 25 0.395 83.7 7,564,603 $47,281,166 EEL ENRG Elements 0.003 50.0 320,863 $2,090,032 CTT Cettire 1.975 48.5 15,776,121 $507,046,833 ICR Intelicare Holdings 0.015 36.4 1,058,342 $5,348,070 ATH Alterity Therapeutics 0.004 33.3 2,804,642 $15,961,008 CDE Codeifai 0.002 33.3 900,607 $3,961,942 OVT Ovanti 0.004 33.3 45,250 $4,669,045 WC1 West Cobar Metals 0.034 25.9 15,103,207 $4,117,509 88E 88 Energy 0.003 25.0 10,460,929 $57,867,624 EP1 E&P Financial Group 0.505 23.2 32,069 $97,448,837 CLV Clover Corp 0.455 23.0 550,671 $61,789,756 EPM Eclipse Metals 0.006 20.0 236,666 $11,254,278 ROG Red Sky Energy 0.006 20.0 1,653,656 $27,111,136 ARR American Rare Earths 0.305 19.6 2,429,345 $126,077,941 SRL Sunrise 0.49 16.7 17,471 $37,895,549 NRZ Neurizer 0.004 16.7 14,013,880 $6,543,358 SP8 Streamplay Studio 0.007 16.7 505,646 $6,903,743 JPR Jupiter Energy 0.029 16.0 161,037 $31,862,138 NMR Native Mineral Res 0.023 15.0 99,312 $7,967,462

Element 25 (ASX:E25) was up on exciting news that it has been selected for award negotiations for a US$166 million grant from the US Department of Energy (DoE) under the Battery Materials Processing Grant Program. The funding will support the construction of Element’s proposed battery-grade high-purity manganese sulphate monohydrate (HPMSM) facility in Louisiana, USA, and the funding is additional to the US$115 million already committed by offtake partners General Motors and Stellantis.

Recent diamond drilling has confirmed a thick zone of antimony copper mineralisation at West Cobar Metals’ (ASX:WC1) Bulla Park project. The drilling supports further confidence of a large antimony copper system at Bulla Park, alongside previous drilling results that include 33m at 0.47% Cu and 0.15% Sb from 229m.

Online retailer Cettire (ASX:CTT) was up after the company delivered a banger of an annual report, which includes news that it has managed to achieve sales revenue of $742 million, an increase of 78% above last year’s result. Cettire’s online stores now boast 692,000 active users, who have contributed to a 61% increase in gross revenue from return business.

Clover Corp (ASX:CLV) was up, despite delivering an annual report this morning that showed a total revenue of $62.2 million which was in line with guidance, but also marked a decline from the previous year’s $79.9 million. Clover also reported that net profit after tax (NPAT) also saw a significant drop, falling to $1.5 million from $6.2 million in FY23.

E&P Financial Group (ASX:EP1) was up this morning after the company dropped a grab-bag of announcements, first informing the market that it has finalised a $12.5 million conditional placement of 125,000 convertible notes at a face value of $100 per note, mandatorily convertible into fully paid ordinary shares at a conversion price of $0.52, together with free-attaching options to wholesale investors.

That was quickly followed by news that the company has officially requested to voluntarily de-list from the ASX, subject to the results of an extraordinary General Meeting, which was announced immediately after the second announcement, at which shareholders will also vote on a proposed an off-market equal access buy-back for up to $25,000,000.

American Rare Earths (ASX:ARR) jumped on news that its 100% owned subsidiary Wyoming Rare has received a non-binding Letter of Interest from the Export-Import Bank of the United States for up to US$456 million in a debt-financing package for the construction and execution phase of the Cowboy State Mine area at the Halleck Creek Project. The facility has a 15-year repayment term under the bank’s Make More In America Initiative.

Earlier, Poseidon Nickel (ASX:POS) was up after it reported finding several gold anomalies extending over multiple soil traverses (between 400m to 800m) following reconnaissance soil sampling at its Black Swan project. The company also said a coherent gold anomaly has been defined (up to 54ppb Au) that is 1.4km by 1km in size and remains open to the south at its Wilson’s prospect.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 24 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap RNE Renu Energy 0.001 -33.3 6,543 $1,206,201 TX3 Trinex Minerals 0.002 -33.3 727,655 $5,485,957 VPR Volt Group 0.001 -33.3 9,814 $16,074,312 WTM Waratah Minerals 0.32 -30.4 7,520,417 $86,862,336 PLN Pioneer Lithium 0.135 -27.0 52,895 $5,880,074 ERL Empire Resources 0.003 -25.0 630,000 $5,935,653 SMM Somerset Minerals 0.003 -25.0 28,631 $4,123,995 VKA Viking Mines 0.007 -22.2 145,165 $9,563,326 CTO Citigold Corp 0.004 -20.0 769,425 $15,000,000 EXL Elixinol Wellness 0.004 -20.0 215,385 $6,605,912 RGL Riversgold 0.004 -20.0 4,959,565 $6,637,313 VML Vital Metals 0.002 -20.0 661,248 $14,737,667 AD1 AD1 Holdings 0.005 -16.7 200,000 $6,584,090 LPD Lepidico 0.003 -16.7 1,878,568 $25,767,375 RDM Red Metal 0.105 -16.0 99,095 $37,457,072 MAT Matsa Resources 0.032 -15.8 435,187 $24,703,325 BCM Brazilian Critical 0.011 -15.4 155,690 $10,799,613 ERA Energy Resources 0.006 -14.3 82,580 $155,038,094 CAZ Cazaly Resources 0.013 -13.3 417,244 $6,919,545 ALM Alma Metals 0.007 -12.5 7,471,176 $11,593,650

ICYMI – AM EDITION

Koba has recommenced drilling at its Yarramba uranium project in South Australia, following a small hiatus due to a an unforeseen mechanical issue.

A new rig has been mobilised to site and is currently drilling at the Oban deposit following up on previously intersected high-grade mineralisation including 7.5m at 831 ppm eU3O8, 2.1m at 2,236ppm eU3O8, 3.9m at 1,104ppm eU3O8, and 4.5m at 964ppm eU3O8.

“With a new rig now on site, drilling is currently focusing on the Oban uranium deposit, where another 70 holes are planned with the aim of growing the resource base by delineating high-grade trends both within and beyond the current resource boundaries,” MD and CEO Ben Vallerine said.

“The rig will then move to the Mt John prospect, which is located just 4km north of Boss Energy’s 10.7Mlb Jason uranium deposit, where we have another 30 holes planned to target discovery of new mineralisation.”

The company plans to commence multiple drill programs in Northwest Queensland over the next month.

These programs will test two standout base metal targets on the separate Gidyea and Lawn Hill projects and complete infill resource definition on our Sybella rare earth oxide discovery. In addition, RDM will offer eligible shareholders the opportunity to participate under a share purchase plan at $0.10 per share targeting to raise $2m to fund the drilling programs.

“We’re thrilled about the upcoming drilling programs on these three exceptional projects, any one of which has the potential to significantly transform Red Metal,” MD Rob Rutherford said.

“We’re also delighted to offer our loyal existing shareholders a discounted share purchase opportunity before this intense period of drilling activity begins, as they continue to be our strongest supporters.”

At Stockhead, we tell it like it is. While Koba Resources and Red Metal are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.