ASX Small Caps and Weekly IPO Wrap: Investors find Solis during a sweaty, confusing week

It made sense at the time. Via Getty

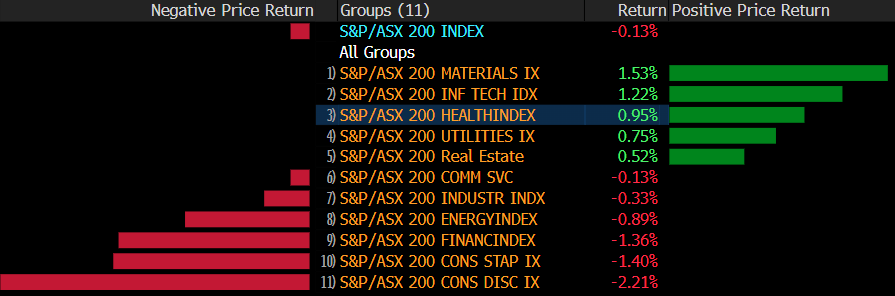

- The ASX200 ended -9 pts or -0.13% lower for the week, trading in a wild 177-point range

- Materials rolled back the earlier losses boosted by stronger commodity prices and a weaker USD

- Dual listed Solis Minerals (ASX:SLM) jumped way more than 200% this week

The local benchmark had a right decent crack at ending the week higher on Friday, following five manic sessions of terrifying, compounded uncertainty.

Hats off though for somehow just missing the mark by a nine points, with a string of data adding to expectations of further RBA rate hikes. That said, the benchmark missed its milestone by a mere eight points in the end. Over the week losses were led by Consumer and Financial stocks.

On Friday Materials were helped by stronger commodity prices and a softer USD, both reversing moves from earlier in the week with a relief rally for global growth leverage following the US debt ceiling vote.

Materials jumped +2.5% on Friday, Energy found +1.25%, while the local Tech, Utilities and Real Estate Sectors all responded well to a bit of a fullstop being put on this debt ceiling nonsense.

Consumer Staples took a hit on Friday though, in the wash-up to changes to the meagre Aussie award and a better than 8.5% bump to the minimum wage. The disappointingly lower-than-expected award wage increase of 5.75% just made those of us with the least pay more than most for the rising cost of everything. Staples lost 1.3%, Healthcare (-0.55%) and Industrials (-0.50%) were the main drags on the index.

For best evidence of all that take a look at how Coles (ASX:COL) traveled Monday to Friday, the supermarket chain is having a bit of a rupture with its own wages worries sans Team Albo getting involved. COL dropped more than -1.7% on Friday as well as adding an unwelcome circa $25m in provisions after the Ombudsman whacked it for underpaying staff.

The ASX200 finished down 0.13% for the week.

ASX Sector Performance this week

Around the traps, the home stuff retailer Adairs (ASX:ADH) lost 15% on Friday. It was awful to watch, and probably ended better than the ridiculously timed FY guidance update.

With a month to go before the financial year ends, the homewares group revealed sales for the first 22 weeks of 2H are down -7% on the same time last year after ADH’s Mocka business copped a near -25% crash in sales.

EBIT guidance was slashed 15% (to $62-65m vs consensus expectations of $74m). The update weighed on the entire sector ahead of FY reporting, Temple & Webster (ASX:TPW) an obvious casualty.

Iron ore was strong in Asian trade, jumping about 3.8%. BHP enjoyed that the most, the iron ore big daddy climbed near +3%. Mineral Resources (ASX:MIN) added +1.8% now they’ve completed the acquisition of Norwest with more than 90% of shares in pocket.

With the Friday session in New York pointing higher and yet to play out, global share markets ended the week mixed.

US shares have been hugely relieved by the sorting of debt ceiling deal as well as suggestions The Fed could be hitting pause on rates this month.

Japanese and Chinese shares ended higher, the Nikkei was up +1.1% on Friday, but vastly outplayed by a resurgent Hang Seng which found almost 4% to end the final session of the week.

Eurozone shares are lower on Friday morning in Paris.

Bond yields fell and the oil price fell, but metal and iron ore prices rose as did the Aussie trooper (er, dollar) on the back of rising RBA rate hike chatter and the softer USD.

Asian stocks were super strong heading into the weekend.

Gold was flat on Friday in Sydney, circa $US1978/oz.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SLM | Solis Minerals | 0.44 | 214% | $18,389,213 |

| ZLD | Zelira Therapeutics | 1.94 | 116% | $26,098,457 |

| IS3 | I Synergy Group Ltd | 0.014 | 100% | $4,047,125 |

| WCG | Webcentral Ltd | 0.125 | 84% | $32,912,623 |

| SRJ | SRJ Technologies | 0.11 | 83% | $10,429,766 |

| GSM | Golden State Mining | 0.06 | 71% | $7,646,003 |

| BLZ | Blaze Minerals Ltd | 0.017 | 70% | $6,862,624 |

| TNY | Tinybeans Group Ltd | 0.3 | 67% | $14,118,655 |

| WC8 | Wildcat Resources | 0.11 | 62% | $66,202,273 |

| MHC | Manhattan Corp Ltd | 0.008 | 60% | $23,490,230 |

| AKP | Audio Pixels Ltd | 13.64 | 58% | $408,941,400 |

| APX | Appen Limited | 3.8 | 57% | $459,510,818 |

| CLE | Cyclone Metals | 0.0015 | 50% | $9,089,248 |

| RR1 | Reach Resources Ltd | 0.009 | 50% | $24,795,456 |

| VPR | Volt Power Group | 0.0015 | 50% | $16,074,312 |

| FTC | Fintech Chain Ltd | 0.019 | 46% | $12,364,622 |

| MXO | Motio Ltd | 0.042 | 45% | $10,980,256 |

| BET | Betmakers Tech Group | 0.1875 | 44% | $136,813,532 |

| AXE | Archer Materials | 0.555 | 42% | $147,811,268 |

| WSR | Westar Resources | 0.083 | 41% | $13,843,314 |

| MEG | Megado Minerals Ltd | 0.065 | 38% | $14,503,967 |

| A3D | Aurora Labs Limited | 0.026 | 37% | $5,161,969 |

| RFX | Redflow Limited | 0.23 | 35% | $44,943,591 |

| BSN | Basin Energy | 0.135 | 35% | $8,104,051 |

| GCY | Gascoyne Res Ltd | 0.155 | 35% | $122,781,835 |

| CAZ | Cazaly Resources | 0.035 | 35% | $13,757,406 |

| ADV | Ardiden Ltd | 0.008 | 33% | $18,818,347 |

| CT1 | Constellation Tech | 0.004 | 33% | $5,884,801 |

| CYQ | Cycliq Group Ltd | 0.008 | 33% | $2,780,133 |

| DTR | Dateline Resources | 0.02 | 33% | $15,240,385 |

| GGE | Grand Gulf Energy | 0.012 | 33% | $14,942,223 |

| GMN | Gold Mountain Ltd | 0.004 | 33% | $5,909,798 |

| INP | Incentiapay Ltd | 0.016 | 33% | $16,445,827 |

| OCN | Oceana Lithium | 0.4 | 33% | $13,320,010 |

| ZEO | Zeotech Limited | 0.063 | 31% | $98,442,340 |

| ZEU | Zeus Resources Ltd | 0.038 | 31% | $14,465,385 |

| XRG | Xreality Group Ltd | 0.055 | 31% | $24,540,469 |

| PAM | Pan Asia Metals | 0.3 | 30% | $47,356,223 |

| TRP | Tissue Repair | 0.35 | 30% | $13,332,401 |

| NRZ | Neurizer Ltd | 0.066 | 29% | $84,545,645 |

| FGL | Frugl Group Limited | 0.009 | 29% | $8,604,558 |

| PVS | Pivotal Systems | 0.009 | 29% | $4,276,950 |

| WBT | Weebit Nano Ltd | 6.87 | 28% | $1,235,365,334 |

| DLT | Delta Drone Intl Ltd | 0.014 | 27% | $6,206,445 |

| ERW | Errawarra Resources | 0.098 | 27% | $5,929,392 |

| HXL | Hexima | 0.014 | 27% | $2,004,476 |

| LRL | Labyrinth Resources | 0.014 | 27% | $13,432,823 |

| IPT | Impact Minerals | 0.014 | 27% | $39,825,854 |

| VSR | Voltaic Strategic | 0.085 | 27% | $26,970,415 |

| KNG | Kingsland Minerals | 0.405 | 27% | $11,475,542 |

The dual listed Solis Minerals (ASX:SLM) (TSX.V: SLMN) kinda casually found 200% this week and it may be far from done after announcing the purchase of the Jaguar lithium project in Brazil on Thursday.

This is a performance worth dwelling on a moment. SLM is up about 380% for 2023.

Reuben reports that SLM believes Jaguar – located in Bahia state — has all sorts of rock chip sampling showing grading up to 4.95% Li2O along a 1km long, 50m wide spodumene-rich pegmatite body.

That’s a lot of cheese.

Drilling, he says, will kick off this month.

“Brazil is fast becoming a significant player in the hard rock lithium space,” former Delta Lithium (ASX:DLI) boss and current SLM exec director Matt Boyes says.

“Solis’s primary objective is to quickly position itself by acquiring highly prospective underexplored projects in the northeast of Brazil.

“The Jaguar pegmatite hosts confirm LCT-bearing pegmatites with some of the coarsest and most abundant spodumene occurrences I have seen.

“These tenements in what may be a new lithium province are a fantastic addition to our already large tenement position in the northeast of Brazil, and with drilling to commence immediately.”

Major shareholder Latin Resources (ASX:LRS) will provide “exploration guidance and country experience”, SLM says.

LRS is currently drilling to expand the size of its 13.3Mt @ 1.2% Li2O inventory at the Salinas project in Minas Gerais, Brazil.

SLM is up 350% year-to-date. It had ~$1.8m in the bank at the end of March.

Zelira Therapeutics’ (ASX:ZLD) share price almost tripled on Wednesday morning, after news outlets worldwide reported that its diabetic nerve pain drug outperforms the mega multi-billion dollar go-to drug Lyrica (pregabalin) developed by Pfizer.

Stockhead’s Eddy Sunarto said top line results demonstrated that Zelira’s proprietary ZLT-L-007 drug outperformed Lyrica by achieving a significant reduction in NRS pain scores, indicating a decrease in symptom severity.

“ZLT-L-007 was found to be safe and well-tolerated, meeting the primary endpoint for safety with no Serious Adverse Events (SAE). The most substantial reduction in pain severity happened particularly at the 60-day and 90-day follow-up periods,” Eddy reported.

Lyrica is prescribed all the time to manage chronic pain associated with nerve damage caused by conditions like diabetic neuropathy and post-herpetic neuralgia (nerve pain following shingles).

“In certain instances, ZLT-L-007 provided up to four times the observed pain relief when compared to Lyrica,” said Zelira’s chairman, Osagie Imasogie.

Lyrica has historically achieved peak year annual sales of approximately US$5 billion, clearly indicating the market potential for Zelira’s ZLT-L-007.

The study also met its secondary endpoints, including significant decreases in Visual Analog Scale (VAS) and Short-form McGill scores, among others.

Now it’s off to the FDA for ZLT-L-007 clinical trials.

“The results align perfectly with our strategy of generating scientifically rigorous and clinically validated data for our patent-protected proprietary cannabinoid-based drugs,” Zelira CEO, Dr Oludare Odumosu reckons.

There’s more to be shared on the full study, and Eddy says to expect those during FY23-24.

ASX SMALL CAP LAGGARDS

Here are the least-best performing ASX small cap stocks for the week

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PYR | Payright Limited | 0.004 | -43% | $3,523,541 |

| ARE | Argonaut Resources | 0.001 | -33% | $6,361,871 |

| CHK | Cohiba Min Ltd | 0.004 | -33% | $8,452,977 |

| MRD | Mount Ridley Mines | 0.002 | -33% | $15,569,766 |

| MTB | Mount Burgess Mining | 0.002 | -33% | $2,207,928 |

| DCL | Domacom Limited | 0.025 | -32% | $11,323,046 |

| H2G | Greenhy2 Limited | 0.019 | -32% | $10,050,140 |

| XTC | Xantippe Res Ltd | 0.0035 | -30% | $45,920,399 |

| AD1 | AD1 Holdings Limited | 0.005 | -29% | $4,112,845 |

| CLU | Cluey Ltd | 0.086 | -28% | $19,556,516 |

| MBK | Metal Bank Ltd | 0.023 | -28% | $6,359,167 |

| IMM | Immutep Ltd | 0.27 | -26% | $259,699,963 |

| CTE | Cryosite Limited | 0.555 | -25% | $29,285,738 |

| ELE | Elmore Ltd | 0.012 | -25% | $19,591,374 |

| PUA | Peak Minerals Ltd | 0.003 | -25% | $3,124,130 |

| SKN | Skin Elements Ltd | 0.009 | -25% | $4,756,248 |

| TD1 | Tali Digital Limited | 0.0015 | -25% | $4,942,733 |

| PPY | Papyrus Australia | 0.023 | -23% | $10,926,883 |

| KED | Keypath Education | 0.23 | -23% | $48,143,504 |

| PPG | Pro-Pac Packaging | 0.23 | -23% | $39,971,296 |

| MHI | Merchant House | 0.053 | -23% | $4,996,124 |

| NYM | Narryer metals | 0.105 | -22% | $3,201,188 |

| PET | Phoslock Env Tec Ltd | 0.018 | -22% | $10,614,639 |

| DTM | Dart Mining NL | 0.044 | -21% | $7,408,351 |

| HAS | Hastings Tech Met | 1.6 | -21% | $189,390,295 |

| MDX | Mindax Limited | 0.069 | -21% | $194,328,084 |

| HAL | Halo Technologies | 0.135 | -21% | $19,424,282 |

| MOH | Moho Resources | 0.0135 | -21% | $3,374,511 |

| X2M | X2M Connect Limited | 0.055 | -20% | $9,051,108 |

| MM8 | Medallion Metals. | 0.079 | -20% | $17,297,439 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | $8,648,637 |

| BTR | Brightstar Resources | 0.012 | -20% | $18,888,183 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | $14,368,295 |

| ERL | Empire Resources | 0.004 | -20% | $4,451,740 |

| PGM | Platina Resources | 0.024 | -20% | $14,956,328 |

| RIE | Riedel Resources Ltd | 0.004 | -20% | $6,606,828 |

| RNX | Renegade Exploration | 0.012 | -20% | $12,325,609 |

| TML | Timah Resources Ltd | 0.04 | -20% | $3,550,390 |

| TSL | Titanium Sands Ltd | 0.008 | -20% | $14,063,978 |

| ZMI | Zinc of Ireland NL | 0.024 | -20% | $4,262,886 |

| FAL | Falcon Metals | 0.25 | -19% | $40,710,000 |

| MAG | Magmatic Resrce Ltd | 0.097 | -19% | $28,735,123 |

| BNZ | Benz Mining | 0.32 | -19% | $24,921,365 |

| SUV | Suvo Strategic | 0.026 | -19% | $21,450,901 |

| BEX | Bikeexchange Ltd | 0.009 | -18% | $11,209,835 |

| FTL | Firetail Resources | 0.09 | -18% | $6,853,000 |

| ID8 | Identitii Limited | 0.027 | -18% | $5,319,962 |

| KRR | King River Resources | 0.009 | -18% | $15,535,249 |

| M24 | Mamba Exploration | 0.09 | -18% | $5,488,500 |

| NCL | Netccentric Ltd | 0.055 | -18% | $15,565,641 |

ASX IPOs THIS WEEK

I can’t think of any off the top of my head.

Enjoy your weekend. We’ll be filing all kinds of stuff you need to know between now and ahead of the ASX open on Monday.

Huzzah!

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.